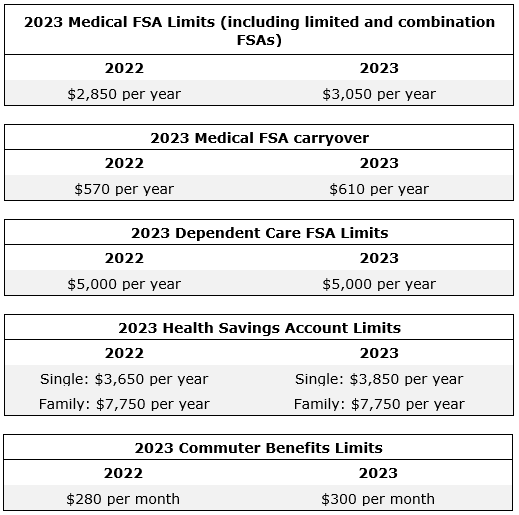

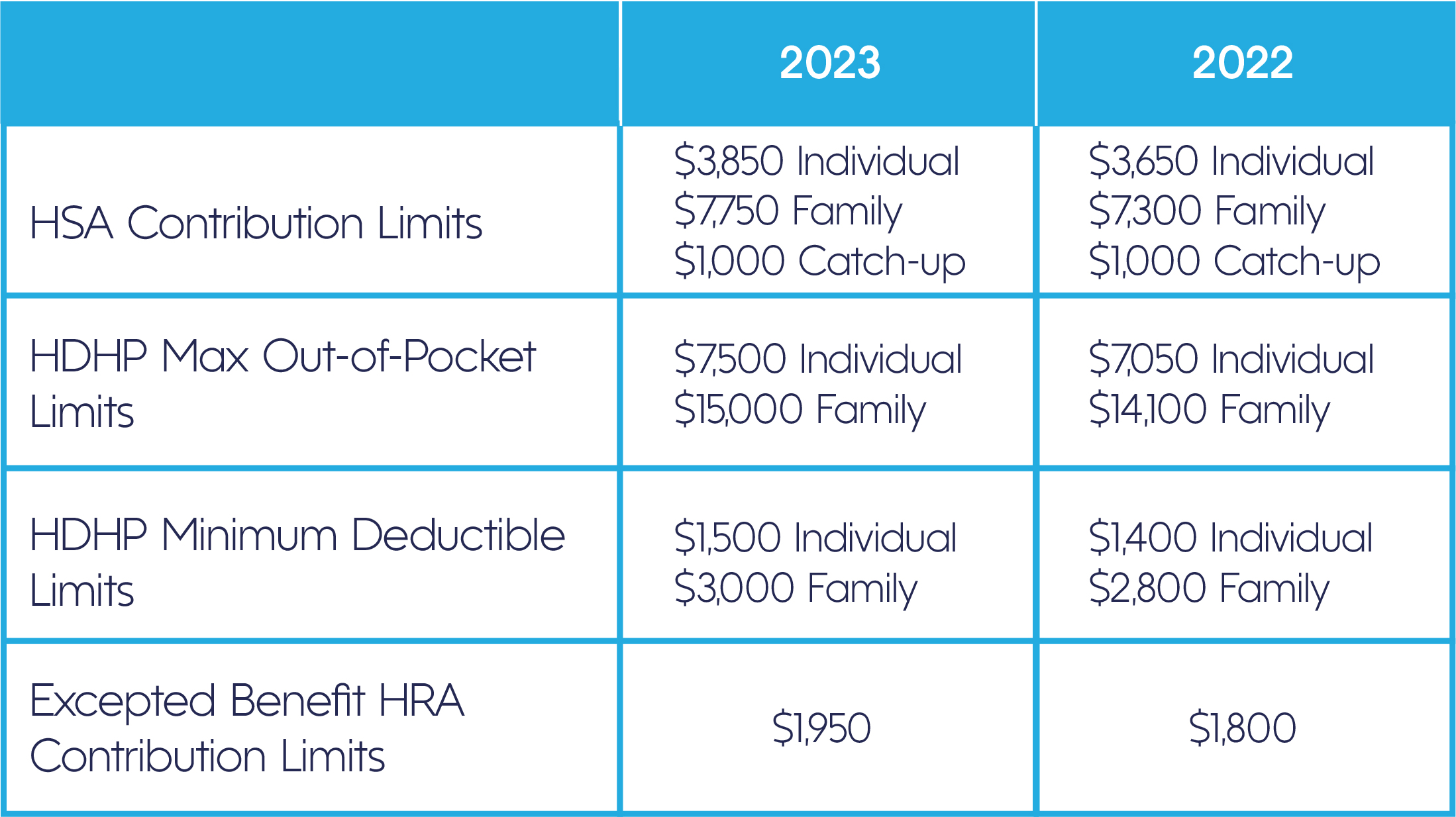

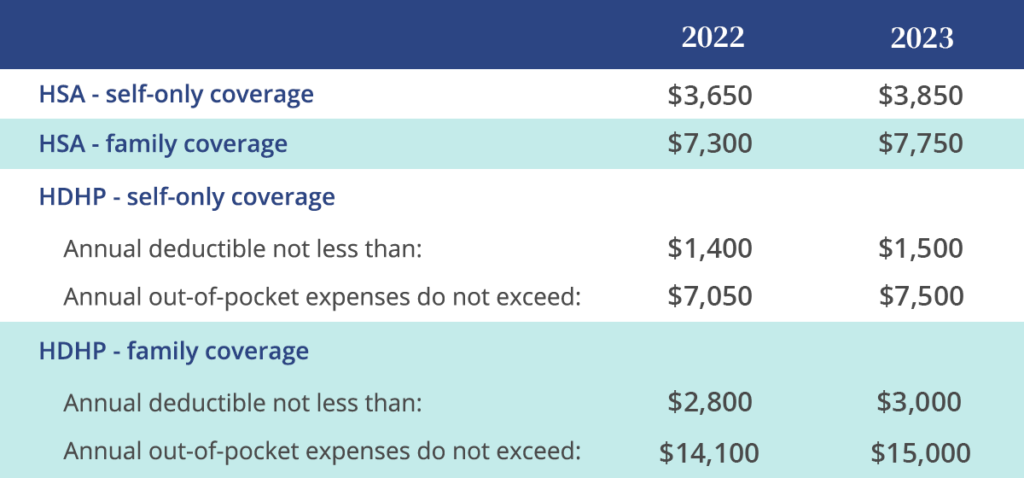

Fsa Limits Non Calendar Year Verkko 9 marrask 2023 nbsp 0183 32 Employees can funnel an extra 150 into their health flexible spending accounts FSAs next year the IRS announced Nov 9 The annual contribution limit

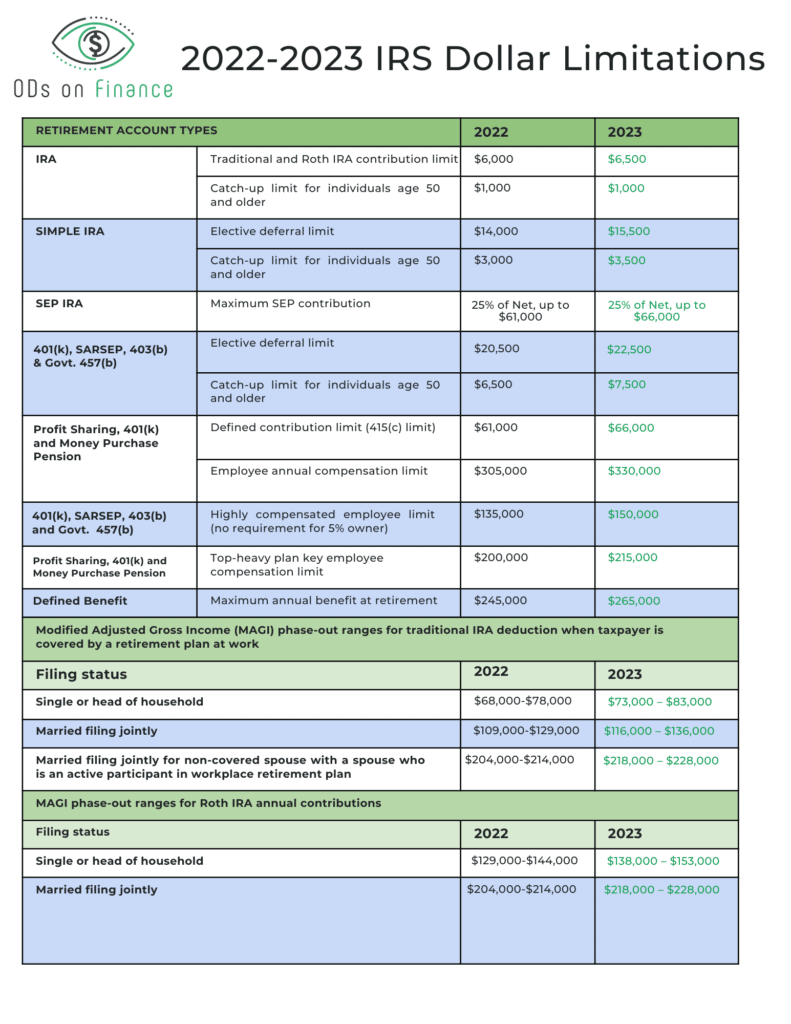

Verkko 1 marrask 2023 nbsp 0183 32 Defined contribution plan annual contribution limit 66 000 69 000 Employee stock ownership plan ESOP limit for determining the lengthening Verkko In the United States a flexible spending account FSA also known as a flexible spending arrangement is one of a number of tax advantaged financial accounts

Fsa Limits Non Calendar Year

Fsa Limits Non Calendar Year

Fsa Limits Non Calendar Year

https://m3ins.com/wp-content/uploads/2022/10/IRS-Announces-Health-FSA-Limits-for-2023_1360x800.jpg

Verkko 28 maalisk 2012 nbsp 0183 32 Beginning January 1 2013 the Patient Protection and Affordable Care Act PPACA requires plan sponsors to limit pre tax health flexible spending

Templates are pre-designed files or files that can be used for different functions. They can conserve effort and time by offering a ready-made format and layout for developing various type of material. Templates can be used for individual or expert jobs, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Fsa Limits Non Calendar Year

Irs Limits 2023 Fsa 2023 Calendar

Irs Limits 2023 Fsa 2023 Calendar

IRS Announces 2023 Health FSA Transportation Plan Limits CBA

Dependent Care Fsa Income Limit Reactive Cyberzine Image Library

Breaking News IRS Sets 2023 Limits For FSA HRA And More Bender

Year end Health Care FSA Reminders Hub

https://www.bakertillyvantagen.com/docs/benetips/Reforma…

Verkko Health FSA Limit amp Non Calendar Year Plans New guidance eases impending administrative woes On May 30 2012 the IRS issued new guidance regarding the

https://fsastore.com/learn-does-an-fsa-have-to-be-on-a-calendar-year.html

Verkko A Flexible Spending Account plan year does not have to be based on the calendar year The FSA plan Administrator or employer decides when the FSA plan year begins and

https://dankex.eu.org/fsa-plan-year-vs-calendar-year

Verkko 18 kes 228 k 2012 nbsp 0183 32 In a recent blog we discussed to need for employment at non calendar time health FSAs to act now to implementation the fresh 2 500 FSA limits imposed

https://shappirehc.com/fsa-plan-year-not-calendar-year

Verkko 18 kes 228 k 2012 nbsp 0183 32 In a recent blog we discussed an need for workplace with non calendar year health FSAs to act now to implement aforementioned new 2 500 FSA

https://koah.eu.org/fsa-plan-year-not-calendar-year

Verkko 18 kes 228 k 2012 nbsp 0183 32 In a recent blog we discussed the must for employers with non calendar year health FSAs to act now to enforce the new 2 500 FSA limits imputed

Verkko 18 kes 228 k 2012 nbsp 0183 32 In a recent blog we discussed the need for employers with non calendar year health FSAs to act now to implement the new 2 500 FSA limits Verkko 3 marrask 2023 nbsp 0183 32 Set by the Social Security Administration the Social Security wage cap will rise to 168 600 in 2024 up from 160 200 in 2023 With the 6 2 rate of

Verkko Health FSA contribution and carryover for 2023 Revenue Procedure 2022 38 October 18 2022 provides that for tax years beginning in 2023 the dollar limitation under