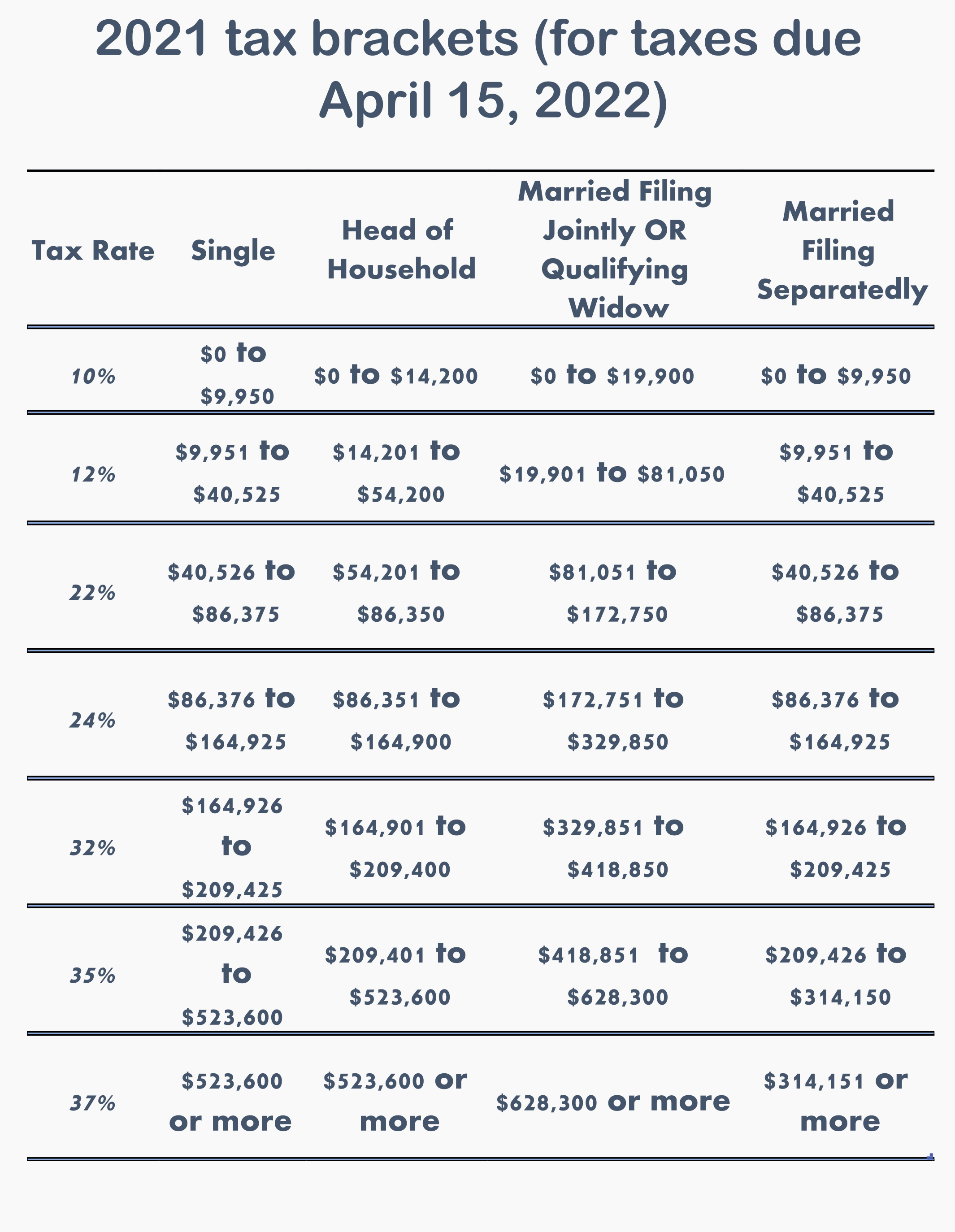

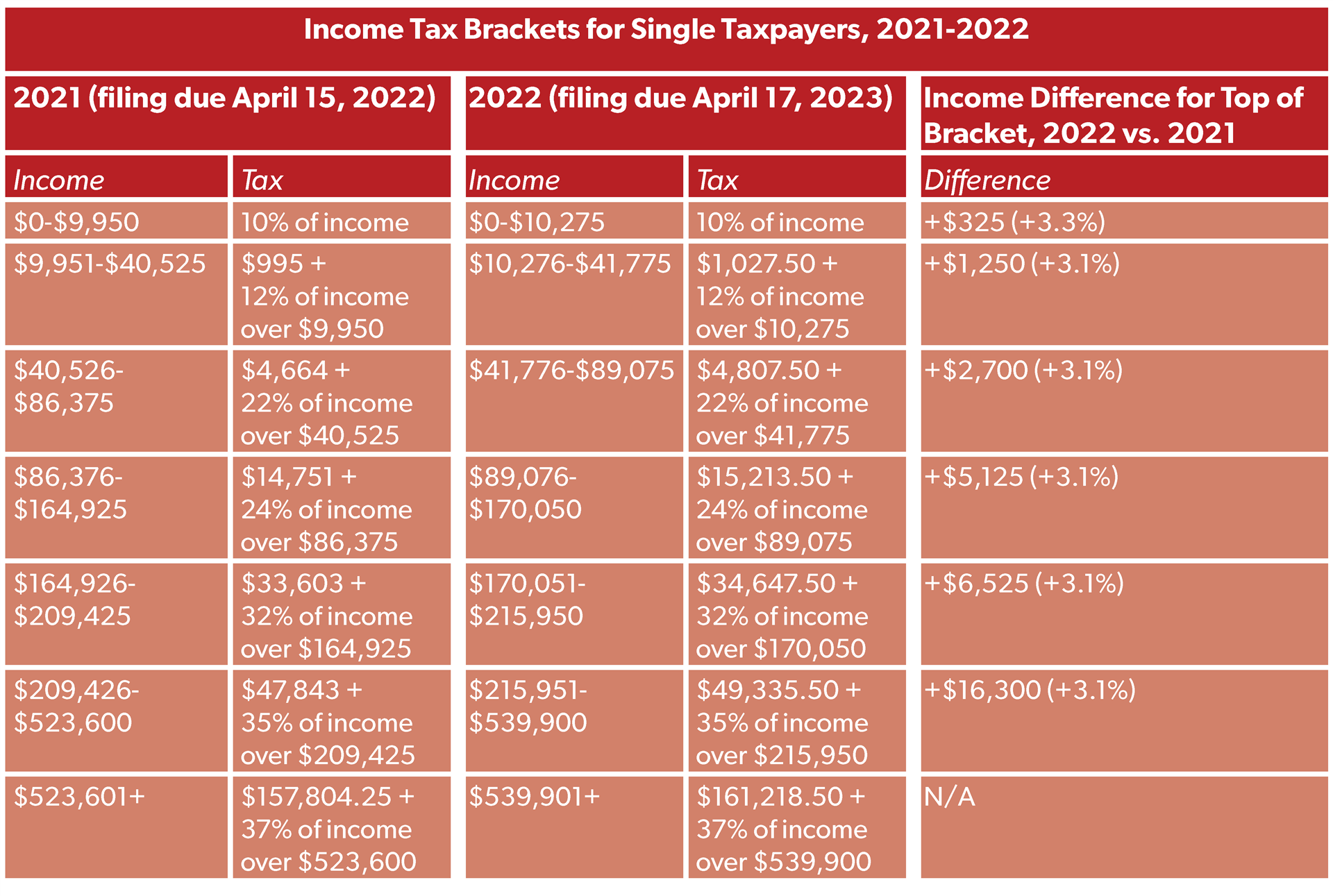

2022 Income Tax Rates Federal Web Nov 1 2022 nbsp 0183 32 Key Takeaways There are seven tax rates that apply to seven brackets of income 10 12 22 24 32 35 and 37 For tax year 2022 the lowest 10 rate applies to an individual s income of 10 275 or less while the highest 37 rate applies to an individual s income of 539 900 or more Income brackets adjust every year to

Web Nov 10 2021 nbsp 0183 32 Twenty 20 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted Web Nov 11 2021 nbsp 0183 32 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021

2022 Income Tax Rates Federal

2022 Income Tax Rates Federal

2022 Income Tax Rates Federal

https://printerfriend.ly/wp-content/uploads/2021/03/Tax-brackets-2021.png

Web Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies to a specific range of income referred to as a tax bracket Where each tax bracket begins and ends depends on your filing status

Templates are pre-designed files or files that can be utilized for various purposes. They can conserve time and effort by providing a ready-made format and design for creating different sort of material. Templates can be utilized for individual or professional projects, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

2022 Income Tax Rates Federal

Will Tax Brackets Change In 2022 2022 CGR

Income Tax Rates 2022 Federal

2022 Tax Inflation Adjustments Released By IRS

2022 Income Tax Tables Printable Forms Free Online

Federal Income Tax Brackets 2021 Ladegseattle

2022 2023 Tax Rates Federal Income Tax Brackets Top Dollar

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web 2 days ago nbsp 0183 32 Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing jointly or qualifying surviving spouse Married filing separately Head of household See the tax rates for the 2024 tax year Page Last Reviewed or Updated 17 Jan 2024 Share

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539 900 for single filers and above 647 850 for married couples filing jointly

https://www.irs.gov/newsroom/irs-provides-tax...

Web Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

Web 2 days ago nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which rates apply to you

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

Web Jun 5 2023 nbsp 0183 32 Note 2022 federal income tax brackets for tax returns due April 18 2023 or October 16 2023 with an extension Source Internal Revenue Service In 1913 the highest federal tax rate was just 7 on income over 500 000 equal to over 10 million today The lowest bracket at the time was just 1 for income up to 20 000 per year Web March 8 2022 8 24 am ET Listen 2 min The top tax rate is 37 For 2026 the top rate is set to return to 39 6 Photo Illustration Tammy Lian The tax code currently has seven income tax

Web Jan 9 2024 nbsp 0183 32 The 2024 tax year and the return due in 2025 will continue with these seven federal tax brackets 10 12 22 24 32 35 and 37 Your filing status and taxable income including