Income Tax Slab For Ay 2022 23 Under Old Regime Web Jun 13 2022 nbsp 0183 32 Stay informed about the Income Tax Rates for the Financial Year 2022 23 and Assessment Year 2023 24 Explore different tax slabs for individuals HUFs companies and more

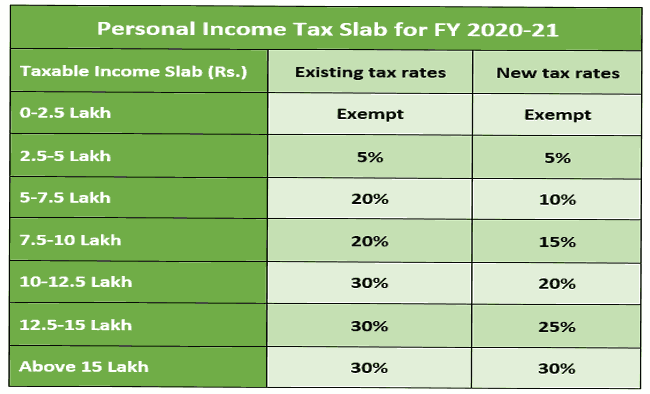

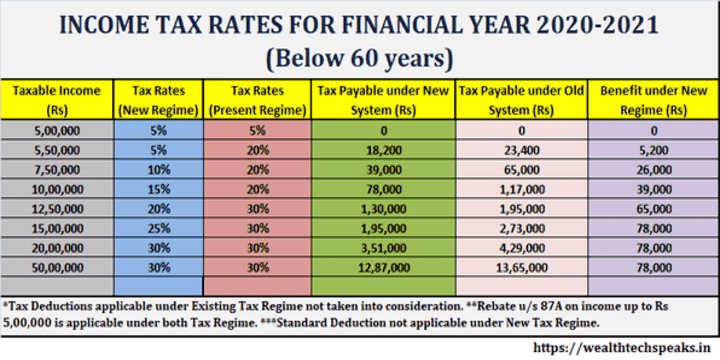

Web Jan 16 2024 nbsp 0183 32 Taxable Income for FY 2022 23 Tax Rate under new regime Tax Payable Tax Rate under old regime Tax Payable Upto 2 50 000 Exempt Exempt From 2 50 001 5 00 000 5 12 500 5 12 500 From 5 00 001 7 50 000 10 25 000 20 50 000 From 7 50 001 10 00 000 15 37 500 20 50 000 From 10 00 001 12 50 000 20 Web The tax rates under the new tax regime are as under a For Assessment Year 2023 24 Net Income Range Tax rate Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 Note The enhanced surcharge of 25 or 37 is not levied on income by way of dividend or from income chargeable to tax under sections 111A 112 112A and 115AD 1 b Hence

Income Tax Slab For Ay 2022 23 Under Old Regime

Income Tax Slab For Ay 2022 23 Under Old Regime

Income Tax Slab For Ay 2022 23 Under Old Regime

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

Web Apr 24 2023 nbsp 0183 32 As ITR filing is expected to start soon for AY 2023 24 read on to find the Income Tax Slabs for FY 2022 23 under old and new tax regimes New Tax Regime Slabs for Salaried FY 2022 23

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by offering a ready-made format and design for developing various sort of content. Templates can be utilized for personal or professional projects, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Income Tax Slab For Ay 2022 23 Under Old Regime

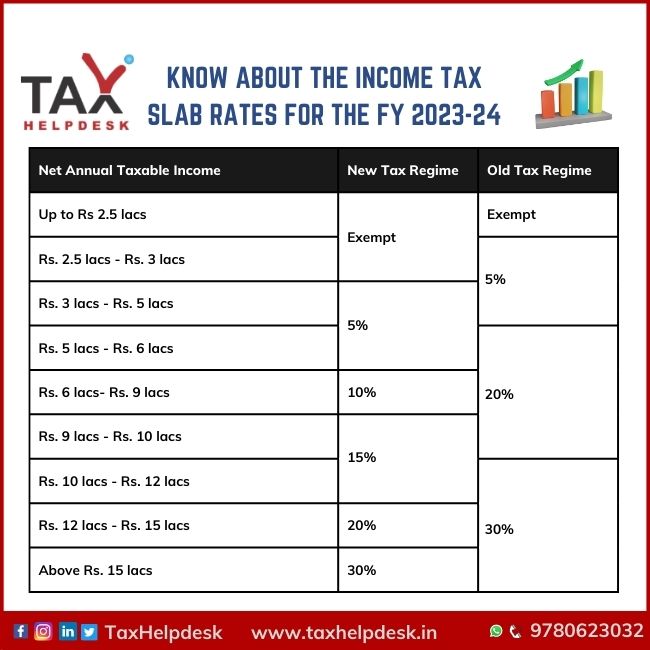

Income Tax Slab Rates For Fy 2023 24 Archives TaxHelpdesk

How To Calculate Income Tax Slab For Ay 2022 2023 Airlift za

Fy 2021 22 Tax Slabs Tutorial Pics

Personal Income Tax Slab For FY 2020 21

Income Tax Slab For 2023 24 Pdf Printable Forms Free Online

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

https://life.futuregenerali.in/.../old-tax-regime

Web Mar 9 2023 nbsp 0183 32 Income Tax slabs amp Rates as Per Old Regime FY 2022 23 Given below are the three tables for the alternative Income Tax Slabs Income Tax Slab for Individual who are below 60 years

