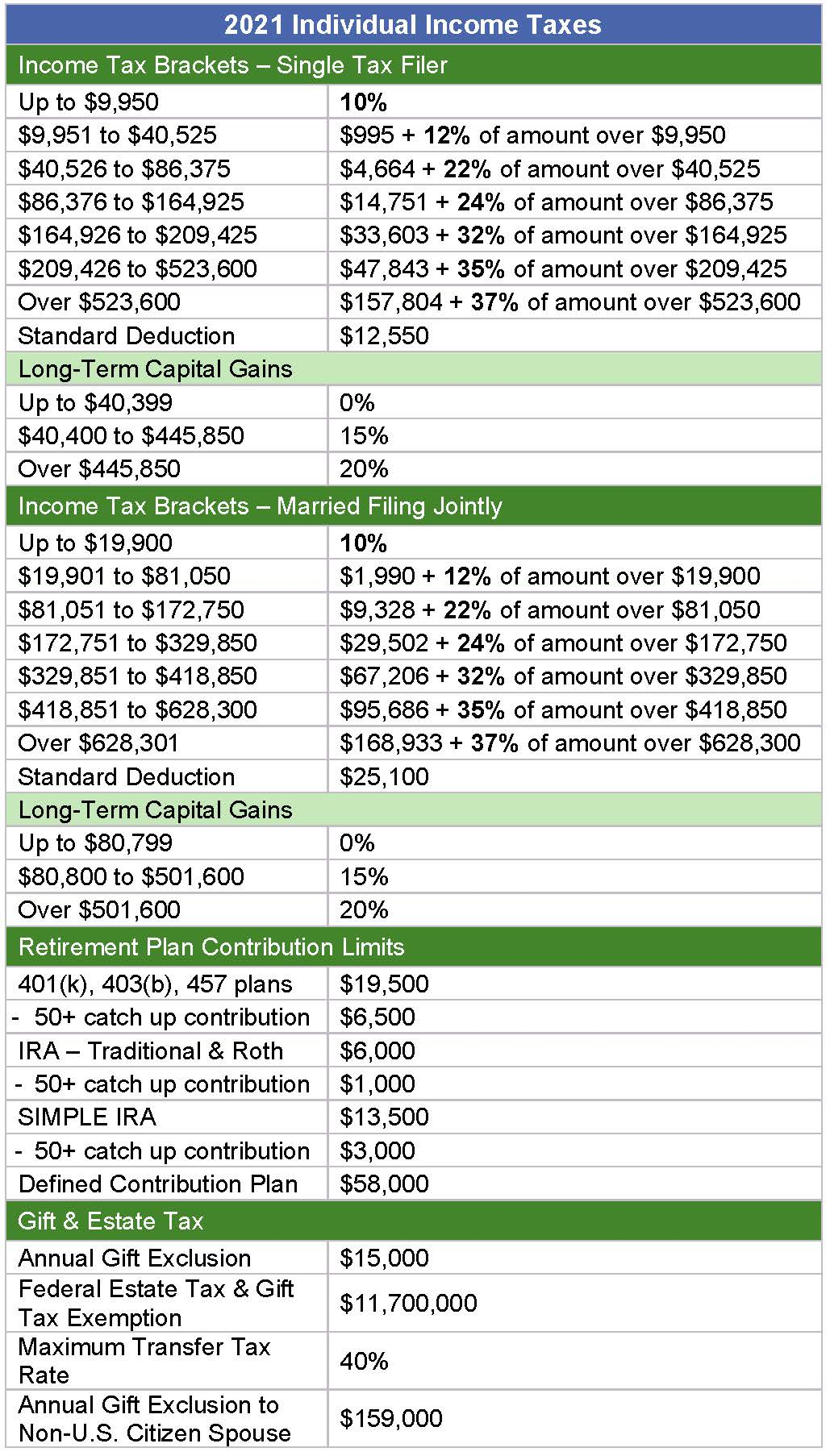

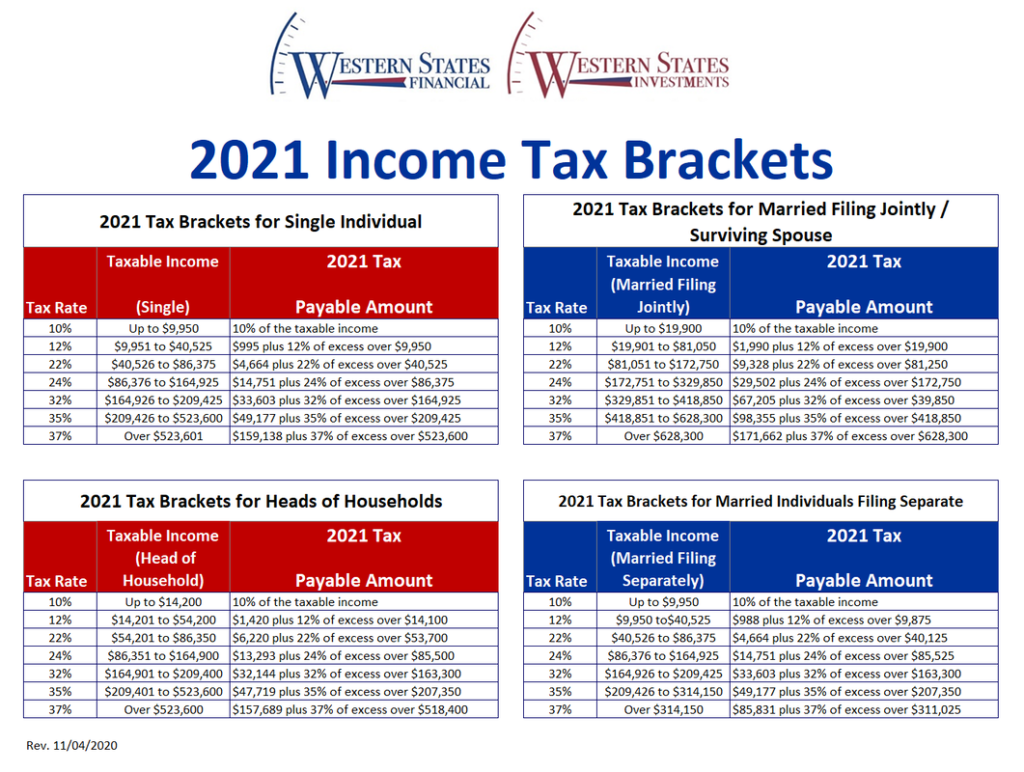

2022 Income Tax Rate Table Web Nov 10 2021 nbsp 0183 32 Marginal Rates For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539 900 647 850 for married couples filing jointly The other rates are 35 for incomes over 215 950 431 900 for married couples filing jointly

Web Nov 10 2021 nbsp 0183 32 Twenty 20 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday The seven tax rates remain unchanged while the income limits have been adjusted Web How to Declare Income Tax Rate Individual Assessment Year 2023 Assessment Year 2022 Assessment Year 2021 Assessment Year 2020 Assessment Year 2018 2019 Assessment Year 2016 amp 2017 Assessment Year 2015 Assessment Year 2013 amp 2014

2022 Income Tax Rate Table

2022 Income Tax Rate Table

2022 Income Tax Rate Table

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t20-0238r.gif?itok=FplbFk5N

Web Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status Single tax rates 2022 AVE Joint tax rates 2022 AVE

Pre-crafted templates provide a time-saving service for producing a varied variety of files and files. These pre-designed formats and layouts can be utilized for various individual and professional tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the material production process.

2022 Income Tax Rate Table

Printable 2021 Federal Income Tax Table Federal Withholding Tables 2021

Federal Income Tax Rate Schedule 2021 Federal Withholding Tables 2021

Higher Federal Withholding Table Vs Standard 2021 Federal Withholding

Solved 1 Mr Lolong Supervisory Employee Received The Following

2022 Irs Tax Brackets Head Of Household Kristi Newman Info

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.irs.com/en/2022-federal-income-tax...

Web Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation

https://www.irs.gov/pub/irs-prior/i1040tt--2022.pdf

