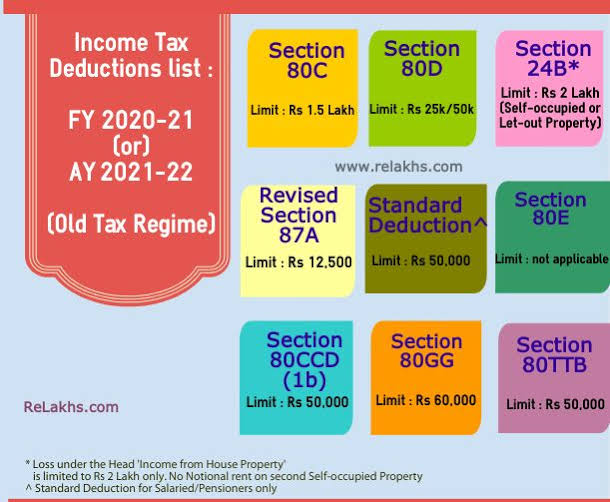

Income Tax Slab Rates For Ay 2021 22 Old Regime Web Feb 1 2020 nbsp 0183 32 Income Tax Slab Rate for AY 2021 22 for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year Net income range Income Tax rate Up to Rs 2 50 000

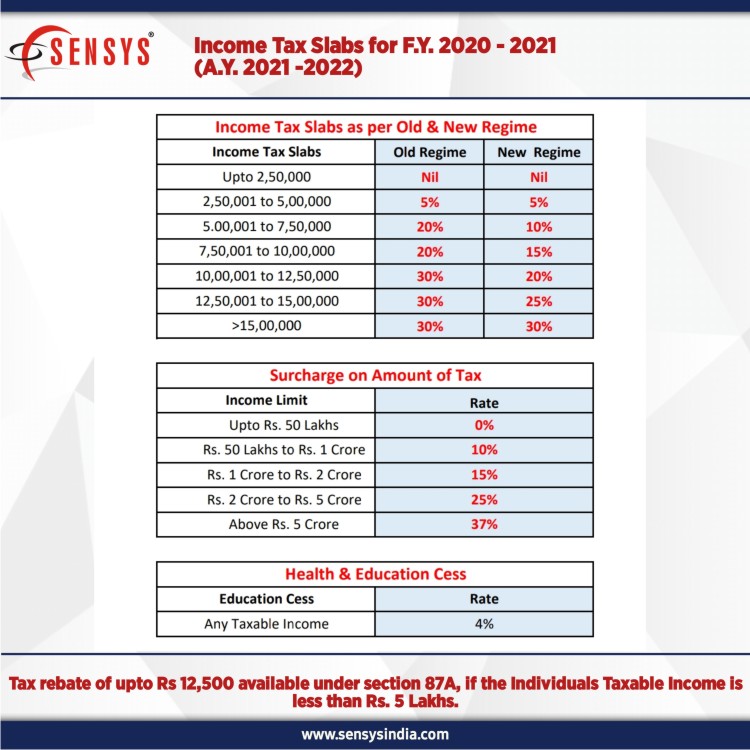

Web Net income range Income Tax rate AY 2021 22 AY 2022 23 Upto Rs 2 50 000 Nil Nil Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 1 5ADD In addition to the Income Tax amount calculated based on the above mentioned tax slabs these assessees are required to pay Surcharge and Cess as Web Mar 28 2021 nbsp 0183 32 Income tax slabs for AY 2021 22 under new tax regime and old tax regime By Vikas Sharma March 28 2021 0 80 For FY 2020 21 taxpayers can choose between two income tax regimes the existing old tax regime and the new tax regime one If one continues with the old tax regime they can continue to avail existing deductions such as

Income Tax Slab Rates For Ay 2021 22 Old Regime

Income Tax Slab Rates For Ay 2021 22 Old Regime

Income Tax Slab Rates For Ay 2021 22 Old Regime

https://static.wixstatic.com/media/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg/v1/fill/w_627,h_284,al_c,q_90/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg

