Income Tax Slab Rate For Ay 2021 22 New Regime Web The income tax slabs in new tax regime will remain unchanged for FY 2024 25 AY 2025 26 No changes have been announced in the interim budget The last year s budget Budget 2023 announced changes in the income tax slabs in the new tax regime The changes were made to make the new tax regime more attractive for individual taxpayers

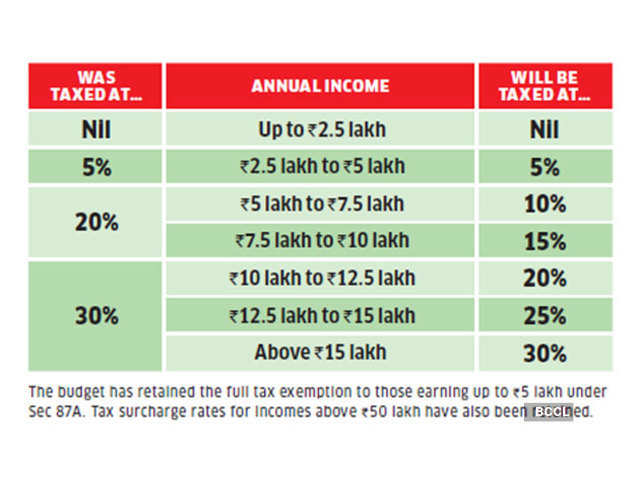

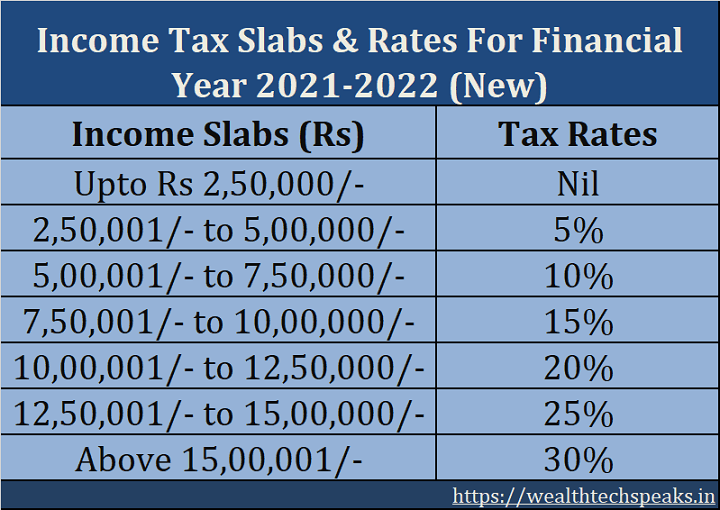

Web The new tax regime system came in force from FY 2020 21 AY 2021 22 What are the tax rates under the new regime In Budget 2023 the income tax slabs under the new tax regime have been revised The new tax slabs and tax rates under the new tax regime for FY 2023 24 AY 2024 25 and FY 2022 23 AY 2023 24 are shown in the table below Web 15 of income tax where total income exceeds Rs 1 00 00 000 Health and Education cess 4 of income tax and surcharge Note A resident individual is entitled for rebate under section 87A if his total income does not exceed Rs 5 00 000 If you go by new slab rates as announced in the Budget 2020 then you will not be eligible to

Income Tax Slab Rate For Ay 2021 22 New Regime

Income Tax Slab Rate For Ay 2021 22 New Regime

Income Tax Slab Rate For Ay 2021 22 New Regime

https://static.wixstatic.com/media/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg/v1/fill/w_627,h_284,al_c,q_90/c43a2f_d5ff0645e0c340c5af92b1c35cbd7187~mv2.jpg

