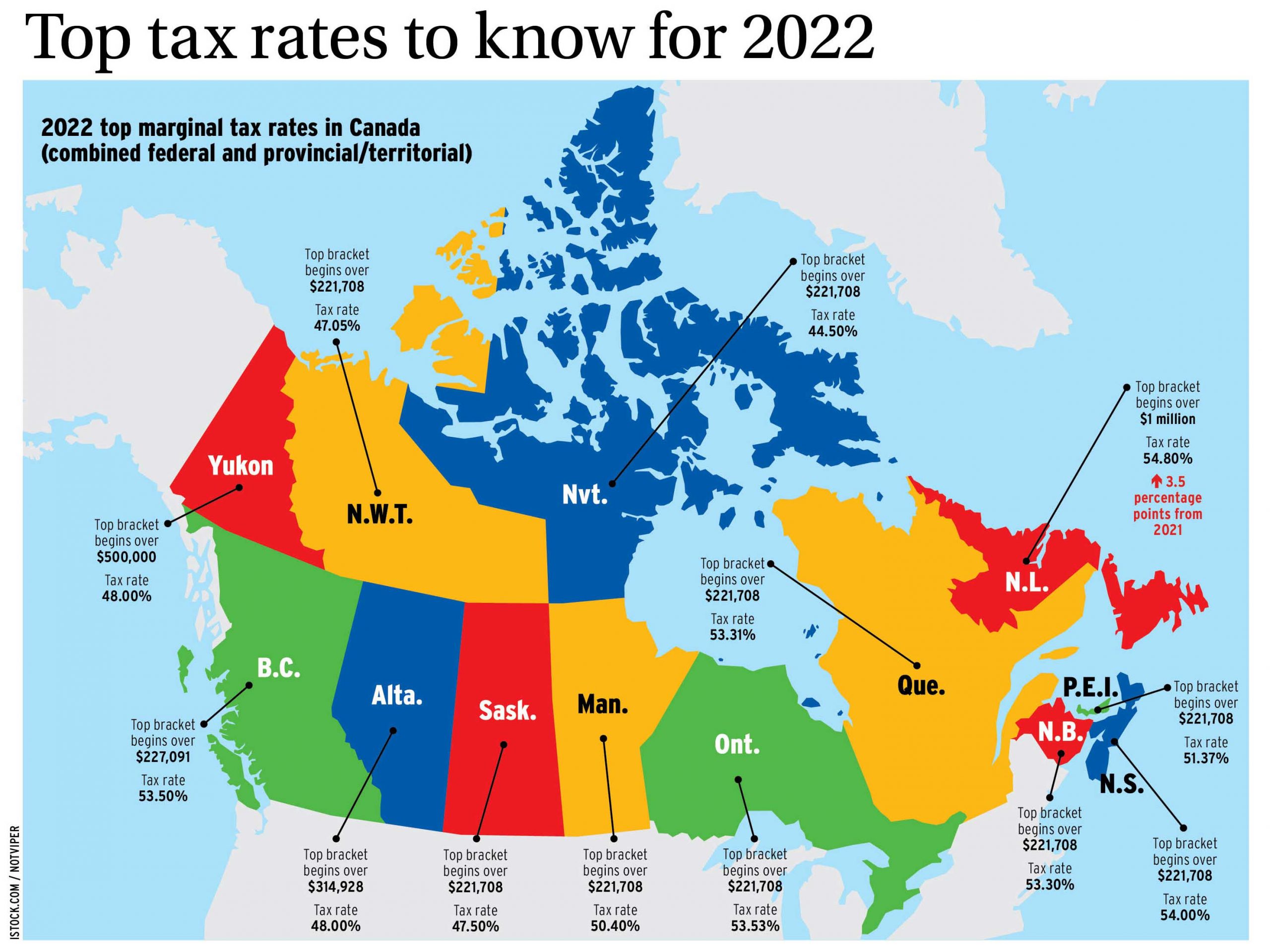

2022 Income Tax Brackets Canada Web The latest 2022 tax rate card puts the most up to date marginal tax rates and tax brackets by taxable income source non refundable tax credits and much more all in one place This reference card is designed to help

