Ato Income Tax Table 2022 23 Web May 17 2023 nbsp 0183 32 2023 Pay as you go PAYG withholding tax tables ATO Software Developers Version 2023 Original Published Date 17 05 2023 1 28pm Status Current Tax Category Payroll Resource Type Statement of formula

Web Australian Residents With Medicare levy included the top marginal rate is 47 Tax rates and thresholds summarised The tax rates for 2022 23 and 2023 24 excluding the 2 Medicare levy are as follows 2022 23 and 2023 24 income year Non residents foreign residents Taxpayers who are not Australian residents are taxed at different rates Web Jun 30 2022 nbsp 0183 32 The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on 1st July and ends on 30 June of the following year This tax table reflects the last amended tax brackets from as at 6 October 2020

Ato Income Tax Table 2022 23

Ato Income Tax Table 2022 23

Ato Income Tax Table 2022 23

https://i1.wp.com/cryptotaxcalculator.io/static/ef330055eee284dfde4af5c1be12b0f3/218a4/ato-reporting-crypto.png

Web Jul 1 2018 nbsp 0183 32 Reflected in the above table are tax rate changes from an 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 who include an expansion of the 19 rate initially to 41 000 and lifting the 32 5 band ceiling to 120 000 A follow up Budget 2019 measure further expanded the 19 income roof to 45 000 from 1 July 2022

Templates are pre-designed files or files that can be utilized for different purposes. They can save effort and time by supplying a ready-made format and layout for developing different kinds of content. Templates can be utilized for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Ato Income Tax Table 2022 23

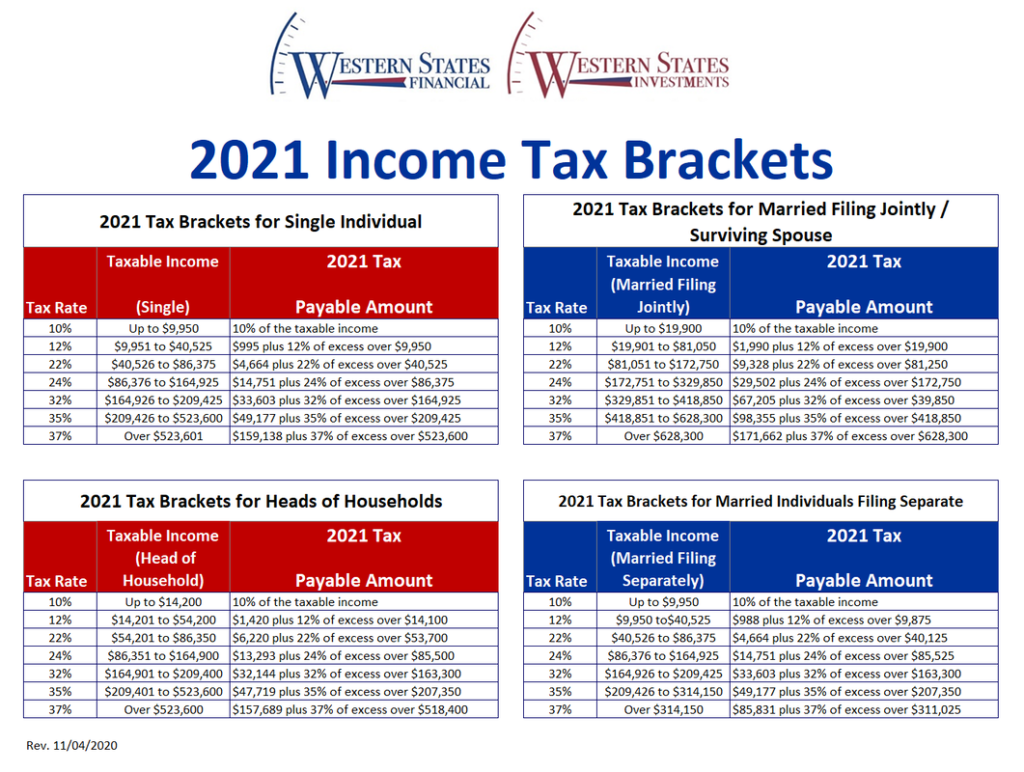

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

Revised Withholding Tax Table Bureau Of Internal Revenue

2021 Taxes For Retirees Explained Cardinal Guide

INTEREST CALCULATOR COMPOUNDED DAILY INTEREST CALCULATOR ATO INCOME

Income Tax Return Online All India ITR Largest Tax Return E filing

Figure 1 Source Www ato gov au

https://www.ato.gov.au/tax-rates-and-codes/tax...

Web Resident tax rates 2022 23 Taxable income Tax on this income 0 18 200 Nil 18 201 45 000 19c for each 1 over 18 200 45 001 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

https://atotaxrates.info/individual-tax-rates-resident/ato-tax-rates-2023

Web Jul 1 2018 nbsp 0183 32 The 2022 23 Tax Scale The basic tax scales are the same as the previous year but the Low amp Middle Income Tax Offset drops out which would effectively increase tax for lower income earners Taxable Income Tax On This Income 0 to 18 200

https://www.ato.gov.au/tax-rates-and-codes/tax-table-monthly

Web Oct 12 2020 nbsp 0183 32 Withholding tax table for payments made on a monthly basis Last updated 12 October 2020 Print or Download Using this tax table This tax table applies to payments made from 13 October 2020 You should use this tax table if you make any of the following payments on a monthly basis salary wages allowances and leave loading to

https://www.superguide.com.au/how-super-works/income-tax-rates

Web On this page Australian income tax rates for 2023 24 and 2022 23 residents Income tax rates for previous years How income tax is calculated What is the tax free threshold Tax offsets and deductions What is included in assessable income What deductions are you allowed What is taxable income Income tax offsets levies and surcharges

https://caat-p-001.sitecorecontenthub.cloud/api/...

Web Oct 13 2020 nbsp 0183 32 Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With tax free threshold No tax free threshold 1 2 3 176 00 0 00 38 00

Web Apr 26 2023 nbsp 0183 32 Knowledge Base Tax brackets 2023 By Brad Ashton April 26 2023 Income Tax Brackets 2023 are published start of each financial year by the ATO These brackets are effective rates at which an individual taxpayer must file their annual tax For financial year ending June 2023 tax rates on this page are to be used as a guide Web Australia Residents Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from 0 000 00 to 18 200 00 19 Income from 18 200 01 to 45 000 00 30 Income from 45 000 01 to 200 000 00 45 Income from 200 000 01 and above

Web Your annual salary Includes superannuation Includes HELP debt Non resident 2022 2023 2023 2024 2024 2025 Take a Guess gt How Much Money in This Stack Our Tax Calculator uses exact ATO formulas when calculating your salary after income tax