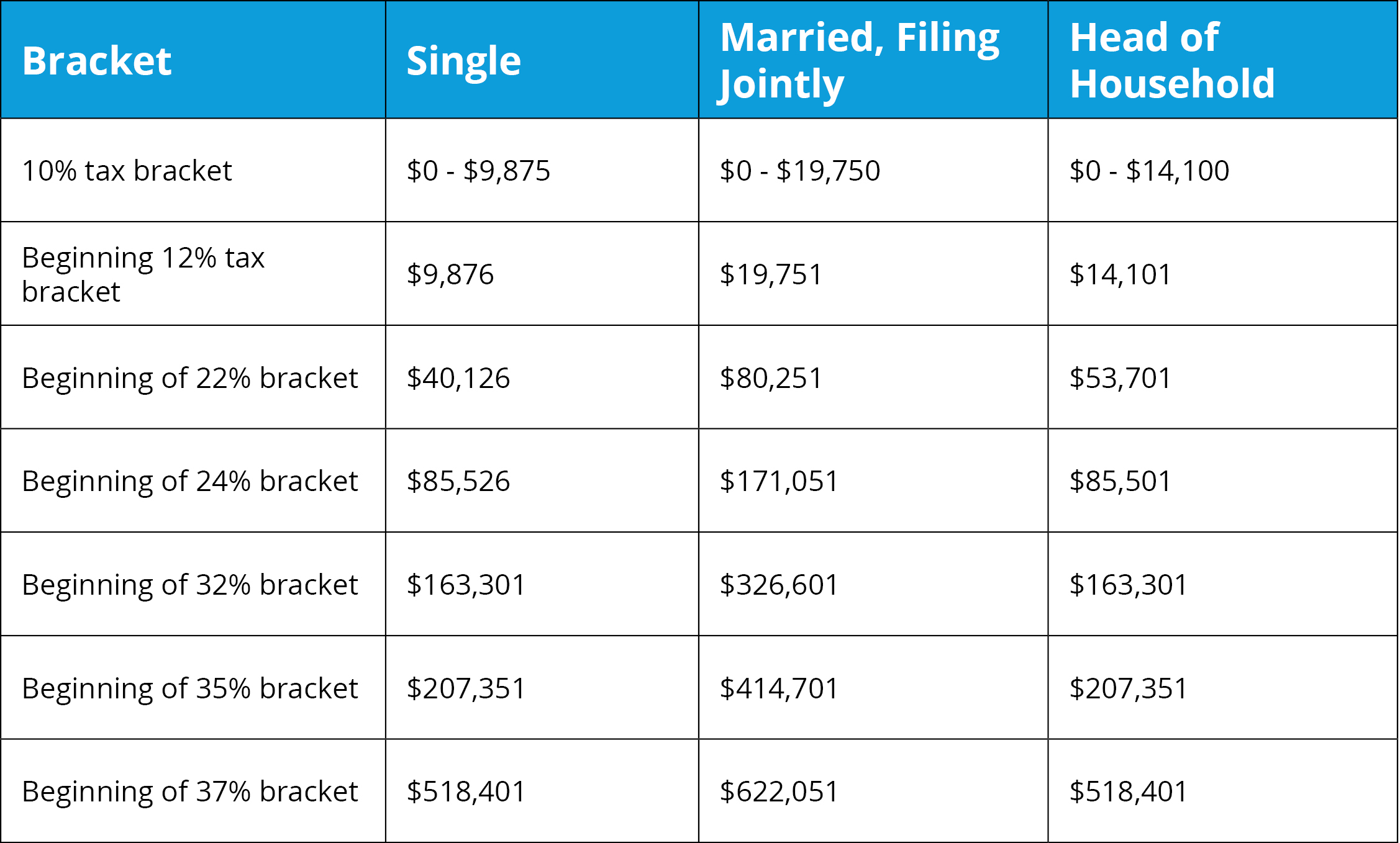

Tax Rates 2022 Federal Web Jan 27 2023 nbsp 0183 32 lechatnoir Getty Images The U S government taxes personal income on a progressive graduated scale the more you earn the higher the percentage you ll pay in taxes Personal income tax rates

