Personal Income Tax Rates 2022 Philippines WEB Feb 2 2022 nbsp 0183 32 The changes included the option to avail of the 8 flat income tax rate and the use of the enhanced BIR Firm No 1701 or the annual income tax return for mixed income earners estates and trusts The BIR was also gradually expanding its

WEB Jan 18 2024 nbsp 0183 32 To calculate income tax in the Philippines Calculate your taxable income by subtracting your benefits contributions from your income Check BIR s revised withholding tax table for at which your taxable income falls Note your corresponding fixed tax compensation level and tax rate Substitute those values in this equation to find your WEB Summary Download The Personal Income Tax Rate in Philippines stands at 35 percent Personal Income Tax Rate in Philippines averaged 32 90 percent from 2004 until 2023 reaching an all time high of 35 00 percent in 2018 and a record low of 32 00 percent in 2005 source Bureau of Internal Revenue Feedback

Personal Income Tax Rates 2022 Philippines

Personal Income Tax Rates 2022 Philippines

Personal Income Tax Rates 2022 Philippines

https://n2r6r8g7.stackpathcdn.com/wp-content/uploads/2020/06/income-tax-tables-train-philippines-2018-2022-1024x535.png

WEB The Monthly Salary Calculator is updated with the latest income tax rates in Philippines for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income The calculator is designed to be

Templates are pre-designed files or files that can be used for different functions. They can save effort and time by providing a ready-made format and design for creating various kinds of material. Templates can be utilized for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Personal Income Tax Rates 2022 Philippines

