Irs Form 1099 Contractor Dec 23 2024 nbsp 0183 32 Individuals or independent contractors who earn 600 or more in nonemployment income within a calendar year must receive a Form 1099 The IRS considers someone an independent contractor if they are self employed or

Mar 21 2025 nbsp 0183 32 issue 1099 forms 1099 nec For each contractor you pay 600 or more during the tax year you must issue Form 1099 NEC Nonemployee Compensation This form reports the Mar 12 2025 nbsp 0183 32 You must file 1099 NEC forms with the IRS and the state if applicable as well as provide a copy to the recipient Do this for every contractor you pay 600 or more to during the tax year Use the following steps to learn

Irs Form 1099 Contractor

Irs Form 1099 Contractor

Irs Form 1099 Contractor

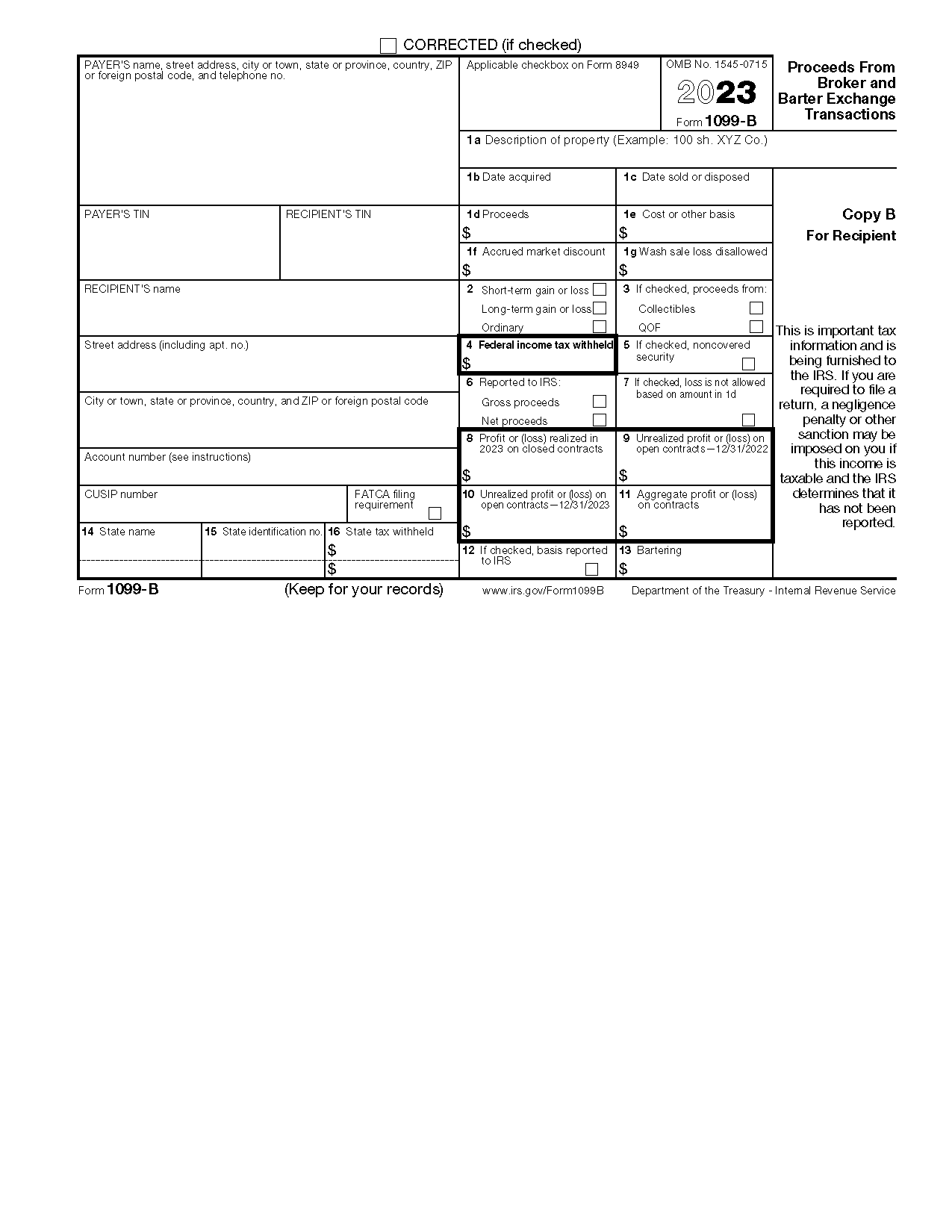

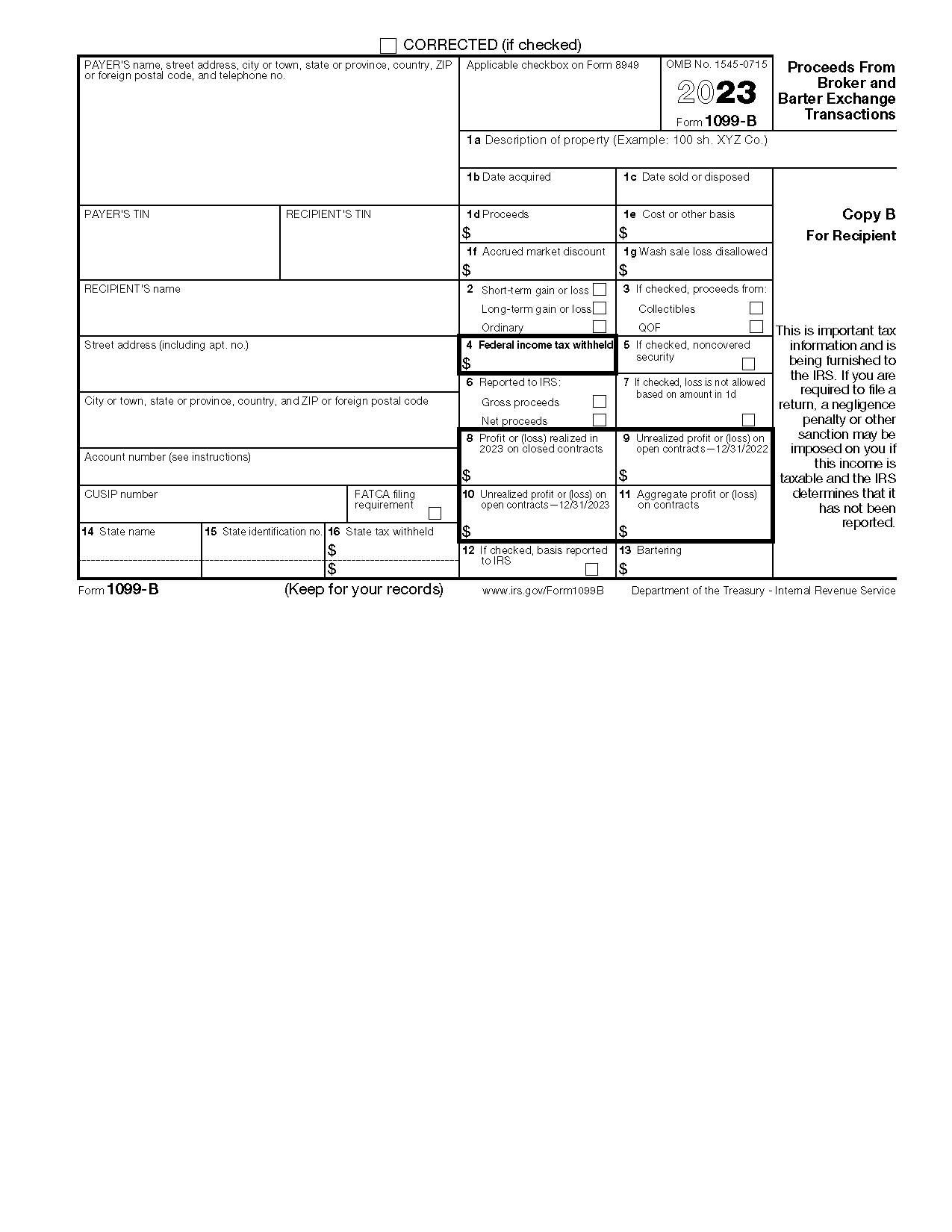

https://eforms.com/images/2023/10/IRS-Form-1099-B.png

May 24 2023 nbsp 0183 32 Form 1099 is a tax form used to report income from independent contractors It is sent to the contractor by the client and also to the IRS at the beginning of tax season every

Templates are pre-designed files or files that can be utilized for numerous functions. They can conserve effort and time by supplying a ready-made format and design for developing different type of material. Templates can be utilized for individual or expert jobs, such as resumes, invitations, flyers, newsletters, reports, discussions, and more.

