Tax Rates 2022 23 Pakistan Income tax rates in Pakistan are progressive meaning that higher levels of income are taxed at higher rates Initially the government proposed exempting salaried class earning up to PKR

Jun 30 2022 nbsp 0183 32 Here we are going to discuss everything you should know about the division of your gross salary income and the taxes levied on it according to the latest tax slab rates in Pakistan We ll also tell you how to search and use an Oct 12 2022 nbsp 0183 32 The government of Pakistan has finalized tax slabs for salaried individuals for the fiscal year 2022 23 and has set a minimum income tax rate of 2 5 for those earning up to Rs 100 000 per month and a maximum of 35

Tax Rates 2022 23 Pakistan

Tax Rates 2022 23 Pakistan

Tax Rates 2022 23 Pakistan

https://icpap.com.pk/wp-content/uploads/2022/11/new-income-tax-slabs-22-23-scaled.jpg

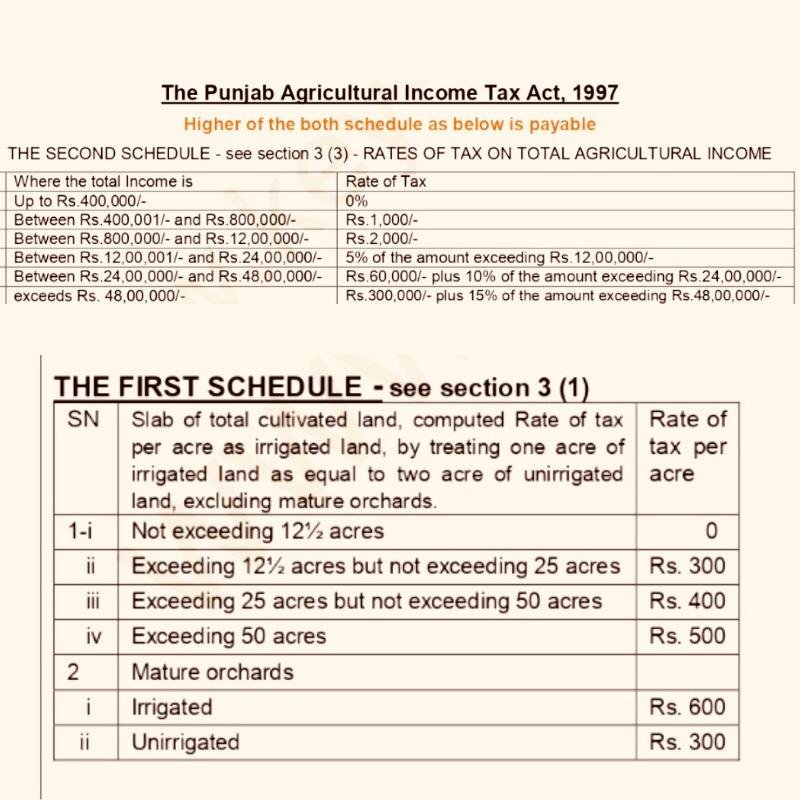

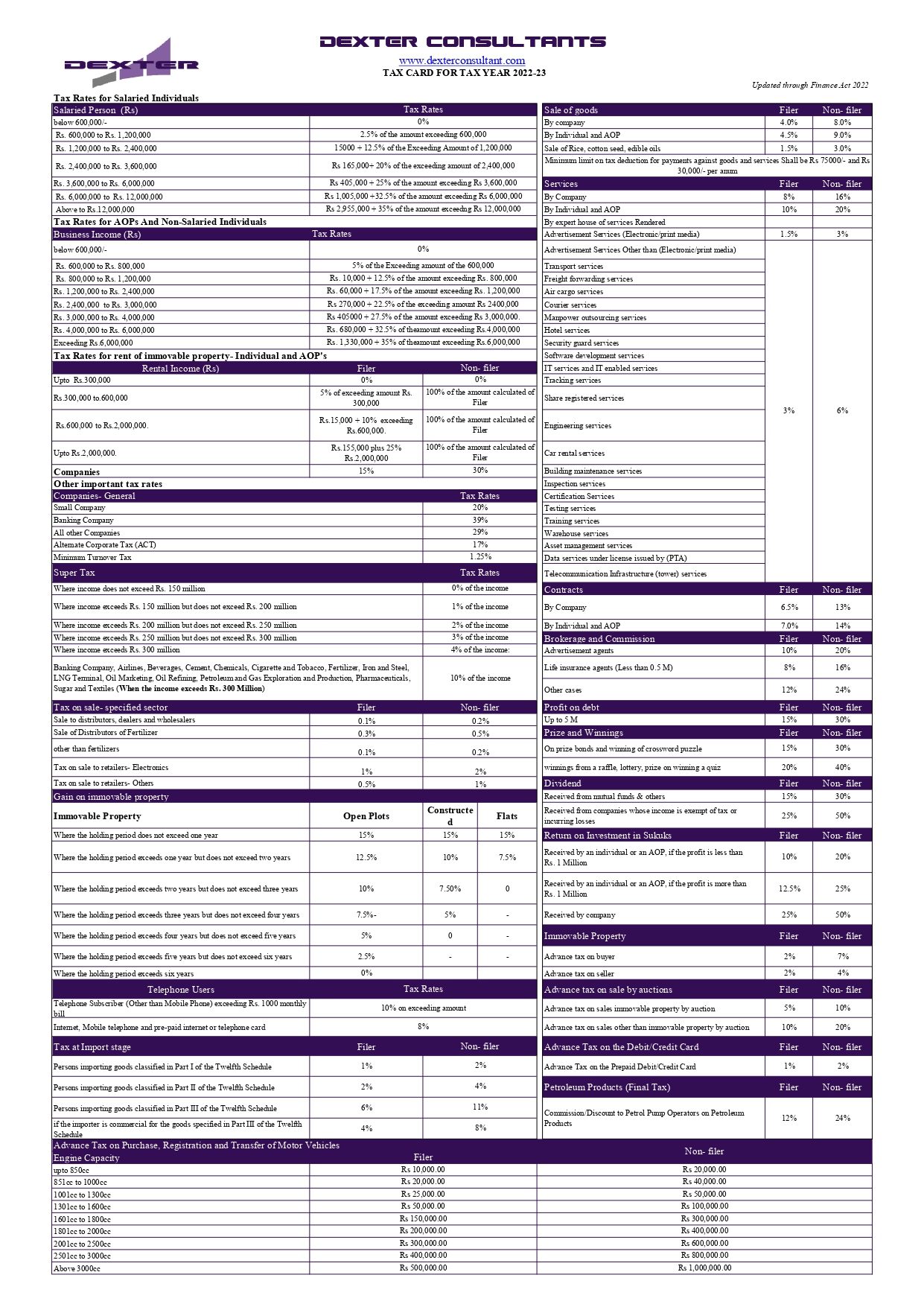

The purpose of this document is to summarize the tax law on withholding tax and treatment thereof taking into account significant amendments vide the Finance Act 2022 and Tax Laws

Pre-crafted templates provide a time-saving service for producing a diverse variety of documents and files. These pre-designed formats and designs can be utilized for different individual and expert jobs, consisting of resumes, invitations, leaflets, newsletters, reports, presentations, and more, enhancing the material production procedure.

Tax Rates 2022 23 Pakistan

Income Tax Slabs 2022 23 Pakistan Salary Tax Calculator

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

Budget 2023 24 high Earners To Pay A Higher Income Tax As Govt

Income Tax Rates 2023 In Pakistan PELAJARAN

