Tax Tables For 2022 Tax Year Web tax tables 2022 edition 1 taxable income base amount of tax plus marginal tax rate of the amount over not over over single 0 10 275 0 10 0 0 10 275 41 775

Web If you are a fiscal year filer using a tax year other than January 1 through December 31 2022 write Tax Year and the beginning and ending months of your fiscal year in the top margin of page 1 of Form 1040 or 1040 SR Web Nov 10 2021 nbsp 0183 32 The Internal Revenue Service announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other

Tax Tables For 2022 Tax Year

Tax Tables For 2022 Tax Year

Tax Tables For 2022 Tax Year

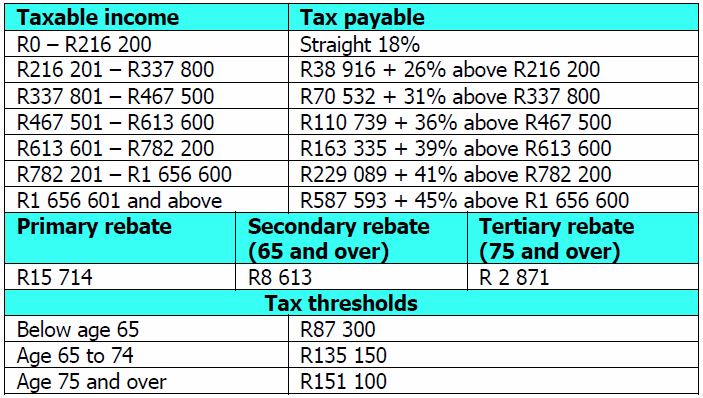

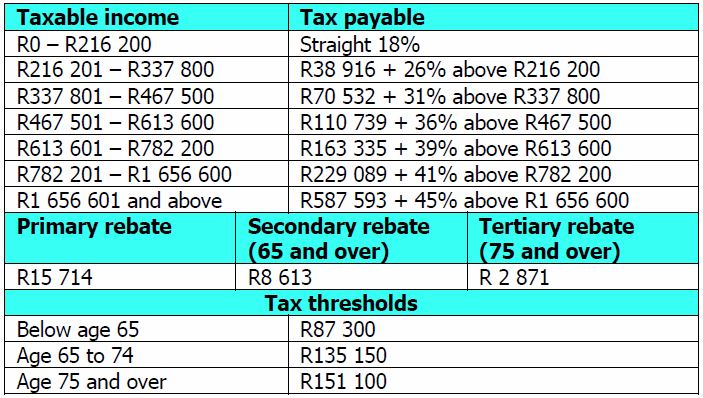

https://www.nexia-sabt.co.za/wp-content/uploads/2021/03/Tax-Table-and-Rebates-2021-2022.jpg

Web The 2022 rate for business use of a vehicle is 58 5 cents a mile from January 1 2022 to June 30 2022 and 62 5 cents a mile from July 1 2022 to December 31 2022 The 2022 rate for use of your vehicle to do

Pre-crafted templates use a time-saving option for developing a varied variety of files and files. These pre-designed formats and designs can be made use of for different personal and professional projects, including resumes, invites, flyers, newsletters, reports, presentations, and more, simplifying the content creation procedure.

Tax Tables For 2022 Tax Year

2022 Tax Brackets Married Filing Jointly Irs Printable Form

2011 Tax Tables Brokeasshome

Irs Tax Tables 2022 Latest News Update

Sars 2022 Tax Tables Brokeasshome

2022 Tax Brackets Chart Latest News Update Bank2home

1040 2020 Instructions Tax Tables Top FAQs Of Tax Dec 2022

https://www.irs.gov/pub/irs-pdf/p17.pdf

Web Part Four Figuring Your Taxes and Refundable and Nonrefundable Credits Chapter 13 How To Figure Your Tax Chapter 14 Child Tax Credit and Credit for Other Dependents

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 Find the updated federal income tax brackets and rates for 2022 as well as the standard deduction alternative minimum tax and earned income tax credit The IRS

https://www.purposefulfinance.org/home/arti…

Web Dec 2 2021 nbsp 0183 32 If you are looking for the tax tables for filing your 2021 taxes by April of 2022 click the button below This article references the 2022 tax tables for the tax forms to be filed in April 2023 Click Here for 2021

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

Web Nov 10 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married Web Jan 23 2023 nbsp 0183 32 You can find the latest tax table which you ll use in 2023 to file 2022 taxes on the IRS website specifically its publication named Tax Year 2022 1040 and 1040

Web The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax