Are Fsa Limits Based On Calendar Year Verkko 24 huhtik 2018 nbsp 0183 32 The SCRIP sets FSA and HSA limits based on calendar year Our benefit year is 10 1 to 9 30 Can we setup our plans so the limits follow the benefit

Verkko Unlike other FSAs Dependent Care FSA contribution limits always align to the calendar tax year which may or may not align with your plan year 2 500 if you file taxes as Verkko 24 huhtik 2018 nbsp 0183 32 The IRS sets FSA and HSA limits based on calendar year Unseren help year is 10 1 to 9 30 Can ours setup our plans so the limits follow up the perform

Are Fsa Limits Based On Calendar Year

Are Fsa Limits Based On Calendar Year

Are Fsa Limits Based On Calendar Year

https://m3ins.com/wp-content/uploads/2022/10/IRS-Announces-Health-FSA-Limits-for-2023_1360x800.jpg

Verkko 24 huhtik 2018 nbsp 0183 32 The IRS sets FSA press HSA restrictions based on organizer per Our benefit year is 10 1 to 9 30 Can we setup the plans so the limits follow the use per

Pre-crafted templates use a time-saving service for developing a diverse variety of documents and files. These pre-designed formats and designs can be made use of for numerous personal and professional jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the content development procedure.

Are Fsa Limits Based On Calendar Year

Irs Limits 2023 Fsa 2023 Calendar

Fsa 2023 Contribution Limits 2023 Calendar

Breaking News IRS Sets 2023 Limits For FSA HRA And More Bender

Solved Construct A P chart Using Two sigma Limits Based On Chegg

IRS Tax Changes For 2023 Heritage Financial Services

2023 FSA Limits Commuter Limits And More Are Now Available WEX Inc

https://benefitslink.com/.../62388-hsafsa-benefit-year-vs-calendar-year

Verkko 26 huhtik 2018 nbsp 0183 32 The IRS sets FSA and HSA limits based on calendar year Our benefit year is 10 1 to 9 30 Can we setup our plans so the limits follow the benefit

https://www.shrm.org/.../fsa-2024-annual-contribution-limit-irs-cola.aspx

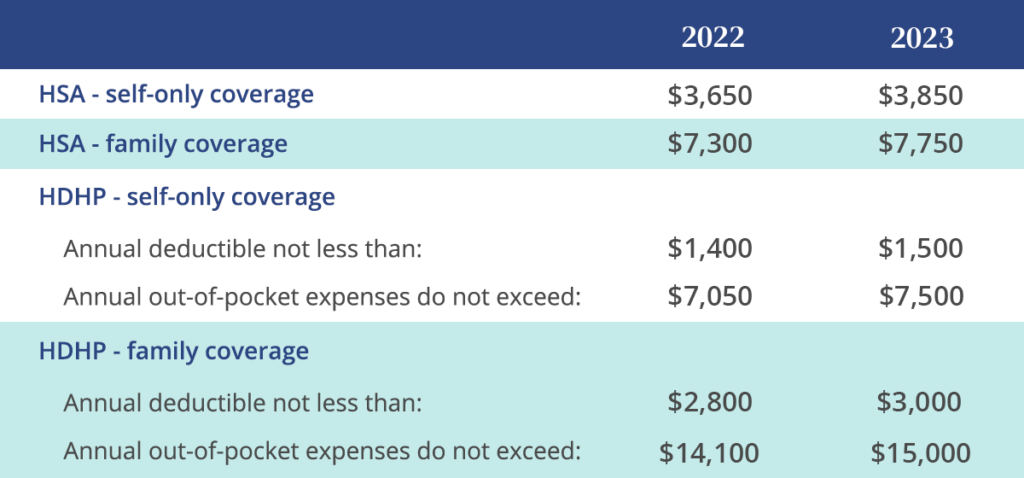

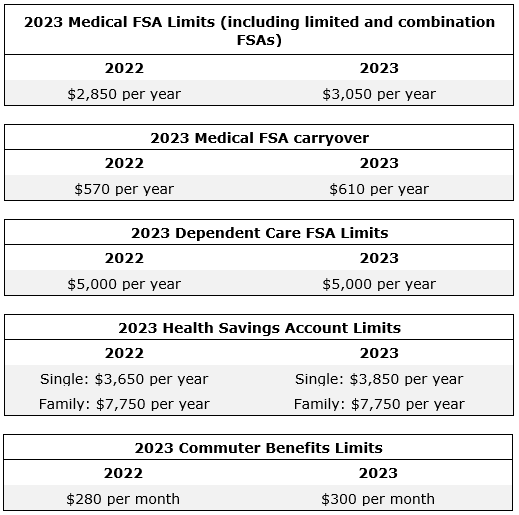

Verkko 9 marrask 2023 nbsp 0183 32 The annual contribution limit is rising to 3 200 in 2024 up from 3 050 in 2023 The hike is still significant although it s a smaller boost than the 200

https://www.bakertillyvantagen.com/docs/benetips/Reforma…

Verkko Health FSA Limit amp Non Calendar Year Plans New guidance eases impending administrative woes On May 30 2012 the IRS issued new guidance regarding the

https://mylife-ts.adp.com/2023/02/calendar-year-versus-plan-year-and...

Verkko IRS contribution limits follow Calendar Year so take this into consideration to avoid excess contributions included in your taxable wages and income All FSA expenses

https://www.cbsnews.com/news/open-enrollment-irs-changes-fsa-hsa...

Verkko 7 marrask 2022 nbsp 0183 32 In 2023 employees can put away as much as 3 050 in an FSA an increase of about 7 from the current tax year s cap of 2 850 Meanwhile single

Verkko 24 huhtik 2018 nbsp 0183 32 That IRS sets FSA or HSA limits based on calendar year Our good year is 10 1 to 9 30 May we arrangement our plans accordingly the limits obey the Verkko 17 toukok 2023 nbsp 0183 32 In contrast the HSA contribution limits are based on the calendar year even for non calendar year plans In addition to the HDHP out of pocket

Verkko 6 lokak 2021 nbsp 0183 32 Meanwhile the limit on contributions to dependent care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in