Tax Rates 2022 23 Tax rate tables for 2022 23 including income tax pensions annual investment limits national insurance contributions vehicle benefits and other tax rates

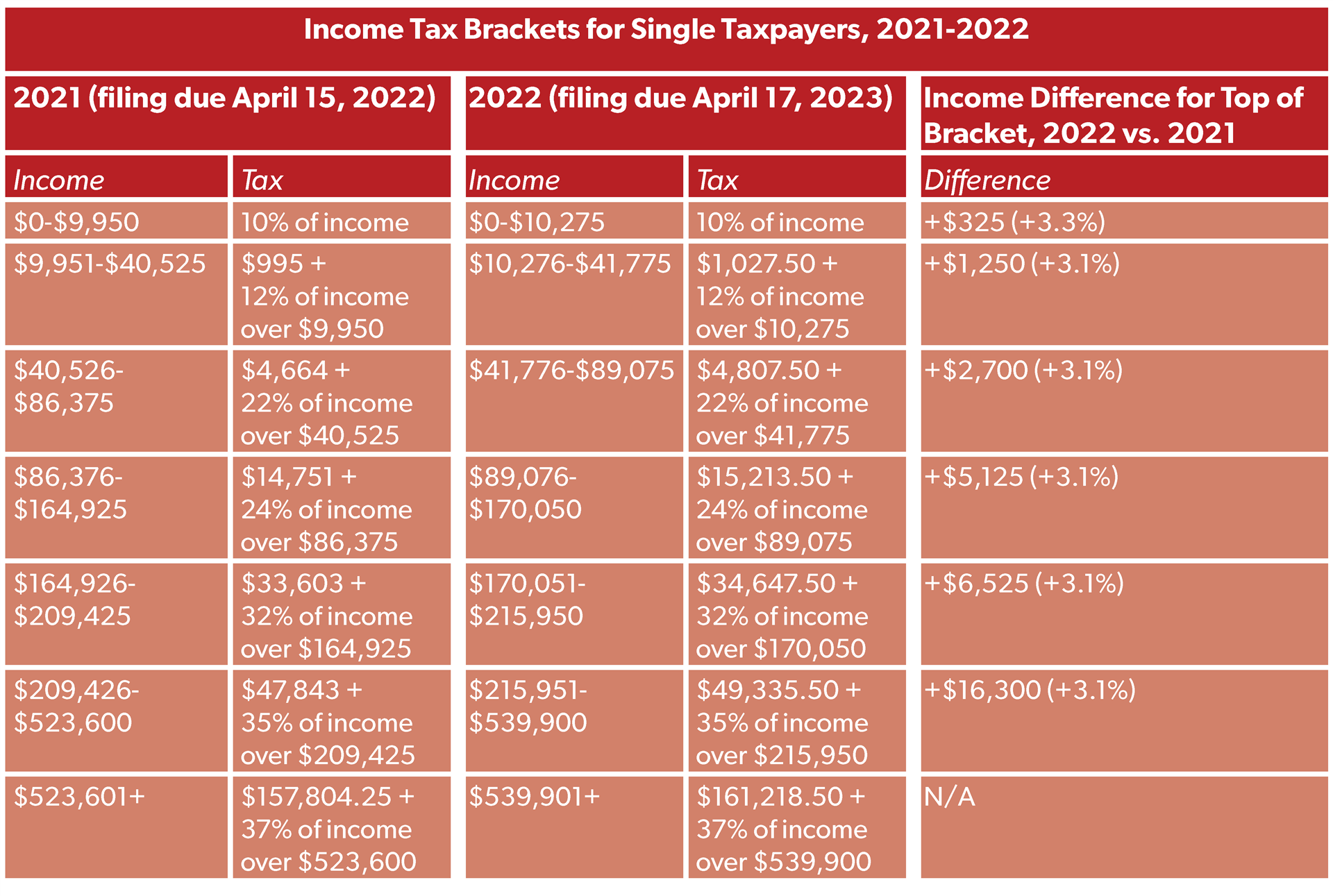

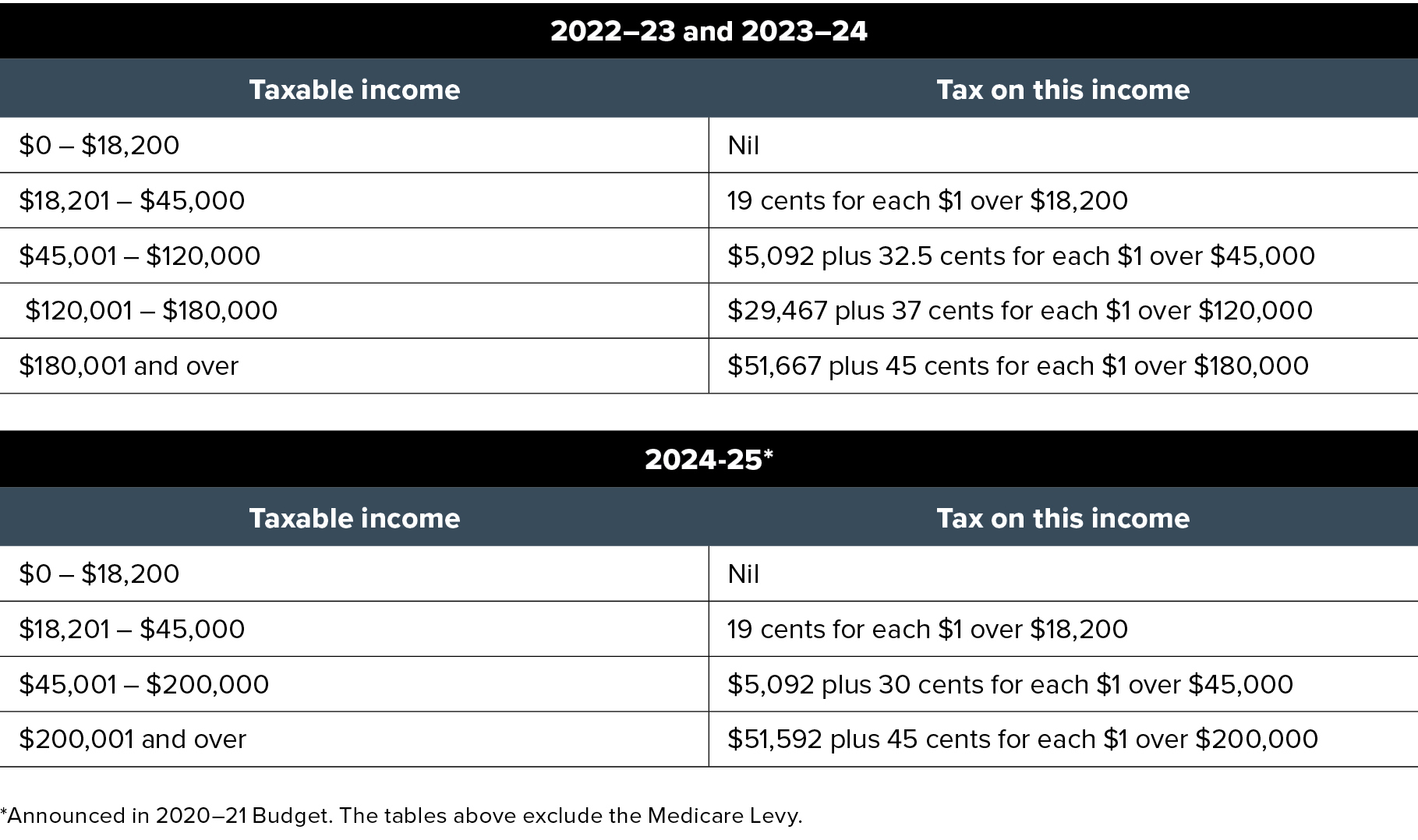

Nov 23 2024 nbsp 0183 32 The tax rate is determined by the amount of earned income you receive during the year Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality religious affiliation and different types of deductions Nov 26 2024 nbsp 0183 32 For 2024 25 and 2023 24 tax years as was the case in 2022 23 and 2021 22 most people are allowed to earn 163 12 570 per year before paying income tax for which there are variable rates depending on their annual salary

Tax Rates 2022 23

Tax Rates 2022 23

Tax Rates 2022 23

https://www.ntu.org/Library/imglib/2021/11/2021-22-single-tax-brackets-2-.png

This guide explains Income Tax rates and Personal Allowances for citizens living in the United Kingdom Additional information clarifies how tax bands and the current tax thresholds work CURRENT TAX ALLOWANCE The basic rate payable in England Wales and Northern Ireland is 20 on taxable income up to 163 50 270

Templates are pre-designed files or files that can be used for different functions. They can conserve effort and time by providing a ready-made format and layout for creating various kinds of material. Templates can be used for individual or expert tasks, such as resumes, invites, flyers, newsletters, reports, presentations, and more.

