2022 Federal Corporate Income Tax Rates Jan 29 2024 nbsp 0183 32 Business Taxes Federal Budget and Economy Support Our Work Main navigation Research TaxVox Events About TPC Statistics Corporate Tax Rate Schedule From 2001 to To 2024 PDF File Download

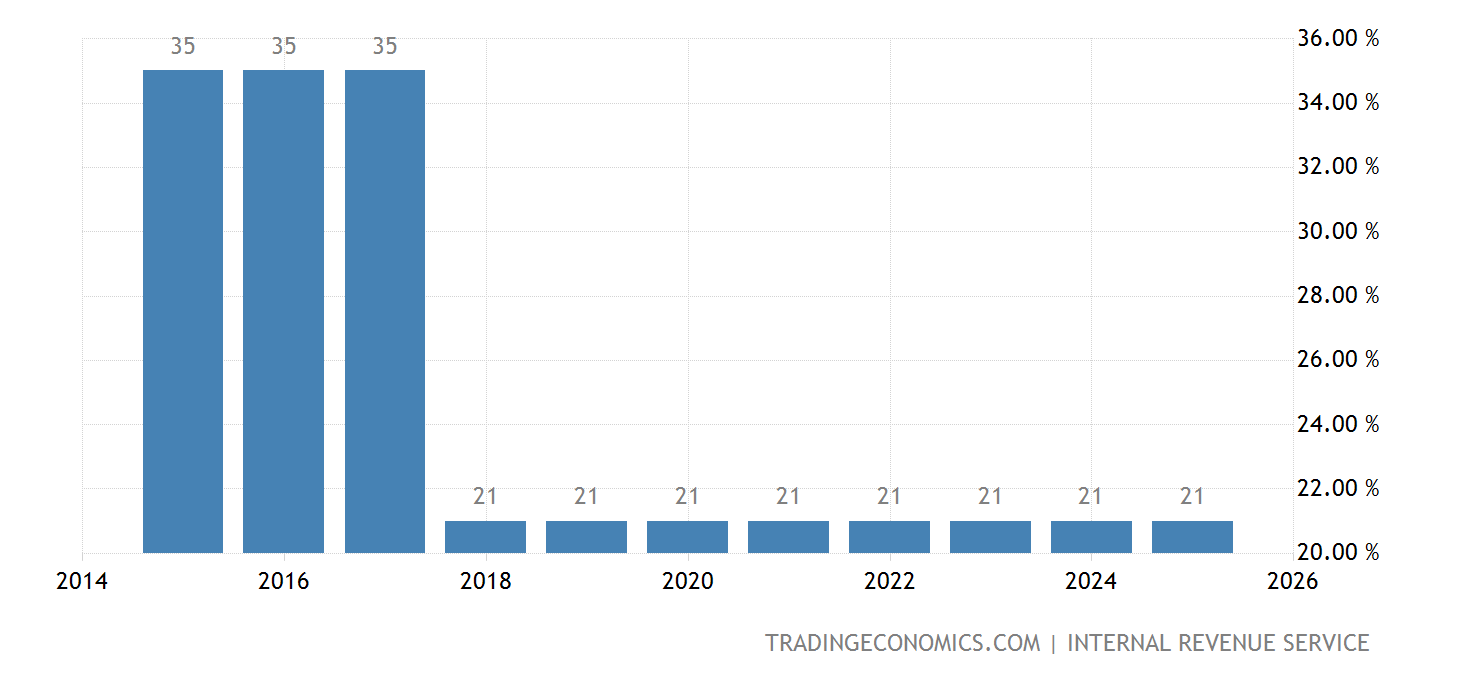

Nov 10 2021 nbsp 0183 32 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate Since January 1 2018 the nominal federal corporate tax rate in the United States of America is a flat 21 following the passage of the Tax Cuts and Jobs Act of 2017 State and local taxes and rules vary by jurisdiction though many are

2022 Federal Corporate Income Tax Rates

2022 Federal Corporate Income Tax Rates

2022 Federal Corporate Income Tax Rates

https://files.taxfoundation.org/20210303101855/2021-combined-federal-and-state-corporate-income-tax-rates.-Do-corporataions-pay-state-and-federal-taxes.png

Aug 13 2024 nbsp 0183 32 P L 115 97 lowered permanently the US federal corporate income tax CIT rate from 35 to 21 The new CIT rate is effective for tax years beginning after 31 December

Pre-crafted templates use a time-saving solution for creating a varied series of documents and files. These pre-designed formats and layouts can be made use of for different individual and professional jobs, including resumes, invites, leaflets, newsletters, reports, presentations, and more, simplifying the content production process.

