2022 Vs 2023 Tax Brackets Single Dec 31 2024 nbsp 0183 32 Here are the 2022 Federal tax brackets Remember these are the amounts you will pay when you file your taxes in January to April 2023 for the year January 1 2022 through December 31 2022 The table below shows the tax bracket rate for each income level

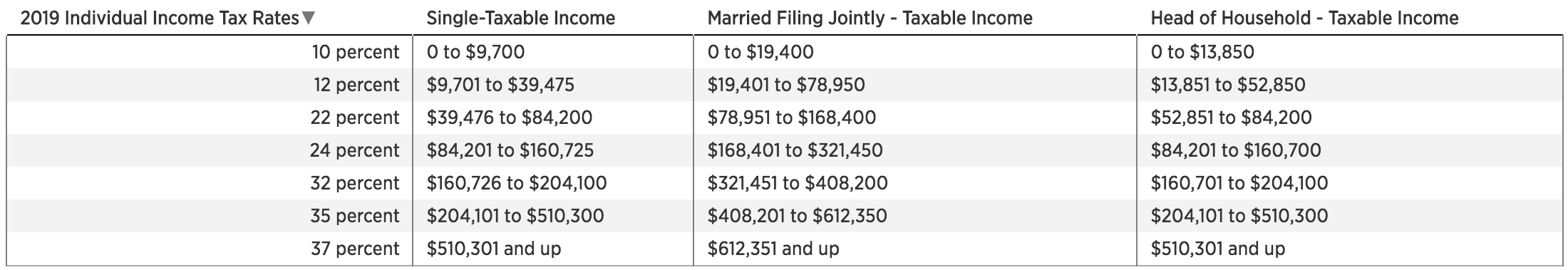

May 12 2023 nbsp 0183 32 The current federal income tax brackets are 10 12 22 24 32 35 and 37 Your tax bracket is determined by your taxable income that year and by your filing status such as single married and filing jointly or separately or head of household Are 2023 tax brackets different than 2022 There are seven federal tax brackets for the 2022 tax year 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status 2022 federal income tax brackets for taxes due in April 2023 2022 Tax brackets for Single filers

2022 Vs 2023 Tax Brackets Single

2022 Vs 2023 Tax Brackets Single

https://s.yimg.com/ny/api/res/1.2/9OoVAtst.kBuEKSi3_7vLA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MA--/https://s.yimg.com/os/creatr-uploaded-images/2023-01/256761a0-9a65-11ed-b57b-4f397ac4ee71

Jul 27 2023 nbsp 0183 32 For 2022 and 2023 the Internal Revenue Service IRS has released its updated income tax brackets for both single and married taxpayers filing jointly Knowing these rates can help you plan ahead for upcoming taxes so you can better prepare yourself financially

Templates are pre-designed documents or files that can be used for various functions. They can conserve effort and time by providing a ready-made format and design for producing different kinds of content. Templates can be utilized for personal or expert jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

2022 Vs 2023 Tax Brackets Single

2022 Tax Brackets JeanXyzander

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

New Federal Tax Brackets For 2023

Married Tax Brackets 2021 Westassets

2022 Tax Brackets AnnmarieEira

IRS 2022 Tax Tables Deductions Exemptions Purposeful finance

https://www.irs.gov › filing › federal-income-tax-rates-and-brackets

3 days ago nbsp 0183 32 Here s how that works for a single person with taxable income of 58 000 per year Find the current tax rates for other filing statuses See the 2024 tax tables for money you earned in 2024 Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status

https://taxfoundation.org › data › all › federal

Oct 18 2022 nbsp 0183 32 The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://www.irs.gov › newsroom

Oct 18 2022 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022

https://finance.yahoo.com › news

Jan 22 2023 nbsp 0183 32 For the 2023 tax year there are seven federal tax brackets 10 12 22 24 32 35 and 37 Your tax bracket is determined by your taxable income and filing status and

Feb 6 2025 nbsp 0183 32 Are you wondering what the income tax brackets for 2022 and 2023 are In this article we ll give you a breakdown of the current income tax brackets as well as how they will change in 2022 and 2023 Nov 1 2022 nbsp 0183 32 There are seven tax rates that apply to seven brackets of income 10 12 22 24 32 35 and 37 For tax year 2022 the lowest 10 rate applies to an individual s income of 10 275 or less while the highest 37 rate applies to an individual s income of 539 900 or more Income brackets adjust every year to account for inflation

Oct 16 2023 nbsp 0183 32 If you are a single filer with an income of 50 000 for example you would fall into the 22 tax bracket for the 2022 tax rate What this means is that the first 11 000 of your income is taxed at 10 the next 33 726 is taxed at 12 and the remaining 5 274 would be at 22