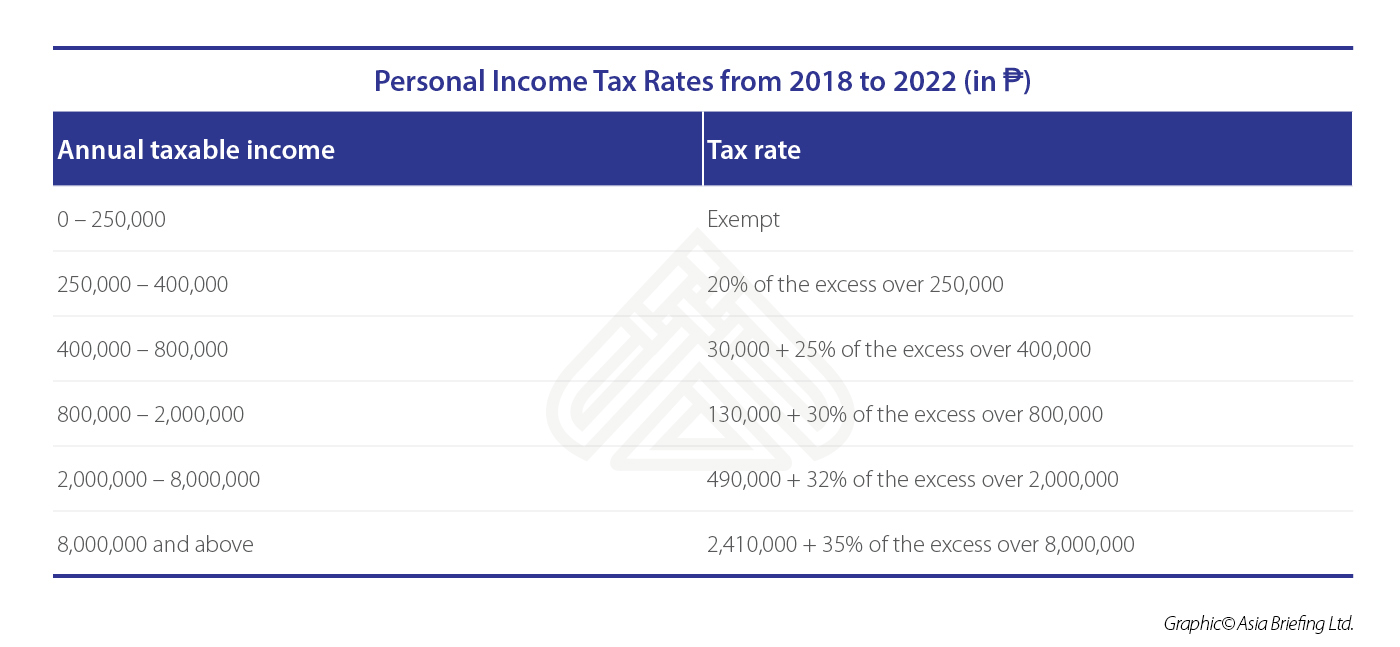

Income Tax Rate Philippines 2022 Vs 2023 Web Jun 11 2023 nbsp 0183 32 The 2023 tax table is a guide that shows the tax rates and brackets deductions and exemptions applicable to taxpayers in the Philippines It is a crucial tool for calculating the amount of income tax payable to the government based on an individual s taxable income