2022 Federal Corporate Income Tax Rates

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021

Corporate Tax Revenues Are Irrelevant The Sounding Line

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

2022 Federal Effective Tax Rate Calculator Printable Form Templates

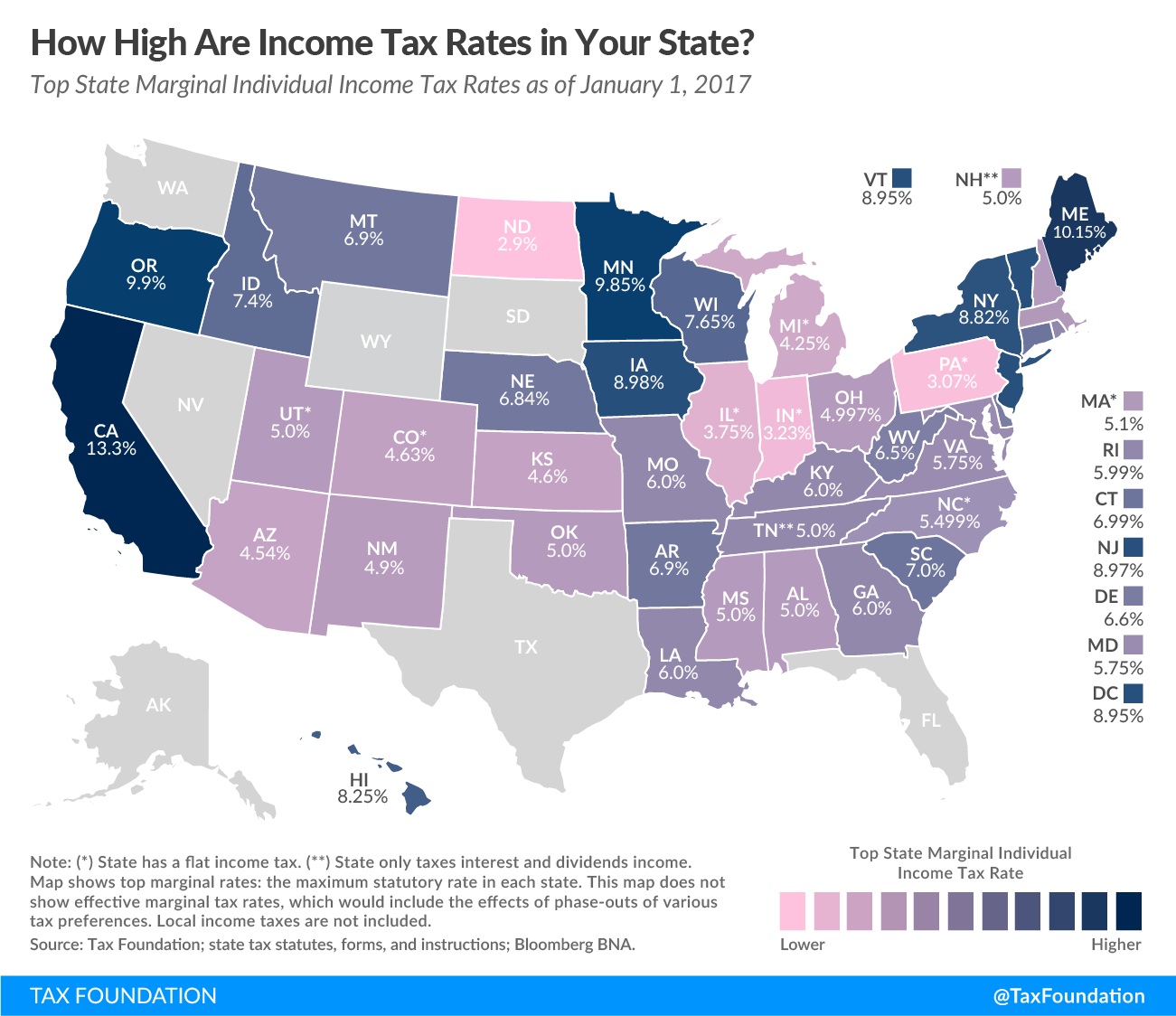

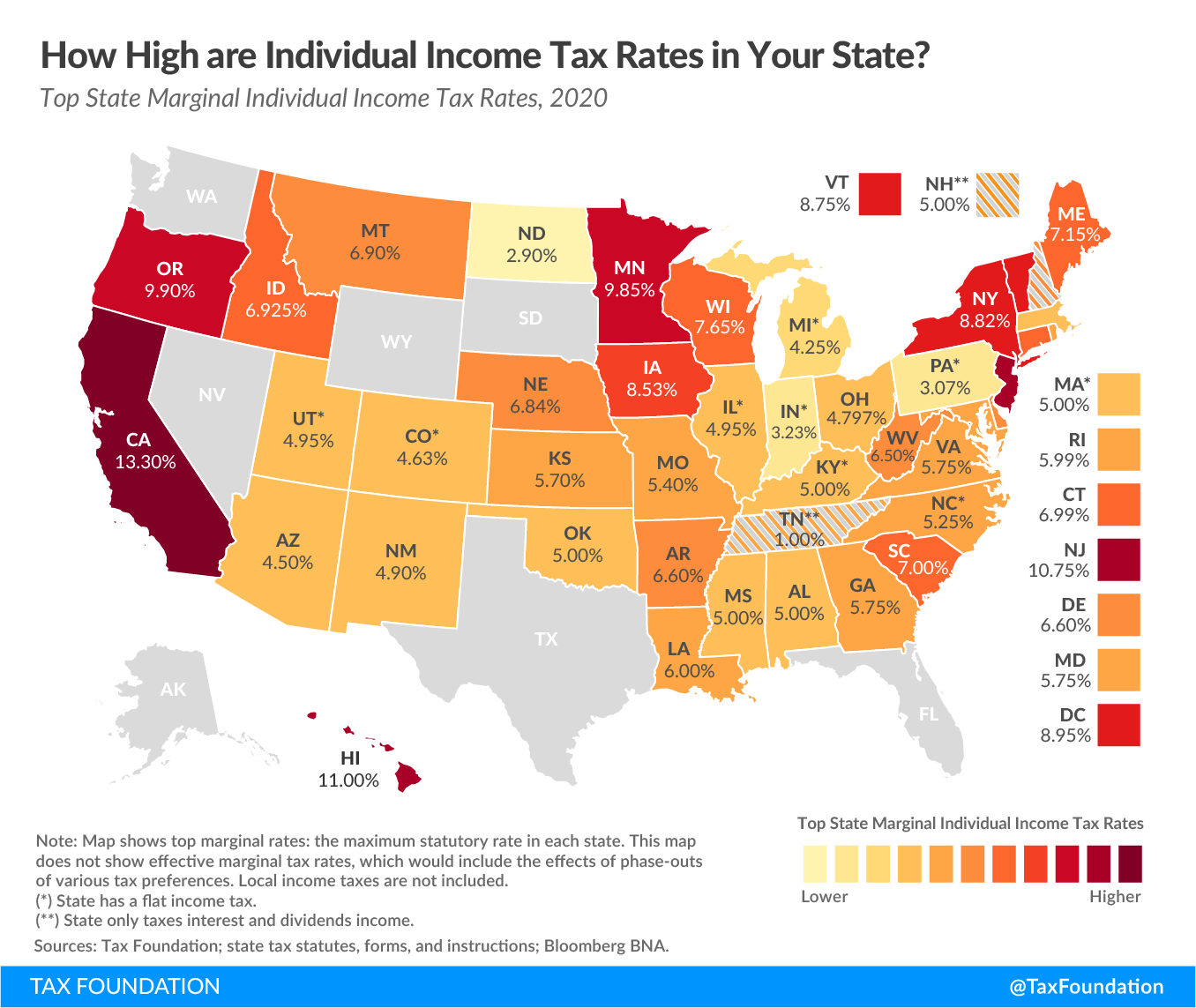

State Individual Income Tax Rates And Brackets 2017 Tax Foundation

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

https://www.irs.gov › publications

This publication discusses the general tax laws that apply to ordinary domestic corporations It provides supplemental federal income tax information for corporations It also supplements the

