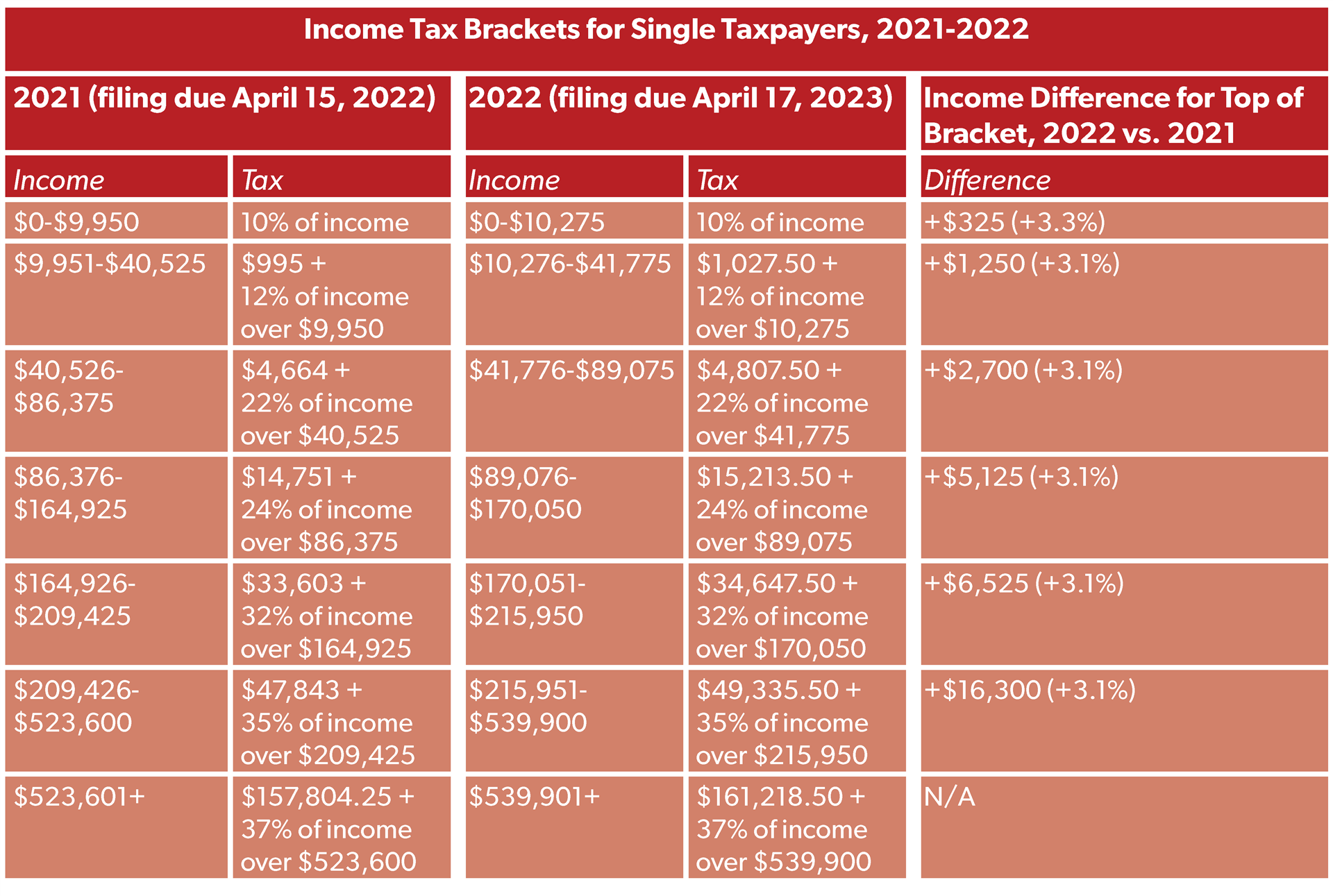

2022 Federal Income Tax Rates Single Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been

Jan 18 2022 nbsp 0183 32 3 8 tax on the lesser of 1 Net Investment Income or 2 MAGI in excess of 200 000 for single filers or head of households 250 000 for married couples filing jointly Nov 11 2021 nbsp 0183 32 For single filers and married individuals who file separately the standard deduction will rise by 400 from 12 550 to 12 950 For heads of households the standard

2022 Federal Income Tax Rates Single

2022 Federal Income Tax Rates Single

2022 Federal Income Tax Rates Single

https://i1.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

Oct 18 2022 nbsp 0183 32 On your 11 001st dollar you will start paying a 12 percent rate on each dollar until you reach the next bracket at 44 725 Here s how a sample tax calculation might work for

Templates are pre-designed files or files that can be utilized for various functions. They can save effort and time by supplying a ready-made format and design for producing various sort of content. Templates can be used for individual or professional projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

2022 Federal Income Tax Rates Single

Tax Tables 2018 Computerfasr

10 2023 California Tax Brackets References 2023 BGH

2022 2023 Tax Rates Federal Income Tax Brackets Top Dollar

Irs Tax Table 2022 Married Filing Jointly Latest News Update

Tax Brackets 2022 Chart

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

https://www.irs.com/en/2022-federal-income-tax...

