2022 Income Tax Tables Web Nov 10 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married individuals filing separately

Web The table shows the tax rates you pay in each band if you have a standard Personal Allowance of 163 12 570 Income tax bands are different if you live in Scotland You can also see the rates Web Dec 2 2021 nbsp 0183 32 Normally AMT is taxed at a flat rate of 26 For high income taxpayers however a 28 tax is applied to income in excess of the following amounts Income over 206 100 Joint Returns individual

2022 Income Tax Tables

2022 Income Tax Tables

2022 Income Tax Tables

https://i2.wp.com/www.taxuni.com/wp-content/uploads/2020/04/tax-withholding-table-example-768x617.jpg

Web Jan 18 2022 nbsp 0183 32 26 tax rate applies to income below 103 050 206 100 28 tax rate applies to income over Child Tax Credit Gift tax annual exclusion 16 000 Estate gift amp generation skipping transfer tax exclusion amount per taxpayer 12 060 000 Exclusion

Templates are pre-designed documents or files that can be used for numerous purposes. They can save effort and time by supplying a ready-made format and layout for producing different kinds of content. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

2022 Income Tax Tables

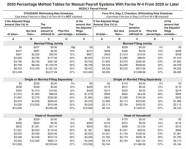

2021 Federal Tax Brackets Withholding Federal Withholding Tables 2021

Federal Income Tax Withholding Tables 2022 FF2022

2020 Form 1040 Tax Table 1040TT

2022 Tax Brackets AnnmarieEira

2021 Philippine Income Tax Tables Under TRAIN LaptrinhX News

2022 Tax Brackets Single Filing

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.morganstanley.com/content/dam/msdotcom/...

Web Find the 2022 tax rate schedule standard deductions personal exemption and additional deductions for non itemizers for each filing status and income range Download the tax tables in PDF or Excel format

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png?w=186)

https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals

Web Feb 22 2023 nbsp 0183 32 Find the tax rates and thresholds for individuals in South Africa for the 2022 and 2023 tax years Compare the changes from the previous year and see the rates for different taxable income ranges

https://www.nerdwallet.com/article/taxes/fed…

Web Dec 6 2023 nbsp 0183 32 There are seven tax rates 10 12 22 24 32 35 and 37 The income thresholds for the 2023 tax brackets were adjusted significantly up about 7 from 2022 due to record high

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 The standard deduction amount for the 2022 tax year jumps to 12 950 for single taxpayers up 400 and 25 900 for a married couple filing jointly up 800

Web Nov 10 2021 nbsp 0183 32 The tax year 2022 maximum Earned Income Tax Credit amount is 6 935 for qualifying taxpayers who have three or more qualifying children up from 6 728 for tax year 2021 The revenue procedure contains a table providing maximum EITC amount for Web 2022 Tax Table General Information Refund Information Instructions for Schedule 1 Instructions for Schedule 2 Instructions for Schedule 3 Tax Topics Disclosure Privacy Act and Paperwork Reduction Act Notice Major Categories of Federal Income and Outlays

Web The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year This page provides detail of the Federal Tax Tables for 2022 has links to historic Federal