Fsa Limits By Year Web You generally must use the money in an FSA within the plan year But your employer may offer one of 2 options It can provide a quot grace period quot of up to 2 189 extra months to use the money in your FSA It can allow you to carry over up

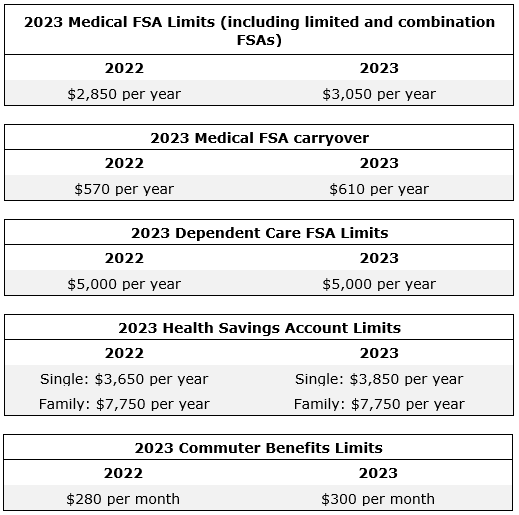

Web Nov 1 2022 nbsp 0183 32 The flexible spending account FSA contribution limit has been set at 3 050 for 2023 In 2022 the cap was 2 850 Learn about why the FSA contribution limit increases each year how you can roll over funds and more Web Published on January 6 2022 Key takeaways A flexible spending account FSA is an employer sponsored benefit that helps you save money on many qualified healthcare expenses You can contribute pretax dollars to fund the account The health FSA contribution limit is 2 850 for 2022 up from 2 750 in the prior year

Fsa Limits By Year

Fsa Limits By Year

Fsa Limits By Year

https://www.wexinc.com/wp-content/uploads/2021/11/WEX_ContributionLimitsChart_Blog-2022-1024x768.jpg

Web Oct 21 2022 nbsp 0183 32 Employees will be able to contribute 3 050 to FSAs made pretax through salary reductions in 2023 the agency said this week That s up 200 from this year s 2 850 limit FSA limits generally increase by about 100 each year

Templates are pre-designed files or files that can be used for numerous purposes. They can conserve time and effort by supplying a ready-made format and layout for producing various type of material. Templates can be used for personal or professional projects, such as resumes, invitations, flyers, newsletters, reports, presentations, and more.

Fsa Limits By Year

IRS Announces 2023 Health FSA Transportation Plan Limits CBA

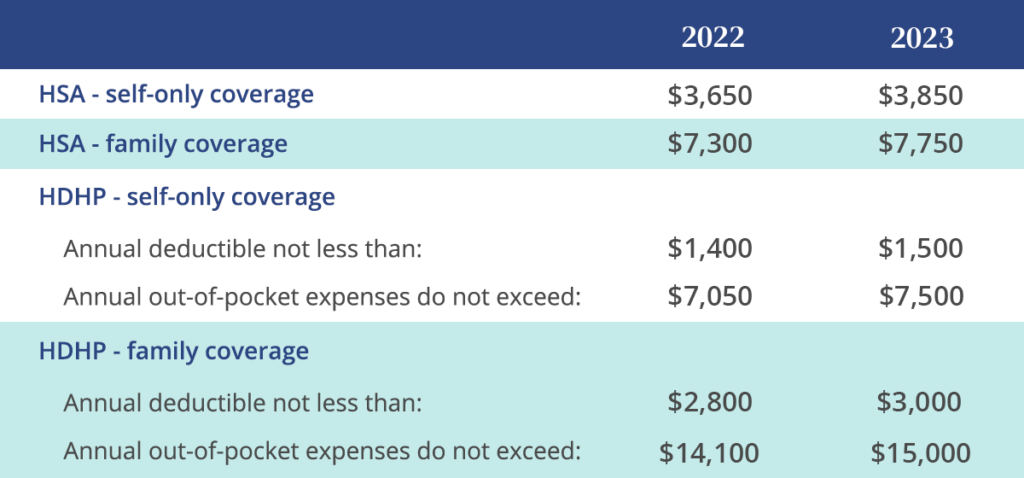

IRS Announces 2023 Limits For HSAs Ameriflex

2023 FSA HSA Retirement Plan Contribution Limits HRWatchdog

IRS Announces 2023 HSA Limits Blog Medcom Benefits

2023 FSA Limits Increase In Response To Rising Inflation

Breaking News IRS Sets 2023 Limits For FSA HRA And More Bender

buyfsa.com /blogs/fsa/year-by-year-fsa-contribution-limits

Web Dec 4 2022 nbsp 0183 32 Every Year s FSA Contribution Limit since 2013 2023 3050 2022 2850 2021 2750 2020 2750 2019 2700 2018 2650 2017 2600 2016 2550 2015 2550 2014 2500 2013 2500 Prior to 2013 employers could independently set their own contribution limits

www. irs.gov /publications/p969

Web The maximum amount you can receive tax free is the total amount you elected to contribute to the health FSA for the year You must provide the health FSA with a written statement from an independent third party stating that the medical expense has been incurred and the amount of the expense

www. kiplinger.com /taxes/irs-new-msa-hsa-and-fsa-limits

Web Jan 9 2024 nbsp 0183 32 Image credit Getty Images By Katelyn Washington last updated 9 January 2024 Contributing to a medical savings account such as an HSA Health Savings Account or FSA Flexible Spending

www. irs.gov /pub/irs-pdf/p969.pdf

Web Health Flexible Spending Arrangement FSA contri bution and carryover for 2023 Revenue Procedure 2022 38 October 18 2022 provides that for tax years be ginning in 2023 the dollar limitation under section 125 i on voluntary employee salary reductions for contributions to health flexible spending arrangements is 3 050

www. shrm.org /topics-tools/news/benefits...

Web Nov 11 2021 nbsp 0183 32 Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov 10 as the annual contribution limit rises to 2 850 up

Web Apr 11 2022 nbsp 0183 32 A flexible spending account or FSA is a tax advantaged account offered by your employer that allows you to pay for medical expenses or dependent care Depending on the extent of your health care Web Feb 8 2024 nbsp 0183 32 Contribution limits for HSAs are higher for 2024 the limits are 4 150 to an HSA for self only coverage and up to 8 300 for family coverage and you can carry the money over from year to year

Web Dec 27 2022 nbsp 0183 32 But your employer may offer one of two options A grace period of up to 2 5 extra months to use the money in your FSA Carrying over up to 610 per year to use in the following year Your employer