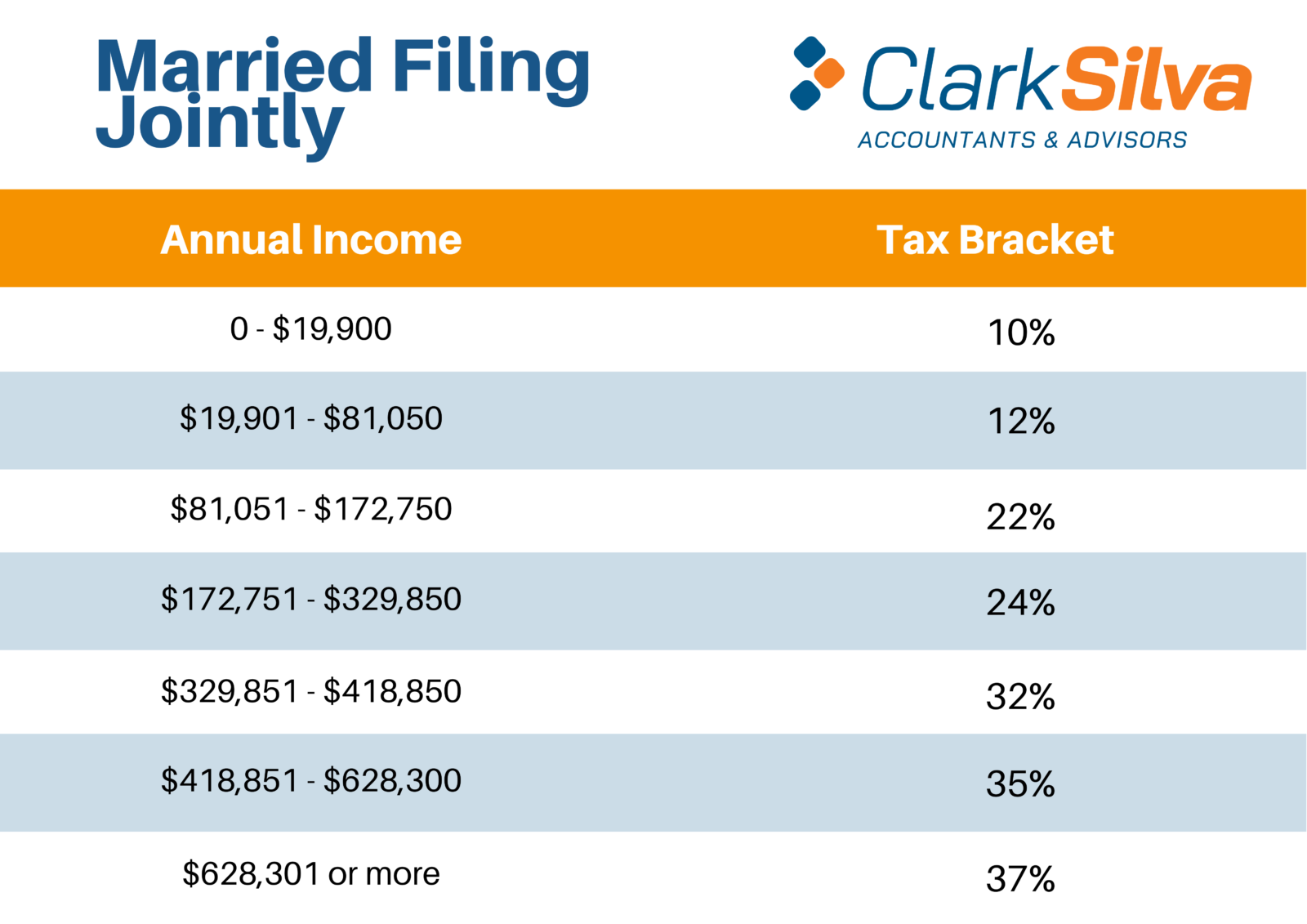

2021 Vs 2022 Capital Gains Tax Rates WEB Dec 21 2023 nbsp 0183 32 According to the IRS the tax rate on most long term capital gains is no higher than 15 for most people And for some it s 0 For the highest earners in the 37 income tax bracket waiting to sell until they ve held investments at least one year could cut their capital gains tax rate to 20

WEB Mar 18 2024 nbsp 0183 32 Capital gains tax rates can be confusing they differ at the federal and state levels as well as between short and long term capital gains WEB Jan 30 2024 nbsp 0183 32 Capital gains tax rates Net capital gains are taxed at different rates depending on overall taxable income although some or all net capital gain may be taxed at 0 For taxable years beginning in 2023 the tax rate on most net capital gain is no higher than 15 for most individuals

2021 Vs 2022 Capital Gains Tax Rates

2021 Vs 2022 Capital Gains Tax Rates

2021 Vs 2022 Capital Gains Tax Rates

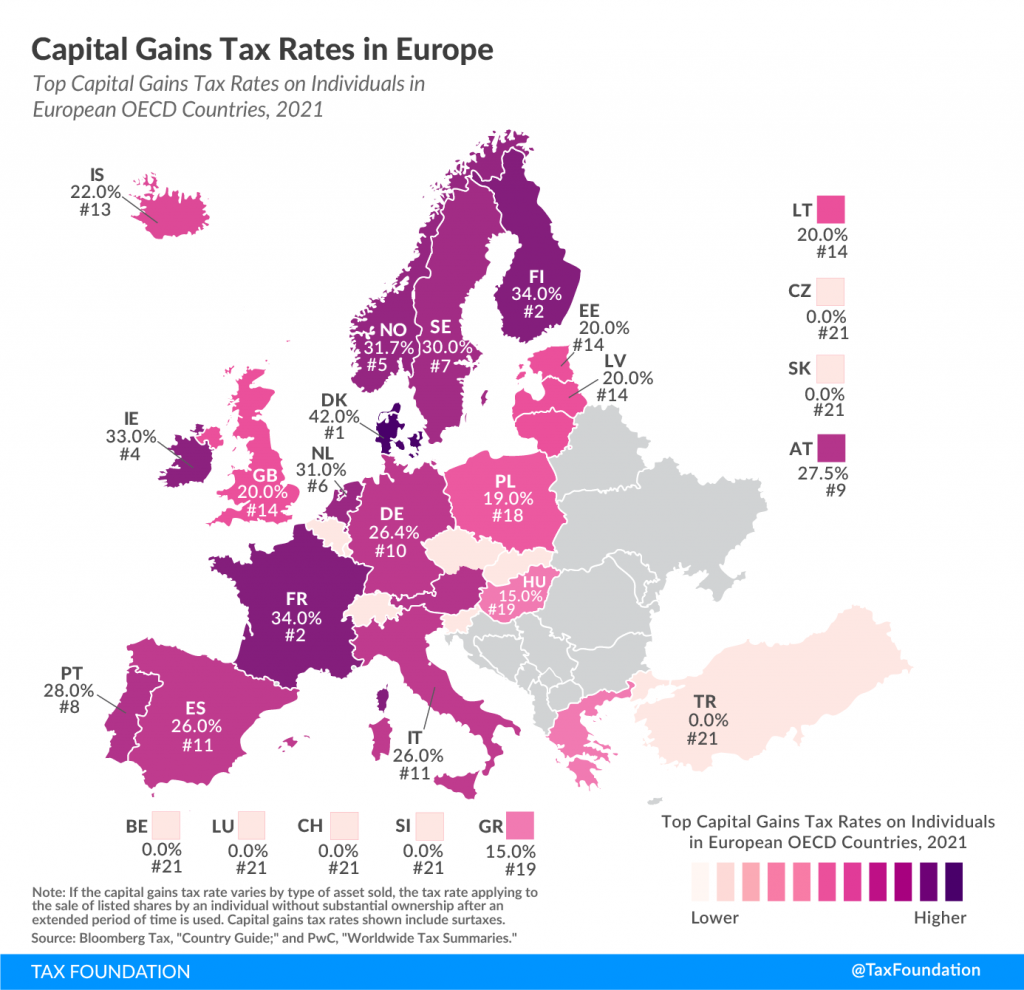

https://files.taxfoundation.org/20210421180619/2021-Capital-Gain-Tax-Rates-in-Europe-2021-Capital-Gain-Taxes-in-Europe-1024x990.png

WEB Jan 5 2023 nbsp 0183 32 Capital gains and losses are taxed differently from income like wages interest rents or royalties which are taxed at your federal income tax rate up to 37 for the 2022 tax filing season

Pre-crafted templates provide a time-saving solution for developing a diverse range of files and files. These pre-designed formats and layouts can be utilized for various individual and professional jobs, including resumes, invites, flyers, newsletters, reports, discussions, and more, improving the content production procedure.