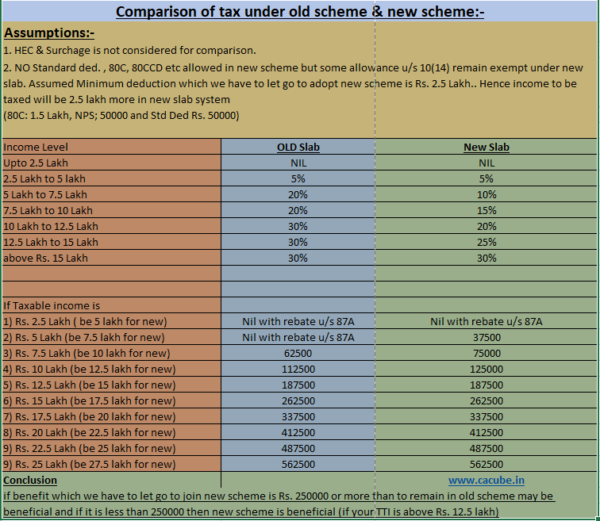

Web Apr 24 2021 nbsp 0183 32 Old And New Taxation Regime Tax Slabs And Rates For AY 2021 22 Old taxation regime Here are the tax slab rates for individuals less than 60 years old For senior citizens For

Templates are pre-designed files or files that can be used for various purposes. They can conserve effort and time by supplying a ready-made format and layout for developing various sort of material. Templates can be used for individual or expert tasks, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Income Tax Slab Rate For Ay 2021 22 New Regime

Income Tax Slab For Ay 2021 22 For Senior Citizens New Regime TAX

Income Tax Slabs For Assessment Year 2023 24 Kulturaupice

Income Tax New Tax Regime Vs Old Tax Regime And Slab Rates FY 2020

Search income Tax Slabfy 2022 23 Ay 2023 24 New Income Tax Slab Rate

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

Income Tax Slab For FY 2022 23 FY 2021 22 Revised Tax Slabs New

https://incometaxindia.gov.in/Booklets Pamphlets/e...

Web Net income range Income Tax rate AY 2021 22 AY 2022 23 Upto Rs 2 50 000 Nil Nil Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 1 5ADD In addition to the Income Tax amount calculated based on the above mentioned tax slabs these assessees are required to pay Surcharge and

https://taxguru.in/income-tax/income-tax-rate-ay...

Web Apr 11 2021 nbsp 0183 32 Income Tax Slab Rate for AY 2021 22 for Individuals 1 1 Individual resident or non resident who is of the age of less than 60 years on the last day of the relevant previous year or HUF or AOP or BOI whether incorporated or not or

https://tax2win.in/guide/income-tax-slabs

Web Feb 2 2024 nbsp 0183 32 New Income Tax Slabs For FY 2023 24 AY 2024 25 As per the Union Budget 2023 a few key changes have been introduced under the new tax regime The tax slab under the new tax regime has been reduced from 6 to 5 and the basic exemption limit has been raised to Rs 3 lakh from Rs 2 5 lakh

https://paytm.com/blog/financial-tools/income-tax...

Web Aug 17 2022 nbsp 0183 32 The taxpayers can choose between the old regime which includes various deductions and exemptions and the new regime which offers lower tax rates for those who are willing to forgo exemptions and deductions Let s take a look at the new income tax slab rates for FY 2021 22 amp AY 2022 23

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Web Old Tax Regime New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 5 00 000 Nil Up to 2 50 000 Nil 5 00 001 10 00 000 20 above 5 00 000 2 50 001 5 00 000 5 above 2 50 000 Above 10 00 000 1 00 000 30 above 10 00 000 5 00 001 7 50 000

Web Year 2024 25 If one to opt out from default new tax regime he has to exercise the option under section 115BAC 6 The tax rates under the new tax regime are as under a For Assessment Year 2023 24 Net Income Range Tax rate Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 From 5 00 001 to 7 50 000 10 From 7 50 001 to 10 00 000 15 Web Jul 15 2022 nbsp 0183 32 No change in rates There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022 23 in Union Budget 2022 The income tax slabs and income tax rates have been kept unchanged since financial year FY 2020 21 Here is a look at the latest income tax slabs and rates for FY 2021 22 for

Web Jul 22 2022 nbsp 0183 32 The old regime has higher tax rates and three tax slabs whereas the new regime has lower tax rates and six tax slabs Here is a look at the latest income tax slabs and rates for FY 2021 22 for ITR filing purposes