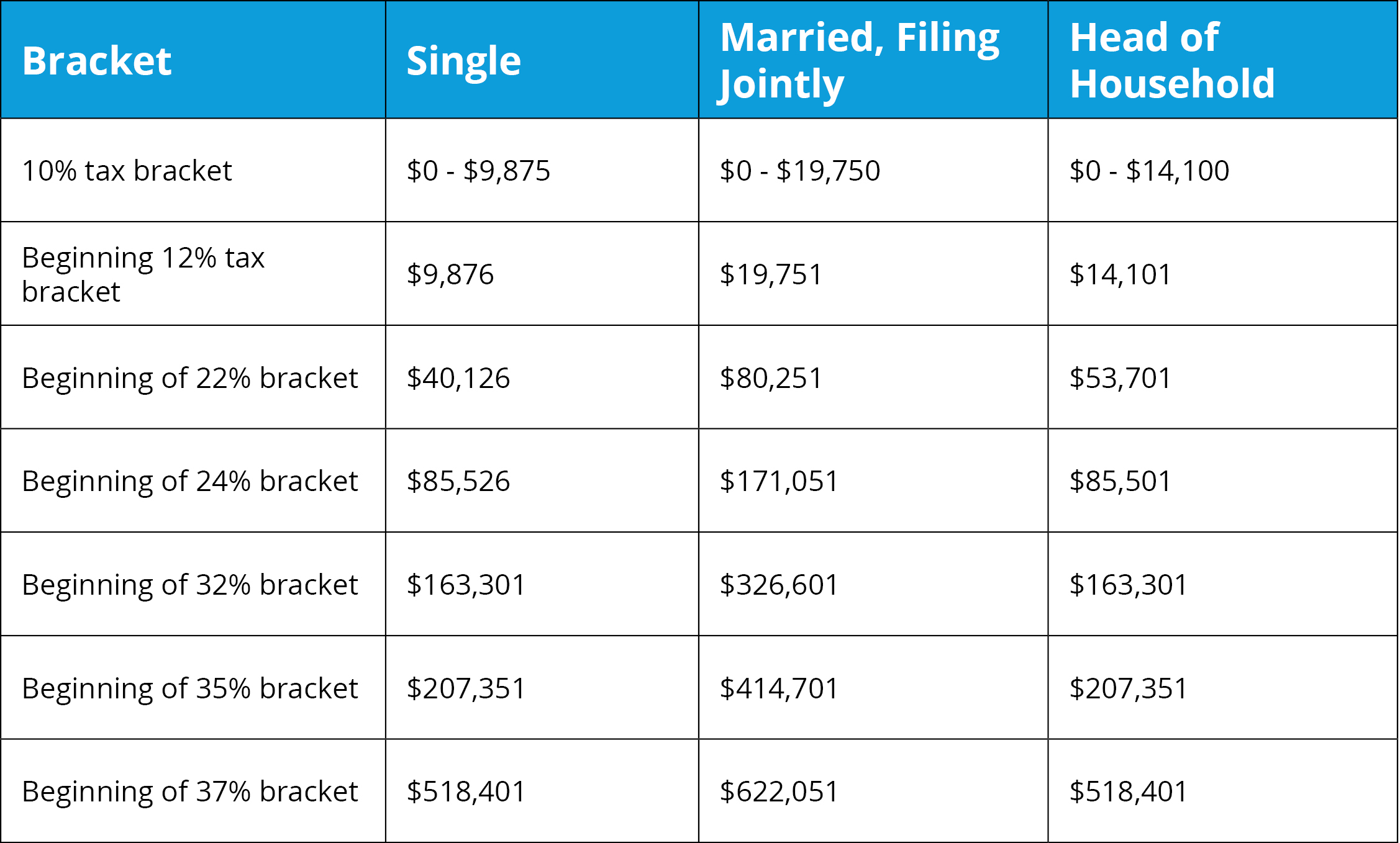

Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

4 days ago nbsp 0183 32 For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Nov 10 2021 nbsp 0183 32 IRS Announces 2022 Tax Rates Standard Deduction Amounts And More Ashlea Ebeling Former Staff Nov 10 2021 10 37am EST This article is more than 2 years old Share

https://www.thebalancemoney.com/federal-income-tax...

Jan 27 2023 nbsp 0183 32 Personal income tax rates begin at 10 for the tax year 2022 the return due in 2023 then gradually increase to 12 22 24 32 and 35 before reaching a top rate of 37 Each tax rate applies to a

https://www.nerdwallet.com/article/taxes/federal...

In 2023 and 2024 there are seven federal income tax rates and brackets 10 12 22 24 32 35 and 37 Taxable income and filing status determine which federal tax rates

The seven federal tax bracket rates range from 10 to 37 2023 tax brackets and federal income tax rates 2022 tax brackets and federal income tax rates 2021 tax brackets and Where the taxable income line and filing status column meet is 2 628 This is the tax amount they should enter in the entry space on Form 1040 line 16 If line 15 taxable income is And

Apr 8 2022 nbsp 0183 32 But instead of paying 24 000 to the federal government the person would pay much less 18 174 50 in income tax That works out to an effective tax rate of just over