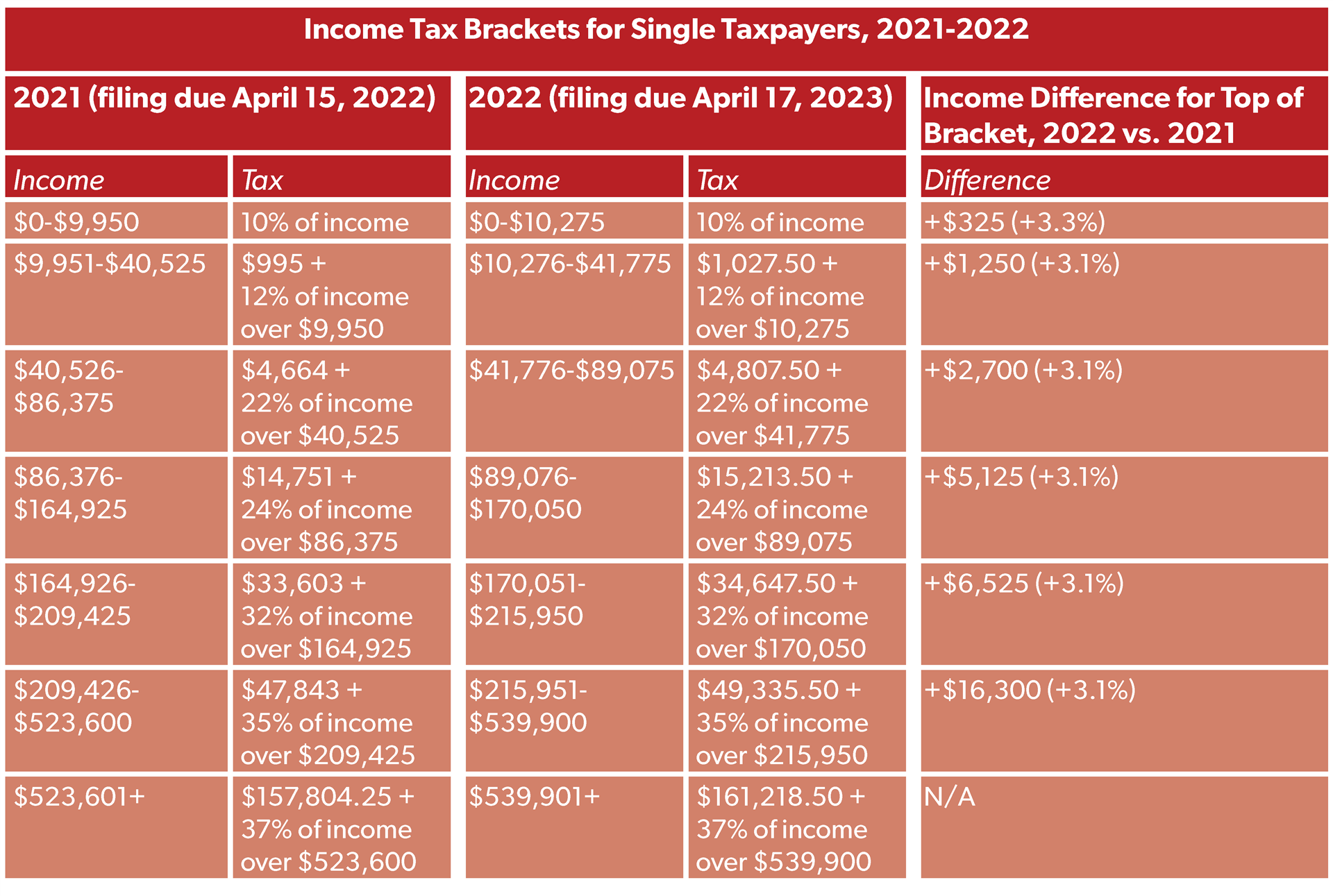

2021 Vs 2022 Tax Tables WEB Jan 17 2023 nbsp 0183 32 There are seven tax brackets for most ordinary income for the 2021 tax year 10 12 22 24 32 35 and 37

