2021 Vs 2022 Tax Brackets Canada Web Dec 5 2023 nbsp 0183 32 Published December 19 2022 What are Canada s Tax Brackets Tax brackets exist at both the federal and provincial or territorial level in Canada Your income determines your tax

Web 2020 taxes owing by certain individuals to April 30 2022 from April 30 2021 Specifically the CRA will not charge interest on 2020 taxes owing until April 30 2022 where all of the Web Dec 4 2021 nbsp 0183 32 Under the Canadian marginal tax rate for 2021 an individual with a taxable income of 216 511 would pay a total federal tax prior to credit at an effective federal

2021 Vs 2022 Tax Brackets Canada

2021 Vs 2022 Tax Brackets Canada

2021 Vs 2022 Tax Brackets Canada

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Web Capital gains amp losses Eligible dividends Income taxes paid Federal Income taxes paid Qu 233 bec Calculate Estimated amount 0 2022 Federal income tax brackets Here are

Pre-crafted templates offer a time-saving service for developing a varied range of files and files. These pre-designed formats and layouts can be utilized for numerous personal and professional projects, including resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content production process.

2021 Vs 2022 Tax Brackets Canada

Married Tax Brackets 2021 Westassets

2022 Federal Tax Brackets And Standard Deduction Printable Form

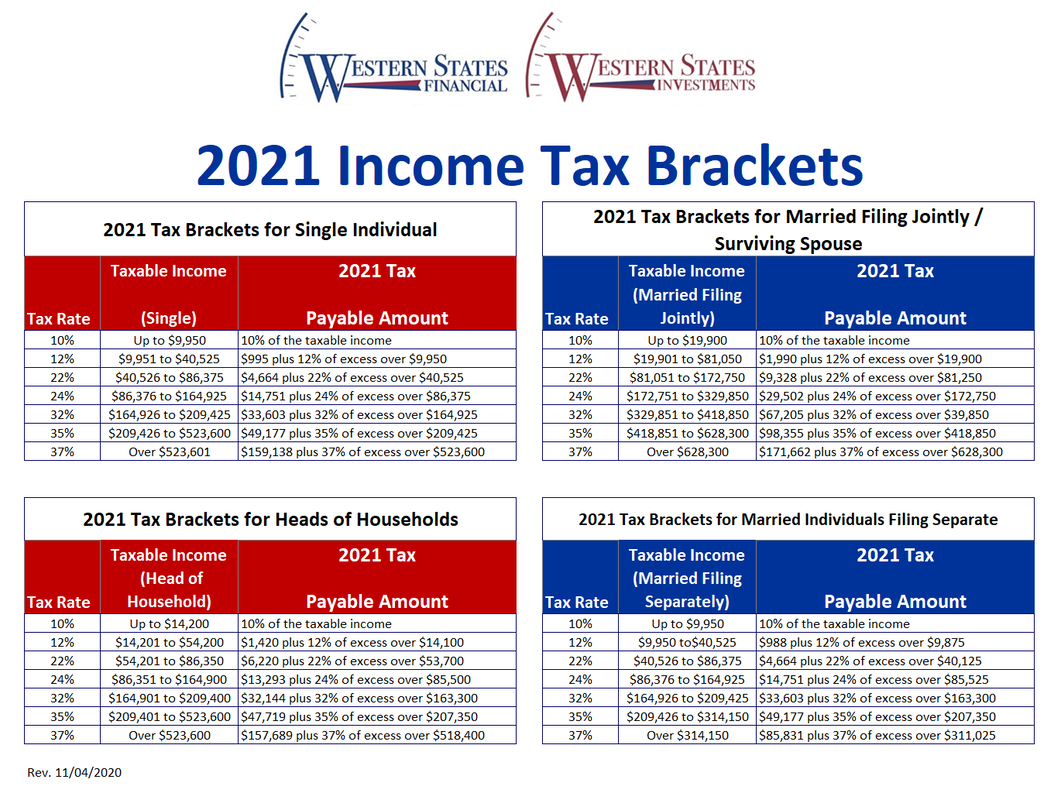

2021 Federal Tax Brackets Tax Rates Retirement Plans Western

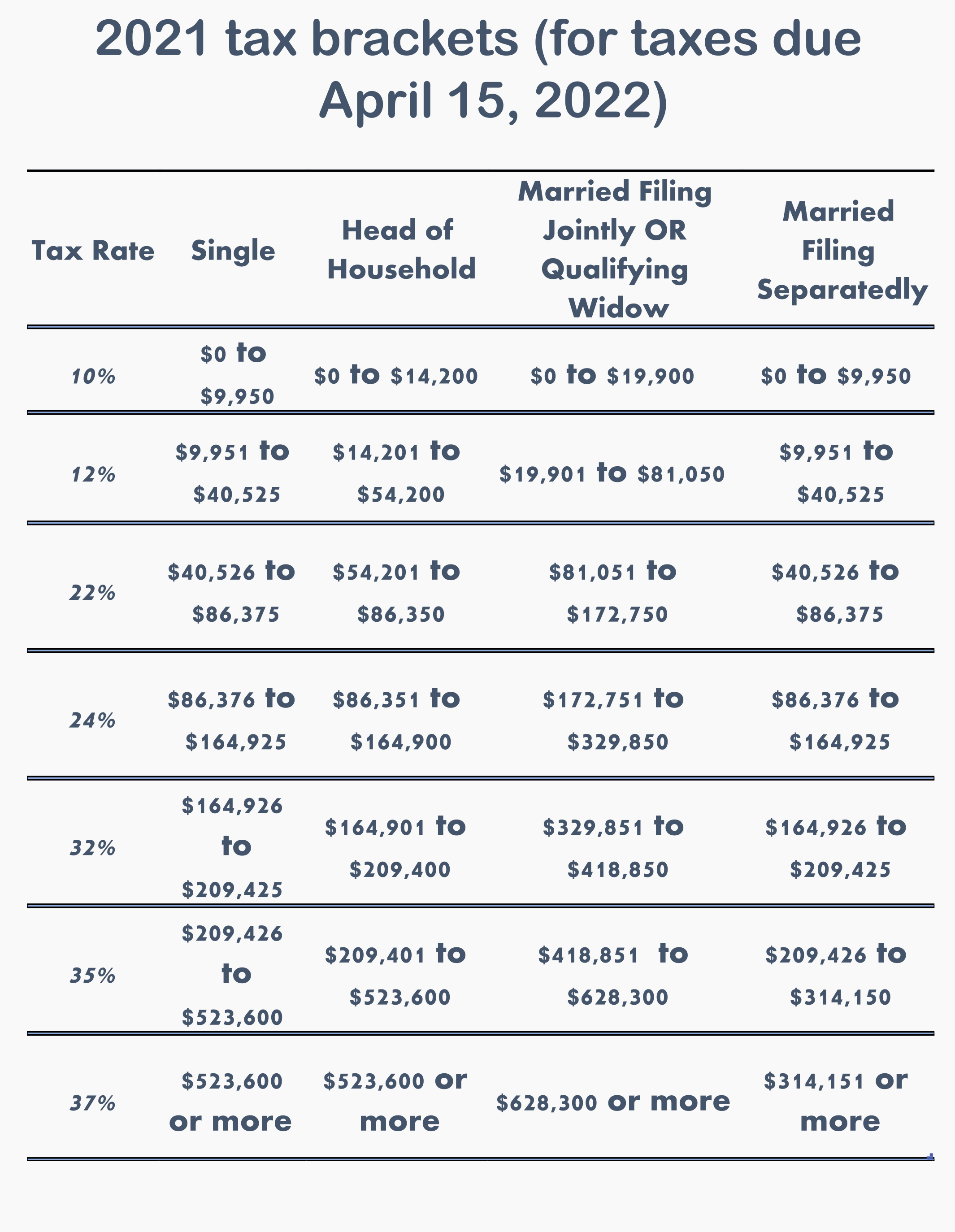

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

