Ato Income Tax Rates 2022 23 Calculator Web Jun 4 2023 nbsp 0183 32 2022 23 tax rates Not for profit companies see note 4 Income category Rate Taxable income 0 416 Nil Taxable income 417 915 55 Taxable

Web May 31 2022 nbsp 0183 32 myTax 2022 Tax estimate important information Australian Taxation Office Individuals and families myTax instructions 2022 Estimate myTax 2022 Tax Web On this page Helps you work out how much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your

Ato Income Tax Rates 2022 23 Calculator

Ato Income Tax Rates 2022 23 Calculator

Ato Income Tax Rates 2022 23 Calculator

https://i2.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-768x539.png

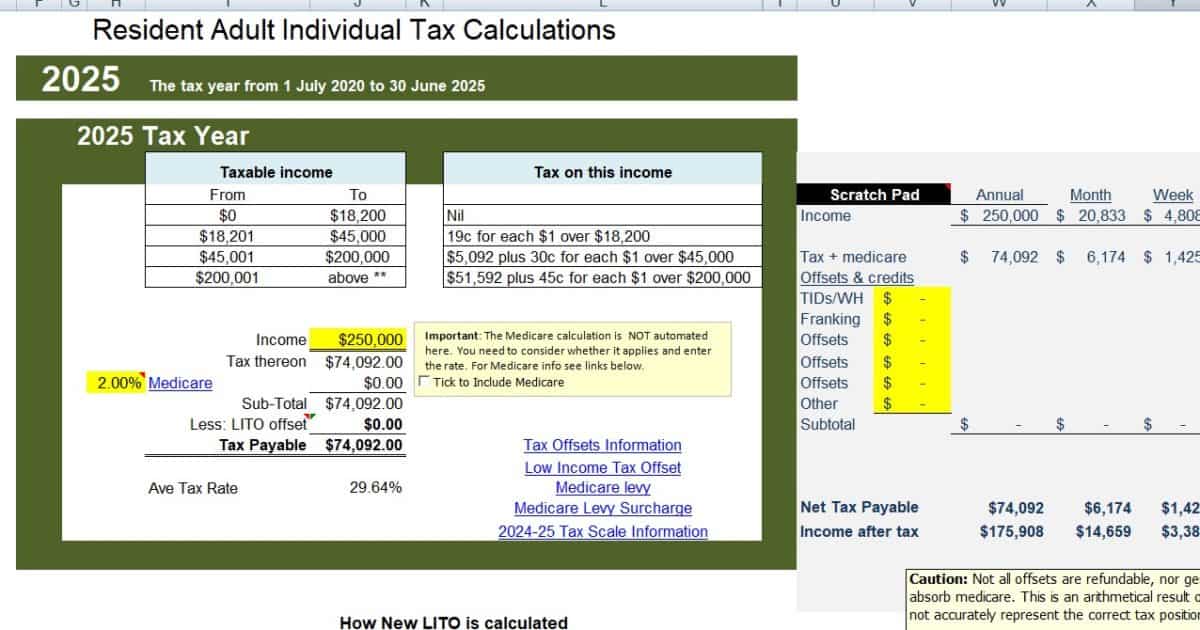

Web This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and week salary after PAYG burden deductions Asking enter your salary into the quot Annual

Pre-crafted templates use a time-saving solution for creating a varied variety of documents and files. These pre-designed formats and designs can be used for numerous personal and professional jobs, consisting of resumes, invitations, leaflets, newsletters, reports, discussions, and more, simplifying the material creation process.

Ato Income Tax Rates 2022 23 Calculator

2016 Foreign Exchange Rates Ato And How To Earn Money With Adsense

Ato Income Tax Rates Prior Years Spot Walls

Estimated Business Tax Brackets 2022 Business Books 2022

Download Irs Tax Tables 2014 Married Filing Jointly Dryinstalsea

Tax Calculator Atotaxrates info

Tax Forms 2022 Atotaxrates info

https://www.ato.gov.au/tax-rates-and-codes/tax-rates-australian-residents

Web Sep 28 2023 nbsp 0183 32 Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use the Income tax estimator to work out your

https://atotaxcalculator.com.au

Web This simplified ATO Tax Calculator will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions Please enter your salary into the quot Annual Salary quot field and click quot Calculate quot

https://atotaxrates.info/individual-tax-rates-resident/ato-tax-rates-2023

Web Jul 1 2018 nbsp 0183 32 Tax Rates 2022 2023 Year Residents The 2023 financial year in Australia starts on 1 July 2022 and ends on 30 June 2023 The financial year for tax purposes for

