New Federal Tax Rates For 2022 In 2022 the first 16 000 of gifts to any person are excluded from tax up from 15 000 The exclusion is increased to 164 000 from 159 000 for gifts to spouses who are not citizens of the United States

Oct 18 2022 nbsp 0183 32 The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code These inflation adjustments will be in effect for income earned in 2023 which taxpayers will file a The latest available tax rates are for 2025 and the Federal income tax brackets have been changed since 2022

New Federal Tax Rates For 2022

New Federal Tax Rates For 2022

New Federal Tax Rates For 2022

https://federalwithholdingtables.net/wp-content/uploads/2021/06/2020-income-tax-brackets-pasivinco.png

Jan 3 2022 nbsp 0183 32 The IRS released the new federal marginal tax rates and income brackets for 2022 on Nov 10 2021 While the tax income tax rates aren t changing income limits have been adjusted

Pre-crafted templates use a time-saving solution for creating a varied series of files and files. These pre-designed formats and designs can be utilized for numerous individual and expert projects, including resumes, invitations, leaflets, newsletters, reports, presentations, and more, simplifying the content creation procedure.

New Federal Tax Rates For 2022

IRS Tax Charts 2021 Federal Withholding Tables 2021

Federal Income Tax Withholding 2022 Latest News Update

2022 Tax Brackets KrissDaemon

These Are The Us Federal Tax Brackets For 2021 And 2020 Vs 2021 Free

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

2022 Tax Brackets HassanMorven

https://taxfoundation.org › data › all › federal

Nov 10 2021 nbsp 0183 32 The IRS recently released the new inflation adjusted 2022 tax brackets and rates Explore updated credits deductions and exemptions including the standard deduction amp personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A

