Virginia Tax Brackets 2023 Married Filing Jointly Find the 2025 tax rates for money you earn in 2025 See current federal tax brackets and rates based on your income and filing status

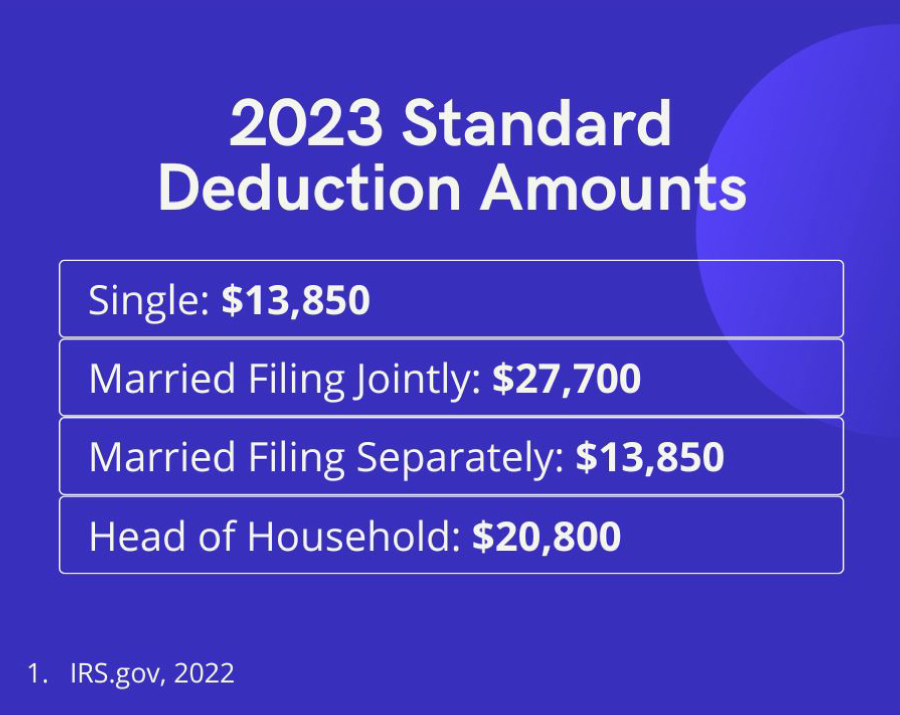

If you filed a joint federal income tax return but your Virginia filing status is married filing separately you ll need to divide your deductions between both spouses Generally you can This page shows Tax Brackets s archived Virginia tax brackets for tax year 2022 This means that these brackets applied to all income earned in 2022 and the tax return that uses these tax

Virginia Tax Brackets 2023 Married Filing Jointly

Virginia Tax Brackets 2023 Married Filing Jointly

Virginia Tax Brackets 2023 Married Filing Jointly

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/e23b505f-ffa6-4e69-9c23-dde3138f86cc_2100x1500.png

Jan 17 2023 nbsp 0183 32 If not covered by a plan single HOH and married filing jointly separately both spouses not covered by a plan tax filers are able to take a full deduction on their IRA

Pre-crafted templates use a time-saving solution for developing a diverse variety of files and files. These pre-designed formats and layouts can be utilized for different personal and expert tasks, consisting of resumes, invitations, flyers, newsletters, reports, discussions, and more, streamlining the content creation procedure.

Virginia Tax Brackets 2023 Married Filing Jointly

2022 Tax Brackets Married Filing Jointly Irs

2023 Tax Brackets And Other Adjustments Conner Ash

IRS Inflation Adjustments Taxed Right

About Tax Brackets Married Filing Jointly Es Article

Tax Brackets Married Filing Jointly Teletype

What Are The 2022 Tax Brackets Advise LLP

https://www.tax.virginia.gov › sites › default › files › ...