https://www.ato.gov.au/tax-rates-and-codes/tax-tables-overview

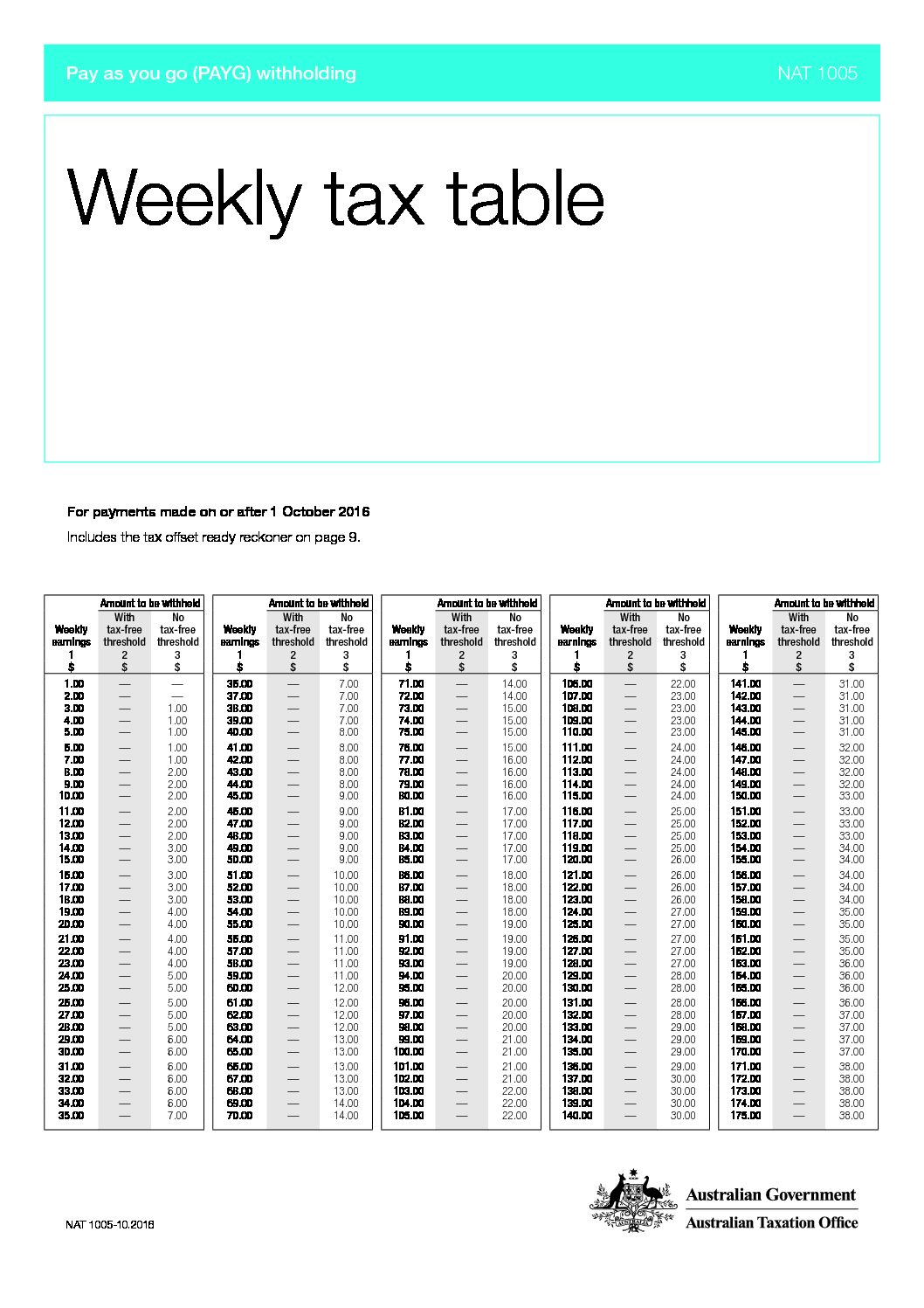

Web Jul 1 2023 nbsp 0183 32 Tax tables for previous years are also available at Tax rates and codes Important information July 2023 updates With the annual indexing of the repayment

https://www.taxcalc.com.au/2223.html

Web Tax Rates 2022 2023 Taxable Income Tax on this income 0 120 000 32 5c for each 1 120 001 180 000 39 000 plus 37c for each 1 over 120 000 Over 180 000

Web Mar 29 2022 nbsp 0183 32 This free to download Excel tax calculator has been updated for the 2021 22 and later years 2022 23 2022 24 and 2024 25 and includes the March 2022 Budget Web Jun 30 2022 nbsp 0183 32 free tax calculator The 2022 financial year in Australia starts on 1 July 2021 and ends on 30 June 2022 The financial year for tax purposes for individuals starts on

Web This simplified ATO Trigger Calculator will calculates thine annual monthly fortnightly and weekly wages following PAYG tax deductions Pleas enter your salary into the quot Annual