https://www.forbes.com › sites › ashleaebeling

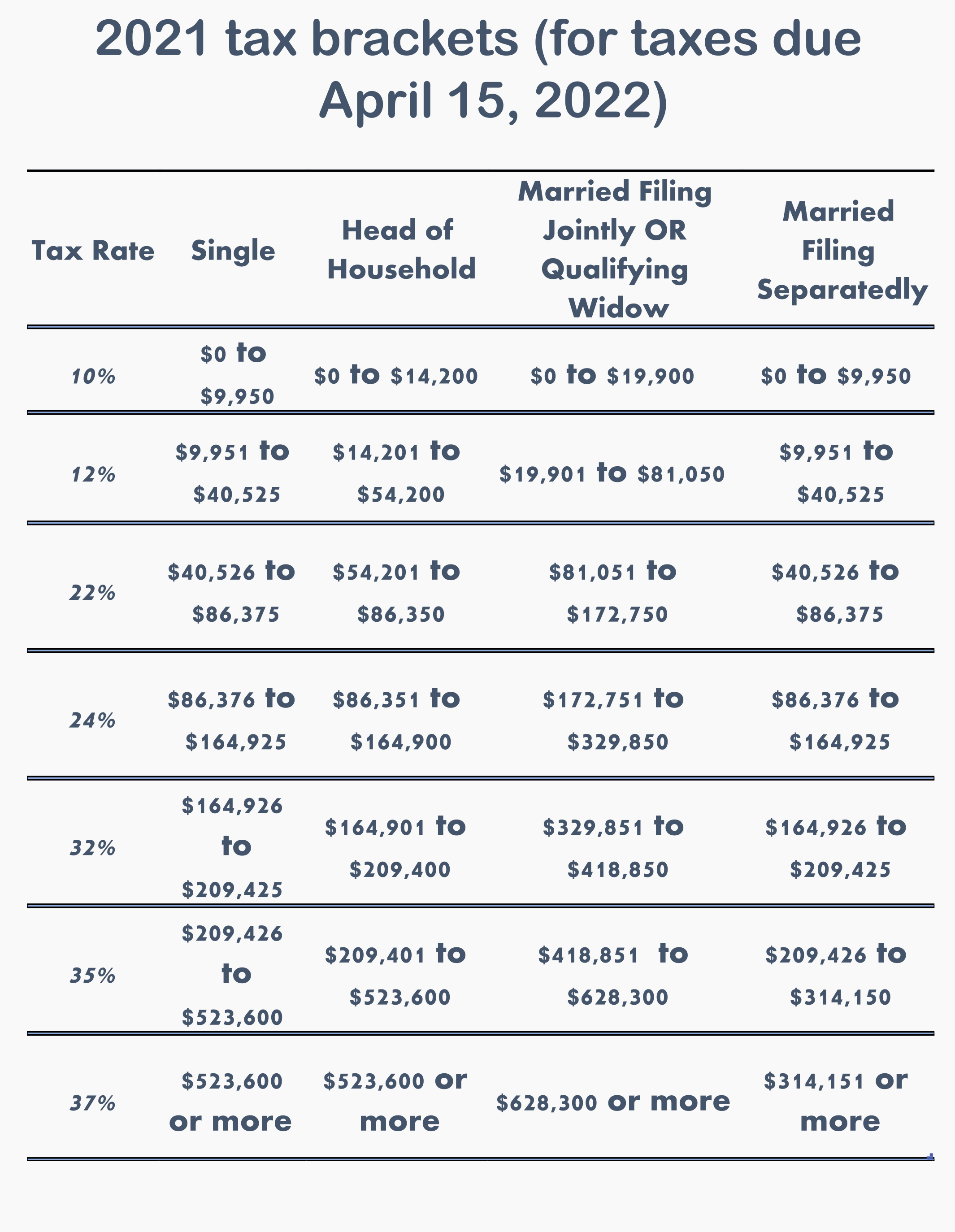

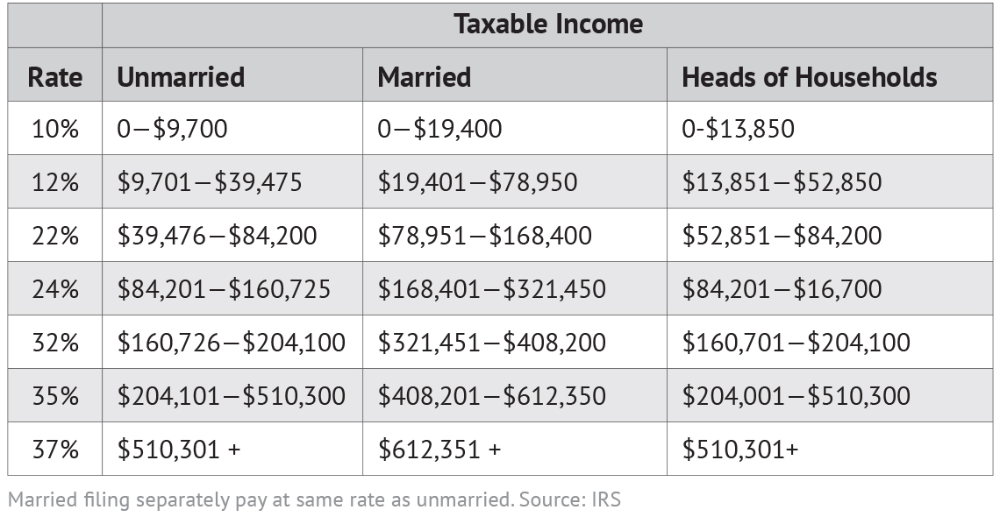

Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status 2022 Standard Deduction Amounts

https://www.irs.gov › filing › federal-income-tax-rates-and-brackets

See current federal tax brackets and rates based on your income and filing status

https://www.cnbc.com

Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday as well as the new standard deduction for filers

https://wealthvogue.com

There are seven federal tax brackets for the 2022 tax year 10 12 22 24 32 35 and 37 Your bracket depends on your taxable income and filing status 2022 Tax brackets for Single filers 0 to 10 275 10 of taxable income 10 276 to 41 775 1 027 50 plus 12 of the amount over 10 275 41 776 to 89 075

Nov 12 2021 nbsp 0183 32 The Internal Revenue Service has released 2022 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code See below for how these 2022 brackets compare to 2021 brackets The Internal Revenue Service IRS released the new Federal Income Tax Rates for the financial year FY 2022 on 10th November 2021 The upper Federal Income Tax Rate levels will reflect the most substantial year over year inflation since 1990 For the 2021 22 taxable year there are seven tax brackets for most regular income

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals filing separate returns and estates and trusts 1