Tax Rates 2022 23

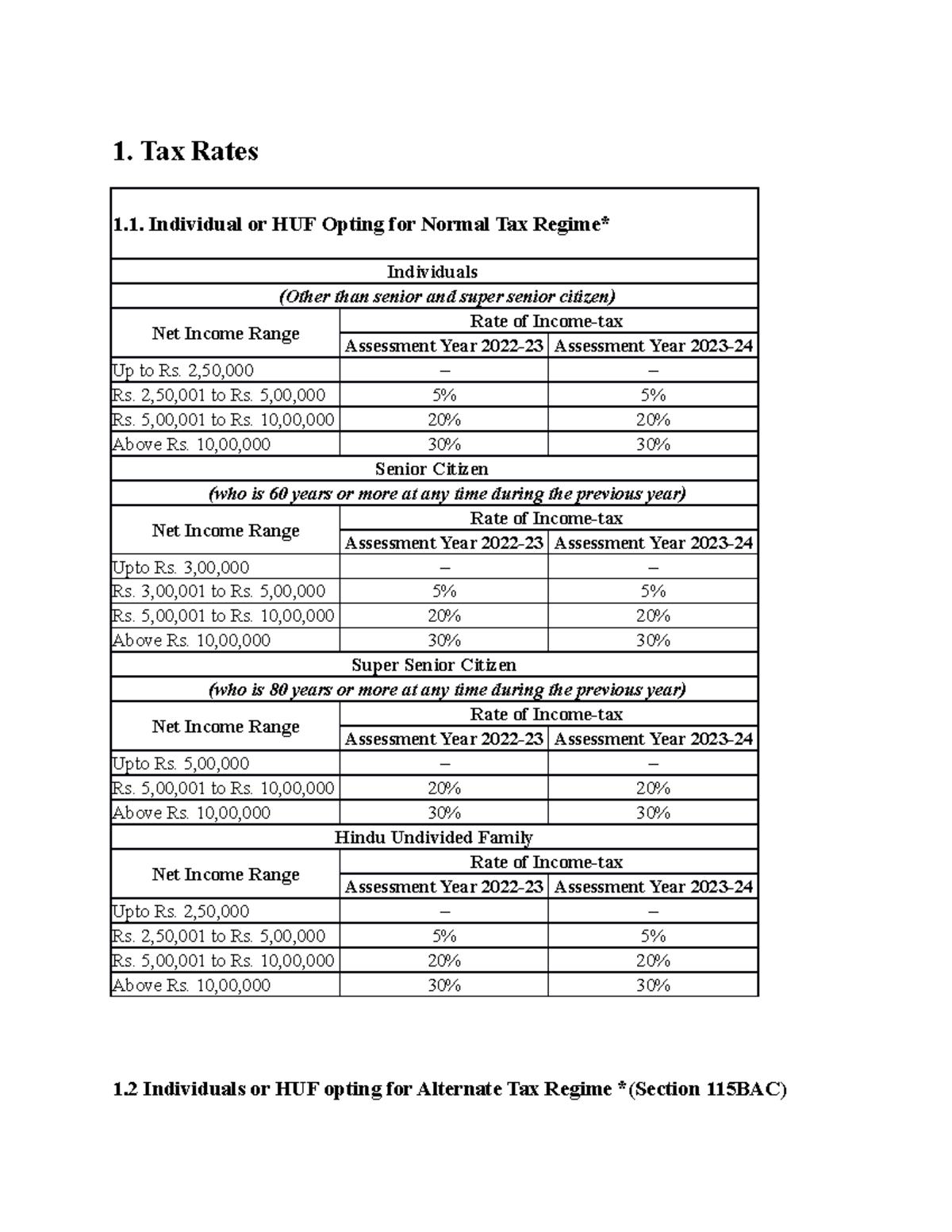

Tax Rates 2022 23 1 Tax Rates 1 Individual Or HUF Opting For Normal

Chart Global Corporation Tax Levels In Perspective Statista

Income Tax Slabs 2022 23 Pakistan Salary Tax Calculator

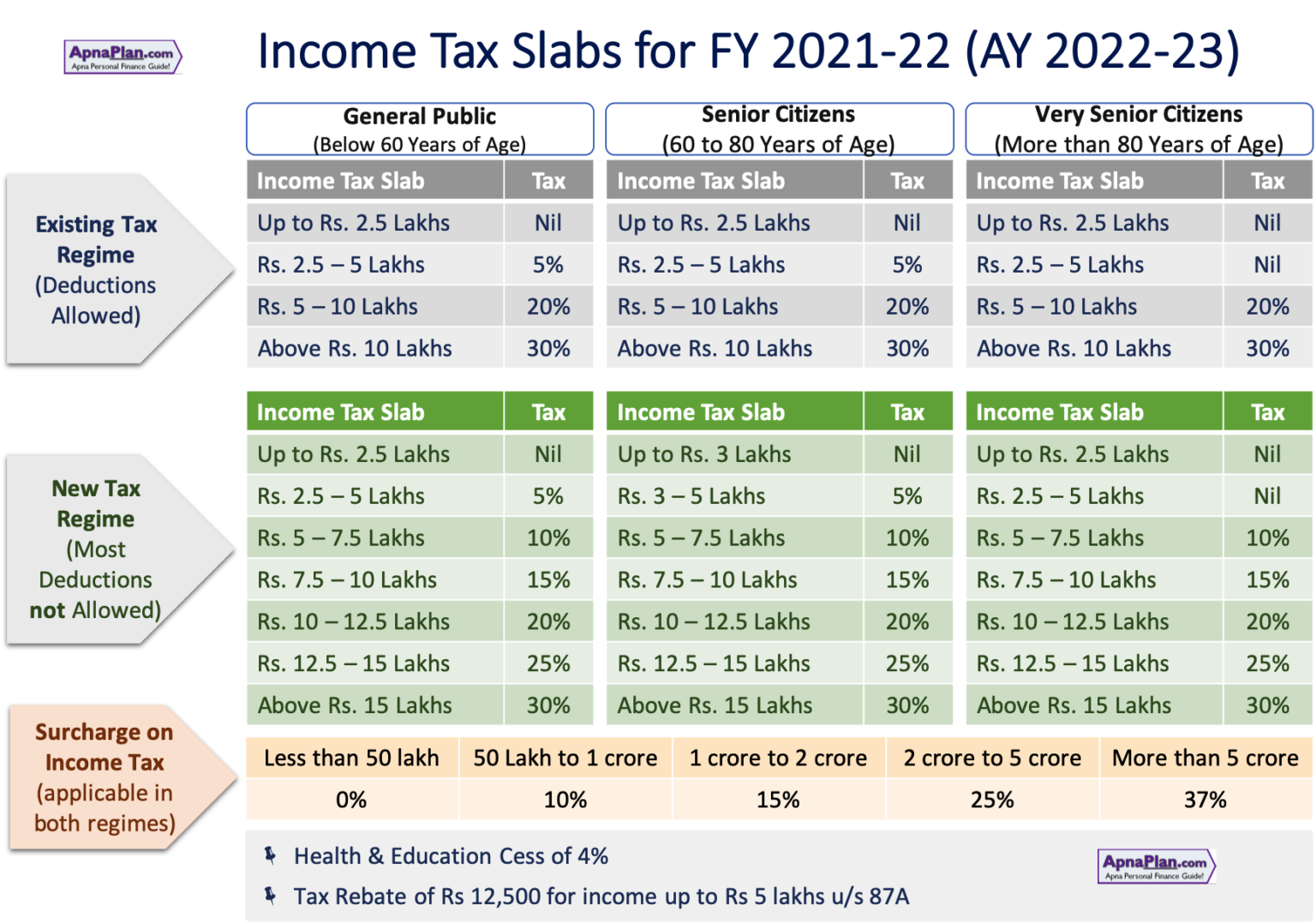

Income Tax Calculator India FY 2021 22 AY 2022 23 ApnaPlan

R35k Salary After Tax Example ZA Tax 2023

Income Tax Rates For Financial Year 2022 23 EduTaxTuber

https://www.gov.uk/guidance/rates-and-thresholds...

Feb 7 2022 nbsp 0183 32 PAYE tax rates and thresholds 2022 to 2023 Employee personal allowance 163 242 per week 163 1 048 per month 163 12 570 per year Scottish starter tax rate

https://www.gov.uk/income-tax-rates

How much Income Tax you pay in each tax year depends on Some income is tax free The current tax year is from 6 April 2024 to 5 April 2025 This guide is also available in Welsh Cymraeg

https://www.uktaxcalculators.co.uk/tax-rates/2022-2023

Income Tax Bands and Percentages 0 starting rate is for savings income only if your non savings income is above the starting band level the 0 rate will NOT apply and the basic rate percentage will be used instead

https://commonslibrary.parliament.uk/research-briefings/cbp-9489

Nov 7 2022 nbsp 0183 32 Direct tax rates and allowances for the 2023 24 tax year are set out in a second Commons Library briefing Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23

https://www.icalculator.com/tax-calculator/2022.html

The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more

Jan 4 2022 nbsp 0183 32 Tax rates for Employees Trust Funds Provident or Pension funds and Termination Funds Sep 9 2023 nbsp 0183 32 Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims to provide a comprehensive guide on the income tax rates applicable for the Assessment Years 2023 24 and 2024 25

Feb 25 2022 nbsp 0183 32 These are the current income tax rates for the UK and they ll stay the same for the financial year 2022 to 2023 The rates are as follows Basic rate Anything you earn from 163 12 571 to 163 50 270 is taxed at 20 Higher rate Anything you earn from 163 50 571 to 163 150 000 is taxed at 40 Additional rate Anything you earn over 163