WEB Tax filing deadline to request an extension until Oct 17 2022 for businesses whose tax return deadline is April 18 2022 1st installment deadline to pay 2022 estimated taxes WEB Jan 23 2024 nbsp 0183 32 The table below shows the levels that will apply in 2024 Current statutory tax rates have evolved from the Tax Reform Act of 1986 TRA86 P L 99 514 and

2021 Vs 2022 Tax Tables

2021 Vs 2022 Tax Tables

2021 Vs 2022 Tax Tables

https://federalwithholdingtables.net/wp-content/uploads/2021/07/federal-income-tax-brackets-released-for-2021-has-yours-1.png

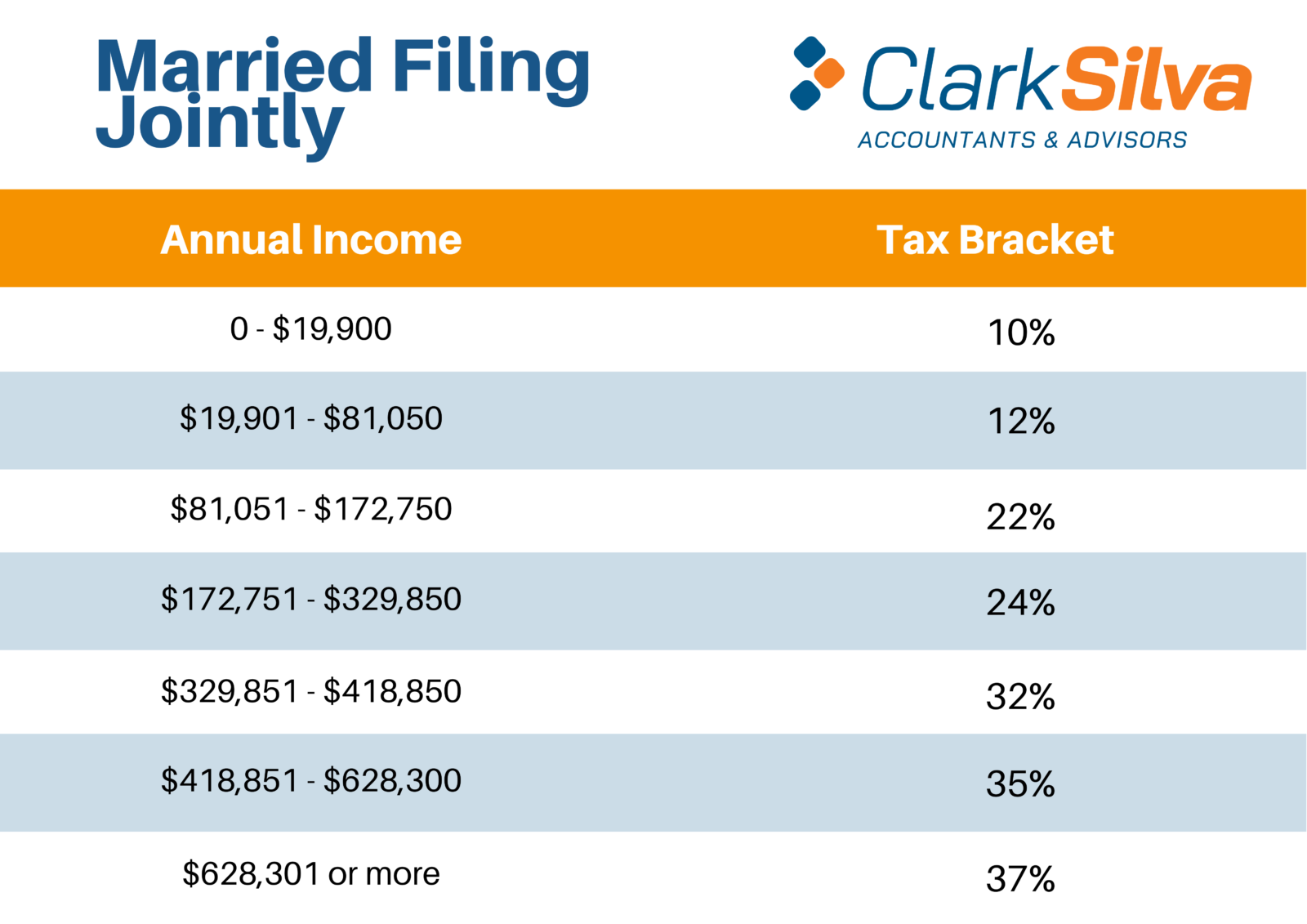

WEB Nov 10 2021 nbsp 0183 32 These are the 2021 brackets Here are the new brackets for 2022 depending on your income and filing status For married individuals filing jointly 10