https://www.taxmann.com/post/blog/income-tax-slab...

Web Mar 30 2021 nbsp 0183 32 Last Updated on 6 March 2023 Union Budget 2022 23 Highlights Table of Contents Income Tax Slab Rate for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year

https://tax2win.in/guide/income-tax-slabs

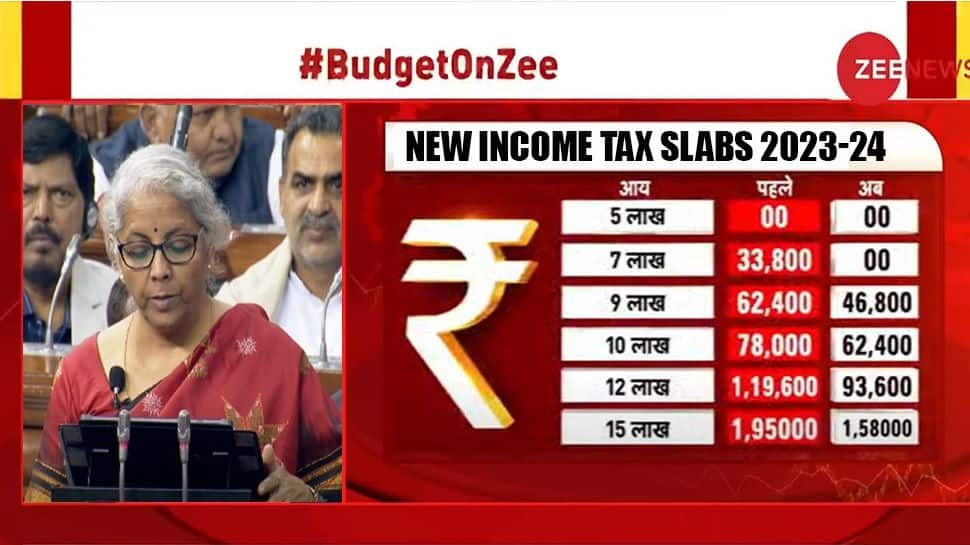

Web May 14 2024 nbsp 0183 32 Income Tax Slab Rs Old Tax Regime FY 2022 23 AY 2023 24 and FY 2023 24 AY 2024 25 New tax Regime Before budget 2023 New Tax Regime Applicable for FY 2023 24 AY 2024 25 0 2 50 000 2 50 001 3 00 000 5 5 3 00 001 5 00 000 5 5 5 5 00 001 6 00 000 20 10 5 6 00 001 7 50 000 20

https://www.incometax.gov.in/iec/foportal/income-tax-calculator

Web Note Click View Comparison to get a more detailed comparison of tax under the old and new tax regime Step 3b In the Advanced Calculator tab enter the following details Preferred tax regime AY taxpayer category age residential status due date and actual date of submission of return

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Web Apr 29 2024 nbsp 0183 32 Tax under Old vs New Regime Here are a few calculations that will help you decide between the old vs the new tax regime When total deductions are 1 5 lakhs or less The new regime will be beneficial When total deductions are more than 3 75 lakhs The old regime will be beneficial

Web Jul 13 2022 nbsp 0183 32 Under the new tax regime the annual income between Rs 5 lakh and Rs 7 5 lakh will be taxed at 10 per cent while the earning ranging Rs 7 5 lakh Rs 10 lakh a year will attract a 15 per cent tax Under the old regime those having an income between Rs 7 lakh and Rs 10 lakh came under a flat 20 per cent tax bracket Web Total Income Old Tax Regime New Tax Regime Rate of Surcharge Applicable U p to Rs 50 Lakh Nil Nil Above Rs 50 Lakh and up to Rs 1 Crore 10 10 Above Rs 1 Crore and up to Rs 2 Crore 15 15 Above Rs 2 Crore and up to Rs 5 Crore 25 25 Above Rs 5 Crore 37 25

Web Above 15 00 000 150 000 30 of total income exceeding 15 00 000 2 62 500 30 of total income exceeding 15 00 000 New income tax slab rates allow a tax liability of 10 if your taxable income is 15 lakhs Under the old tax regime your tax liability was 14 of your taxable income