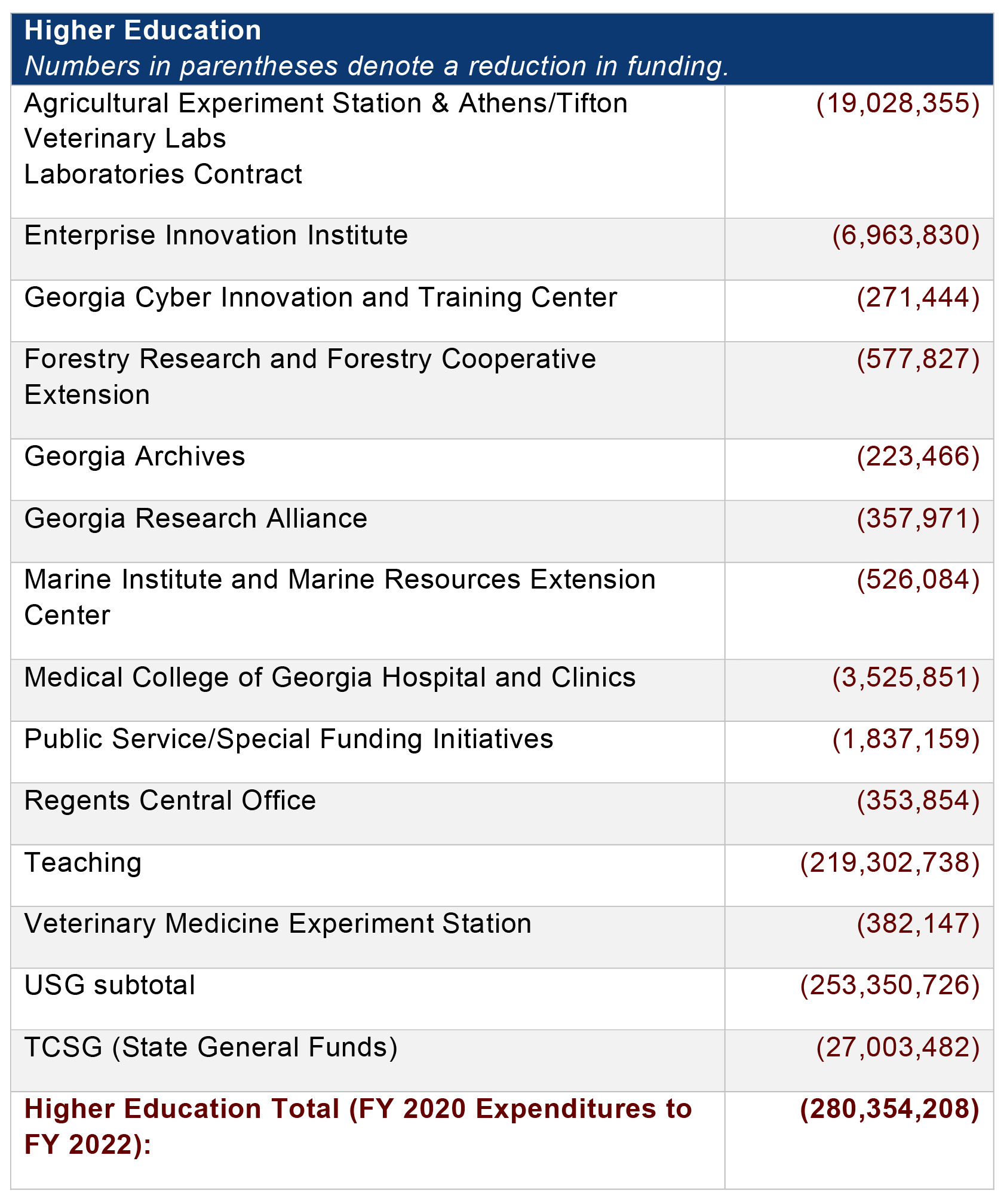

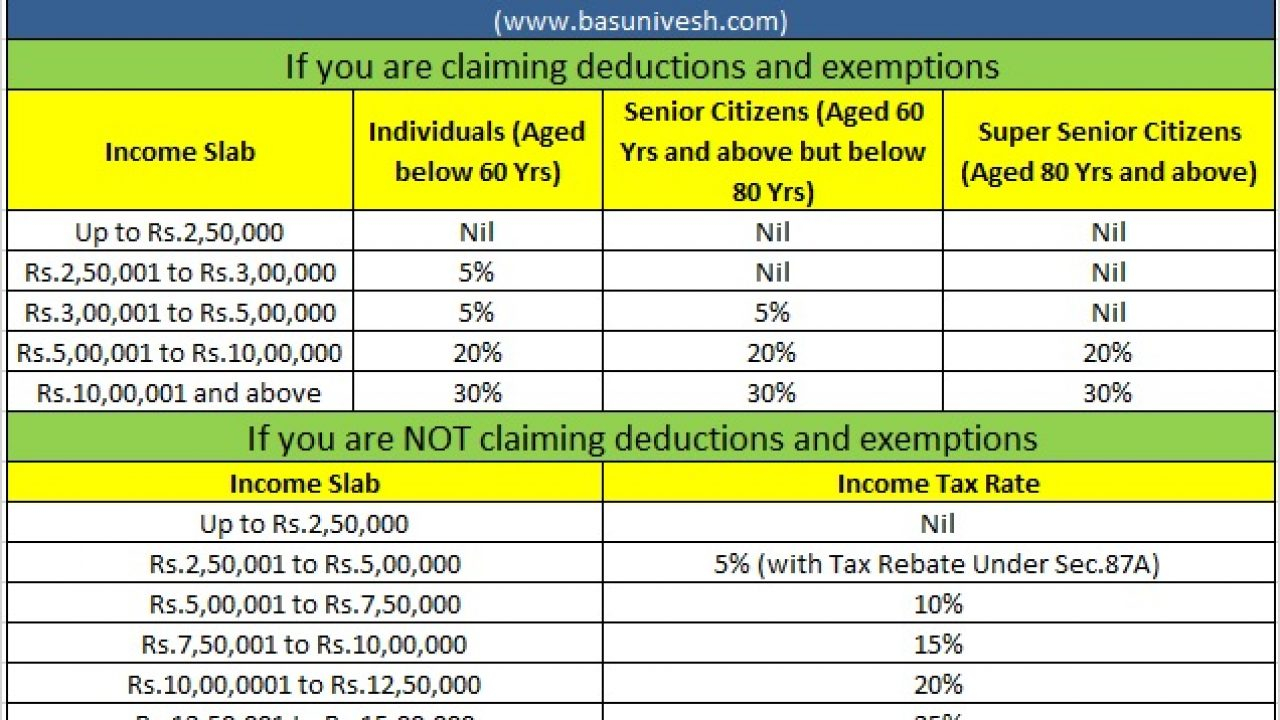

What Is The Tax Year 2023 Web Oct 18 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

Web Nov 3 2022 nbsp 0183 32 For tax year 2023 the top marginal tax rate will remain at 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly The other marginal rates are 35 for single taxpayers with incomes over 231 250 462 500 for married couples filing jointly Web Apr 6 2023 nbsp 0183 32 The freezing of the threshold from 6 April 2023 to 5 April 2028 will mean an effective rise in NICs for both employees and employers over time when pay levels increase The more you earn the

What Is The Tax Year 2023

What Is The Tax Year 2023

What Is The Tax Year 2023

https://taxedright.com/wp-content/uploads/2022/10/2023-Tax-Brackets.jpg

Web Oct 20 2022 nbsp 0183 32 For the 2023 tax year the standard deduction increases to 13 850 for single filers an increase of 900 20 800 for head of household filers an increase of 1 400 27 700 for

Templates are pre-designed documents or files that can be utilized for various purposes. They can save effort and time by providing a ready-made format and layout for producing various kinds of material. Templates can be utilized for personal or professional jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

What Is The Tax Year 2023

What Will My 2022 Tax Return Be 2022 CGR

2022 Tax Brackets DhugalKillen

Listed Here Are The Federal Revenue Tax Brackets For 2023 Film Fanatics

What Is The Tax Year 2022 Helps cartocars

Federal Withholding Tax Table 2022 Vs 2021 Tripmart

/shutterstock_133005938-5bfc4773c9e77c002636c216.jpg)

