What Is The Tax Year For 2021 Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

Starting July 3 2025 some benefit recipients will now receive their CRA mail online If you are registered for a CRA account and currently receive paper mail you may now receive most of Jul 17 2025 nbsp 0183 32 Provide tax information If your representative submits an authorization request using the Representative to provide tax information option you will need to provide your

What Is The Tax Year For 2021

What Is The Tax Year For 2021

What Is The Tax Year For 2021

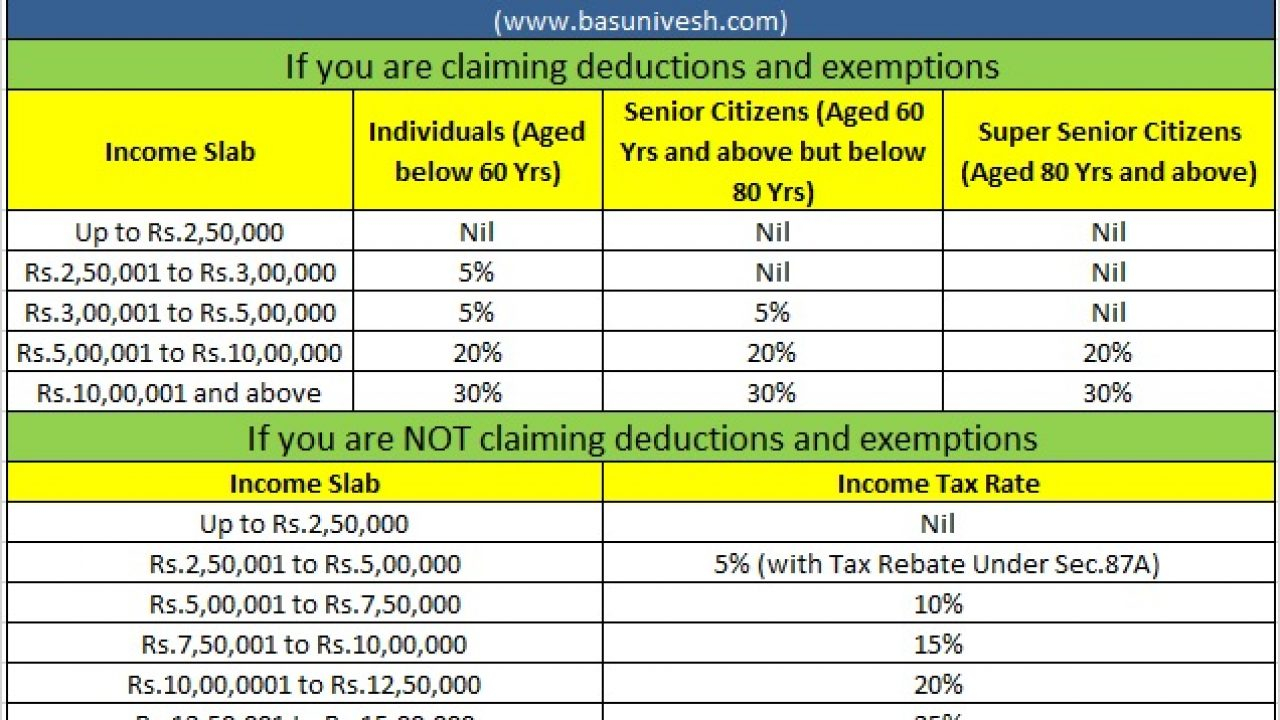

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

Jan 1 2025 nbsp 0183 32 TD1 Personal Tax Credits Returns TD1 forms for 2025 for pay received on January 1 2025 or later

Pre-crafted templates use a time-saving solution for producing a varied variety of files and files. These pre-designed formats and layouts can be made use of for numerous individual and professional projects, consisting of resumes, invites, flyers, newsletters, reports, presentations, and more, improving the material development procedure.

What Is The Tax Year For 2021

2022 Tax Brackets KrissDaemon

What Is The Tax Year 2022 Helps cartocars

/shutterstock_133005938-5bfc4773c9e77c002636c216.jpg)

What Is The Tax Year Definition When It Ends And Types Smartinvestplan

Federal Tax Withheld Tax Rate 2021 Federal Withholding Tables 2021

Form 8812 Credit Limit Worksheet A

2020 Personal Taxes FAQ KATA Accounting

https://howtaxworks.co.za › questions › tax-implications-retiring-from-ra

Mar 1 2024 nbsp 0183 32 The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount

https://www.canada.ca › en › services › taxes › income-tax

File non resident corporations income tax file non residents income tax get information on tax treaties country by country reporting Doing taxes for someone who died Report the date of

https://howtaxworks.co.za › questions › income-tax-calculator

Do you need to register for income tax If your income exceeds the tax thresholds then you will need to register as a tax payer with SARS Do you need to submit a tax return for the 2024 25

:max_bytes(150000):strip_icc()/taxyear.asp-final-8600d1dae2f845b795b6017fb894f431.jpg?w=186)

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

Jan 15 2025 nbsp 0183 32 This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

https://www.canada.ca › en › services › benefits › disability › canada-dis…

Jul 17 2025 nbsp 0183 32 The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is administered by Service

[desc-11] [desc-12]

[desc-13]