Ato Income Tax Rates 2022 23 WEB The following rates for FY 2022 23 apply from 1 July 2022 Please note the above ATO tax rates do not include the Medicare levy which increased from 1 5 to 2 from July 1 2014 ATO Tax Rates 2021 2022 These tax rates apply to individuals who are Australian residents for tax purposes The following rates for FY 2021 22 apply from 1 July 2021

WEB Last updated 4 June 2023 Print or Download Tax rates 2022 23 Company tax rates for the 2022 23 income year Tax rates 2021 22 Company tax rates for the 2021 22 income year Tax rates 2011 12 to 2020 21 Company tax rates for the 2011 12 to 2020 21 income years Tax rates 2001 02 to 2010 11 WEB The tax rates for 2022 23 and 2023 24 excluding the 2 Medicare levy are as follows 2022 23 and 2023 24 income year Non residents foreign residents Taxpayers who are not Australian residents are taxed at different rates The current rates for non residents for 2022 23 and 2023 24 are 2022 23 and 2023 24 income year Working Holiday Makers

Ato Income Tax Rates 2022 23

Ato Income Tax Rates 2022 23

Ato Income Tax Rates 2022 23

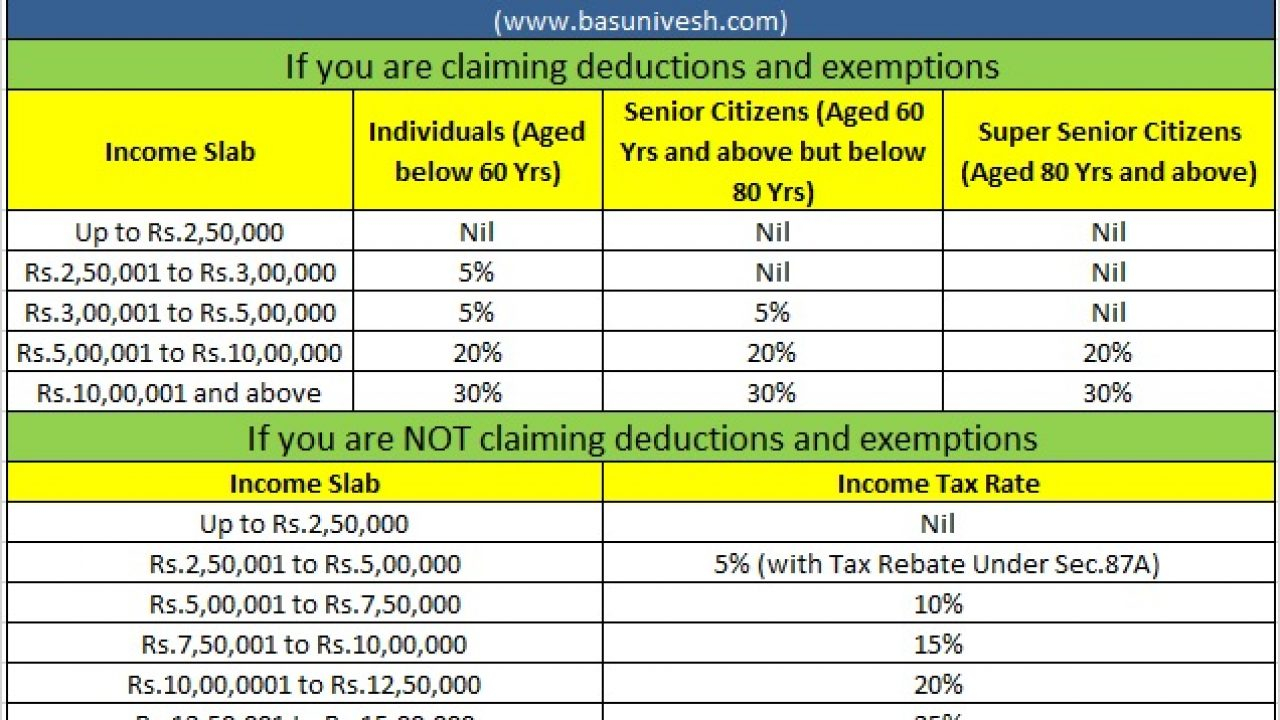

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

WEB Feb 27 2024 nbsp 0183 32 tax rates 2022 23 The basic tax scales are the same as the previous year but the Low amp Middle Income Tax Offset drops out which would effectively increase tax for lower income earners Fringe Benefits Tax 2025 What s changed for 2025 Fringe Benefits Tax 2024 What s changed for 2024 Super contribution limits

Pre-crafted templates use a time-saving service for developing a varied range of documents and files. These pre-designed formats and layouts can be used for numerous individual and expert tasks, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material development procedure.

Ato Income Tax Rates 2022 23

2021 Tax Changes Kesilall

Ato Income Tax Rates Prior Years Spot Walls

California Individual Tax Rate Table 2021 2022 Brokeasshome

2016 Foreign Exchange Rates Ato And How To Earn Money With Adsense

Ato Income Tax Rates Prior Years Spot Walls

Download Irs Tax Tables 2014 Married Filing Jointly Dryinstalsea

https://atotaxrates.info/individual-tax-rates-resident/ato-tax-rates-2023

WEB Jul 1 2018 nbsp 0183 32 Taxable Income Tax On This Income 0 to 18 200 Nil 18 201 to 45 000 19c for each 1 over 18 200 45 001 to 120 000 5 092 plus 32 5c for each 1 over 45 000 120 001 to 180 000 29 467 plus 37c for each 1 over 120 000 180 001 and over 51 667 plus 45c for each 1 over 180 000

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-foreign-residents

WEB Last updated 28 September 2023 Print or Download On this page About foreign resident tax rates Foreign residents tax rates 2023 to 2024 Foreign residents tax rates 2011 to 2022 Foreign residents tax rates 2000 to 2010 Foreign residents tax rates 1988 to 1999 About foreign resident tax rates

https://www.ato.gov.au/calculators-and-tools/tax...

