Irs Tax Table For 2022 Income Tax Mar 28 2024 nbsp 0183 32 Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules Find your total tax as a percentage of your taxable income Calculate net income after taxes

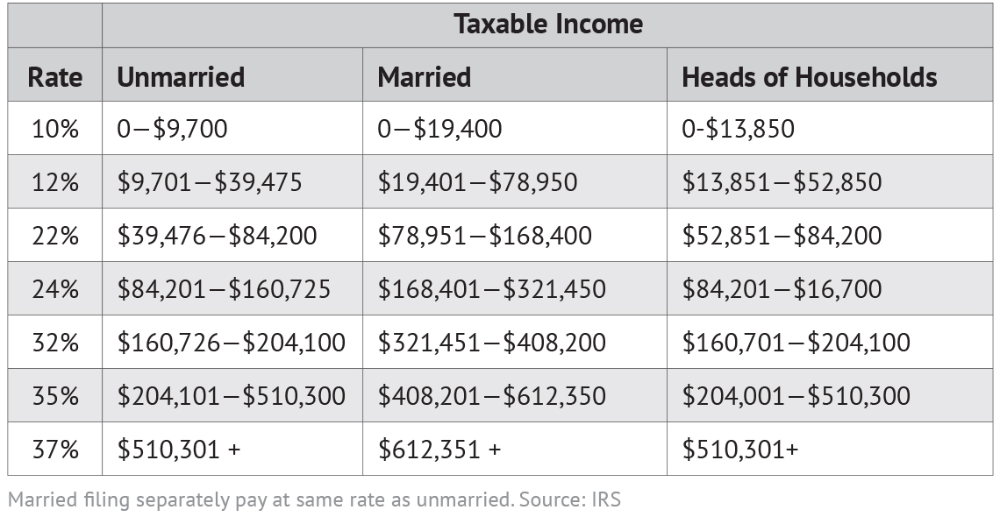

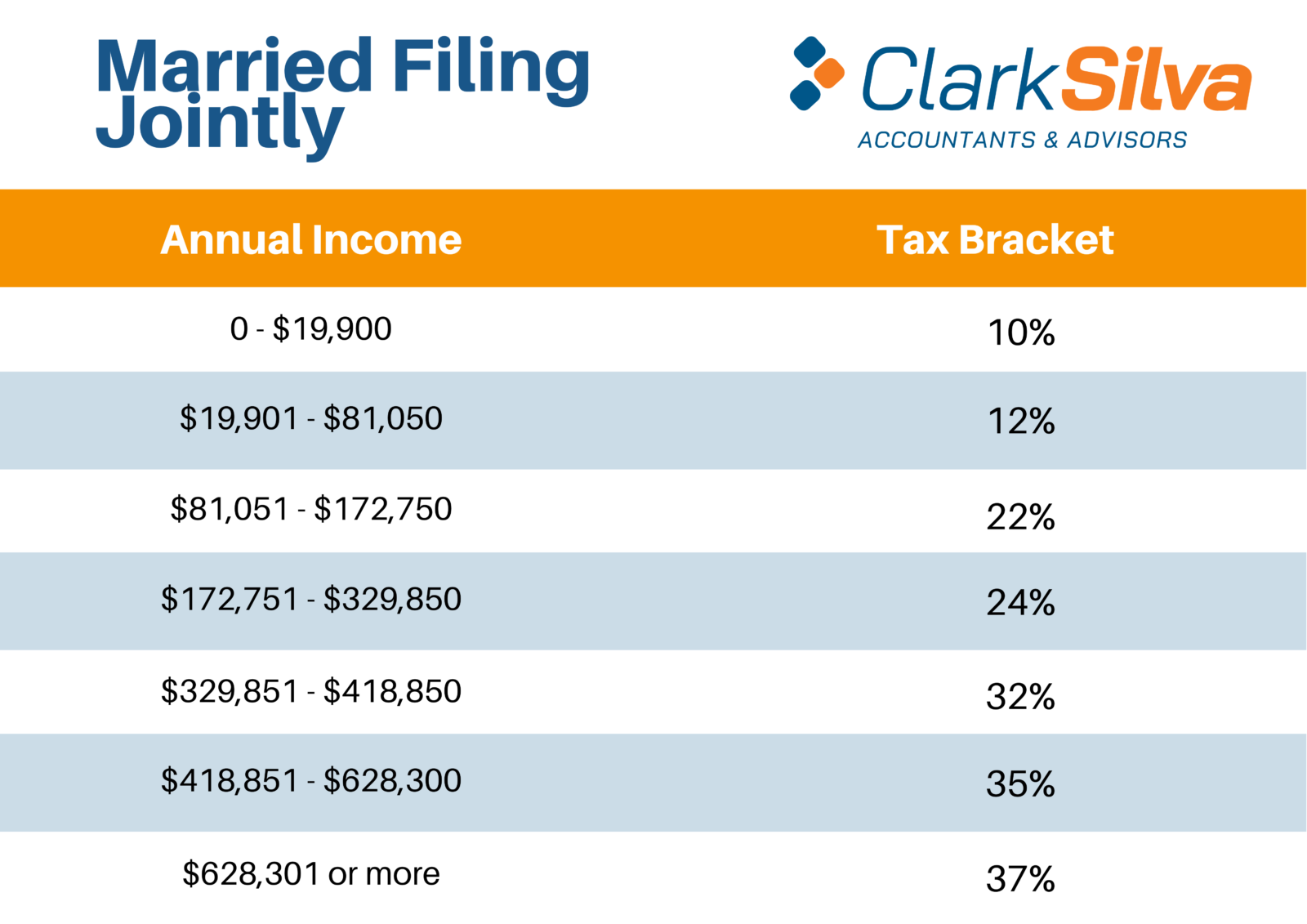

Feb 21 2022 nbsp 0183 32 The federal income tax rates for 2022 are 10 12 22 24 32 35 and 37 depending on the tax bracket What are the tax brackets for 2022 The 2022 tax brackets have been changed since 2021 to adjust for inflation 2022 Tax Tables Individual Married Joint Head of Household Widower tax tables with annual deductions exemptions and tax credit amounts

Irs Tax Table For 2022 Income Tax

Irs Tax Table For 2022 Income Tax

Irs Tax Table For 2022 Income Tax

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Nov 11 2021 nbsp 0183 32 Marginal tax rates for 2022 will not change but the level of taxable income that applies to each rate is going up The top rate of 37 will apply to income over 539 900 for individuals and

Templates are pre-designed documents or files that can be used for numerous functions. They can save time and effort by supplying a ready-made format and layout for developing different sort of material. Templates can be used for personal or professional tasks, such as resumes, invites, flyers, newsletters, reports, discussions, and more.

Irs Tax Table For 2022 Income Tax

2022 Federal Tax Brackets And Standard Deduction Printable Form

2022 Tax Table Philippines Latest News Update

2022 Tax Brackets Irs Calculator

STUMP Articles Taxing Tuesday The Governor Of Illinois Talks Taxes

Irs Tax Table 2022 Married Filing Jointly Latest News Update

