2022 Tax Rate Philippines Review the latest income tax rates thresholds and personal allowances in Philippines which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Philippines

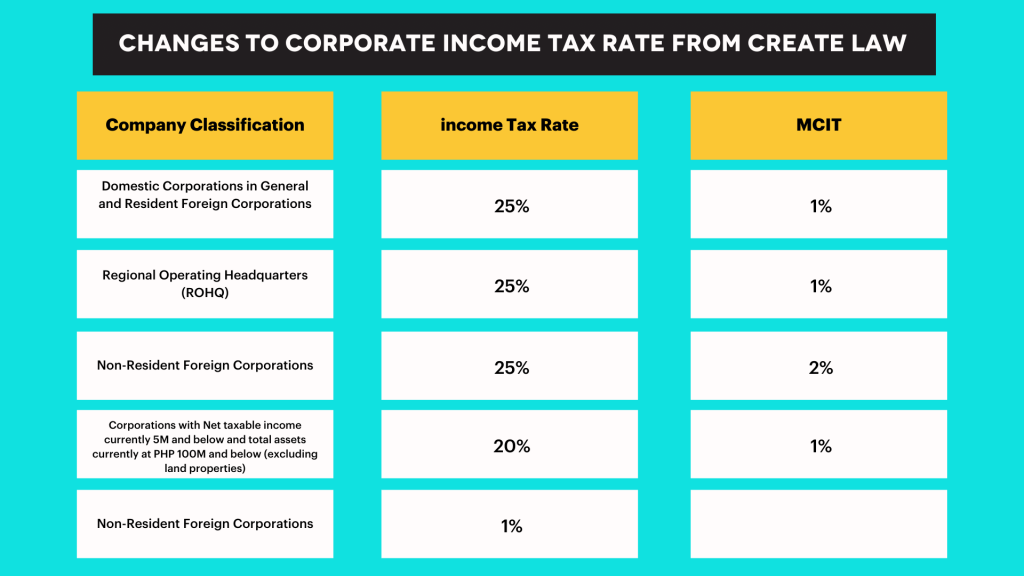

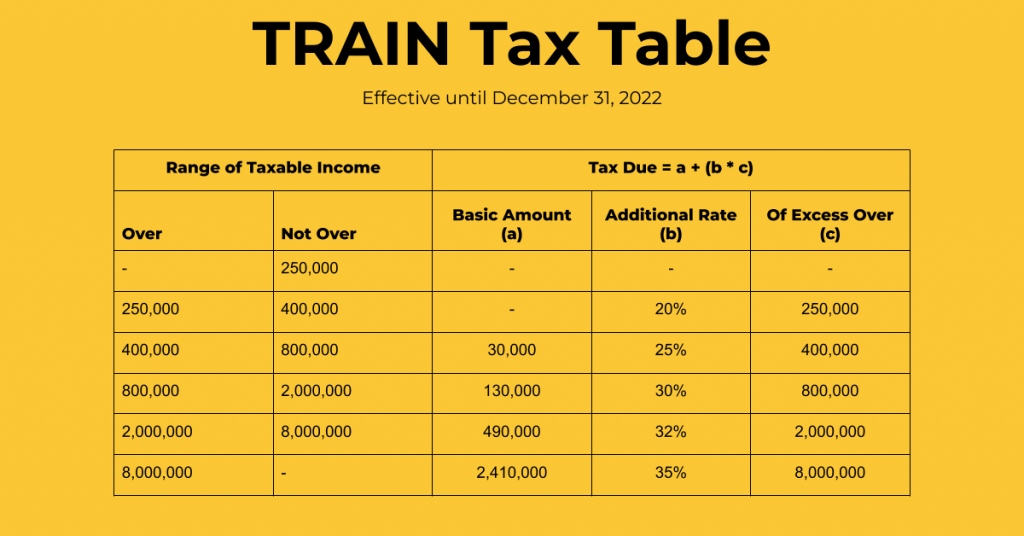

For individual taxpayers the income tax rate until December 31 2022 are shown as follows For corporate taxpayers the regular income tax rate in the Philippines of 25 or 20 for the 2022 annual ITR depends on the classification as follows DOMESTIC CORPORATION Apr 30 2023 nbsp 0183 32 What Is The New Income Tax Rate In The Philippines In 2023 Depending on your annual income the tax rate varies There are 5 tiers including 1st 0 P250 000 2nd P250 000 P400 000 3rd P400 000 P800 000 4th P800 000 P2 000 000 5th P2 000 000 P8 000 000 6th over 8 000 000