WEB Jun 29 2023 nbsp 0183 32 Calculators and tools Simple tax calculator Calculate the gross tax on your taxable income for the 2013 14 to 2022 23 income years Last updated 29 June 2023 Print or Download On this page Go to the calculator What you can do with this calculator What you will need Limitations What else you can do Go to the calculator

https://www.ato.gov.au/calculators-and-tools/income-tax-estimator

WEB Jun 29 2023 nbsp 0183 32 Calculators and tools Income tax estimator Work out your tax refund or debt estimate for the 2015 16 to 2022 23 income years Last updated 29 June 2023 Print or Download On this page Go to the calculator What you can do with the calculator What s new for 2022 23 What you will need Limitations What else you can do Go to

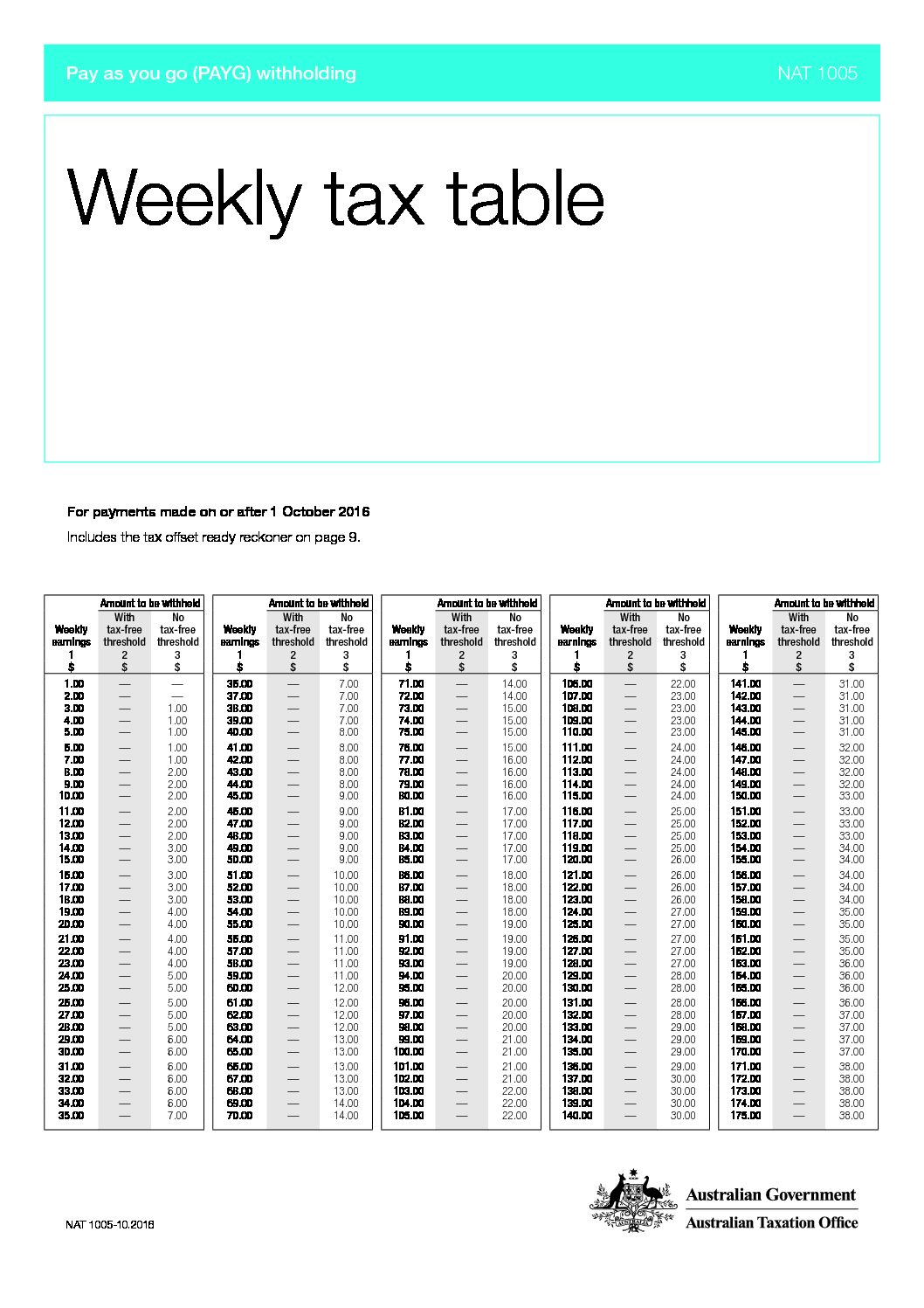

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

WEB Jul 1 2023 nbsp 0183 32 Last updated 22 November 2023 Print or Download About tax tables We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees A tax withheld calculator that calculates the correct amount of tax to withhold is also available

WEB Tax rates 2022 23 There are no changes to the income tax rates for 2023 24 This means if you earned 60 000 during the 2022 23 tax year your tax would be calculated like this This calculation does not include the 2 Medicare levy WEB Jun 4 2023 nbsp 0183 32 2022 23 tax rates Not for profit companies that are base rate entities see note 5 Income category Rate Taxable income 0 416 Nil Taxable income 417 762 55 Taxable income 763 and above 25

WEB Tax Rates for 2022 2023 Australian Residents Medicare Levy of 2 applies not applicable to low income earners Low and middle income tax offset LMITO to be removed in this year Non Residents Summary Tax and salary calculator for the 2022 2023 financial year Also calculates your low income tax offset HELP SAPTO and