Income Tax Rates 2022 To 2023 India Web Feb 27 2023 nbsp 0183 32 Total Income Income Tax Rates Up to INR 2 50 000 NIL INR 2 50 001 to INR 5 00 000 5 INR 5 00 001 to INR 7 50 000 10 INR 7 50 001 to INR 10 00 000 15 INR 10 00 001 to INR 12 50 000 20 INR 12 50 001 to INR 15 00 000 25 Above INR 15 00 000 30

Web Budget 2023 has announced changes in the income tax slabs in the new tax regime The changes in the income tax slabs have been made to make it more attractive for individual taxpayers The budget has hiked the basic exemption limit to Rs 3 lakh from Rs 2 5 lakh Web Feb 1 2022 nbsp 0183 32 The Union Budget 2022 2023 was presented 1 February 2022 There are no proposals to the basic income tax exemption limit income brackets slabs and tax rates The surcharge rate on all long term capital assets are being capped at 15 An option would allow taxpayers to file amended tax returns within two years from the end of

Income Tax Rates 2022 To 2023 India

Income Tax Rates 2022 To 2023 India

Income Tax Rates 2022 To 2023 India

https://taxguru.in/wp-content/uploads/2022/02/icome-tax-rates.jpg

Web Feb 1 2022 nbsp 0183 32 Income Tax Slabs for FY 2022 2023 Old tax regime With deductions and exemptions Total Income New tax regime With deductions and exemptions Nil Up to Rs 2 5 lakh Nil 5 per cent From 2 50 000 to 5 lakh 5 per cent 20 per cent From 5 00 001 to 7 5 lakh From 7 50 001 to 10 lakh 10 per cent 15 per cent 30 per cent From 10 00 001

Templates are pre-designed documents or files that can be used for different functions. They can conserve effort and time by providing a ready-made format and design for producing various kinds of material. Templates can be utilized for individual or professional jobs, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Income Tax Rates 2022 To 2023 India

Tax Calculator 2022 CharisseRhyanna

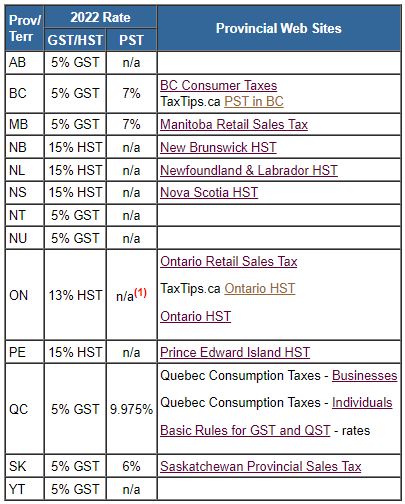

TaxTips ca 2022 Sales Tax Rates PST QST RST GST HST

2023 Income Tax Rates Singapore Pay Period Calendars 2023

The Union Role In Our Growing Taxocracy California Policy Center

Income Tax Rates For 2022 What You Need To Know Kadinsalyasam

Income Tax Brackets For 2021 And 2022 Publications National

https://taxguru.in/income-tax/income-tax-rates...

Web Sep 9 2023 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 3 00 000 Rs 3 00 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Super Senior Citizen who is 80 years or more at any time during the previous year Net Income

https://incometaxindia.gov.in/Charts Tables/Tax rates.htm

Web Net Income Range Rate of Income tax Assessment Year 2024 25 Assessment Year 2023 24 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Resident Senior Citizen who is 60 years or more but less than 80 years at any time during the previous year Net Income

https://incometaxindia.gov.in/Tutorials/2 Tax Rates.pdf

Web The tax rates under the new tax regime are as under a For Assessment Year 2023 24 Net Income Range Tax rate Up to 2 50 000 Nil From 2 50 001 to 5 00 000 5 From 5 00 001 to 7 50 000 10 From 7 50 001 to 10 00 000 15 From 10 00 001 to 12 50 000 20 From 12 50 001 to 15 00 000 25 Above Rs 15 00 000 30 Income

https://incometaxindia.gov.in/Pages/tax-rates.aspx

Web Tax Rates AY 2023 24 and AY 2024 25 Tax rates for last 10 years Tax Rates DTAA v Income tax Act Withholding Tax Rates TDS Rates

https://economictimes.indiatimes.com/wealth/income-tax-slabs

Web Income tax rates and slabs in new tax regime for FY 2021 22 FY 2022 23 Income tax slabs Income tax rates Up to Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 of total income minus Rs 2 50 000 Rs 5 00 001 to Rs 7 50 000 Rs 12 500 10 of total income minus Rs 5 00 000 Rs 7 50 001 to Rs 10 00 000 Rs 37 500 15 of total income

Web Aug 15 2023 nbsp 0183 32 Income Tax Slab Rates for FY 2022 23 AY 2023 24 In this system Specifically there are 2 slabs one is the old slab and the second is the New Slab rate Let s check both with the use of Table Assessee having net taxable income less than or equal to 5 lacks will be eligible for a Tax Rebate of Rs 12 500 u s 87A Web Income Tax Calculator How to calculate Income taxes online for FY 2020 21 AY 2021 22 2021 2022 amp 2020 21 with ClearTax Income Tax Calculator Refer examples amp tax slabs for easy calculation

Web Calculate the tax on your income in India in a few simple steps through online income tax calculator Also check tax slabs tax regimes and how to calculate tax with examples 2022 23 2023 24 My age is Below 60 60 80 Above 80 My city is a Income Tax Slab Rates for Super Senior Citizens Over 80 Years Up to Rs 2 50 000 Nil