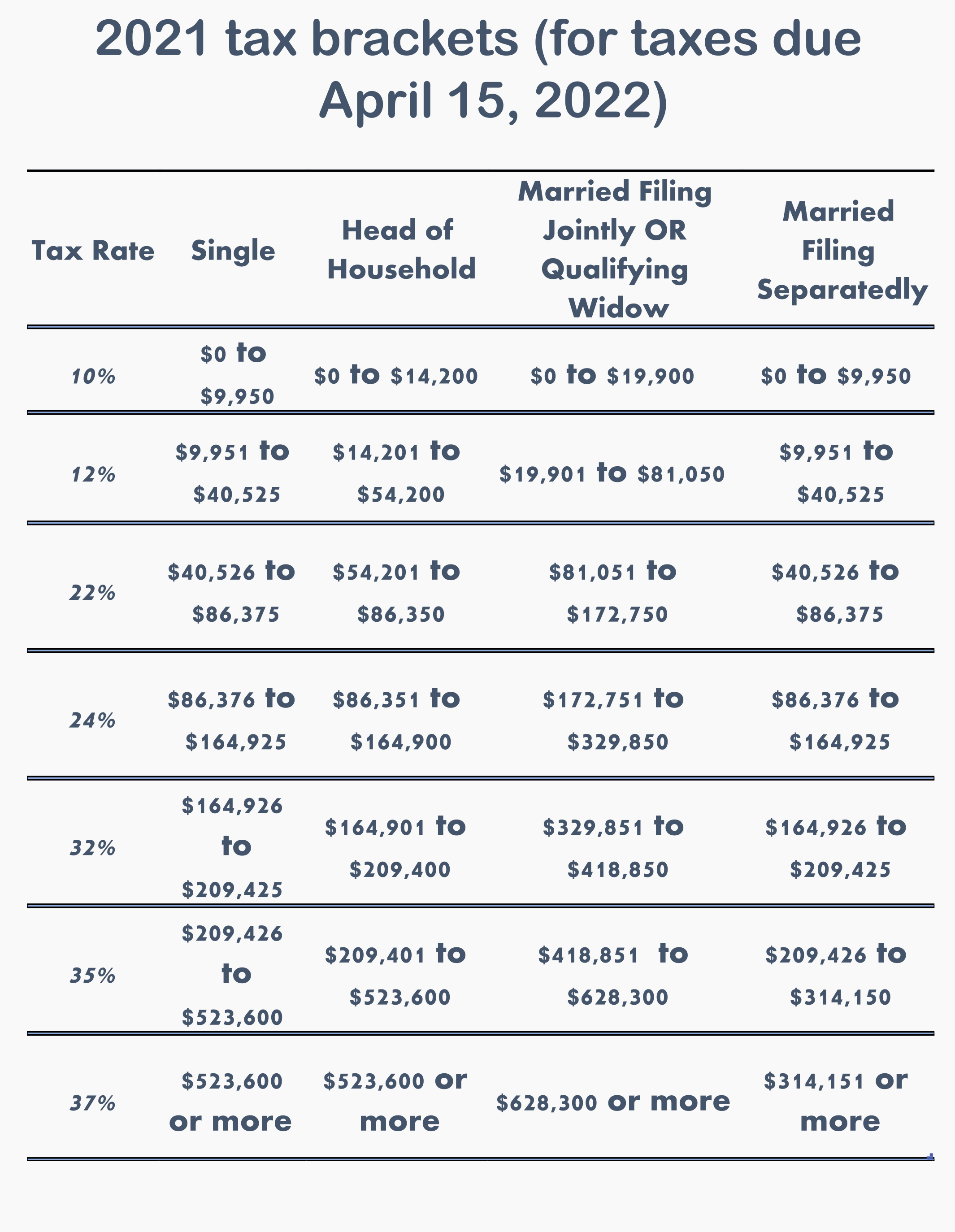

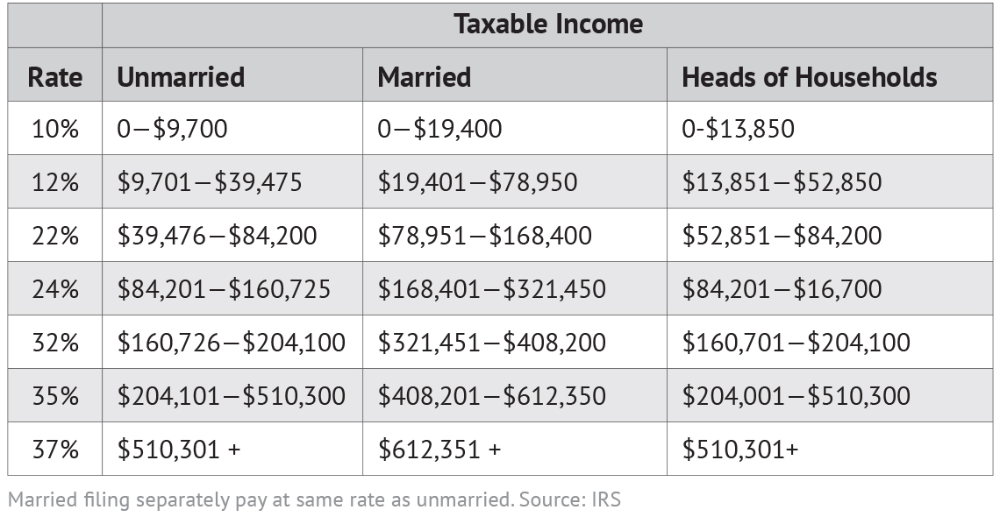

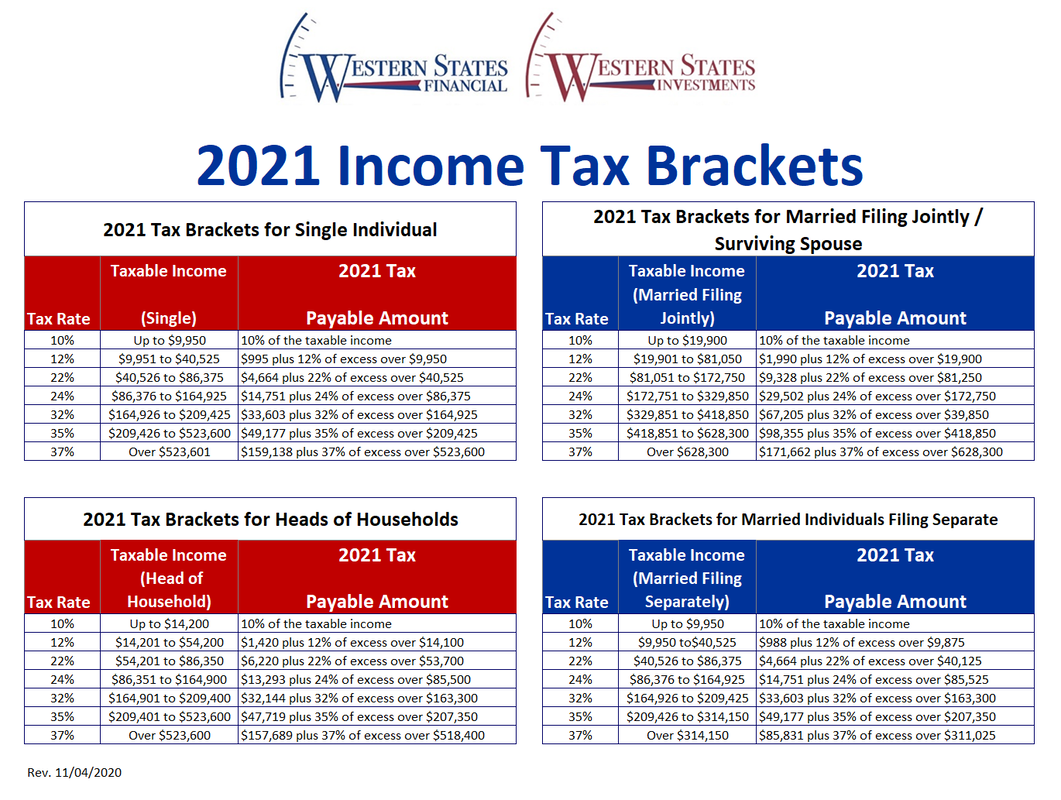

What Are The Tax Brackets For 2021 And 2022 This page shows Tax Brackets s archived Federal tax brackets for tax year 2021 This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in April 2022

Depending on your taxable income you can end up in one of seven different federal income tax brackets each with its own marginal tax rate Dec 31 2024 nbsp 0183 32 Here are the 2022 Federal tax brackets Remember these are the amounts you will pay when you file your taxes in January to April 2023 for the year January 1 2022 through December 31 2022 The table below shows the tax bracket rate for each income level

What Are The Tax Brackets For 2021 And 2022

What Are The Tax Brackets For 2021 And 2022

What Are The Tax Brackets For 2021 And 2022

https://federalwithholdingtables.net/wp-content/uploads/2021/06/2020-income-tax-brackets-pasivinco.png

Dec 10 2021 nbsp 0183 32 The top tax rate for individuals is 37 percent for taxable income above 539 901 for tax year 2022 The IRS changes these tax brackets from year to year to account for inflation and other changes in economy

Templates are pre-designed documents or files that can be utilized for different functions. They can save effort and time by offering a ready-made format and layout for developing different kinds of content. Templates can be utilized for individual or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

What Are The Tax Brackets For 2021 And 2022

2022 Tax Brackets New York Latest News Update

10 2023 California Tax Brackets References 2023 BGH

2022 Tax Brackets Irs Calculator

2022 Tax Brackets Lashell Ahern

2021 IRS Tax Brackets Table Federal Withholding Tables 2021

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

https://taxfoundation.org › data › all › federal

Oct 27 2020 nbsp 0183 32 There are seven federal individual income tax brackets the federal corporate income tax system is flat and Rates In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1

https://molentax.com

The 2022 tax rates themselves are the same as the rates in effect for the 2021 tax year 10 12 22 24 32 35 and 37 However as they are every year the 2022 tax brackets were adjusted to account for inflation

https://www.irs.gov › filing › federal-income-tax-rates-and-brackets

See current federal tax brackets and rates based on your income and filing status

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://www.bankrate.com › taxes

Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 12 22 24 32 35 and 37

What are the tax brackets for 2021 Income tax brackets 2021 What are the standard deductions With our tax bracket calculator you can quickly check which tax bracket you are in and find the federal income tax on your income Mar 24 2022 nbsp 0183 32 For tax year 2022 here is what the federal brackets will look like What Is a Tax Bracket The U S uses the 2021 federal income tax brackets to determine how much money you ll owe the IRS or

There are seven brackets with progressive rates ranging from 10 up to 37 and they are the same over all three years Federal income tax rate brackets are indexed for inflation The brackets are adjusted using the chained Consumer Price Index CPI