The tax table can be used if your Virginia taxable income is listed in the table Otherwise use the Tax Rate Schedule

https://www.tax.virginia.gov › filing-status

Married couples filing Form 760PY the Virginia part year resident return have two options for reporting their income on the same return A married couple may elect to file a joint return

https://www.tax-brackets.org › virginiatax…

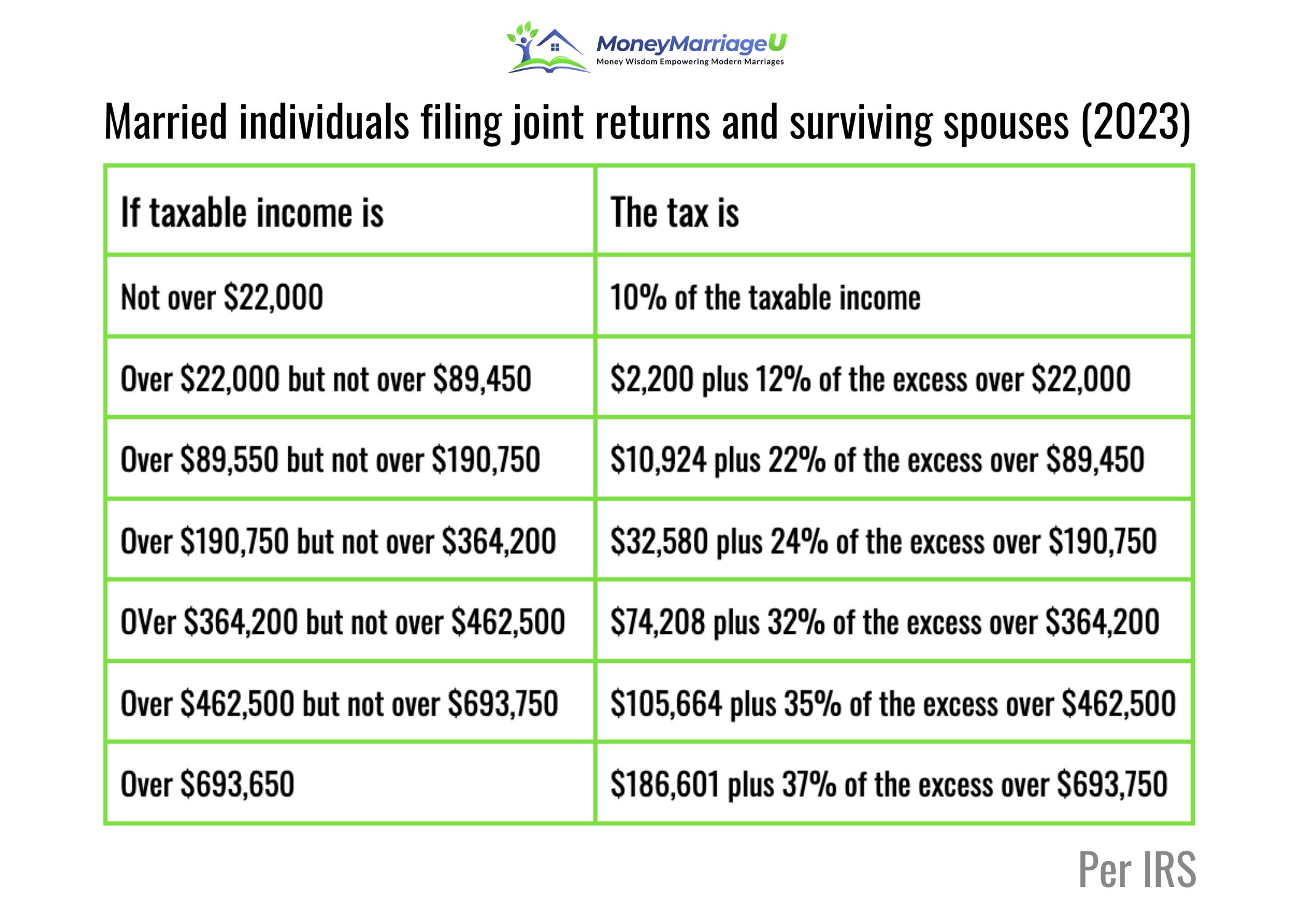

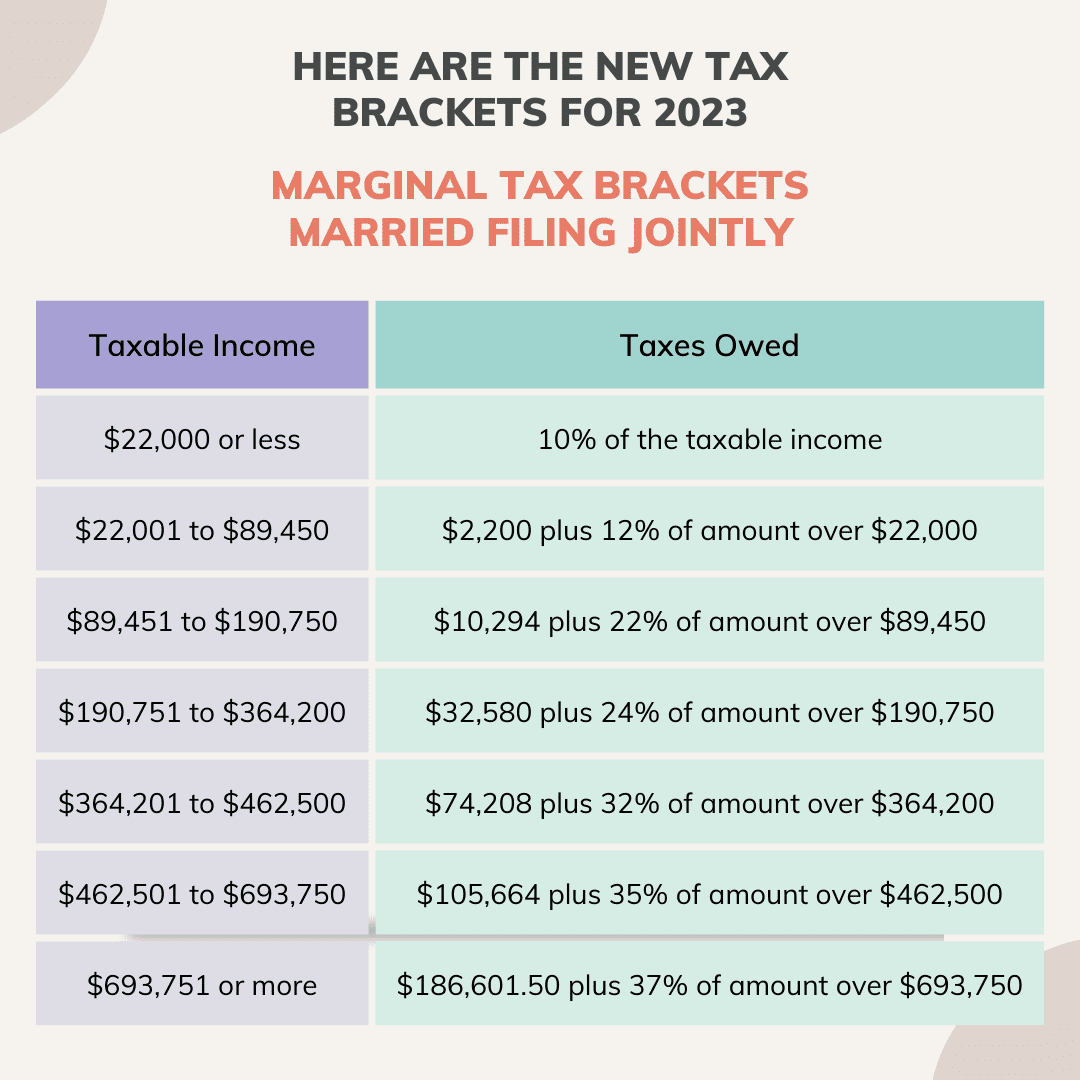

Married Filing Jointly is the filing type used by taxpayers who are legally married including common law marriage and file a combined joint income tax return rather than two individual income tax returns

https://www.tax-brackets.org › virginiatax…

Virginia has four marginal tax brackets ranging from 2 the lowest Virginia tax bracket to 5 75 the highest Virginia tax bracket Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the

https://www.efile.com › virginia-tax-brackets-rates-and-forms

Dec 25 2024 nbsp 0183 32 Find Commonwealth of Virginia standard deductions tax brackets and rates by the current and previous tax years Also you can find links to other important Virginia income tax

