What Are The Tax Brackets For 2021 Ireland Review the latest income tax rates thresholds and personal allowances in Ireland which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Ireland

How your Income Tax is calculated If you are paid weekly your Income Tax is calculated by applying the standard rate of 20 to the income in your weekly rate band applying the higher Use PwC Ireland s interactive income tax calculator to estimate your income tax position for the coming year in light of the measures announced in Budget 2025

What Are The Tax Brackets For 2021 Ireland

What Are The Tax Brackets For 2021 Ireland

What Are The Tax Brackets For 2021 Ireland

https://federalwithholdingtables.net/wp-content/uploads/2021/06/2020-income-tax-brackets-pasivinco.png

Jul 17 2024 nbsp 0183 32 An individual who is resident but not domiciled in Ireland is liable to Irish income tax on Irish source income foreign employment income earned while carrying out duties in

Pre-crafted templates offer a time-saving option for creating a varied variety of files and files. These pre-designed formats and designs can be made use of for numerous personal and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, presentations, and more, streamlining the material development procedure.

What Are The Tax Brackets For 2021 Ireland

2022 Tax Brackets Irs Calculator

2021 Tax Brackets PriorTax Blog

10 2023 California Tax Brackets References 2023 BGH

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

2022 Tax Brackets Lashell Ahern

https://ie.icalculator.com/income-tax-rates/2021.html

The Income tax rates and personal allowances in Ireland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the

https://www.revenue.ie/.../tax-rate-band.aspx

Jan 1 2024 nbsp 0183 32 The current tax rates are 20 and 40 Standard rate of tax Your income up to a certain limit is taxed at the standard rate of Income Tax which is currently 20 This is known

https://assets.kpmg.com/content/dam/kpmg/ie/pdf/...

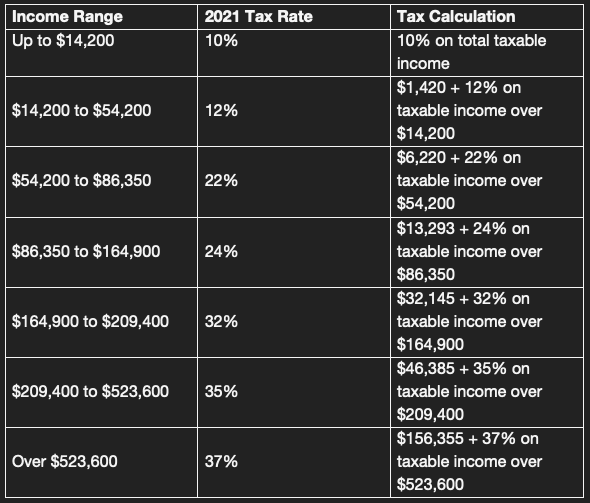

Tax Rates and Credits 2021 44 300 with an increase of 26 300 maximum The increased credit will apply for 2020 also Applies to self employed income and certain PAYE employments not

https://taxcalc.ie/budget-2021

The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment Changes for 2021 Increase in second USC rate band from 20 484 to 20 687

https://www.charteredaccountants.ie/taxsourcetotal/...

Here you can access details of the annual key tax rates and bands for Ireland and the UK The tax rates and bands are displayed in a table format per year and by country Tax rates and

Tax brackets for Ireland vary according to your income and personal circumstances They will differ for single individuals civil partners and married couples You can find the tax rates and Here you can access details of the annual key tax rates and bands for Ireland and the UK The tax rates and bands are displayed in a table format per year and by country Tax rates and

Income Tax Ireland salaries are taxed at two rates the quot standard rate quot of 20 applied to the first section of your income and the quot higher rate quot of 40 applied to your remaining income