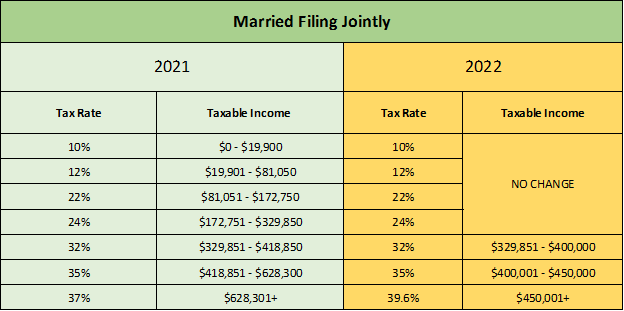

2022 Income Tax Brackets Married Filing Jointly Web Nov 22 2021 nbsp 0183 32 The 2022 AMT exemption amount is increased to 75 900 for single people and people filing as head of household 118 100 for married people filing jointly and 59 050 for married people filing

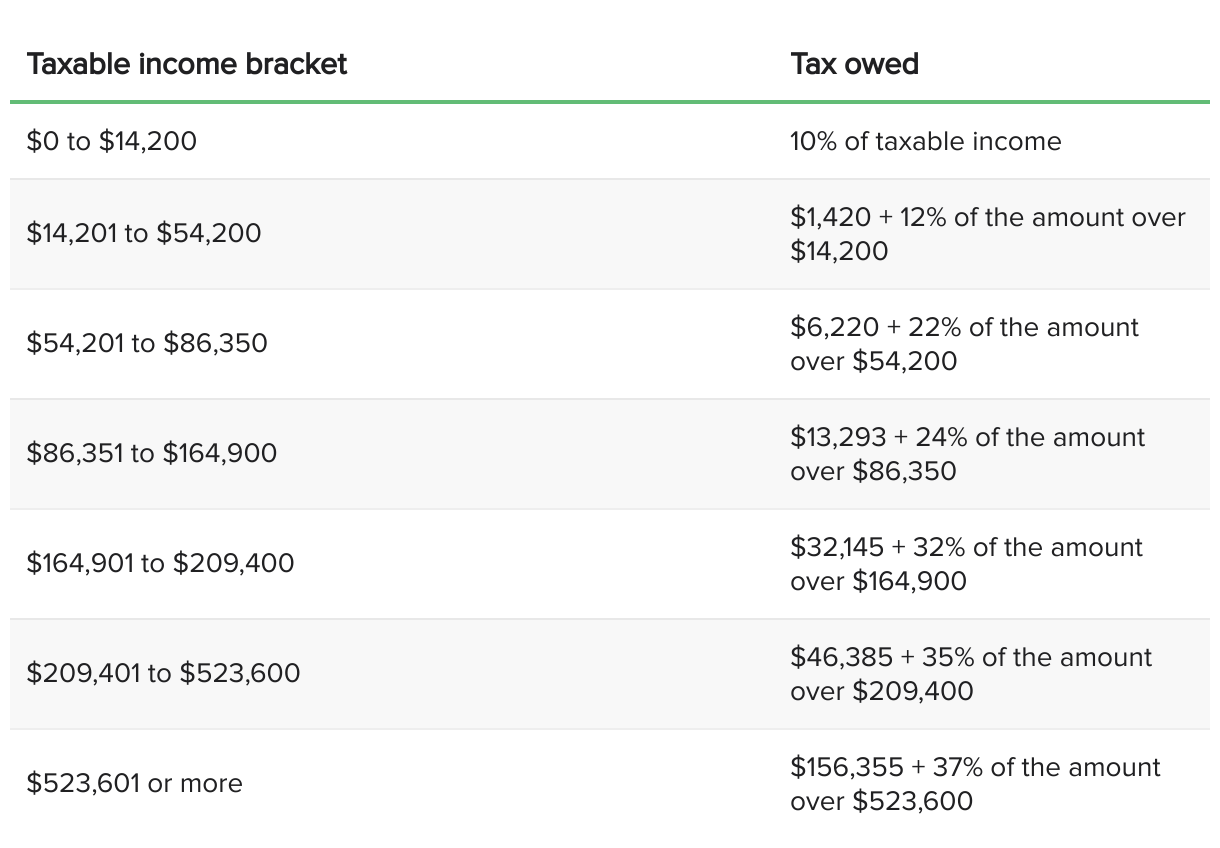

Web Dec 10 2021 nbsp 0183 32 MFJ Tax rate MFJ Taxable Income Bracket MFJ Taxes Owed in 10 0 to 20 500 10 of taxable income 12 20 550 to 83 550 2 055 plus 12 of the Web Jan 26 2023 nbsp 0183 32 The seven federal income tax brackets for the 2022 tax year are 10 12 22 24 32 35 and 37 married filing jointly married filing separately and head of household filers

2022 Income Tax Brackets Married Filing Jointly

2022 Income Tax Brackets Married Filing Jointly

2022 Income Tax Brackets Married Filing Jointly

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-married-filing-jointly.png?fit=1456

Web Dec 13 2023 nbsp 0183 32 For tax brackets and federal income tax rates marginal tax rates mean that the rate associated with your tax bracket is the highest rate your taxable income will

Pre-crafted templates provide a time-saving option for creating a varied series of documents and files. These pre-designed formats and designs can be used for different personal and expert projects, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the material development procedure.

2022 Income Tax Brackets Married Filing Jointly

2021 Tax Brackets Irs Calculator

2022 Tax Brackets Married Filing Jointly With Dependents

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

2022 Us Tax Brackets Irs

2022 Tax Brackets Married Filing Jointly Irs Printable Form

IRS Tax Brackets For 2023 Taxed Right

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Nov 10 2021 nbsp 0183 32 2022 Federal Income Tax Brackets and Rates for Single Filers Married Couples Filing Jointly and Heads of Households Tax Rate For Single Filers For

https://www.cnbc.com/2021/11/10/2022-income-tax...

Web Nov 10 2021 nbsp 0183 32 Married couples filing jointly 25 900 Single taxpayers and married individuals filing separately 12 950 Heads of households 19 400 for tax year 2022

https://turbotax.intuit.com/.../tax-bracket

Web 8 rows nbsp 0183 32 Tax Rate Single filers Married filing jointly or qualifying widow er Married filing separately Head of household 10 0 to 9 950 0 to 19 900 0 to 9 950 0 to 14 200 12 9 951 to 40 525 19 901

https://www.morganstanley.com/content/dam/msdotcom/...

Web Tax Tables 2022 Edition Traditional IRA Deductibility Limits The max contribution limit for IRAs is 6 000 Social Security FILING STATUS PROVISIONAL INCOME AMOUNT OF

https://finance.yahoo.com/news/incom…

Web Feb 9 2021 nbsp 0183 32 2022 Tax Brackets for Married Couples Filing Separately and Head of Household Filers Tax Rate Taxable Income Taxable Income Married Filing Jointly 10 Up to 9 950 Up to 19 900 12

Web Oct 11 2022 nbsp 0183 32 The IRS has released the federal income tax brackets for the 2022 tax year which are as follows For married couples filing jointly the tax bracket thresholds are Web 6 days ago nbsp 0183 32 Tax Rate Single Married filing separately Head of household Married filing jointly 10 Not over 11 600 Not over 11 600 Not over 16 550 Not over

Web Oct 27 2023 nbsp 0183 32 2022 tax brackets for taxes due in April 2023 announced by the IRS on November 10 2021 for individuals married filing jointly married filing separately and