What Is The Tax Year For 2023 Sars Web Jul 5 2023 nbsp 0183 32 The tax submission deadlines for the 2023 tax season are as follows Non provisional taxpayers filing via the eFiling platform or manually Opening 7 July 2023 20h00 Closing 23 October

Web 23 June 2023 The following guides were updated for Filing Season 2023 starting on 7 July 2023 8pm Guide to submit a dispute via eFiling Guide to submit your individual income tax return via eFiling Guide to complete the Company Income Tax Return ITR14 eFiling Guide to the Individual ITR12 Return for Deceased and Insolvent Estates Web 1 day ago nbsp 0183 32 The deadline for individual taxpayers and trusts that are provisional taxpayers to file their income tax returns for the 2023 tax year is Wednesday 24 January 2024 The 2023 year of assessment refers to the period between 01 March 2022 to 28 February 2023

What Is The Tax Year For 2023 Sars

What Is The Tax Year For 2023 Sars

What Is The Tax Year For 2023 Sars

https://usaindiacfo.com/wp-content/uploads/2021/12/Downloader.la-61caf09f2db5f-768x512.jpg

Web Jun 14 2023 nbsp 0183 32 FAQ 2023 SARS TAX RETURN Yes it s almost that time of year again SARS tax return filing for individuals The 2023 start date is 7 July 2023 running to November 2023 As it is every year we

Templates are pre-designed files or files that can be utilized for various purposes. They can conserve time and effort by providing a ready-made format and design for creating various kinds of content. Templates can be used for personal or expert projects, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

What Is The Tax Year For 2023 Sars

2022 Tax Brackets JeanXyzander

/shutterstock_133005938-5bfc4773c9e77c002636c216.jpg)

What Is The Tax Year Definition When It Ends And Types Smartinvestplan

SARS Tax Rates For Individuals South African Tax Consultants

What Is The Tax Year 2022 Helps cartocars

Why Would A Paralegal Or Attorney Use A Form When Drafting A Legal Document

SheldonKaelia

https://www.sars.gov.za/types-of-tax/personal-income-tax

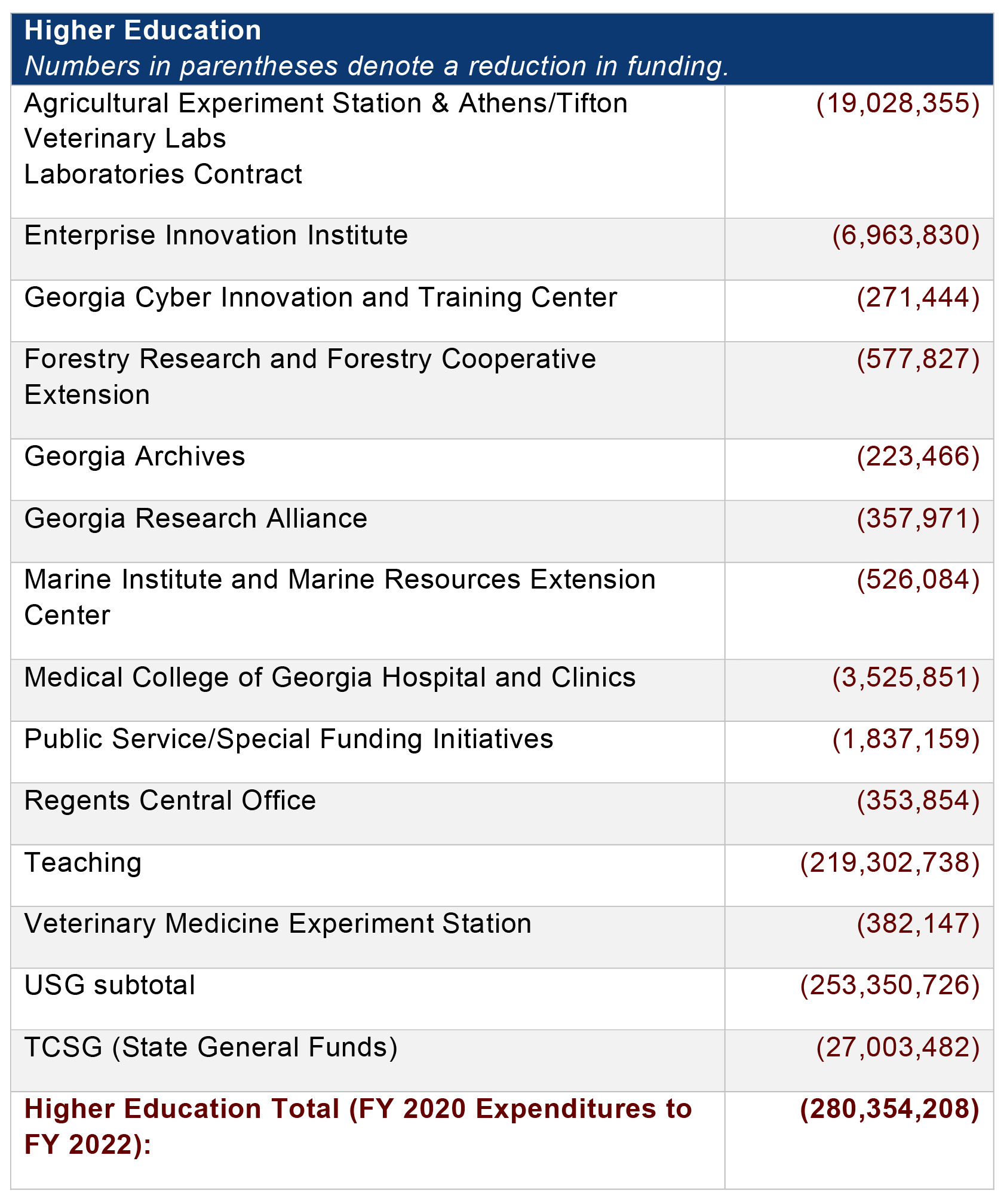

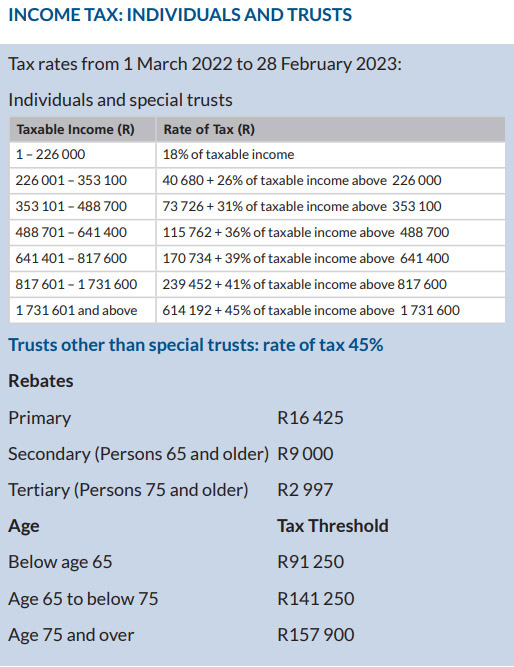

Web Sep 20 2023 nbsp 0183 32 For the 2023 year of assessment 1 March 2022 28 February 2023 R91 250 if you are younger than 65 years If you are 65 years of age to below 75 years the tax threshold i e the amount above which income tax becomes payable is R141 250 For taxpayers aged 75 years and older this threshold is R157 900

https://www.sars.gov.za/latest-news/personal...

Web 20 June 2023 What are the changes this year SARS has made the following updates for the upcoming Personal Income Tax PIT Filing Season Aligning the 40 Business Days Rule to the Filing Season End Date Last year when the rule was first introduced those in the auto assessment population were granted 40 business days

https://www.sars.gov.za/tax-rates/income-tax/rates-of-tax-for-individuals

Web Dec 27 2023 nbsp 0183 32 Tax Year 2024 2023 2022 Under 65 R95 750 R91 250 R87 300 65 an older R148 217 R141 250 R135 150 75 and older R165 689 R157 900 R151 100

https://quickbooks.intuit.com/za/tax-brackets-and-tax-tables

Web SARS Tax Brackets amp Tax Tables for 2023 2024 Personal Income Tax In South Africa you are liable to pay income tax if you earn more than R95 750 and you are younger than 65 years If you are 65 or older but younger than 75 years old the tax threshold i e the amount above which income tax becomes payable is R148 217

https://www.sars.gov.za/latest-news/sars-key-dates-for-2023-were-published

Web 29 November 2022 The important and key dates for next year 2023 were published See the Important Dates and navigate with the right arrow to the coming months

Web A person and tax resident of South Africa who during the 2023 tax year 1 March 2022 to 28 February 2023 meets the following definitions and requirements must submit a return 7 July to 23 October 2023 SARS MobiApp Taxpayers who prefer not to file online can submit at a SARS branch by appointment Provisional taxpayers Web Jun 19 2023 nbsp 0183 32 This year from 1 July 2023 SARS will again issue auto assessments to taxpayers whose tax affairs are less complicated If you are in agreement with your auto assessment then there is no need to

Web The company s financial year end will be reflected in its CIPC registration documents The tax year is different from a normal calendar year which always runs from 1 January to end December The tax year is named by the year in which it ends e g the 2024 tax year runs from 1 March 2023 to end February 2024