Web Apr 24 2021 nbsp 0183 32 Tax slabs under old regime 1 Individuals 2 Senior Citizens 3 Super Senior citizens 4 Surcharge Surcharge is levied on the amount of income tax at following rates if the total income of an assessee exceeds specified limits

Templates are pre-designed documents or files that can be utilized for different functions. They can save time and effort by offering a ready-made format and design for producing various type of material. Templates can be utilized for individual or expert projects, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Income Tax Slab Rates For Ay 2021 22 Old Regime

Ine Tax Slab For Fy 2021 22 Pdf Tutorial Pics

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling Otosection

Income Tax Slab Rate For Ay 2022 23 Pdf Printable Forms Free Online

https://taxguru.in/income-tax/income-tax-rates-for...

Web Jun 16 2020 nbsp 0183 32 Income tax rates for Individual for AY 2021 22 Old Vs New Budget 2020 introduced a new personal income tax regime for individual taxpayers However the option for this concessional tax regime came with a cost it required the taxpayer to forego certain specified deductions The new lower income tax rates offered in the Budget 2020 21 will

https://cleartax.in/s/income-tax-slabs

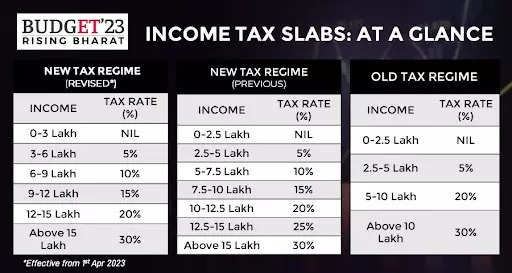

Web The income tax slabs are revised periodically typically during each budget These slab rates vary for different groups of taxpayers Let us take a look at all the slab rates applicable for FY 2022 23 AY 2023 24 and FY 2023 24 AY 2024 25

http://irtsa.net/pdfdocs/Income-Tax-Slabs-New-&-Old...

Web Income Tax Slab Rate for AY 2021 22 amp AY 2020 21 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year Net income range Income Tax rate

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Old Tax Regime New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 2 50 000 Nil Up to 2 50 000 Nil 2 50 001 5 00 000 5 above 2 50 000 2 50 001 5 00 000 5 above 2 50 000 5 00 001 10 00 000 12 500 20 above 5 00 000 5 00 001 7 50 000

https://taxguru.in/income-tax/income-tax-rate-ay...

Web Apr 11 2021 nbsp 0183 32 Income Tax Slab Rate for AY 2021 22 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year or HUF or AOP or BOI whether incorporated or not or

Web Oct 5 2023 nbsp 0183 32 Rate of Tax under Old Regime for FY 22 23 AY 23 24 New Regime Slab Rates for FY 22 23 AY 23 24 Rs 0 0 to Rs 2 50 000 NIL NIL Rs 2 50 001 to Rs 5 00 000 5 5 Rs 5 00 001 to Rs 7 50 000 20 10 Rs 7 50 001 to Rs 10 00 000 20 15 Rs 10 00 001 to Rs 12 50 000 30 20 Rs 12 50 001 to Rs 15 00 000 30 25 Web The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior Citizen and Super Senior Citizen Senior Citizen 60 years or more but below the age of 80 years Super Senior Citizen 80 years and above Income Slabs Rs Tax Rate Income Slabs Rs Tax Rate Income Slabs Rs Tax Rate Upto 2 50 000 Nil Upto 3

Web Feb 9 2022 nbsp 0183 32 Income tax slabs for AY 2021 22 Old and new regimes For individuals aged less than 60 yrs and for HUF Hindu Undivided Family For individuals aged 60 to 80 yrs For individuals aged above 80 yrs Conditions for selecting the new regime Which regime is better Conclusion What are income tax slabs