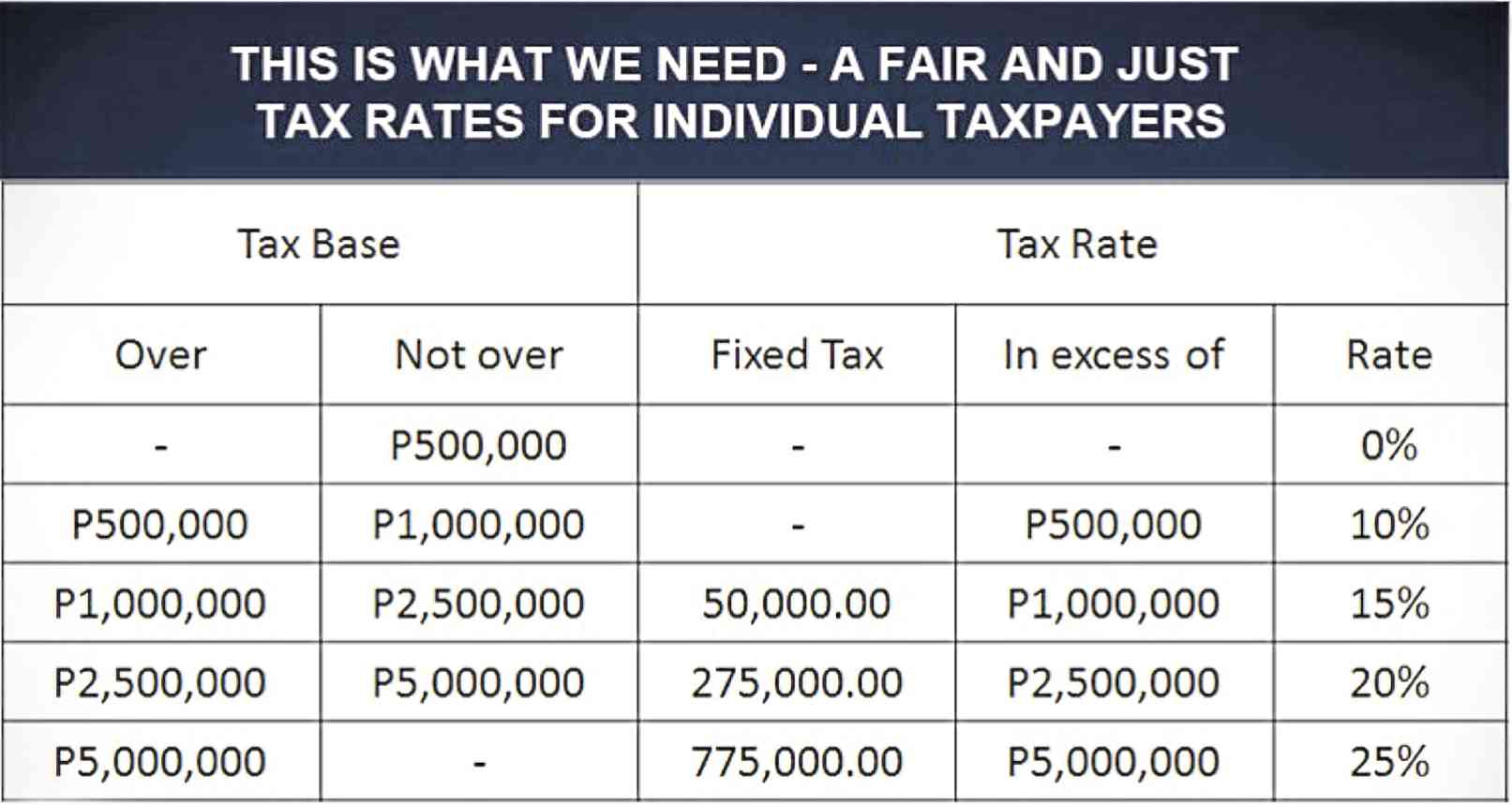

Web 8 Income Tax on Gross Sales Receipts and Other Non Operating Income in Lieu of the Graduated Income Tax Rates and the Percentage Tax Or Income Tax Based on Graduated Income Tax Rates If the total Gross Sales Receipts Exceed VAT Threshold of P3 000 000 Income Tax Based on Graduated Income Tax Rates Web Feb 1 2023 nbsp 0183 32 TRAIN Law increases take home pays in the new Income Tax Table for 2023 A news article from Mazars trusted Tax consultant firm in the Philippines that provides tax services in the Philippines

Income Tax Rate Philippines 2022 Vs 2023

Income Tax Rate Philippines 2022 Vs 2023

Income Tax Rate Philippines 2022 Vs 2023

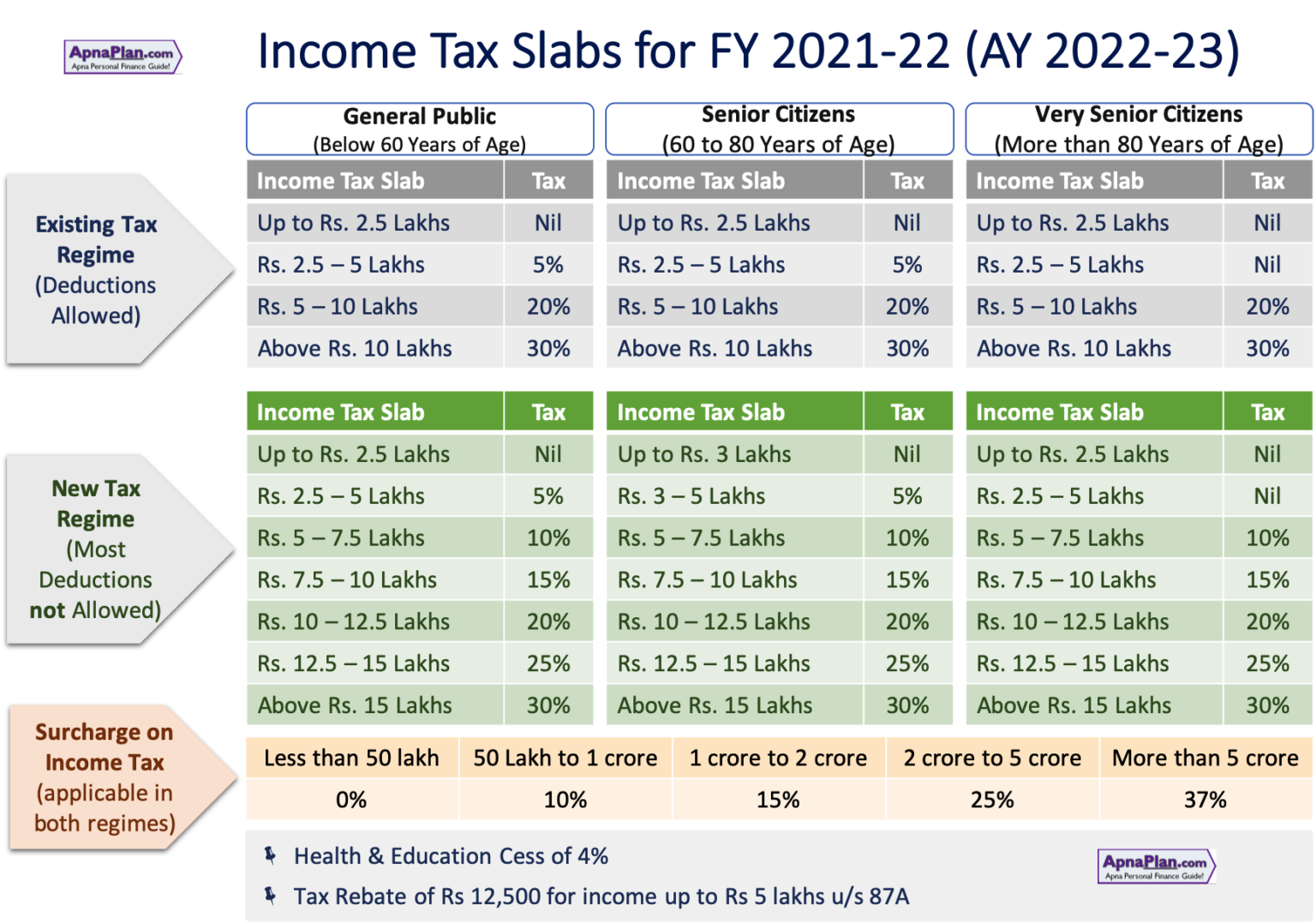

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

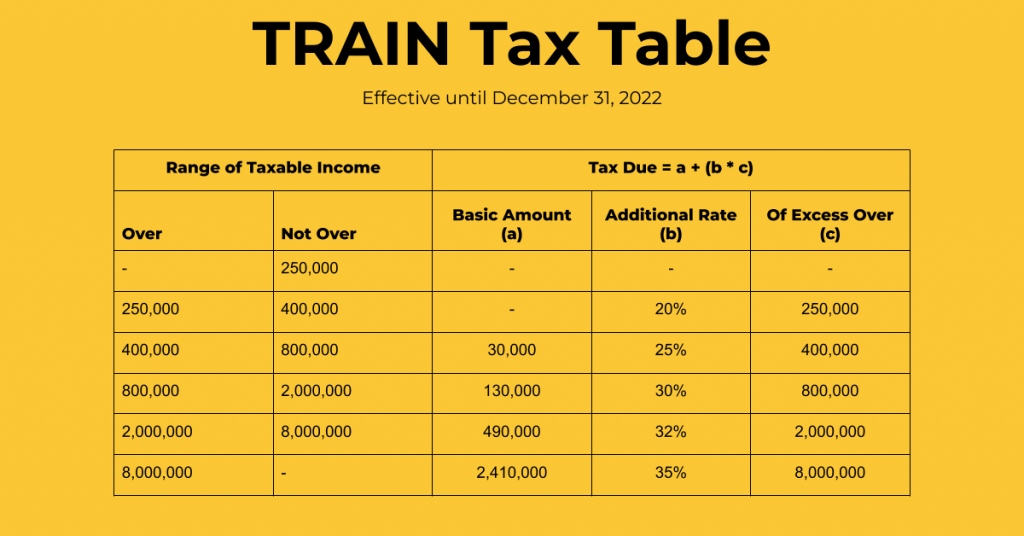

Web Dec 30 2022 nbsp 0183 32 The clarification explains 1 the annual taxable income below 250 000 Philippine pesos US 4 459 79 is exempt from personal income tax while other taxpayers will have lower tax ranging from 15 percent to 30 percent by 2023 except for taxpayers with taxable income of more than 8 000 000 Philippine pesos US 142 713 15 2 the

Pre-crafted templates use a time-saving solution for developing a varied range of documents and files. These pre-designed formats and layouts can be utilized for numerous personal and professional projects, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the material development process.