What Is The Tax Year Definition When It Ends And Types Smartinvestplan

https://www.gov.uk/self-assessment-tax-returns/deadlines

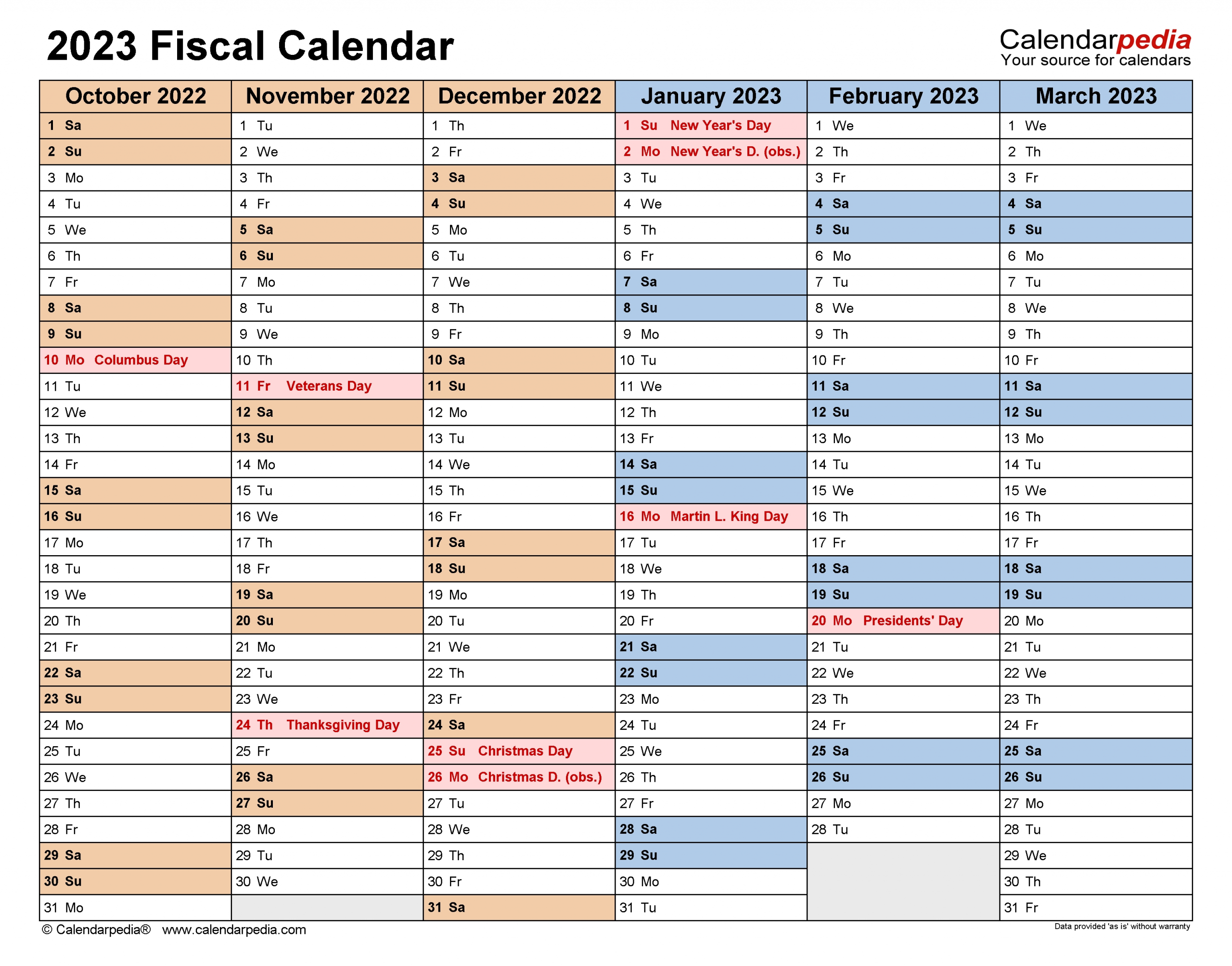

Web The last tax year started on 6 April 2023 and ended on 5 April 2024 Deadline for telling HMRC you need to complete a return You must tell HMRC by 5 October if you need to complete a tax

https://www.irs.gov/newsroom/irs-provides-tax...

Web Oct 18 2022 nbsp 0183 32 The tax year 2023 adjustments described below generally apply to tax returns filed in 2024 The tax items for tax year 2023 of greatest interest to most taxpayers include the following dollar amounts The standard deduction for married couples filing jointly for tax year 2023 rises to 27 700 up 1 800 from the prior year

https://inews.co.uk/news/tax-year-when-end-start...

Web April 3 2023 3 48 pm Updated 3 49 pm The current tax year is set to end on Wednesday with the 2023 24 tax year starting the following day The UK tax year always follows this

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Web Mar 18 2024 nbsp 0183 32 2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Use tab to go to the next focusable element Married filing jointly or qualifying surviving spouse

https://www.income-tax.co.uk/key-dates-2023-tax-year

Web Mar 28 2023 nbsp 0183 32 Key dates for the 2023 24 tax year The UK tax year runs from April 6 to April 5 the following year So the good news is you ve got time to plan out your calendar for the 2023 24 tax year which is about to start With that in mind here are the upcoming key dates for both PAYE and Self Assessment that you need to know

Web Seren Morris March 14 2024 The tax year is made up of 12 months but it doesn t run from January until December Instead the tax year begins and ends each April While many people won t Web Feb 27 2023 nbsp 0183 32 Guidance Rates and thresholds for employers 2023 to 2024 English Cymraeg Use these rates and thresholds when you operate your payroll or provide expenses and benefits to your employees From

Web Oct 20 2022 nbsp 0183 32 Here are 12 IRS changes for tax year 2023 for returns filed in 2024 that could save retirees and pre retirees money and offset the financial hit of higher consumer prices 1 Tax brackets