Pre-crafted templates provide a time-saving service for developing a varied variety of files and files. These pre-designed formats and designs can be used for various personal and expert tasks, including resumes, invitations, leaflets, newsletters, reports, discussions, and more, streamlining the content creation procedure.

2021 Vs 2022 Tax Tables

2021 Tax Brackets Irs Married Filing Jointly

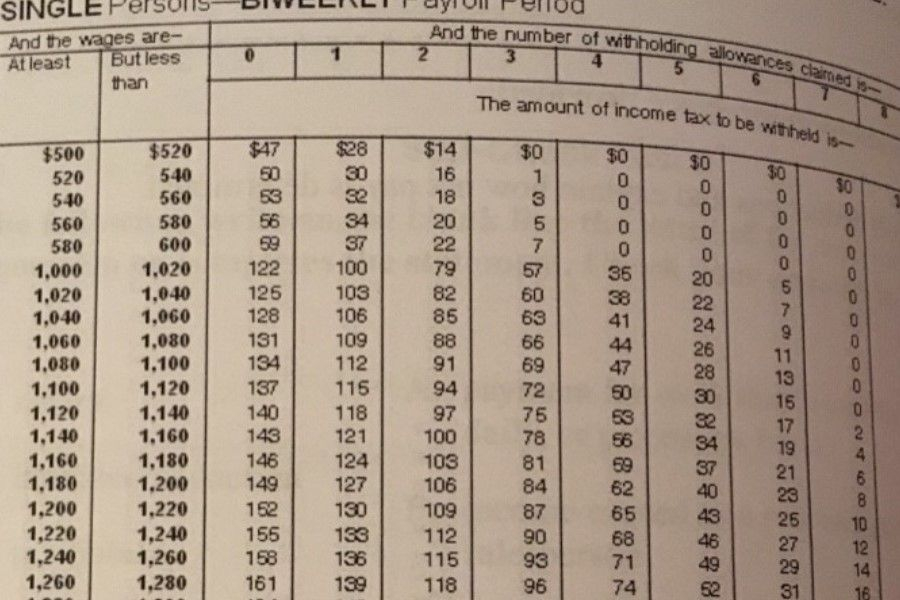

Weekly Deduction Tables 2021 Federal Withholding Tables 2021

2021 Federal Withholding Tax Tables Publication 15 Federal

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

Ca Tax Brackets 2023 2023

https://www.ntu.org/publications/detail/income-tax...

WEB Nov 12 2021 nbsp 0183 32 See below for how these 2022 brackets compare to 2021 brackets Importantly the 2021 brackets are for income earned in 2021 which most people will file

https://taxfoundation.org/data/all/federal/2021-tax-brackets

WEB Oct 27 2020 nbsp 0183 32 2021 Federal Income Tax Brackets and Rates In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

WEB Jul 1 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status You pay tax as a percentage of your income in layers called tax brackets As

https://www.fidelity.com/insights/personal-finance/2022-tax-brackets

WEB Depending on your taxable income you can end up in one of seven different federal income tax brackets each with its own marginal tax rate

https://taxfoundation.org/data/all/federal/2022-tax-brackets

WEB Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in

WEB Mar 9 2022 nbsp 0183 32 Wolters Kluwer looks at the 2021 and 2022 tax brackets and standard deduction amounts WEB Page 3 of 26 Fileid tax table 2022 a xml cycle02 source 13 19 28 Nov 2022 The type and rule above prints on all proofs including departmental reproduction

WEB Nov 10 2021 nbsp 0183 32 WASHINGTON The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax