Tax Rates 2022 To 2023 Jun 5 2024 nbsp 0183 32 Medicare levy surcharge income thresholds and rates Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year Use

Nov 7 2022 nbsp 0183 32 Direct tax rates and allowances for the 2023 24 tax year are set out in a second Commons Library briefing Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For Oct 16 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As your income goes up the tax rate on the next layer of income is

Tax Rates 2022 To 2023

Tax Rates 2022 To 2023

Tax Rates 2022 To 2023

https://files.taxfoundation.org/20220215111110/2022-state-income-tax-rates-and-brackets-2022-state-individual-income-tax-rates-and-brackets-See-income-taxes-by-state-flat-income-taxes.png

Tax Rates 2022 23 updated for Autumn Statement 2022 announcements on 17 November 2022 Download

Templates are pre-designed documents or files that can be utilized for various purposes. They can conserve effort and time by providing a ready-made format and layout for producing different sort of material. Templates can be utilized for individual or professional tasks, such as resumes, invites, leaflets, newsletters, reports, presentations, and more.

Tax Rates 2022 To 2023

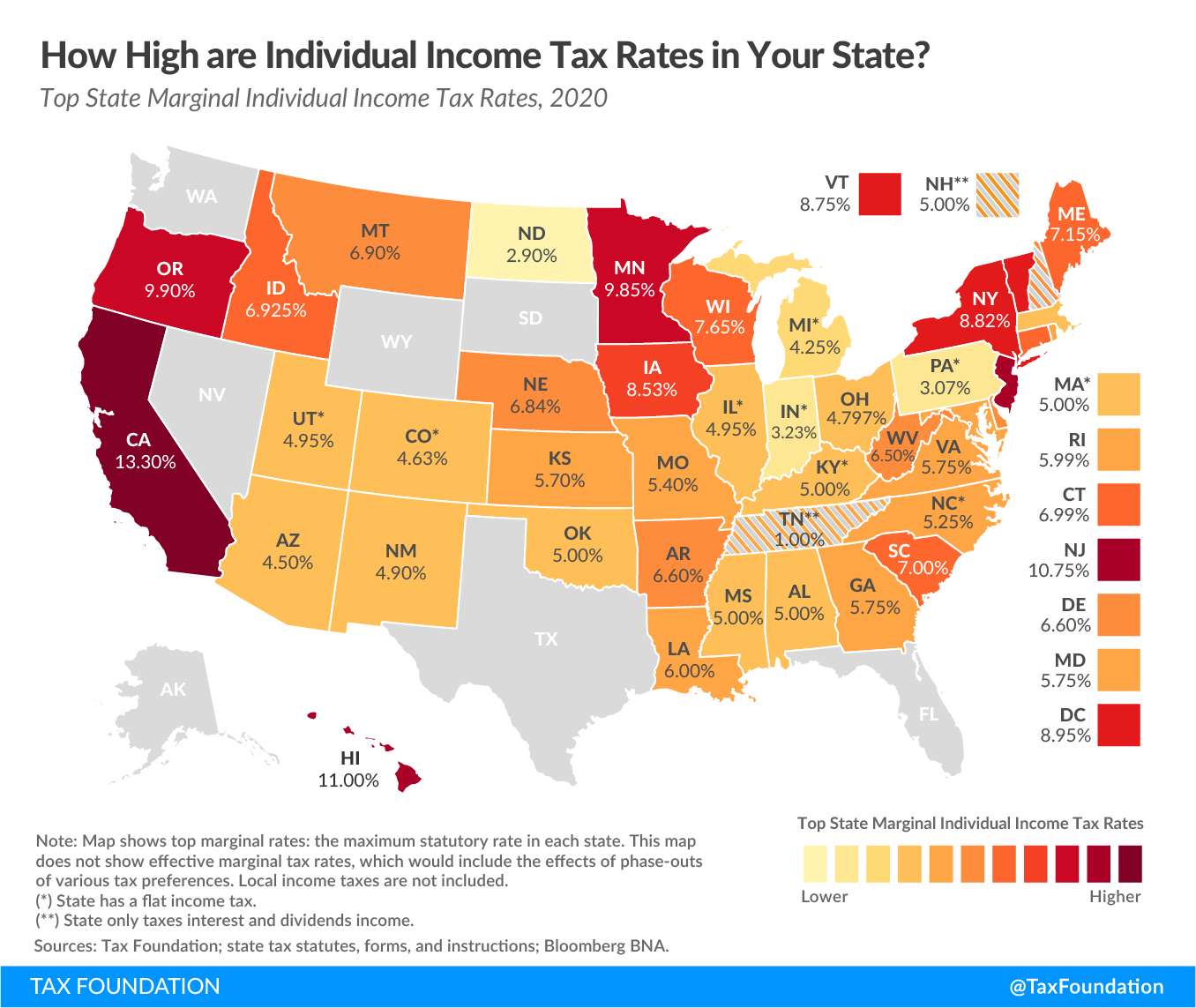

State Individual Income Tax Rates And Brackets For 2020 Upstate Tax

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

2022 Tax Brackets Married Filing Jointly Irs Printable Form

California Individual Tax Rate Table 2021 2022 Brokeasshome

2022 Tax Brackets DhugalKillen

What Is Medicare Rate For 2022

https://www.gov.uk/guidance/rates-and-thresholds...

Feb 7 2022 nbsp 0183 32 You report and pay Class 1A on expenses and benefits at the end of each tax year The National Insurance Class 1A rate on expenses and benefits for 2022 to 2023 is 14 53

https://www.ntu.org/foundation/detail/wh…

Oct 18 2022 nbsp 0183 32 The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code These inflation adjustments will be in effect for income

https://www.gov.uk/income-tax-rates

How much Income Tax you pay in each tax year depends on how much of your income is above your Personal Allowance how much of your income falls within each tax band Some income is

https://taxfoundation.org/data/all/feder…

Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum

https://taxfoundation.org/data/all/feder…

Oct 18 2022 nbsp 0183 32 The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum

Oct 18 2022 nbsp 0183 32 WASHINGTON The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions including the tax rate This handy calculator will show you how much income tax and National Insurance you ll pay in the 2024 25 2023 24 2022 23 and 2021 22 tax years as well as how much of your salary you ll

This guide explains Income Tax rates and Personal Allowances for citizens living in the United Kingdom Additional information clarifies how tax bands and the current tax thresholds work