3 New Property Taxes To Impose In The Budget 2022 23

Income Tax Withholding Rates Card 2022 23 Dexter Consultants

https://taxcel.pk › wp-content › uploads

Sales tax reduced rates shall to apply on different class of services according to their Provincial Sales Tax Act on Services ONLINE MARKET PLACE In Finance Act 2022 the person

https://karachitaxbar.com › wp-content › uploads › tax_rates

The income of builders and developers from a project in excess of 10 times of tax paid shall be chargeable to tax at reduced rate of 20 instead of normal rates Tier 1 retailers required to

https://taxcalculatorpakistan.pk

Review the Income Tax Slabs for 2022 23 Access comprehensive details on last year s tax rates and brackets for better financial planning

https://taxcalculator.pk › public › index.php

Income Tax Slabs Salary Tax Calculator for year 2022 2023 Calculate monthly income and total payable tax amount on your salary Learn more about tax slabs

https://tax.net.pk

Jul 9 2022 nbsp 0183 32 LATEST SALARY INCOME TAX SLAB RATES IN PAKISTAN FOR TAX YEAR 2023 According to the revised income tax slabs for FY 2022 23 Income tax rates has been revised and have been increased as compare to

The 2022 23 Federal Budget of Pakistan was presented on 10 June 2022 by Finance Minister Miftah Ismail with Rs 9 5 trillion budgeted for expenditure in financial year 2022 2023 This is the tax calculator as per slabs defined in Pakistan Budget for 2022 2023 Select Salary Period Monthly Yearly Tax Year As per the Federal Budget 2022 2023 presented by the

Income tax slabs in Pakistan are determined by an individual s annual taxable income The government of Pakistan has established tax rates for salaried individuals for the fiscal year