Irs Form 1099 Contractor

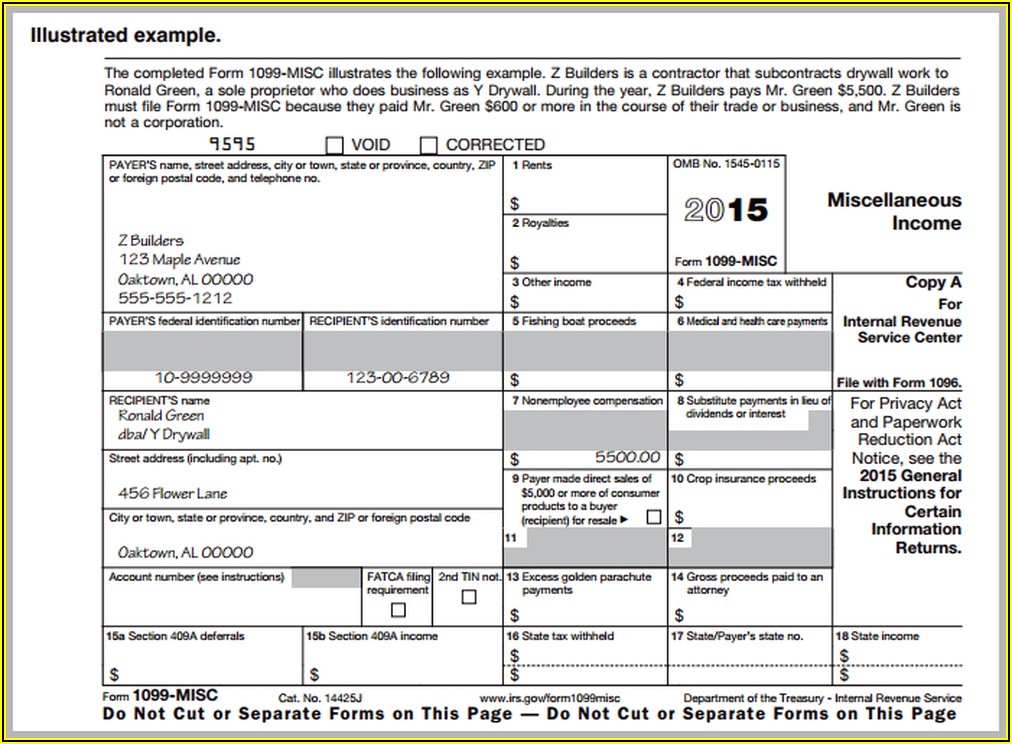

How To Fill Out A 1099 Form In 2022 STEP BY STEP TUTORIAL

How To Fill Out 1099 Form For Independent Contractor Form Resume

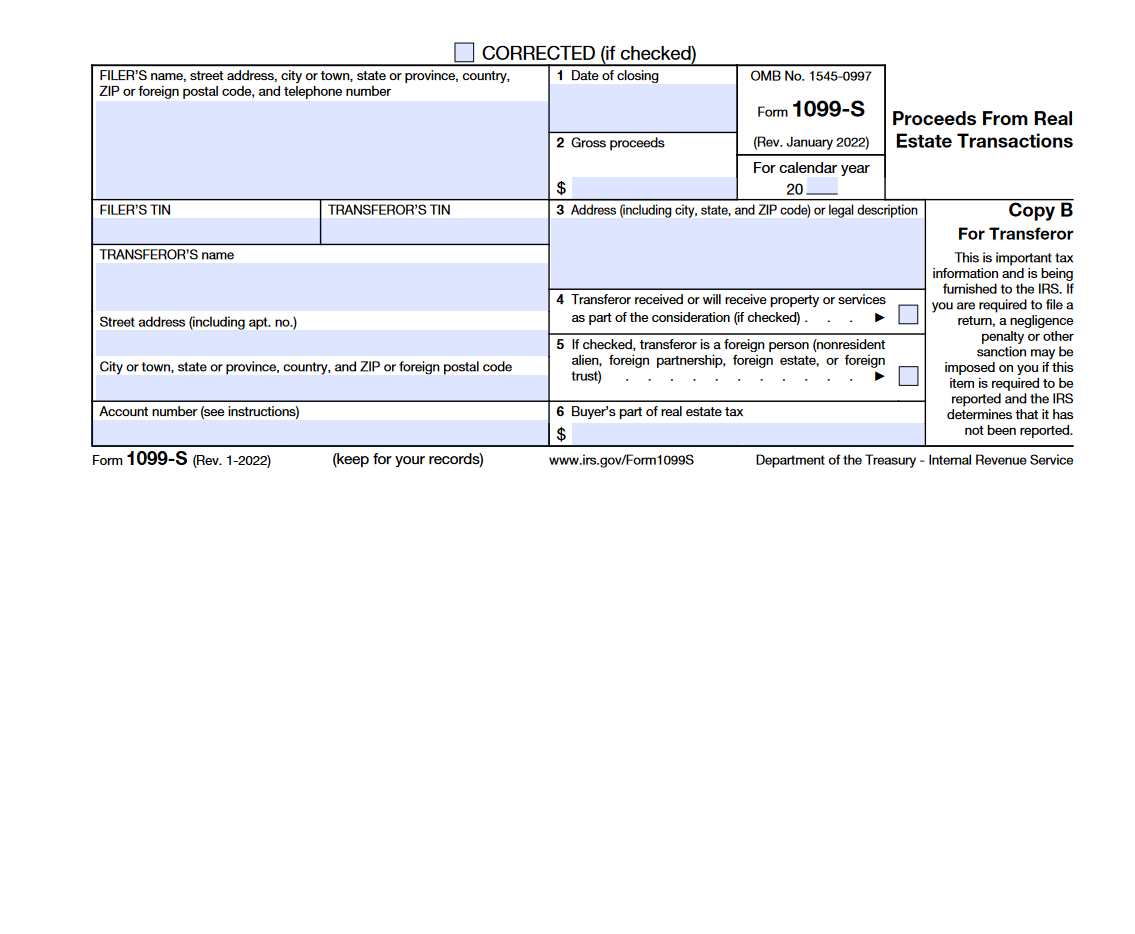

IRS Form 1099 S Proceeds From Real Estate Transactions Forms Docs

What Are IRS 1099 Forms