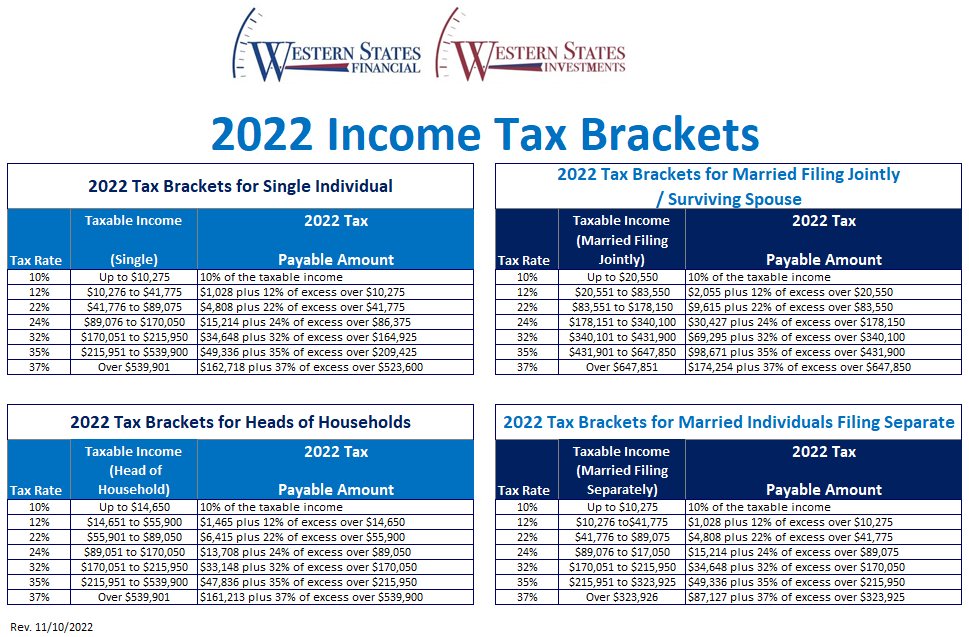

Web Tax rates for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts Find out Web Nov 10 2021 nbsp 0183 32 The 2022 tax brackets affect the taxes that will be filed in 2023 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and

Tax Rates 2022 Federal

Tax Rates 2022 Federal

Tax Rates 2022 Federal

https://images.squarespace-cdn.com/content/v1/5a60cb144c0dbf811647fce8/4cfd08cb-987e-478d-a566-3307b2c5b398/2022-tax-brackets.jpg

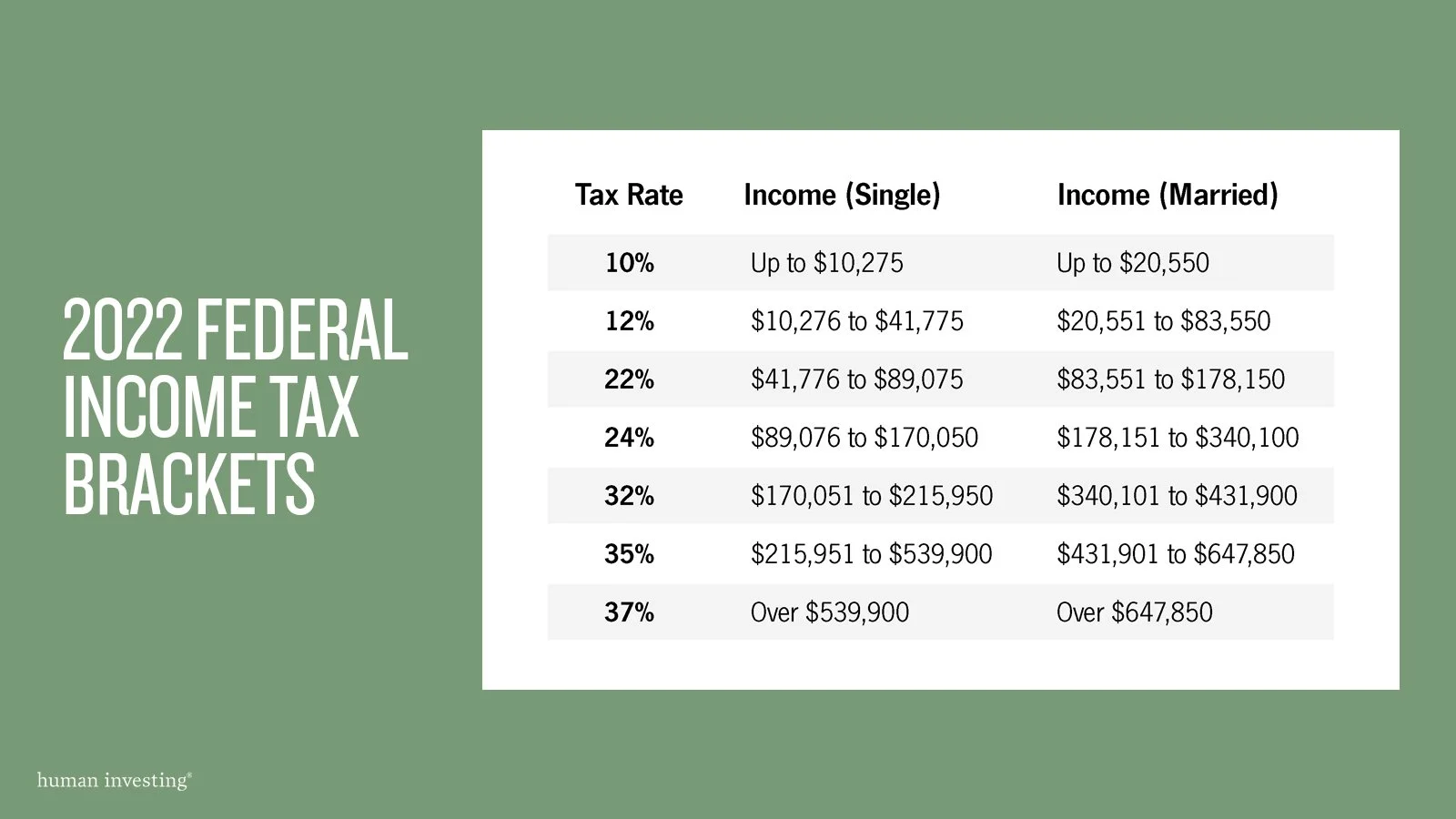

Web Feb 4 2024 nbsp 0183 32 It s essential to know which federal tax bracket you are in as your tax bracket determines your federal income tax rate for the year There are seven different income tax rates