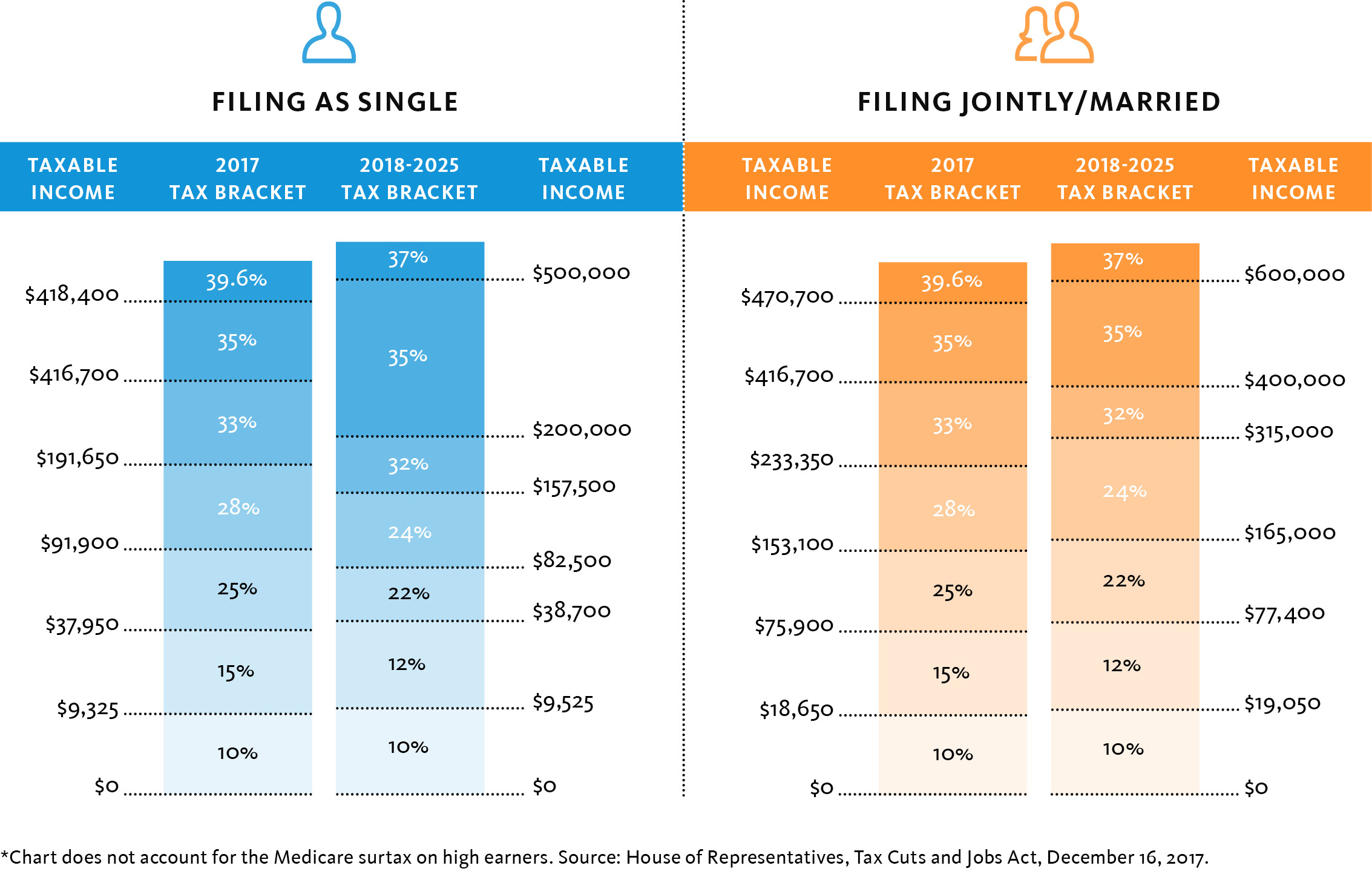

Feb 27 2024 nbsp 0183 32 Virginia has four tax brackets which start at a 2 percent tax rate and cap out at 5 75 percent for the highest earners You must file taxes if you have a Virginia adjusted gross Oct 18 2022 nbsp 0183 32 The IRS recently released the new inflation adjusted 2023 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp

Feb 5 2025 nbsp 0183 32 If they have a Virginia adjusted gross income VAGI above 11 950 single or married filing separately or 23 900 married filing jointly