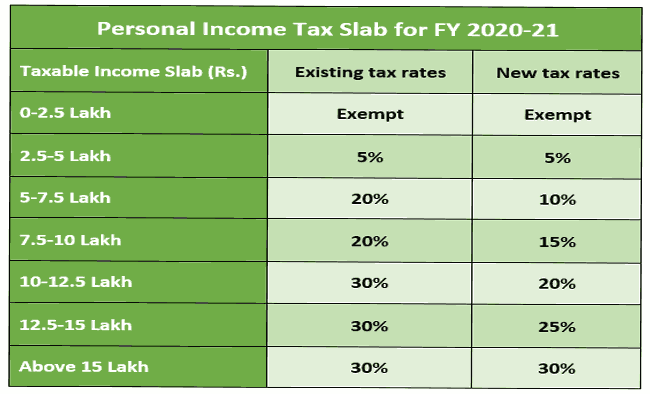

New Regime Income Tax Slab Rates For Fy 2021 22 Web Result Mar 22 2022 nbsp 0183 32 Effective from April 1 2020 FY 2020 21 an individual has the option to continue with the existing old income tax regime and avail existing tax deductions and exemptions or choose the new tax regime and forgo 70 tax deductions and exemptions such as sections 80C 80D tax exemption on HRA LTA etc

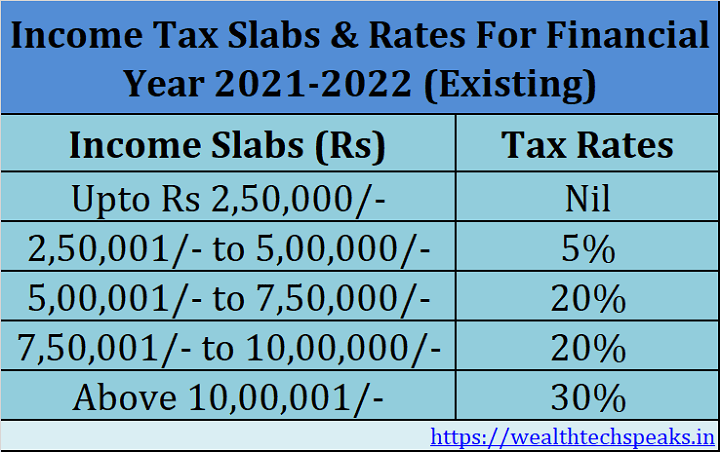

Web Result Jul 15 2022 nbsp 0183 32 There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022 23 in Union Budget 2022 The income tax slabs and income tax rates have been kept unchanged since financial year FY 2020 21 Here is a look at the latest income tax slabs and rates for FY 2021 22 Web Result A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between the new or old tax regime and pay applicable income tax as per slabs and rates for FY 2021 22 AY 2022 23

New Regime Income Tax Slab Rates For Fy 2021 22

New Regime Income Tax Slab Rates For Fy 2021 22

New Regime Income Tax Slab Rates For Fy 2021 22

https://cdn.statically.io/img/i0.wp.com/wealthtechspeaks.in/wp-content/uploads/2020/07/Old-Income-Tax-Slab-Rates-FY-2021-22.png?resize=650,400

Web Result INCOME TAX RATES ASSESSMENT YEAR 2021 2022 RELEVANT TO FINANCIAL YEAR 2020 2021 The normal tax rates applicable to a resident individual will depend on the age of the individual However in case of a non resident individual the tax rates will be same irrespective of his age

Pre-crafted templates offer a time-saving service for developing a diverse range of files and files. These pre-designed formats and designs can be used for various individual and professional tasks, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, improving the content development procedure.

New Regime Income Tax Slab Rates For Fy 2021 22

Income Tax Slab For 2022 23 Pay Period Calendars 2023

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Personal Income Tax Slab For Fy 2020 21 Return Standard Deduction 2021

Salary Slab Rate For Fy 2021 22 Pay Period Calendars 2023

Income Tax Slab Rate Fy 2021 22 Ay 2022 23 And Fy 2020 21 Ay 2021 22

https://economictimes.indiatimes.com/wealth/tax/...

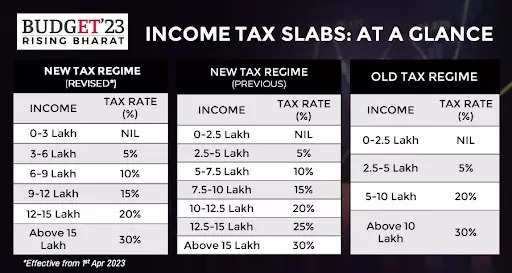

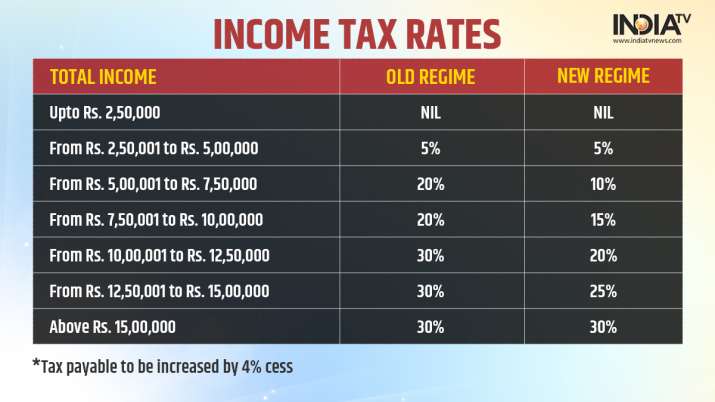

Web Result Jul 22 2022 nbsp 0183 32 The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes and FY 2022 23 for tax saving purposes

https://cleartax.in/s/income-tax-slabs

Web Result Latest Income Tax Slab amp Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax regime

https://paytm.com/blog/financial-tools/income-tax...

Web Result Aug 17 2022 nbsp 0183 32 Let s take a look at the list of most commonly used exemptions and deductions New Tax Slab Rates for Domestic Companies for FY 2021 22 Surcharge Health and Education Cess 4 of income tax and surcharge Income Tax Rate for FY 2021 22 amp AY 2022 23 for Partnership Firm as per Old New

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Result Old Tax Regime New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 2 50 000 Nil 2 50 001 5 00 000 5 above 2 50 000 2 50 001 5 00 000 5 above 2 50 000 5 00 001 10 00 000 12 500 20 above 5 00 000 5 00 001

https://economictimes.indiatimes.com/wealth/tax/...

Web Result Jul 28 2022 nbsp 0183 32 With regards to income tax slabs the old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six income tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes and FY 2022 23 for tax saving purposes

Web Result Feb 16 2021 nbsp 0183 32 Income Tax Slabs amp Rates under the existing tax regime availing income tax deductions amp exemptions remain unaltered in the Union Budget 2021 for the Financial Year 2021 22 Tax Rebate U S 87A up to maximum of Rs 12 500 is available to the Individuals with income up to Rs 5 lacs Web Result Jan 3 2024 nbsp 0183 32 Latest Income tax slab for FY 2021 22 is same as that of FY 2020 21 This means there is no change in income tax slab for FY 2021 22 The old rate and slab will continue in FY 2021 22 AY 2022 23 New simplified tax

Web Result Feb 21 2021 nbsp 0183 32 Posted By Amritesh On February 21st 2021 Comments 44 responses The Income Tax Slabs amp Rates remain unchanged for the Financial Year 2021 22 In the Financial Year 2021 22 Assessment Year 2022 23 Salaried Individuals may pay tax under the New or the Existing Old Tax Regime