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

https://www.irs.gov/pub/irs-prior/i1040gi--2022.pdf

The Taxpayer Bill of Rights describes ten basic rights that all taxpayers have when dealing with the IRS The TAS website TaxpayerAdvocate IRS gov can help you understand what these rights mean to you and how they apply

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

Oct 16 2024 nbsp 0183 32 See current federal tax brackets and rates based on your income and filing status

https://taxfoundation.org/data/all/federal/2022-tax-brackets

Nov 10 2021 nbsp 0183 32 In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.morganstanley.com/content/dam/msdotcom/...

Oct 17 2022 Last day to file federal income tax return if 6 month extension was requested by April 18 2022 Last day to recharacterize an eligible Traditional IRA or Roth IRA contribution from 2021 if extension

https://www.forbes.com/sites/ashleaebeling/2021/11/...

Nov 10 2021 nbsp 0183 32 There are seven tax rates in 2022 10 12 22 24 32 35 and 37 Here s how they apply by filing status 2022 Standard Deduction Amounts

Nov 10 2021 nbsp 0183 32 The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday as well as the new standard deduction for filers The IRS has released the annual inflation adjustments for 2022 for the income tax rate tables plus more than 56 other tax provisions The IRS makes these cost of living adjustments COLAs each year to reflect inflation

Jan 23 2023 nbsp 0183 32 You can find the latest tax table which you ll use in 2023 to file 2022 taxes on the IRS website specifically its publication named Tax Year 2022 1040 and 1040 SR Tax and Earned Income Credit Tables