Are Hsa Contributions Based On Calendar Year Or Plan Year Apr 10 2025 nbsp 0183 32 HSA contributions are either pretax if through an employer or tax deductible if you make your own contributions Therefore every dollar you save to an HSA is one less

The money stays in the HSA until you use it n Possible use for spouse and dependents You can use your HSA to pay for qualified medical expenses for your spouse and dependents even if Nov 8 2024 nbsp 0183 32 An HSA is a tax advantaged savings account that you can use to pay for qualifying healthcare expenses HSAs can help you cover out of pocket costs if your health insurance

Are Hsa Contributions Based On Calendar Year Or Plan Year

Are Hsa Contributions Based On Calendar Year Or Plan Year

Are Hsa Contributions Based On Calendar Year Or Plan Year

https://law.asia/wp-content/uploads/2021/09/年假必须以日历年为基础-Annual-leave-must-be-based-on-calendar-year.jpg

An HSA can be a useful tool for addressing the high costs of healthcare In today s healthcare market we all need to evaluate our short and long term needs as they relate to healthcare

Pre-crafted templates use a time-saving solution for creating a diverse series of files and files. These pre-designed formats and layouts can be utilized for different individual and professional tasks, including resumes, invites, flyers, newsletters, reports, presentations, and more, streamlining the content production process.

Are Hsa Contributions Based On Calendar Year Or Plan Year

Compound It Share The Love How Mid Year Weddings Affect HSA

Hsa Contribution Limits 2021 Calendar Year Or Plan Year 2021julllg

Are Hsa Contributions Pre Tax TaxProAdvice

Payroll ZuoTi Pro

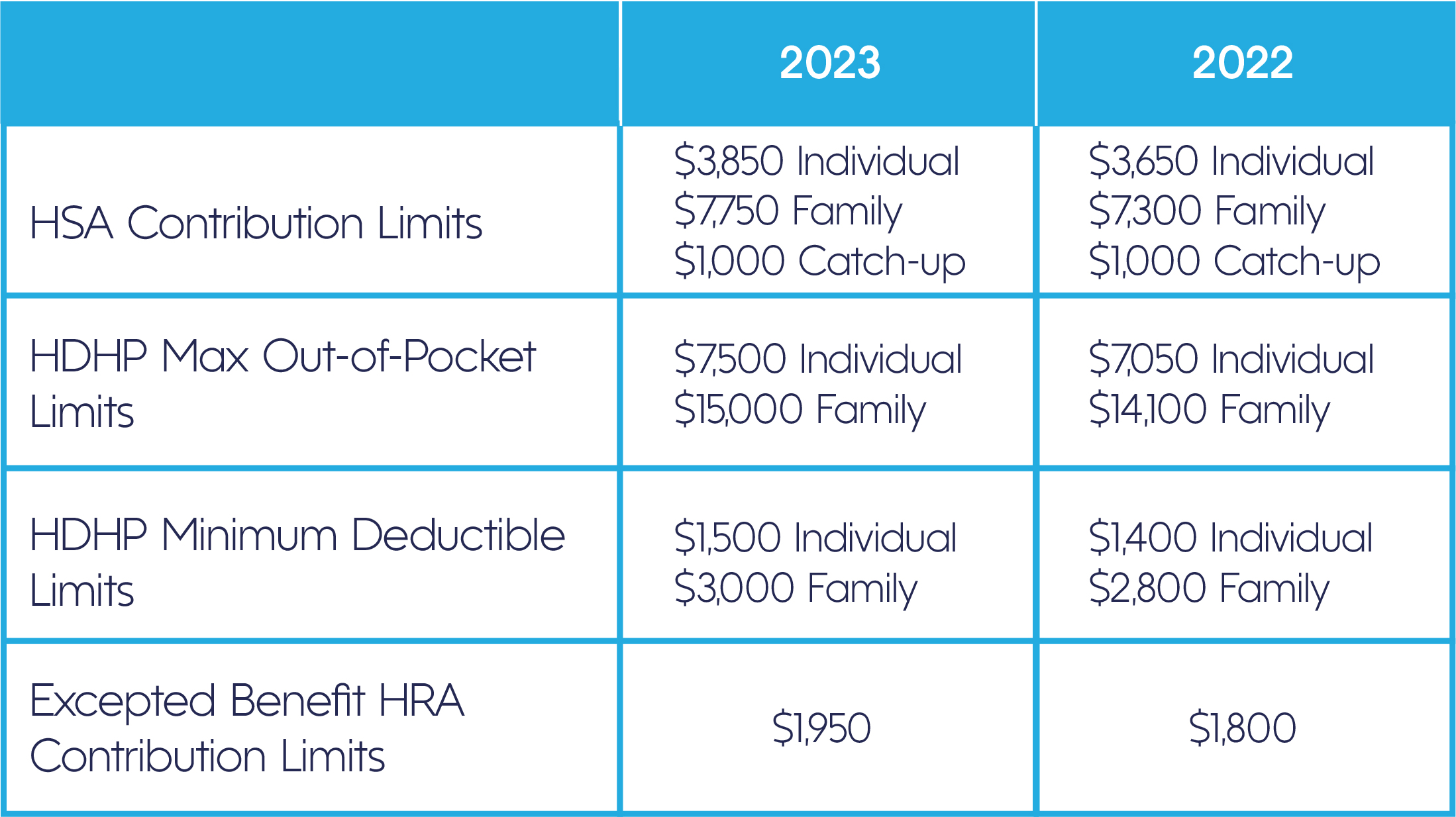

Irs 2023 Contribution Limits

IRS Maintains Health FSA Contribution Limit For 2021 Adjusts Other

https://www.healthequity.com › learn › hsa

HSA vs 401 k Both accounts let you make pre tax contributions and grow tax free earnings But only an HSA lets you take tax free distributions for qualified medical expenses After age 65

https://www.fidelity.com › ... › what-is-an-hsa

May 13 2025 nbsp 0183 32 A health savings account HSA is a tax advantaged way to save for qualified medical expenses HSAs pair with an HSA eligible health plan Because it offers potential tax

https://www.investopedia.com › terms › hsa.asp

Sep 16 2024 nbsp 0183 32 An HSA while owned by an employee can be funded by the employee and the employer or both Contributions are vested and unused account balances at year end can be

https://www.healthinsurance.org › faqs › how-does-a

Apr 20 2025 nbsp 0183 32 A health savings account is a tax advantaged savings account combined with a high deductible health insurance policy to provide an investment and health coverage

https://www.principal.com › individuals › build-your...

May 3 2024 nbsp 0183 32 You can use HSA distributions to pay for nonmedical expenses after age 65 Those payouts aren t tax free but are taxed at the same rate as distributions from a traditional IRA So

[desc-11] [desc-12]

[desc-13]