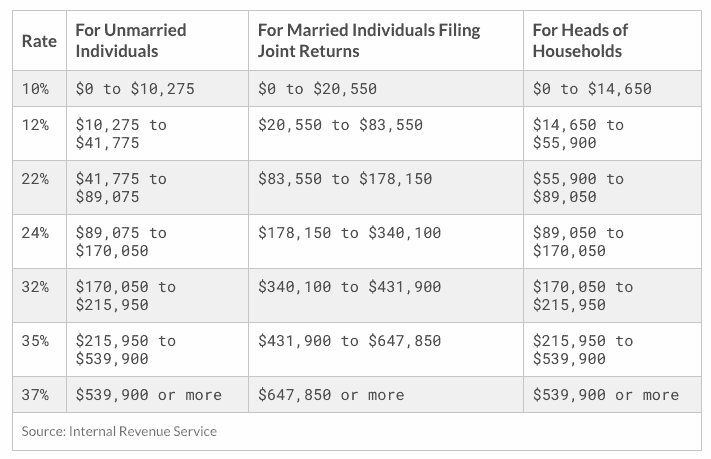

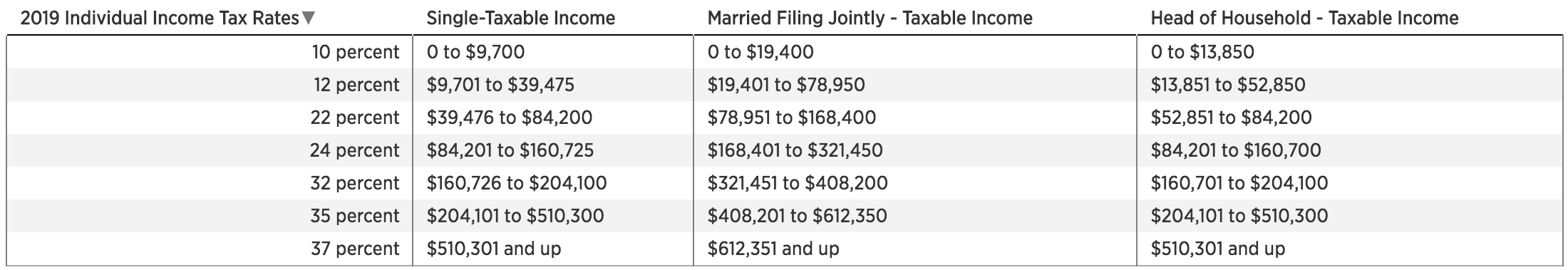

2022 To 2023 Tax Brackets Single WEB May 12 2023 nbsp 0183 32 The current federal income tax brackets are 10 12 22 24 32 35 and 37 Your tax bracket is determined by your taxable income that year and by your filing status such as single married and filing jointly or separately or head of household Are 2023 tax brackets different than 2022

