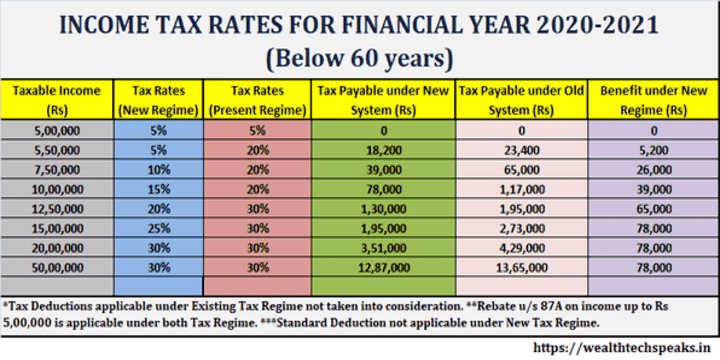

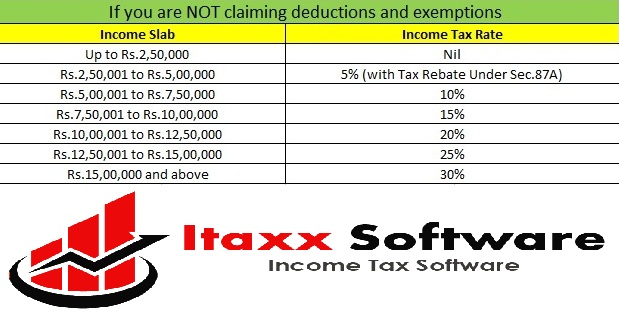

Tax Slab Rate For Ay 2022 23 Old And New Regime WEB Dec 13 2023 nbsp 0183 32 In the Union Budget of 2020 the Finance Minister introduced new tax slabs as an alternative Further budget 2023 proposed some changes to the new income tax regime and now there are six different tax slabs for taxpayers 2 Income Tax Slabs as Per the New and Old Tax Regime

WEB Note Click View Comparison to get a more detailed comparison of tax under the old and new tax regime Step 3b In the Advanced Calculator tab enter the following details Preferred tax regime AY taxpayer category age residential status due date and actual date of submission of return WEB Apr 24 2023 nbsp 0183 32 1 Up to Rs 2 5 lakh 2 Rs 2 5L to Rs 5L 3 Rs 5L to Rs 10L 4 Above Rs 10 lakh The last date to file ITR for income earned in FY 2022 23 is July 31 As ITR filing

Tax Slab Rate For Ay 2022 23 Old And New Regime

Tax Slab Rate For Ay 2022 23 Old And New Regime

Tax Slab Rate For Ay 2022 23 Old And New Regime

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-7.jpg

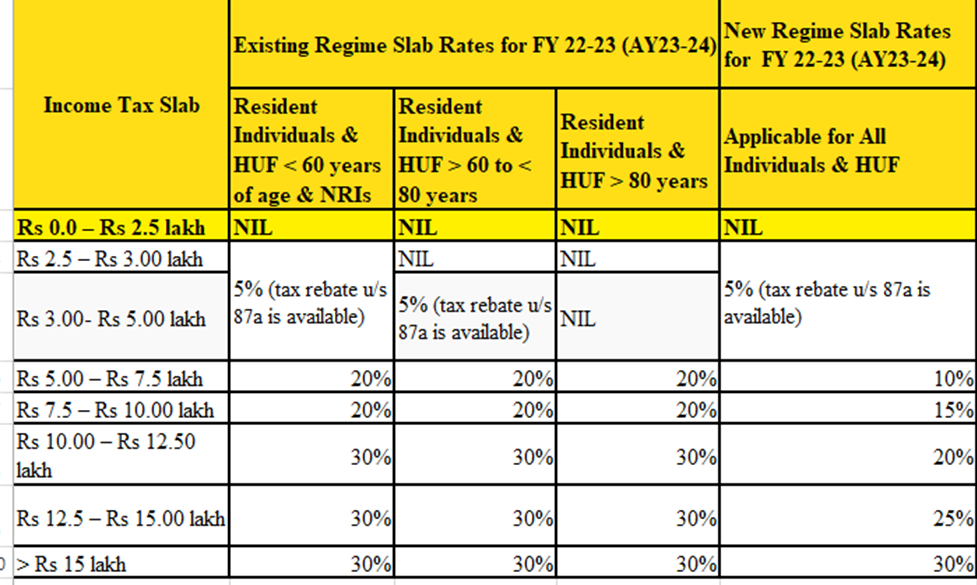

WEB Mar 19 2023 nbsp 0183 32 Comparison of old and new tax regime f y 2022 23 The new income tax slabs have been normalized for taxpayers of all age groups with lower income tax rates in the income bracket up to Rs 15 00 000 But it disallows 70 tax exemptions and deductions that are available as relief with the old regime tax rates

Templates are pre-designed files or files that can be used for different purposes. They can save time and effort by providing a ready-made format and layout for creating various kinds of content. Templates can be used for personal or professional jobs, such as resumes, invites, leaflets, newsletters, reports, discussions, and more.

Tax Slab Rate For Ay 2022 23 Old And New Regime

Income Tax 2022 23 Slab Bed Frames Ideas

Budget 2023 Income Tax Slabs Savings Explained New Tax Regime Vs Old

Income Tax Rates For Fy 2021 22 Pay Period Calendars 2023

How To Choose Between The New And Old Income Tax Regimes Chandan

Income Tax Slab FY 2023 24 AY 2024 25 Old New Regime

Download Auto Fill Income Tax Preparation Software In Excel For The F Y

https://www.taxmann.com/post/blog/income-tax-slab...

WEB Mar 30 2021 nbsp 0183 32 Last Updated on 6 March 2023 Union Budget 2022 23 Highlights Table of Contents Income Tax Slab Rate for Individuals opting for old tax regime Individual resident or non resident who is of the age of fewer than 60 years on the last day of the relevant previous year

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

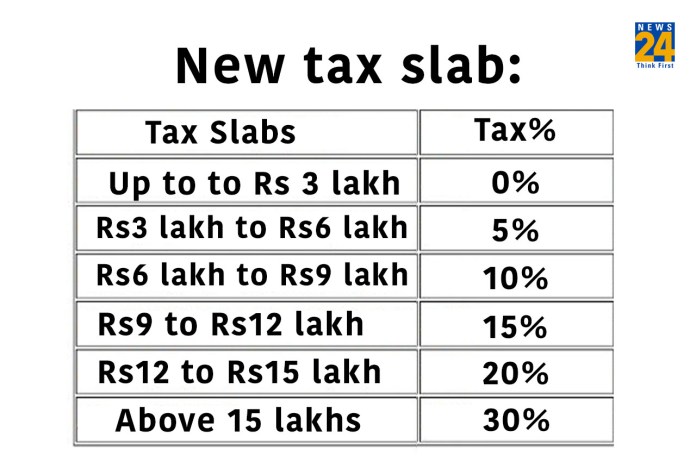

WEB Apr 29 2024 nbsp 0183 32 Streamlined Tax Slabs The tax exemption limit has been increased to 3 lakhs and the new tax slabs are The tax rates under both regimes are compared as below Standard Deduction and Family Pension Deduction

https://tax2win.in/guide/income-tax-slabs

WEB Updated on 30 Apr 2024 01 27 PM India follows a progressive tax system where the tax rates increase as income levels rise The income tax slabs in India determine the applicable tax rates for different income brackets

https://incometaxindia.gov.in/Charts Tables/Tax...

WEB Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Super Senior Citizen who is 80 years or more at any time during the previous year Net Income Range Rate of Income tax

https://www.incometax.gov.in/iec/foportal/help/...

WEB Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the assessee being an Individual HUF AOP not being co operative societies BOI and Artificial Juridical Person

WEB Jun 1 2023 nbsp 0183 32 Income Tax Slab Rates For Ay 2022 23 Written by CHETNAA GOYAL Posted on 1 June 2023 Tax Slabs for AY 2022 23 Individuals and HUFs can opt for the Existing Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act WEB Jul 13 2022 nbsp 0183 32 Under the new tax regime the annual income between Rs 5 lakh and Rs 7 5 lakh will be taxed at 10 per cent while the earning ranging Rs 7 5 lakh Rs 10 lakh a year will attract a 15 per cent tax Under the old regime those having an income between Rs 7 lakh and Rs 10 lakh came under a flat 20 per cent tax bracket

WEB Dec 19 2022 nbsp 0183 32 Income Tax Slabs FY 2022 23 New amp Old Income Tax Regime The New Regime gives taxpayers the option to choose from the following As per the New Tax Regime income tax can be paid at lower rates with a condition that forgoes certain permissible exemptions and deductions that are already available