The 2022 Tax Brackets In Canada Based On Annual Income And Broken Down

https://www.wealthsimple.com/en-ca/learn/tax-brackets-canada

Web 61 rows nbsp 0183 32 Nov 25 2023 nbsp 0183 32 The following are the provincial territorial tax rates for 2023 in

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that

https://www.canada.ca/en/revenue-agency/programs/...

Web The taxable income of an individual taxfiler is used to determine the respective tax bracket As seen in the 2021 federal tax rate table below individuals with higher taxable income

https://www.moneysense.ca/save/taxes/2021 …

Web Nov 4 2021 nbsp 0183 32 Here are the tax brackets for all the provinces and territories in Canada for 2021 in alphabetical order Alberta tax brackets 2021 British Columbia tax brackets 2021 Manitoba

https://kpmg.com/.../canadian-personal-tax-ta…

Web Sep 30 2023 nbsp 0183 32 Canadian personal tax tables Canadian personal tax tables Canadian personal tax tables Federal and Provincial Territorial Income Tax Rates and Brackets for 2023 Current as of September 30 2023

Web 2 British Columbia indexes its tax brackets using the same formula as that used federally but uses the provincial inflation rate rather than the federal rate in the calculation The Web November 7 2022 Figuring out how much tax you owe every year is an exercise in mental gymnastics Your tax brackets will largely determine how much you owe in both federal

Web 1 The personal amount is increased federally and for Yukon for 2023 from 13 521 to 15 000 for taxpayers with net income line 23600 of 165 430 or less For incomes