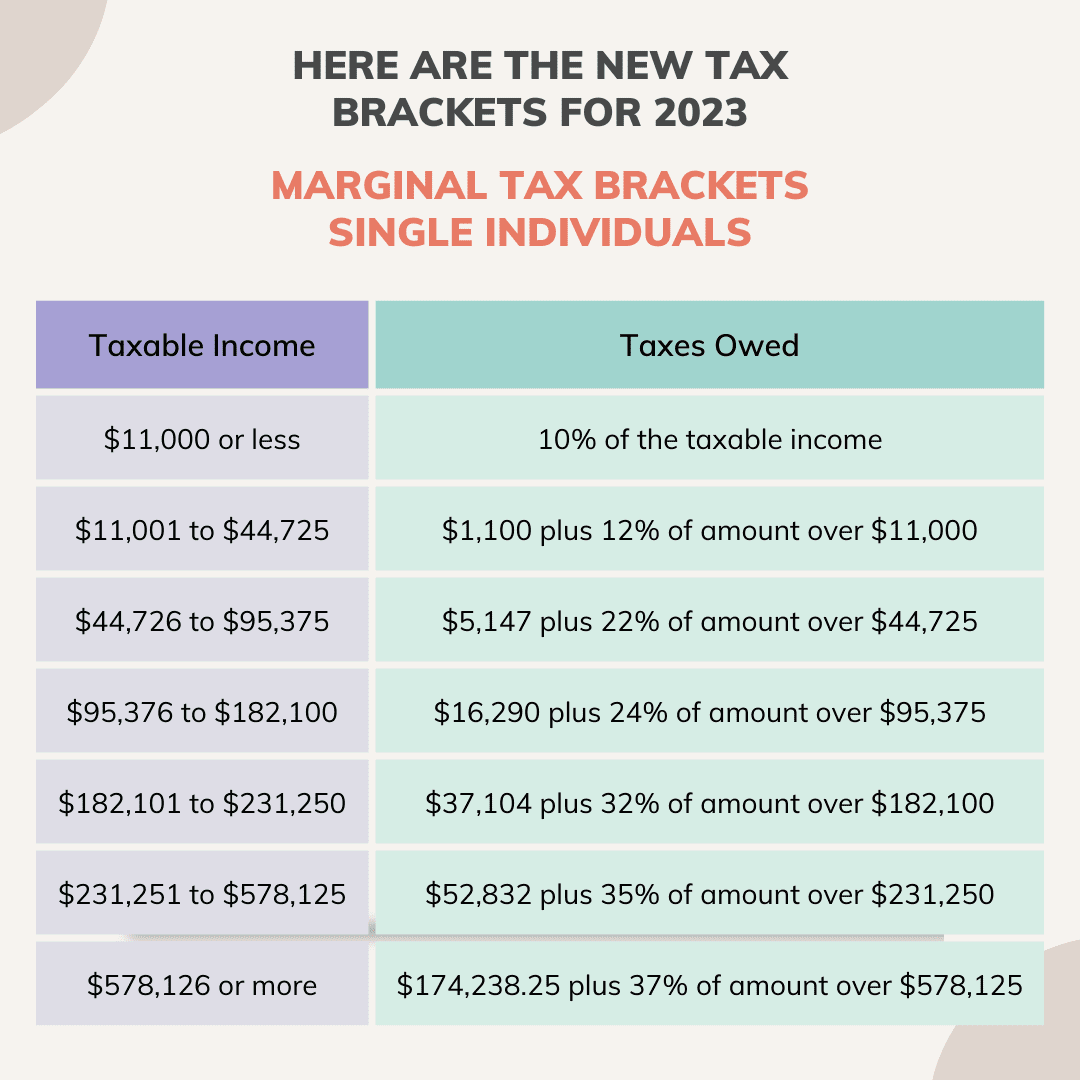

WEB Credits deductions and income reported on other forms or schedules Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax bracket determines your federal tax rate WEB Let s take the IRS tax brackets for individual single filers in 2023 Unless you made 10 275 or less in taxable income in 2023 it s likely you fall into at least two brackets This means different parts of your income is taxed at a different rate For example let s say that your taxable income ends up being 20 000

2022 To 2023 Tax Brackets Single

2022 To 2023 Tax Brackets Single

2022 To 2023 Tax Brackets Single

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

WEB Jan 22 2023 nbsp 0183 32 For the 2023 tax year there are seven federal tax brackets 10 12 22 24 32 35 and 37 Your tax bracket is determined by your taxable income and filing status and shows

Templates are pre-designed documents or files that can be utilized for different functions. They can conserve time and effort by supplying a ready-made format and design for producing different type of material. Templates can be utilized for individual or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

2022 To 2023 Tax Brackets Single

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Brackets JeanXyzander

Oct 19 IRS Here Are The New Income Tax Brackets For 2023

2022 Tax Brackets Irs Calculator

2022 Tax Brackets JeanXyzander

2022 Tax Brackets HassanMorven

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Mar 18 2024 nbsp 0183 32 2023 tax rates for a single taxpayer For a single taxpayer the rates are Tax rate on taxable income from up to 10 0 11 000 12

https://taxfoundation.org/data/all/federal/2023-tax-brackets

WEB Oct 18 2022 nbsp 0183 32 The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://turbotax.intuit.com/tax-tips/irs-tax...

WEB Jan 12 2024 nbsp 0183 32 What Are the Tax Brackets for 2022 for filing in 2023 Single Married Filing Jointly or Qualifying Widow Widower Married Filing Separately Head of Household TurboTax Tip There are different tax rate schedules for long term capital gains than for

https://www.ntu.org/foundation/detail/what-are...

WEB Oct 18 2022 nbsp 0183 32 Income Tax Brackets for Single Taxpayers 2022 2023 2022 Income 2023 Filing Season due April 17 2023 2023 Income 2024 Filing Season due April 15 2024 Income Difference for Top of Bracket 2023 vs 2022 Income Tax Income Tax Difference 0 10 275 10 of income 0 11 000 10 of income 725 7 1 10 275

https://www.irs.gov/newsroom/irs-provides-tax...

WEB Oct 18 2022 nbsp 0183 32 For single taxpayers and married individuals filing separately the standard deduction rises to 13 850 for 2023 up 900 and for heads of households the standard deduction will be 20 800 for tax year 2023 up 1 400 from the amount for tax year 2022

WEB Oct 18 2022 nbsp 0183 32 getty The Internal Revenue Service has released dozens of inflation adjustments affecting individual income tax brackets deductions and credits for 2023 and no surprise today s four decade WEB Dec 21 2023 nbsp 0183 32 The 2023 federal income tax rates will stay the same from 2022 What will change again are the income ranges for each 2023 federal income tax bracket which have already been adjusted for inflation

WEB Nov 13 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2023 tax year 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent