Standard Deduction For 2022 Married Filing Jointly Web Feb 28 2023 nbsp 0183 32 For married couples filing jointly it is 1 400 for 2022 and 1 500 for 2023 for each spouse age 65 and older What is the standard deduction in 2023 for a married couple For 2023 it is 13 850

Web Nov 11 2021 nbsp 0183 32 The standard deduction which is claimed by the vast majority of taxpayers will increase by 800 for married couples filing jointly going from 25 100 for 2021 to 25 900 for 2022 Web Dec 2 2021 nbsp 0183 32 Standard Deduction for 2022 25 900 Married filing jointly and surviving spouses 19 400 Head of Household 12 950 Unmarried individuals 12 950 Married filing separately The Standard Deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income

Standard Deduction For 2022 Married Filing Jointly

Standard Deduction For 2022 Married Filing Jointly

Standard Deduction For 2022 Married Filing Jointly

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

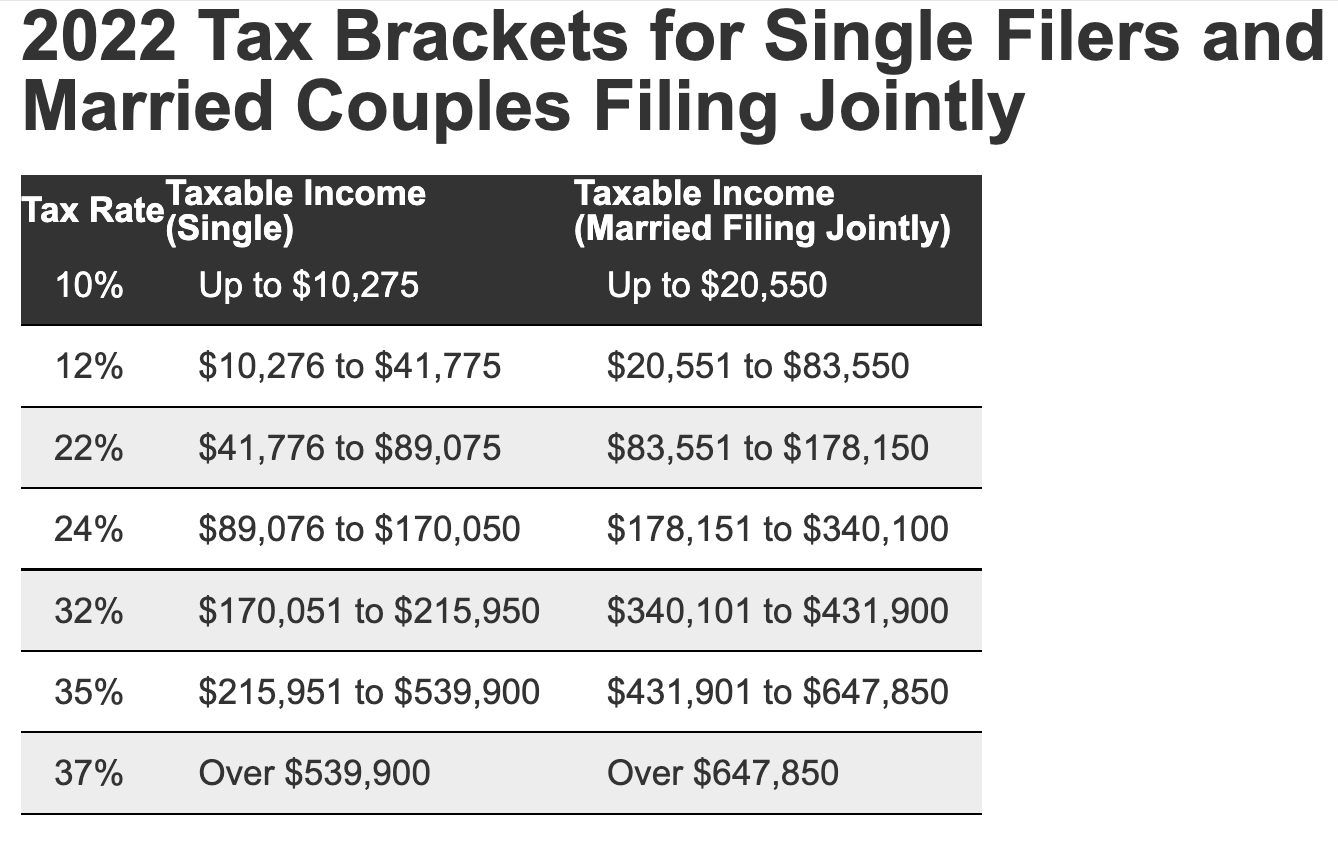

Web Nov 10 2021 nbsp 0183 32 The IRS also announced that the standard deduction for 2022 was increased to the following Married couples filing jointly 25 900 Single taxpayers and married individuals filing

Pre-crafted templates provide a time-saving solution for producing a diverse variety of files and files. These pre-designed formats and layouts can be made use of for various personal and professional tasks, including resumes, invites, leaflets, newsletters, reports, presentations, and more, enhancing the content development process.

Standard Deduction For 2022 Married Filing Jointly

Standard Deduction Amounts For 2021 Tax Returns Don t Mess With Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

2022 Tax Brackets Vs 2021 Latest News Update

2022 Tax Tables Married Filing Jointly Printable Form Templates And

IRS Tax Brackets For 2023 Taxed Right

2022 Federal Tax Brackets And Standard Deduction Printable Form

https://www.irs.gov/newsroom/irs-provides-tax...

Web Nov 10 2021 nbsp 0183 32 The standard deduction for married couples filing jointly for tax year 2022 rises to 25 900 up 800 from the prior year For single taxpayers and married individuals filing separately the standard deduction rises to 12 950 for 2022 up 400 and for heads of households the standard deduction will be 19 400 for tax year 2022 up 600

https://www.forbes.com/advisor/taxes/standard-deduction

Web Dec 4 2023 nbsp 0183 32 Additional Standard Deduction 2024 Per Person Married Filing Jointly or Married Filing Separately Blind 1 500 1 550 Married Filing Jointly or Married Filing

https://www.irs.gov/publications/p501

Web married filing jointly under 65 both spouses 27 700 65 or older one spouse 29 200 65 or older both spouses 30 700 married filing separately any age 5 qualifying surviving spouse under 65 27 700 65 or older 29 200 If you were born before January 2 1959 you re considered to be 65 or older at the end of 2023

https://www.irs.gov/publications/p554

Web Married filing jointly enter 32 000 Single head of household qualifying surviving spouse or married filing separately and you lived apart from your spouse for all of 2022 enter 25 000 or Married filing separately and you lived with your spouse at any time during 2022 enter 0 F G

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Nov 10 2021 nbsp 0183 32 getty The Internal Revenue Service has announced annual inflation adjustments for tax year 2022 meaning new tax rate schedules and tax tables and cost of living adjustments for various tax

Web Jan 27 2023 nbsp 0183 32 Ad LendingTree Read on to discover everything taxpayers need to know in order to maximize refunds or minimize tax payments Let s get started Table of Contents What is the Standard Deduction Web Dec 19 2023 nbsp 0183 32 2022 Standard Deduction Amounts Returns Normally Due April 2023 Swipe to scroll horizontally 2023 Additional Standard Deduction Married Filing Jointly or Separately 65 or older or blind

Web The standard deduction for 2022 is based on if a taxpayer was born before or after Jan 2 1958 and it will vary for married taxpayers If you are married filing jointly your standard deduction increases by 1 550 for each spouse that was born before 1960 and for each spouse that is blind