Web Sep 27 2022 Cat No 24327A TAX AND EARNED INCOME CREDIT TABLES This booklet only contains Tax and Earned Income Credit Tables from the Instructions for Form 1040 and 1040 SR FreeFile is the fast safe and free way to prepare and e le your taxes See IRS gov FreeFile Pay Online It s fast simple and secure Go to IRS gov Payments

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Mar 18 2024 nbsp 0183 32 Page Last Reviewed or Updated 18 Mar 2024 See current federal tax brackets and rates based on your income and filing status

https://www.investopedia.com/irs-announces-tax...

Web Nov 11 2021 nbsp 0183 32 The top rate of 37 will apply to income over 539 900 for individuals and heads of household and 647 850 for married couples who file jointly The full list of tax rates and brackets for 2022

https://www.morganstanley.com/content/dam/msdotcom/...

Web Tax Tables 2022 Edition 1 TAXABLE INCOME BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE OF THE AMOUNT OVER NOT OVER OVER SINGLE 0 10 275 0 10 0 0 10 275 41 775 1 027 50 12 0 10 275 41 775 89 075 4 807 50 22 0 41 775 89 075 170 050 15 213 50 24 0 89 075 170 050 215 950

Web Dec 2 2021 nbsp 0183 32 IRS 2022 Tax Tables Deductions amp Exemptions purposeful finance Joshua Escalante Troesh CFP December 2 2021 The IRS Announces New Tax Numbers for 2022 Each year the IRS updates the existing tax code numbers for items that are indexed for inflation This includes the tax rate tables many deduction limits and Web MSWM 2022 Income Tax Tables 2022 Tax Rate Schedule TAXABLE INCOME OVER NOT OVER BASE AMOUNT OF TAX PLUS MARGINAL TAX RATE OF THE AMOUNT OVER Kiddie Tax All net unearned income over a threshold amount of 2 300 for 2022 is taxed using the brackets and rates of the child s parents

Web Next Year 2023 Federal 2023 Single Tax Brackets Federal 2023 Married Filing Separately Tax Brackets Federal 2023 Married Filing Jointly Tax Brackets Federal 2023 Head of Household Tax Brackets This page shows Tax Brackets s archived Federal tax brackets for tax year 2022