Income Tax Rate Philippines 2022 Vs 2023

Philippine Personal Income Tax Rates 2018 Ines Gopez Amarante And Co

Personal Income Tax Rates For Australian Residents 2018 2019

Personal Income Tax 2023 Government PH

The Philippines New Tax Reform Package Approved Vinh Le IR Global

Download Income Tax Calculator Excel 2021 22 AY 2022 23 Outsource

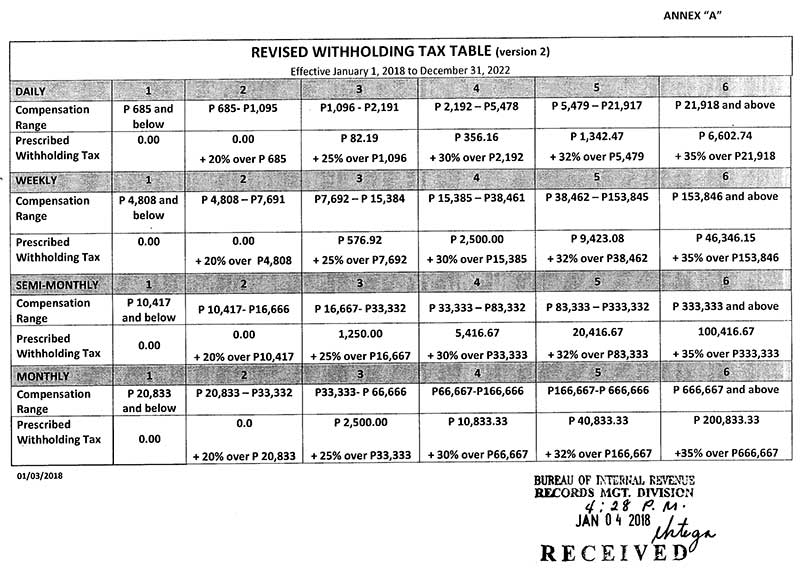

Revised Withholding Tax Table Bureau Of Internal Revenue

https://www.dof.gov.ph/train-law-to-further-reduce-personal-

Web Dec 28 2022 nbsp 0183 32 The revised tax schedule beginning January 1 2023 reduces personal income taxes for those earning PHP8 000 000 and below compared to the initial tax cuts for January 1 2018 to December 31 2022 Meanwhile to maintain the progressivity of the tax system the tax rate for individuals earning PHP8 000 000 and above annually will be

https://www.pinoymoneytalk.com/new-income-tax-table-rates-philippines

Web Sep 17 2023 nbsp 0183 32 The new income tax rates from year 2023 onwards as per the TRAIN law are as follows Taxable Income per Year Income Tax Rate Year 2023 onwards P250 000 and below 0 Above P250 000 to P400 000 15 of the excess over P250 000 Above P400 000 to P800 000 P22 500 20 of the excess over P400 000

https://mpm.ph/bir-tax-tables-2023

Web Dec 29 2022 nbsp 0183 32 The act stated two schedule of new income tax rate as follows a Effective January 1 2018 to December 31 2022 b Effective January 1 2023 and onward Because of this change on income tax rate withholding tax rate on employee s compensation will likewise change

https://www.rappler.com/business/personal-income...

Web Dec 23 2022 nbsp 0183 32 Under the TRAIN or the Tax Reform for Acceleration and Inclusion Law individuals earning purely from compensation income whose taxable earnings are less than P8 million yearly will have lower tax

https://ph.icalculator.com/income-tax-rates/2022.html

Web 2022 Salary Calculator 2022 VAT Calculator 2022 Reverse VAT Calculator 2022 Income Tax Calculator Philippines Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Philippines are updated annually with new tax tables published for Resident and Non resident taxpayers

Web Nov 1 2022 nbsp 0183 32 Starting January 1 2023 they will be subject to lower income tax rates ranging from 15 to 30 High income earners who have taxable income in excess of Php 8 million will continue to be subjected to a 35 rate Note however that the present administration through the Department of Finance DOF has proposed changes in Web Jan 17 2023 nbsp 0183 32 Compared to the rates imposed at the initial implementation of the TRAIN Law in 2018 the new income tax rates for individuals have been decreased by 5 for those with taxable income of more than PhP250 000 00 up to PhP2 000 000 00 while a 2 decrease in the tax rate for those individuals with taxable income of more than

Web Dec 15 2022 nbsp 0183 32 The new tax table effective January 1 2023 still exempts taxpayers having a net taxable income of not over P250 000 and continues to subject taxpayers with over P8 000 000 net taxable income to 35