New Irs Tax Brackets For 2022 Web Result Nov 10 2021 nbsp 0183 32 2022 Tax Brackets Mark Kantrowitz The Kiddie Tax thresholds are increased to 1 150 and 2 300 The refundable portion of the Child Tax Credit has increased to 1 500 The maximum

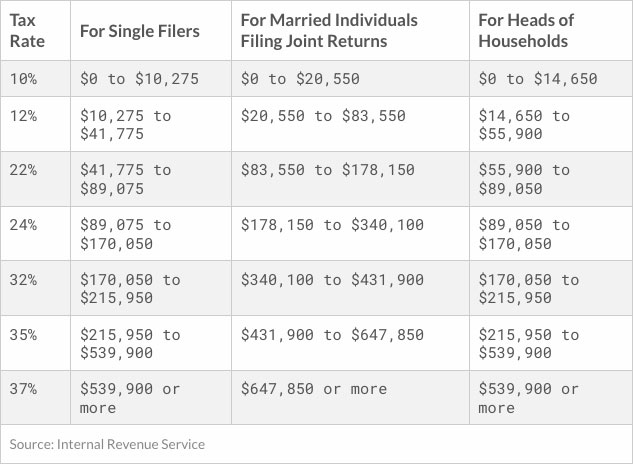

Web Result Nov 10 2021 nbsp 0183 32 Here are the new brackets for 2022 depending on your income and filing status For married individuals filing jointly 10 Taxable income up to 20 550 12 Taxable income between 20 550 Web Result Nov 26 2021 nbsp 0183 32 Articles News IRS Announces New Tax Brackets and Deductions for 2022 Ines Zemelman EA 26 Nov 2021 The IRS has recently announced inflation adjustments for tax year 2022 affecting over 60 tax provisions including federal income tax brackets standard deductions and tax breaks

New Irs Tax Brackets For 2022

New Irs Tax Brackets For 2022

New Irs Tax Brackets For 2022

https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/11/2022-income-tax-rates-for-singles.png?fit=1456,9999

Web Result Nov 12 2021 nbsp 0183 32 The IRS said the income thresholds for federal tax brackets will be higher in 2022 reflecting the faster pace of inflation That means a married couple will need to earn almost 20 000

Pre-crafted templates use a time-saving service for producing a diverse series of documents and files. These pre-designed formats and layouts can be used for numerous personal and expert projects, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the material creation procedure.

New Irs Tax Brackets For 2022

2022 Tax Brackets KrissDaemon

Here Are The New IRS Tax Brackets For 2020 Irs Taxes Tax Brackets Irs

IRS Tax Brackets For 2023 Taxed Right

2021 Tax Brackets Irs Calculator

2022 Tax Brackets Irs Calculator

New IRS Tax Brackets For 2023 Explained By Pros Shared Economy Tax

https://www.irs.com/en/2022-federal-income-tax...

Web Result Feb 21 2022 nbsp 0183 32 These are broken down into seven 7 taxable income groups based on your federal filing statuses e g whether you are single a head of household married etc The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Web Result Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains

https://www.irs.gov/newsroom/irs-provides-tax...

Web Result IR 2021 219 November 10 2021 The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes Revenue Procedure 2021 45 provides details about these annual adjustments

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Web Result Nov 10 2021 nbsp 0183 32 There s one big caveat to these 2022 numbers Democrats are still trying to pass the now 1 85 trillion Build Back Better Act and the latest November 3 legislative text includes income tax

https://www.investopedia.com/irs-announces-tax...

Web Result Nov 11 2021 nbsp 0183 32 IRS Announces Tax Brackets and Other Inflation Adjustments for Tax Year 2022 The 2022 standard deduction for married filing jointly is 25 900 By Jim Probasco Published November 11

Web Result Nov 22 2022 nbsp 0183 32 WASHINGTON The Internal Revenue Service today encouraged taxpayers to take simple steps before the end of the year to make filing their 2022 federal tax return easier With a little advance preparation a preview of tax changes and convenient online tools taxpayers can approach the upcoming tax season Web Result Oct 10 2022 nbsp 0183 32 What Are the Income Tax Brackets for 2022 Published Oct 10 2022 at 8 23 AM EDT Updated Oct 10 2022 at 11 26 AM EDT By Emilia Shovelin Personal Finance Reporter

Web Result by Andrew Lautz November 12 2021 The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code See below for