Web Dec 4 2021 nbsp 0183 32 If your taxable income is greater than 42 184 the first 42 184 of taxable income is taxed at 5 06 another 42 185 of taxable income is taxed at 7 70 and Web Where the dividend tax credit exceeds the federal and provincial tax otherwise payable on the dividends the rates do not reflect the value of the excess credit that may be used to

2022 Income Tax Brackets Canada

2022 Income Tax Brackets Canada

2022 Income Tax Brackets Canada

https://cardinalpointwealth.com/wp-content/uploads/2021/12/Winter_2021_Canadian_Income_Tax_Table.jpg

Web Feb 10 2022 nbsp 0183 32 CRA Newsroom What you need to know for the 2022 tax filing season February 10 2022 Ottawa Ontario Canada Revenue Agency Last year Canadians filed

Pre-crafted templates provide a time-saving service for creating a varied range of files and files. These pre-designed formats and layouts can be made use of for different personal and expert jobs, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, improving the material creation process.

2022 Income Tax Brackets Canada

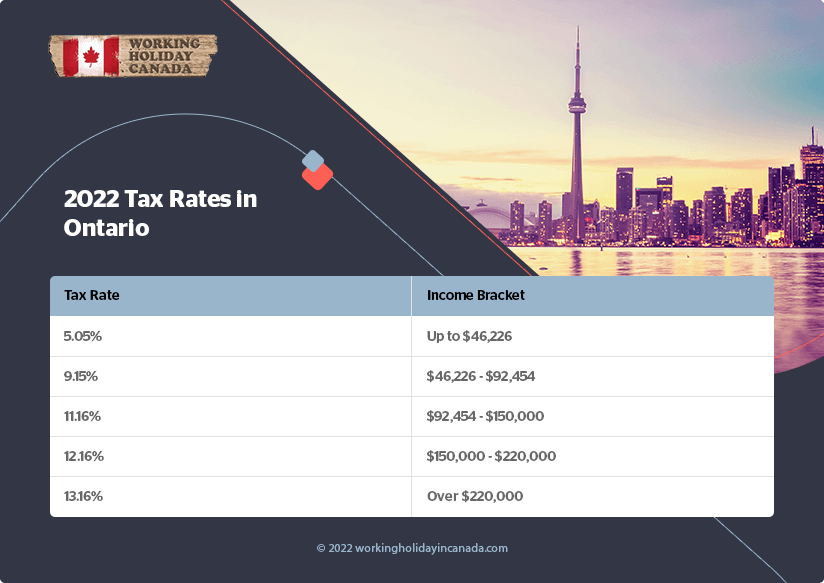

2022 Tax Brackets Canada Ontario

2022 Tax Brackets Canada Calculator

2022 Tax Brackets Canada Bc

Personal Income Tax Brackets Ontario 2022 MD Tax

2022 Tax Brackets Canada Ontario

Income Tax Rates Australia 2023 24 Pay Period Calendars 2023

https://www.canada.ca/en/revenue-agency/services/tax/rates.html

Web Rates for current and previous tax years that an individual uses when completing their income tax and benefit return Prescribed interest rates For amounts owed to the

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that

https://www.taxtips.ca/priortaxrates/tax-rates-2022-2023/canada.htm

Web For 2022 the marginal rate for 155 625 to 221 708 is 29 38 because of the above noted personal amount reduction through this tax bracket The additional 0 38 is calculated

https://ca.icalculator.com/income-tax-rates/2022.html

Web Amount As of 2022 the basic personal amount in Canada is set at 15 705 00 This amount is adjusted annually to account for inflation and other economic factors

https://www.taxtips.ca/priortaxrates/tax …

Web The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to

Web Nov 7 2022 nbsp 0183 32 Here are the federal tax brackets for 2022 according to the Government of Canada 15 on the first 50 197 of taxable income plus1 20 5 on the next 50 195 of Web The 2022 edition of Individual Tax Statistics by Tax Bracket presents basic counts and amounts of individual tax filer information by tax bracket These statistics are based on

Web Sep 30 2023 nbsp 0183 32 Insights and resources Canadian corporate tax tables Tax rates are continuously changing Get the latest rates from KPMG s corporate tax Tax Facts 2023