2022 Tax Rate Philippines

2022 Tax Rate Philippines

2022 Tax Rate Philippines

https://i2.wp.com/4.bp.blogspot.com/-wl38od7nLRA/Wk2lXlTURXI/AAAAAAAAAH0/D-ctdDAAmNAumM0Fbt5_hnZpX5pmMWZkwCEwYBhgL/s640/Personal%2BIncome%2BTax%2B-%2BTRAIN%2B2018.jpg

Jan 3 2022 nbsp 0183 32 What is the income tax rate in The Philippines The compensation income tax rate in The Philippines is progressive and ranges from 0 to 35 depending on your income This income

Pre-crafted templates use a time-saving solution for producing a varied series of files and files. These pre-designed formats and designs can be used for different individual and expert tasks, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the content development procedure.

2022 Tax Rate Philippines

New Withholding Tax Rates 2022

2022 Tax Rate Schedules Latest News Update

The 2022 Bir Tax Table JobStreet Philippines

Income Tax Rate Philippines 2021 Olin Barone

Philippines Personal Income Tax Rate 2023 Take profit

2022 Tax Table Philippines Latest News Update

https://www.pinoymoneytalk.com › new-income-tax...

Sep 17 2023 nbsp 0183 32 1 income brackets were streamlined and reduced to just six 6 from seven 7 brackets 2 taxable income threshold per bracket has been adjusted upwards 3 tax rate charged on each taxable income bracket was revised mostly lowered 4 annual gross income eligible for tax exemption has been adjusted upwards from previously the amount of

https://taxsummaries.pwc.com › philippines › ...

Jan 1 2023 nbsp 0183 32 For resident and non resident aliens engaged in trade or business in the Philippines the maximum rate on income subject to final tax usually passive investment income is 20 For non resident aliens not engaged in trade or business in the Philippines the rate is a flat 25

https://www.bir.gov.ph › income-tax

ANNUAL INCOME TAX FOR INDIVIDUALS ESTATES AND TRUSTS ACCOUNT INFORMATION FORM FOR SELF EMPLOYED INDIVIDUALS ESTATES AND TRUSTS INCLUDING THOSE WITH MIXED INCOME I E COMPENSATION INCOME AND INCOME FROM BUSINESS AND OR PRACTICE OF PROFESSION

https://ph.jobstreet.com › career-advice › article › ...

Sep 1 2022 nbsp 0183 32 BIR withholding tax table shows how much tax shall be withheld by employers from their employees compensation The withholding tax tables show six columns for every pay period Under the columns are the compensation ranges and their corresponding tax rates

https://ph.icalculator.com › income-tax-calculator

Welcome to the 2022 Income Tax Calculator for Philippines which allows you to calculate Income Tax Due the Effective Tax Rate and the Marginal Tax Rate based on your taxable income in Philippines in 2022

Jul 15 2022 nbsp 0183 32 Income tax in the Philippines is levied by the Bureau of Internal Revenue BIR The basic tax rate is 25 percent but there are several other rates that apply to different income brackets For single individuals the taxable income range starts The document summarizes tax rates and bases for individual taxpayers in the Philippines as amended by the TRAIN law It outlines 14 categories of income and the applicable tax rates for resident citizens alien individuals non resident citizens and non resident aliens engaged in

Starting January 1 2023 income tax rates will be reduced to 15 to 35 Instead of using the income tax rates self employed and mixed income individuals with gross annual sales receipts of Php 3 million or less may opt to pay the 8 tax on gross sales receipts in excess of Php 250 000 g Percentage tax