https://taxpolicycenter.org › briefing-book › …

The corporate income tax raised 424 7 billion in fiscal year 2022 accounting for 8 7 percent of total federal receipts and 1 7 percent of GDP The United States taxes the profits of US resident C corporations named after the relevant

http://taxunfiltered.com

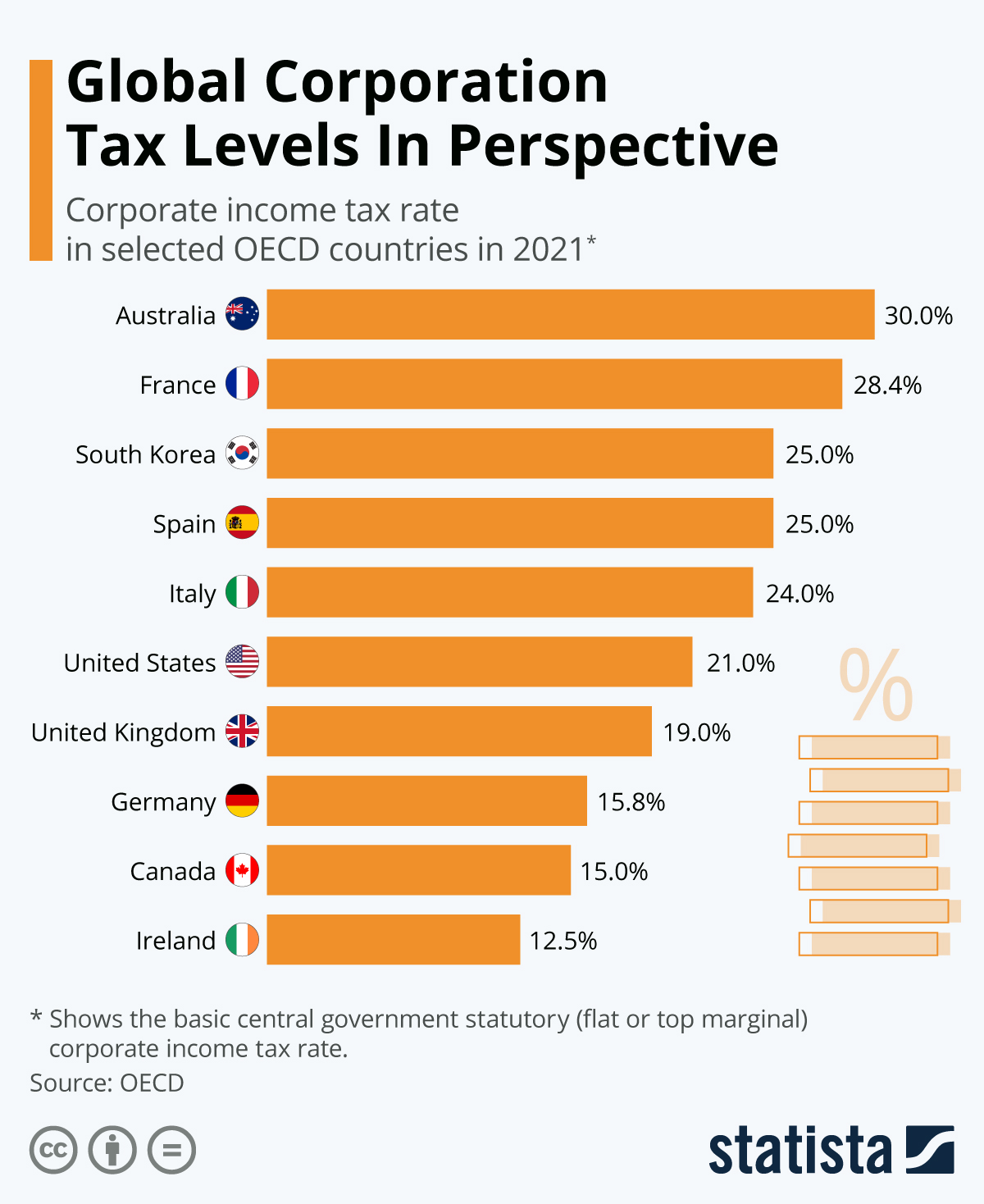

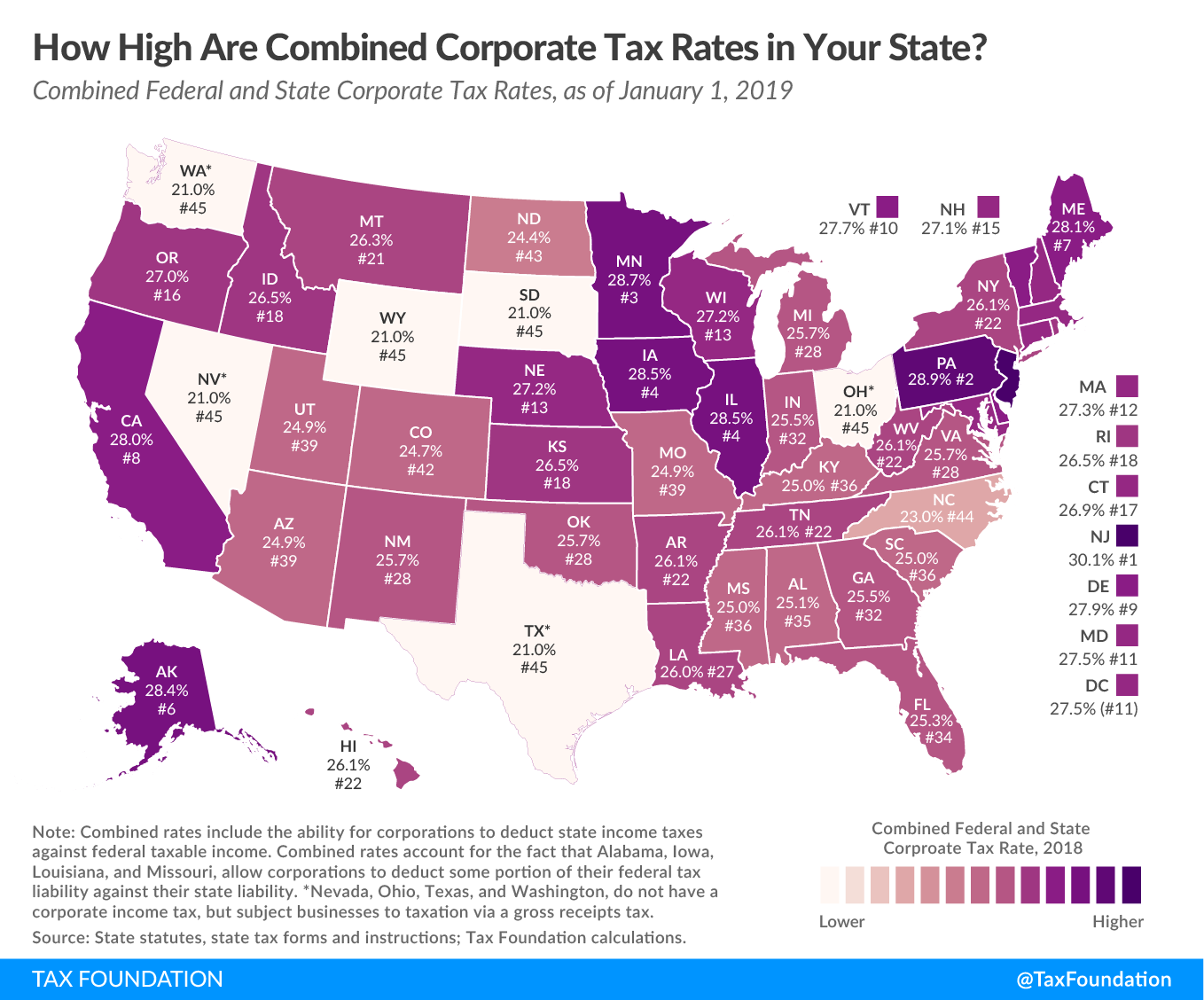

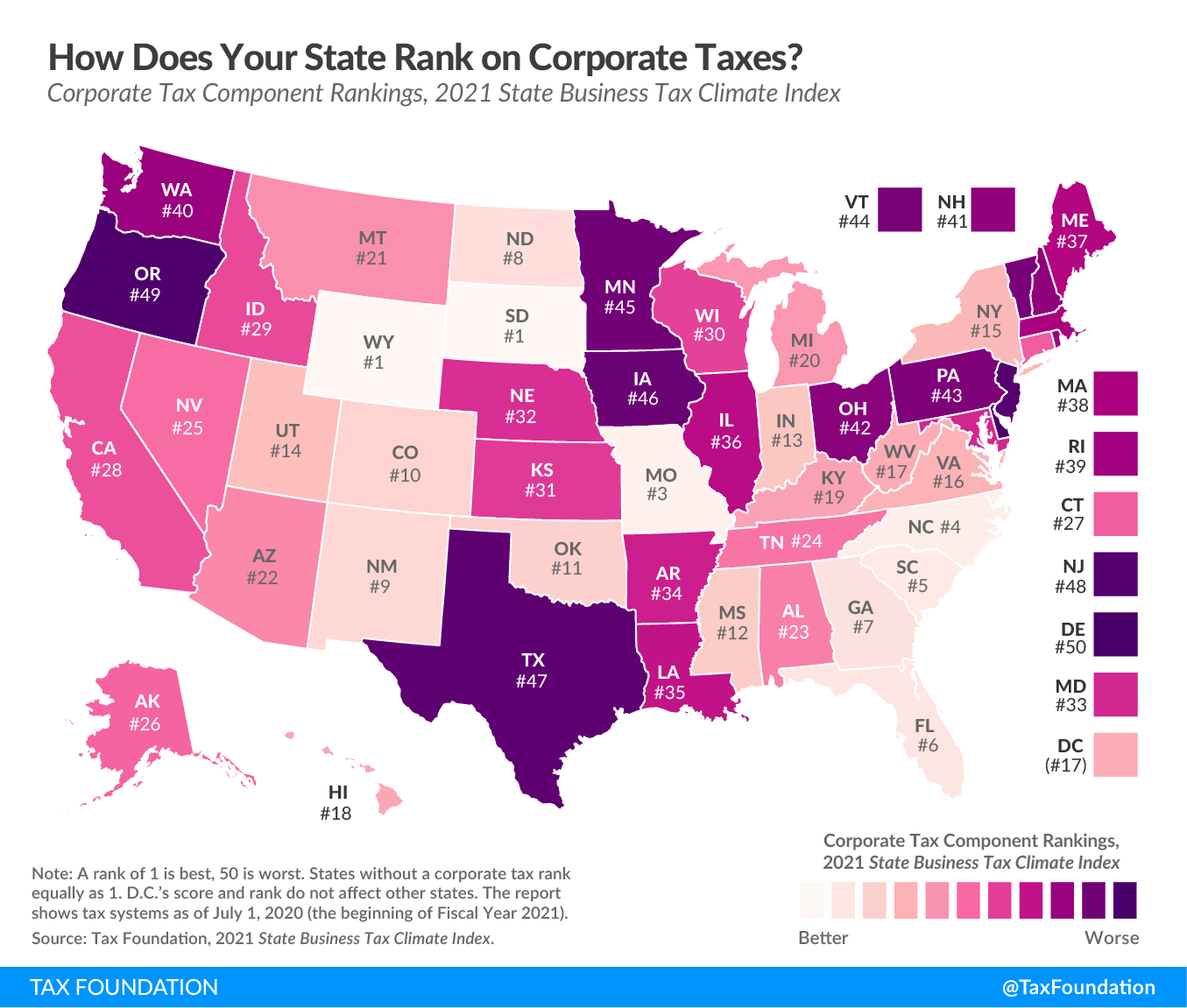

Sep 27 2022 nbsp 0183 32 Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate Forty four states and D C also levy taxes on corporate income with top

https://americanlegaljournal.com

Feb 9 2023 nbsp 0183 32 Corporations in the United States pay federal corporate income taxes levied at a 21 percent rate Forty four states and D C also levy taxes on corporate income with top marginal

https://taxpolicycenter.org › statistics › corp…

Jan 29 2024 nbsp 0183 32 Top marginal tax rate and income bracket for corporations Subscribe to our newsletters today

May 6 2024 nbsp 0183 32 The current corporate tax rate federal is 21 Prior to the 2017 Tax Cuts and Jobs Act of 2017 there were taxable income brackets and the maximum tax rate was 35 The Tax Apr 5 2023 nbsp 0183 32 In 2022 the reduced tax rate on the income of controlled foreign corporations the credit for depreciation of business equipment and the credit for increasing research and

Jan 31 2022 nbsp 0183 32 Here are the latest updates to Corporate tax rates and Section 179 expense limits for your reference Flat 21 corporate tax rate Includes personal service corporations No