Pre-crafted templates offer a time-saving option for creating a varied series of documents and files. These pre-designed formats and layouts can be used for numerous individual and expert jobs, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the content development process.

Tax Rates 2022 Federal

STUMP Articles Taxing Tuesday The Governor Of Illinois Talks Taxes

Low Tax Rates Provide Opportunity To Cash Out With Dividends

IRS Releases Income Tax Brackets For 2022 Kiplinger

2022 Federal Tax Brackets Tax Rates Retirement Plans Western

2022 Tax Brackets PersiaKiylah

2022 Tax Brackets Irs Calculator

https://taxfoundation.org/data/all/federal/2022-tax-brackets

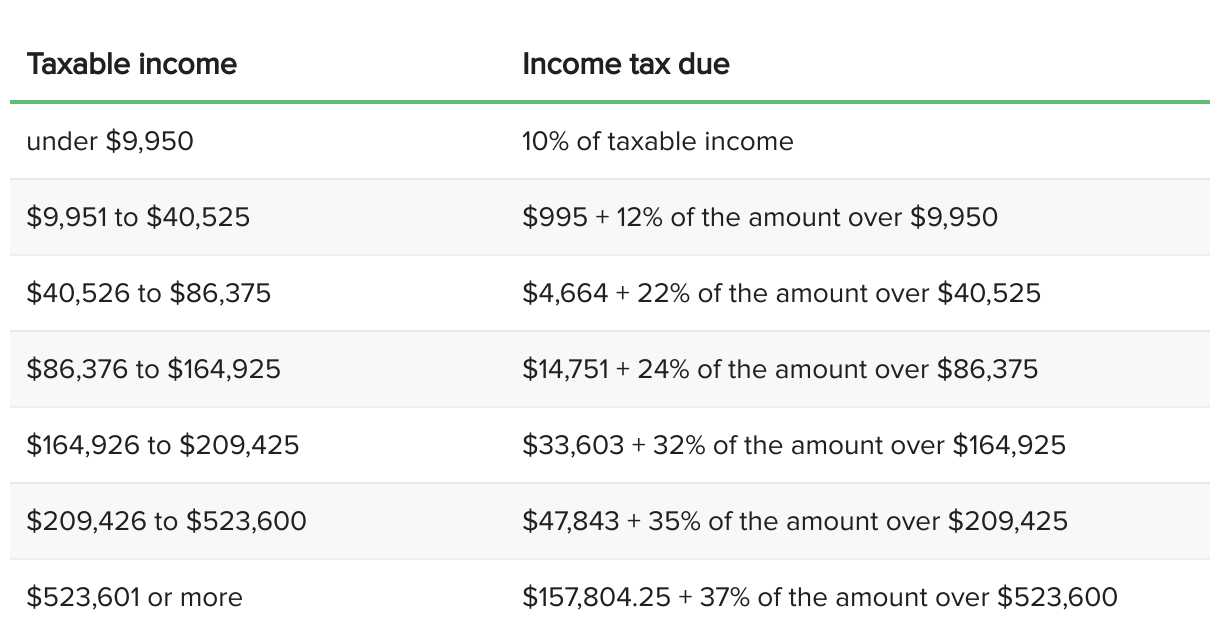

Web Nov 10 2021 nbsp 0183 32 Find the updated federal income tax brackets and rates for 2022 as well as the standard deduction alternative minimum tax and earned income tax credit The IRS

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Jan 31 2024 nbsp 0183 32 Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Married filing

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 2022 Tax Bracket and Tax Rates There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status

https://www.morganstanley.com/content/dam/msdotcom/...

Web Jan 18 2022 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing

https://www.investopedia.com/irs-announce…

Web Nov 11 2021 nbsp 0183 32 Standard deductions and about 60 other provisions have been adjusted for inflation to avoid bracket creep The maximum Earned Income Tax Credit for 2022 will be 6 935 vs 6 728 for tax year 2021

Web Jan 20 2022 nbsp 0183 32 Total income taxes paid rose by 42 billion to 1 58 trillion a 2 7 percent increase above 2018 The average individual income tax rate was nearly unchanged Web 2022 tax brackets and federal income tax rates Thanks for visiting the tax center Below you will find the 2022 tax rates and income brackets 2022 tax brackets are here Get

Web Oct 18 2022 nbsp 0183 32 What Are Federal Income Tax Rates for 2022 and 2023 by Andrew Lautz October 18 2022 The Internal Revenue Service IRS has released 2023 inflation