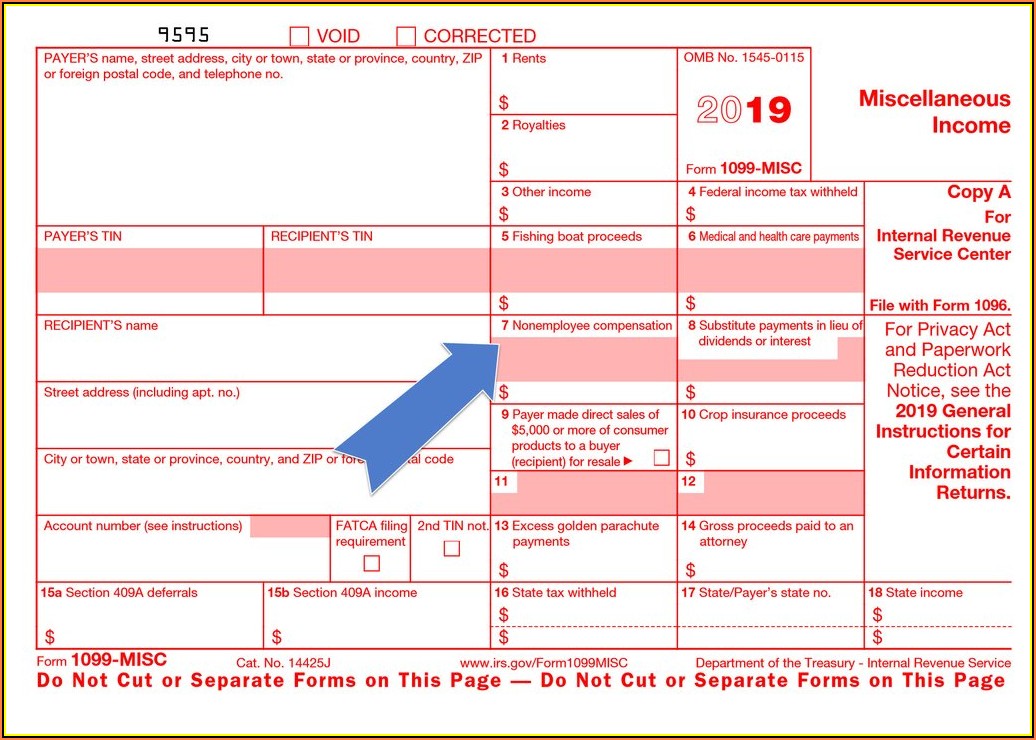

1099 Misc Form 2023 Printable Free

Irs Form 1099 Independent Contractor Form Resume Examples 7NYAKJO2pv

https://www.bankrate.com › taxes

Apr 26 2025 nbsp 0183 32 If you re an independent contractor or freelancer or if you received untaxed income you ll receive 1099 forms at tax time Here s what you need to know

https://accountinginsights.org

Jan 24 2025 nbsp 0183 32 Businesses and individuals who pay an independent contractor 600 or more during the tax year must issue a 1099 form This IRS threshold applies to payments for

https://fullyaccountable.com

Nov 26 2024 nbsp 0183 32 By law businesses must issue Form 1099 NEC to applicable vendors contractors and freelancers and file these forms with the Internal Revenue Service IRS by January 31 This requirement applies to individuals

https://thetaxbooks.com › blog

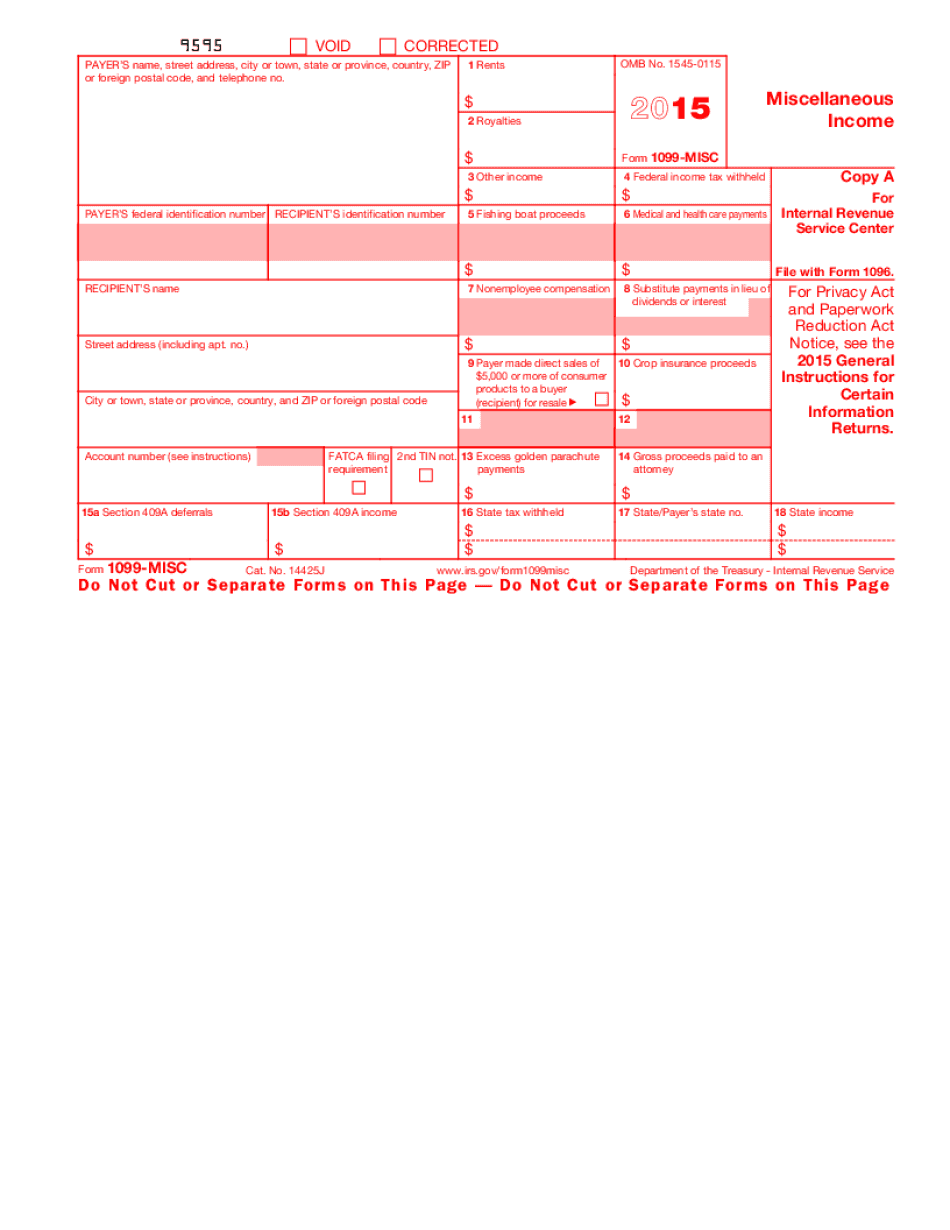

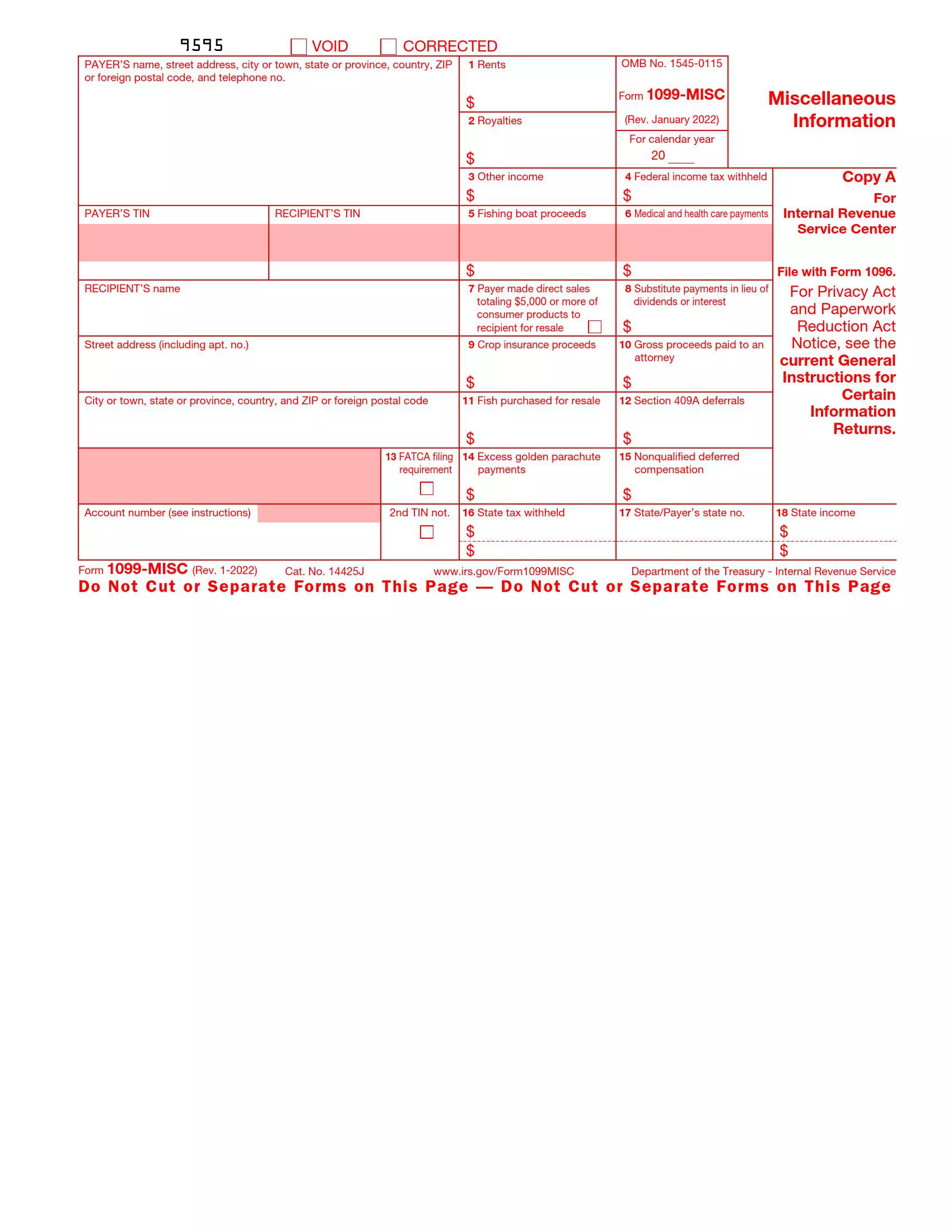

Aug 3 2024 nbsp 0183 32 This article provides a detailed explanation of the two primary forms used for reporting payments to independent contractors Form 1099 NEC and Form 1099 MISC We ll delve into their historical context proper usage

https://www.handoff.ai › blog

Apr 21 2025 nbsp 0183 32 A 1099 form is basically the IRS s way of saying Hey we know you made money this year As a general contractor receiving a 1099 taxes are not withheld from your pay like

Mar 22 2024 nbsp 0183 32 This article provides important information on IRS Form 1099 including key deadlines and due dates that independent contractors and consultants need to be aware of In Oct 2 2024 nbsp 0183 32 Learn who gets a 1099 when 1099s are due how 1099s work amp the different types of 1099s As a contractor roofer or business owner in the trades and construction industry

How to Fill Out Form 1099 for an Independent Contractor Step 1 Collect Personal Information Using Form W 9 Gather the contractor s legal name address TIN and other necessary