2022 Income Tax Rates Philippines WEB Philippines Income Tax Calculator 2022 Welcome to the 2022 Income Tax Calculator for Philippines which allows you to calculate Income Tax Due the Effective Tax Rate

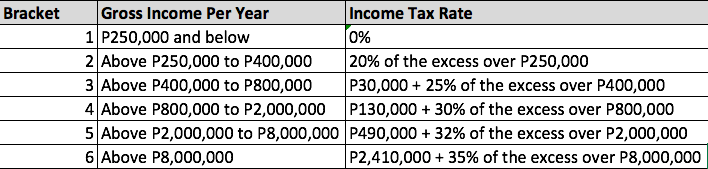

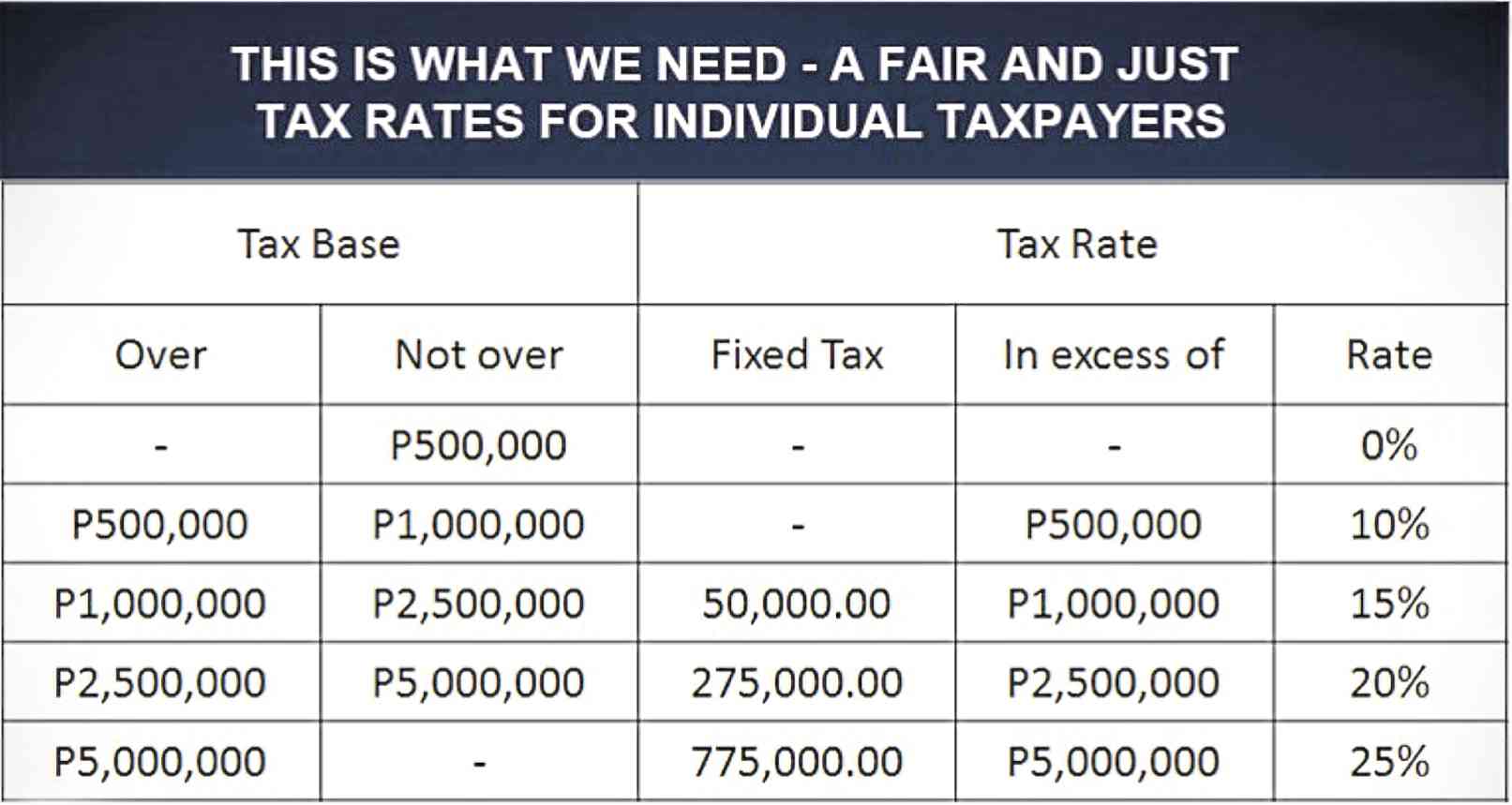

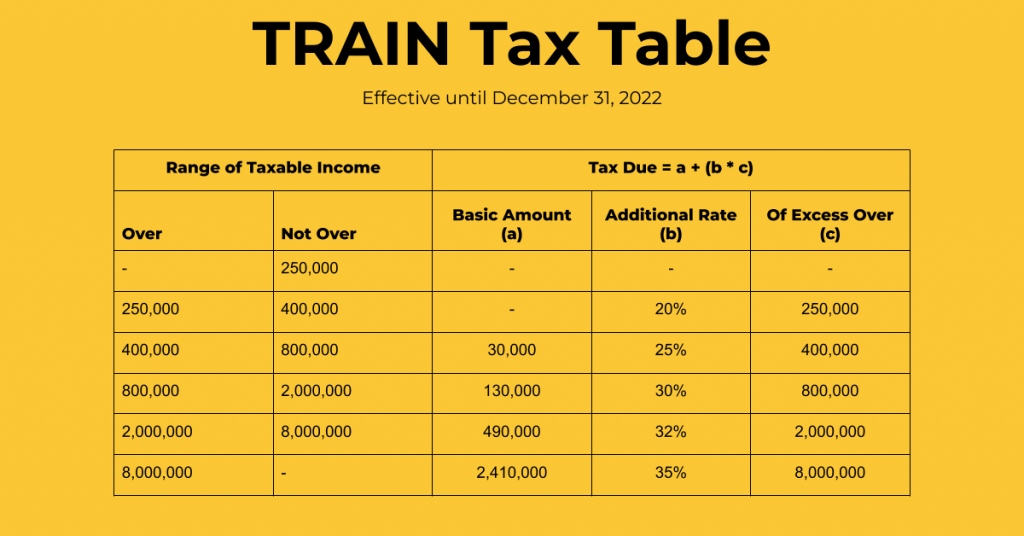

WEB Apr 9 2022 nbsp 0183 32 Employed and self employed people who earn above this threshold pay a 20 to 35 income tax until December 31 2022 Starting January 1 2023 income tax rates will be reduced to 15 to 35 WEB The online rates tool allows you to a compare the highest corporate indirect and individual income tax rates for one country for any given year s and b compare one

2022 Income Tax Rates Philippines

2022 Income Tax Rates Philippines

2022 Income Tax Rates Philippines

https://i0.wp.com/www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-tables-train-philippines-2018-2022.png

WEB KPMG s individual income tax rates table provides a view of individual income tax rates around the world tax rates tool test page close Share with your friends Insights

Pre-crafted templates use a time-saving option for producing a varied series of files and files. These pre-designed formats and designs can be utilized for different individual and expert jobs, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, improving the content creation process.

2022 Income Tax Rates Philippines

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

New Monthly Withholding Tax Table 2018 Philippines Elcho Table

2022 Tax Table Philippines Latest News Update

How The TRAIN Law Affects The Real Estate Industry Buyingph

2019 Income Tax Philippines Table Carfare me 2019 2020

2022 Tax Brackets California

https://ph.icalculator.com/income-tax-rates/2022.html

WEB Philippines Residents Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from

https://www.bir.gov.ph/index.php/tax-information/income-tax.html

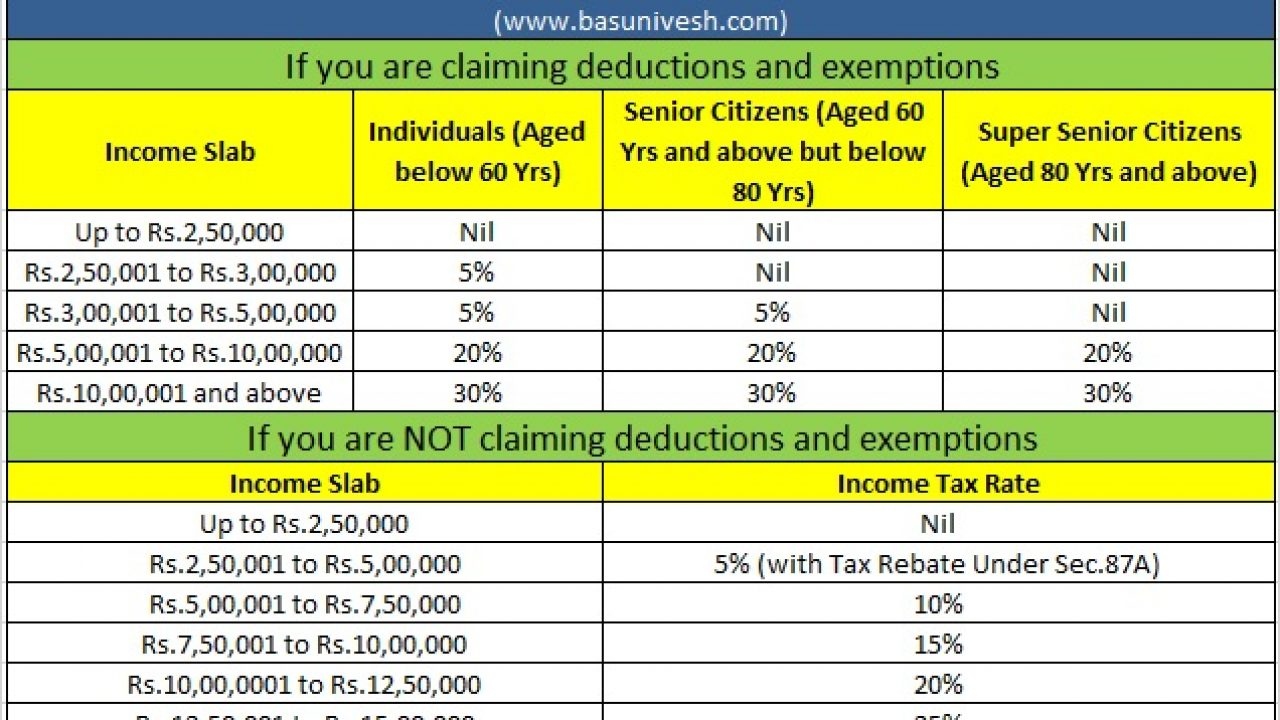

WEB Passive Income Tax Rate 1 Interest from currency deposits trust funds and deposit substitutes 20 2 Royalties on books as well as literary amp musical compositions 10

https://taxsummaries.pwc.com/philippines/...

WEB Jan 1 2023 nbsp 0183 32 8 tax on gross sales receipts and other non operating income in excess of PHP 250 000 in lieu of the graduated income tax rates and percentage tax business

https://www.jobstreet.com.ph/career-advice/article/...

WEB Under the TRAIN Law individuals earning less than Php250 000 per year are exempted from paying income tax while those earning more than Php8 million a year will pay

https://kpmg.com/ph/en/home/insights/2022/02/a...

WEB Feb 2 2022 nbsp 0183 32 TRAIN provided individuals with a restructured personal income tax table The changes included the option to avail of the 8 flat income tax rate and the use of

WEB Philippines Personal Income Tax Rate The Personal Income Tax Rate in Philippines stands at 35 percent Personal Income Tax Rate in Philippines averaged 32 90 percent WEB Jan 18 2024 nbsp 0183 32 As a responsible citizen of the country a Filipino individual earning at least 1 000 monthly is mandated to pay tax to the government amounting to a percentage of

WEB Interest from any currency bank deposit and yield or any other monetary benefit from deposit substitutes and from trust funds and similar arrangements and royalties derived