2021 Vs 2022 Capital Gains Tax Rates

Capital Gains Tax Rate 2021 And 2022 Latest News Update

State Capital Gains Tax Rates

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

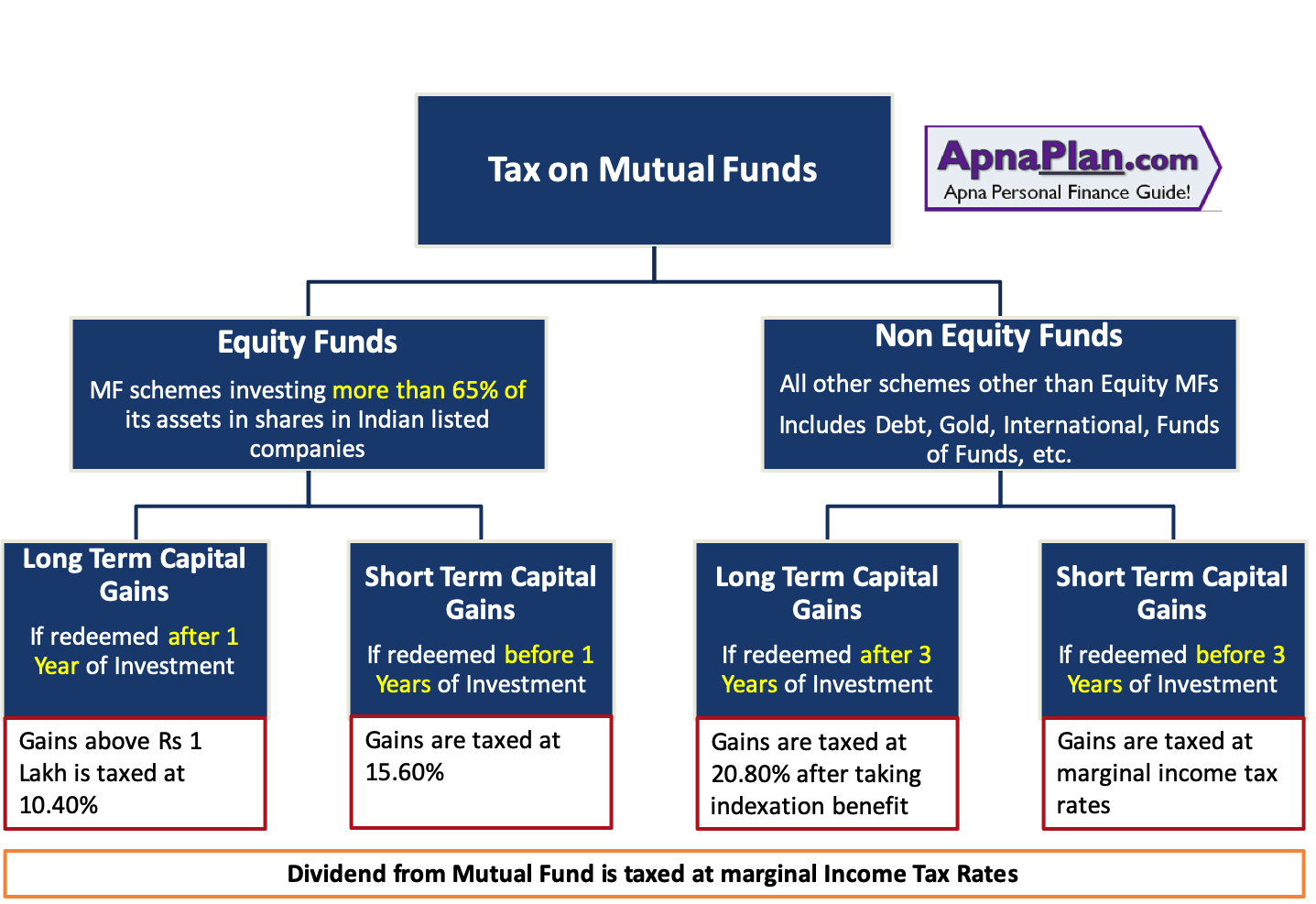

Do You Know How Tax On Mutual Funds Impact Your Returns FY 2021 22

2023 Tax Brackets The Best Income To Live A Great Life

Capital Gains Tax Rate Basics For Stock Market Investors DIY Stock Picker

https://www.gov.uk/capital-gains-tax/rates

WEB Market value Capital Gains Tax rates You pay a different rate of tax on gains from residential property than you do on other assets You do not usually pay tax when you sell your home If you

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

WEB Jun 4 2024 nbsp 0183 32 Long term capital gains tax is a tax on profits from the sale of an asset held for more than a year The rates are 0 15 or 20 depending on your taxable income and filing status

https://taxwealth.com/what-are-the-capital-gains...

WEB Mar 15 2022 nbsp 0183 32 The tax rate on short term capitals gains i e from the sale of assets held for less than one year is the same as the rate you pay on wages and other ordinary income Those rates currently range from 10 to 37 depending on your taxable income

https://www.investopedia.com/terms/c/capital_gains_tax.asp

WEB Jun 18 2024 nbsp 0183 32 What Is the Capital Gains Tax A capital gains tax is a tax imposed on the sale of an asset The long term capital gains tax rates for the 2023 and 2024 tax years are 0 15 or 20 of the

https://www.forbes.com/advisor/taxes/capi

WEB Nov 15 2022 nbsp 0183 32 Long term capital gains are taxed at lower rates than ordinary income while short term capital gains are taxed as ordinary income We ve got all the 2023 and 2024 capital gains

WEB Jan 6 2021 nbsp 0183 32 Long term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status For single tax filers you can benefit from the zero WEB Aug 18 2022 nbsp 0183 32 The tax rate on short term capitals gains i e from the sale of assets held for one year or less is the same as the rate you pay on wages and other ordinary income Those rates currently range from 10 to 37 depending on your taxable income

WEB Apr 5 2024 nbsp 0183 32 Capital gains tax is paid on the profits you make when you sell something if it exceeds your tax free allowance and losses from previous years Find out the CGT rates for 2023 24 and 2022 23 and how much tax free profit you can make