2022 2023 PAYE Personal Income Tax Rates And Allowances Tax Rates

2022 Tax Brackets PersiaKiylah

2022 Tax Brackets DhugalKillen

California Individual Tax Rate Table 2021 2022 Brokeasshome

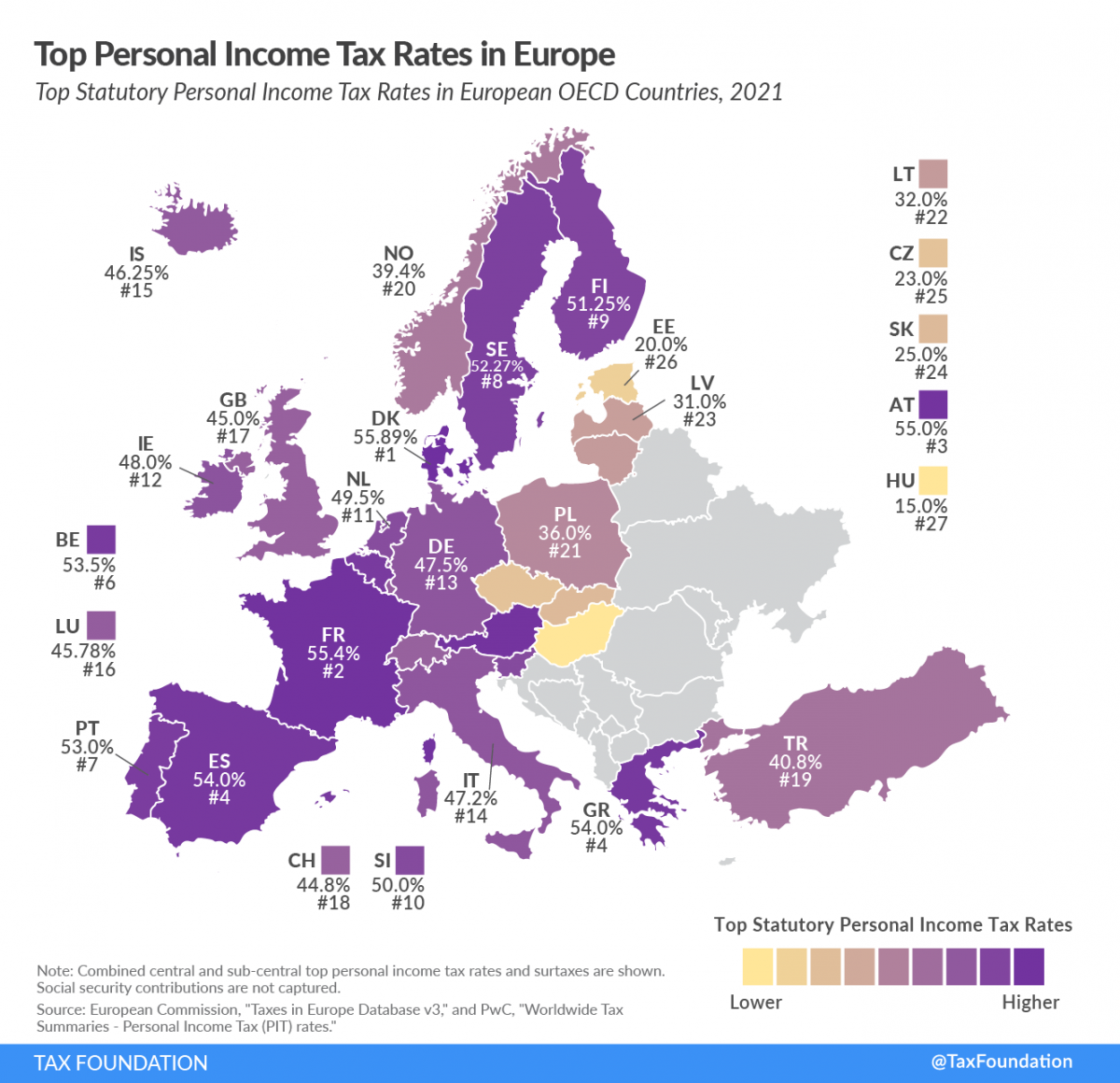

Income Tax Rates In Eu Countries Pay Period Calendars 2023

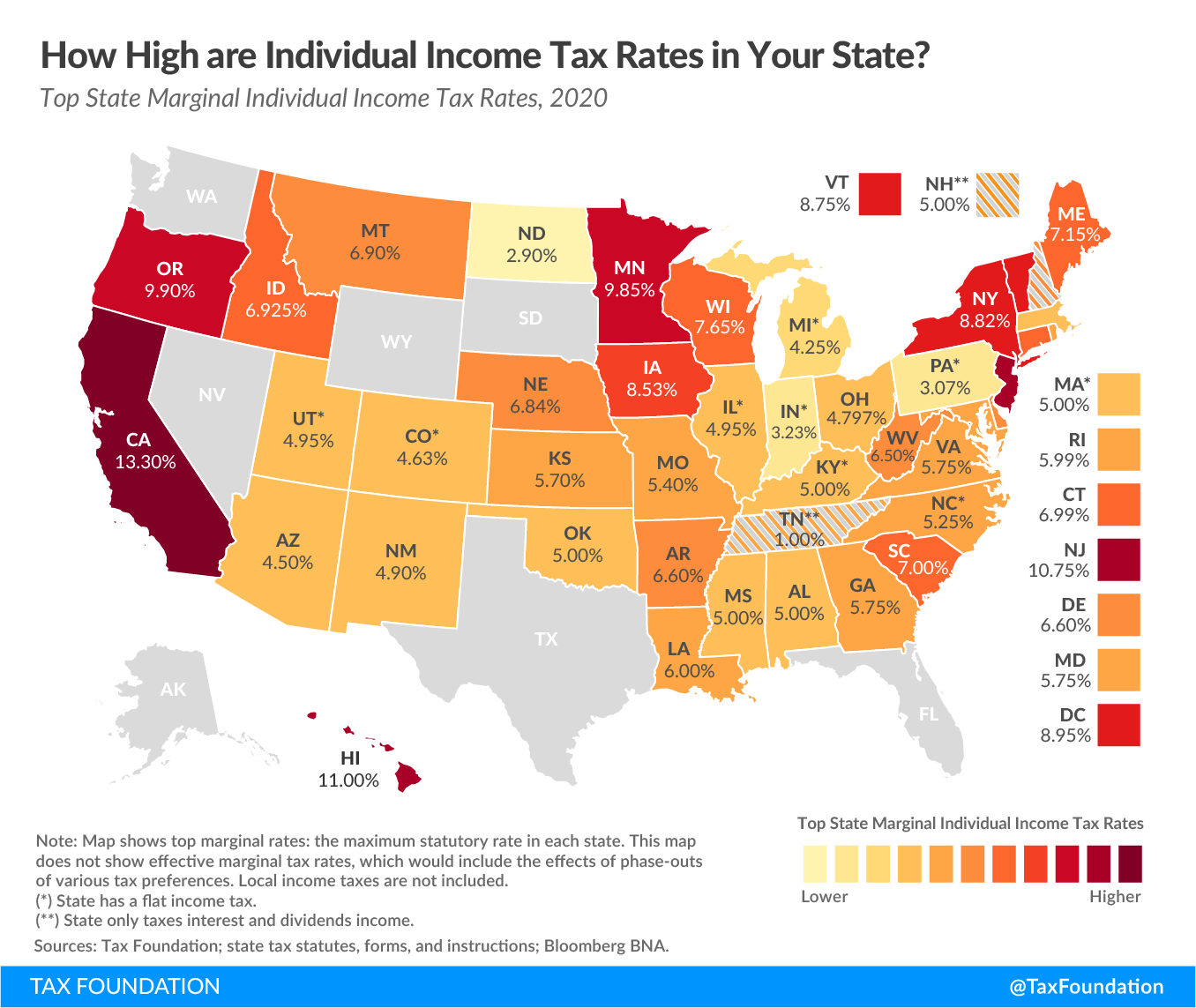

Income Tax Rates By State INVOMERT

https://ph.icalculator.com/income-tax-rates/2022.html

WEB Philippines Residents Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from 0 000 00 to 250 000 00 20 Income from 250 000 01 to 400 000 00 25 Income from 400 000 01 to 800 000 00 30 Income from 800 000 01 to 2 000 000 00 32

https://taxsummaries.pwc.com/philippines/...

WEB Individual Taxes on personal income Last reviewed 02 March 2024 The Philippines taxes its resident citizens on their worldwide income Non resident citizens and aliens whether or not resident in the Philippines are taxed only on income from sources within the Philippines Rates of tax on income of aliens resident or not depend on the

https://www.bir.gov.ph/index.php/tax-information/income-tax.html

WEB Income Tax Rates For Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Profession Graduated Income Tax Rates under Section 24 A 2 of the Tax Code of 1997 as amended by Republic Act No 10963

https://ph.icalculator.com/income-tax-calculator/2022.html

WEB The calculator is updated with the latest tax rates and brackets as per the 2022 tax year in Philippines This tool is designed for simplicity and ease of use focusing solely on income tax calculations For a more detailed assessment including other deductions or specific tax advice consult a tax professional

https://filipiknow.net/tax-table

WEB Apr 15 2023 nbsp 0183 32 1 Itemized deduction 2 Optional standard deduction TRAIN Law Tax Table 2023 Graduated income tax rates for January 1 2023 and onwards How To Compute Your Income Tax Based on Graduated Rates Sample income tax computation for the taxable year 2020

WEB Last reviewed 02 March 2024 Typical tax computation for 2024 Assumptions Resident alien husband and wife with two dependent children Salary and allowances of husband arising from employment Salary of PHP 652 000 living allowances of PHP 100 000 and housing benefits 100 of PHP 300 000 Teaching salary of wife PHP 68 000 WEB Jan 4 2023 nbsp 0183 32 Personal Income Tax Rates in the Philippines Income 2021 2022 tax rate 2023 tax rate 0 PHP 250 000 US 4 463 0 0 PHP 250 001 US 4 464 PHP 400 000 US 7 142 20 15 PHP 400 001 US 7 142 PHP 800 000 US 14 288 25 20 PHP 800 001 US 14 283 PHP 2 000 000 US 35 712 30 25 PHP 2 000 001

WEB This manual computation of your income tax uses the following formula to determine your income tax due Taxable income Gross income Allowable deductions x Tax rate Tax withheld To determine the applicable tax rate please refer to the table below effective January 1 2023 Taxable Income Tax Rate