Irs Form Independent Contractor Employee Publication 15 A Employer s Supplemental Tax Guide provides additional information on independent contractor status You can download and print IRS publications forms and other

Feb 10 2025 nbsp 0183 32 Learn the IRS definition of employee vs independent contractor and how the new 2025 rules impact classification payroll taxes and employer compliance May 24 2023 nbsp 0183 32 Form 1099 is a tax form used to report income from independent contractors It is sent to the contractor by the client and also to the IRS at the beginning of tax season every

Irs Form Independent Contractor Employee

Irs Form Independent Contractor Employee

Irs Form Independent Contractor Employee

https://mycountsolutions.com/wp-content/uploads/2019/07/Form-1099-for-Independent-Contractors-scaled.jpg

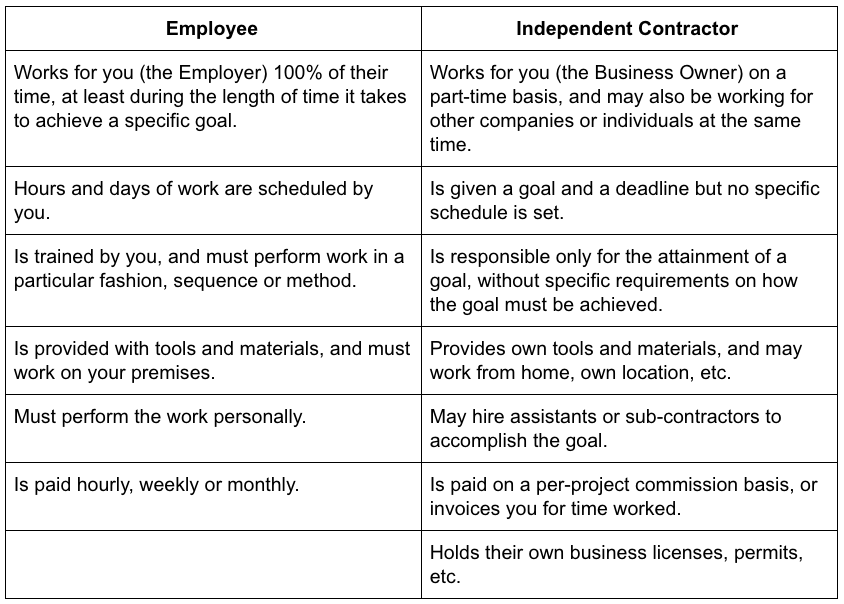

Jun 6 2025 nbsp 0183 32 For IRS purposes as an employer you must weigh all these factors to determine whether a worker is an employee or an independent contractor The IRS also has a helpful

Pre-crafted templates use a time-saving option for creating a diverse series of documents and files. These pre-designed formats and designs can be utilized for various personal and professional jobs, consisting of resumes, invitations, flyers, newsletters, reports, presentations, and more, streamlining the material production process.

Irs Form Independent Contractor Employee

Free Independent Contractor Agreements 47 PDF Word EForms

1099 Form Printable 2025 Dara Milzie

Free Independent Contractor Agreement Template 1099 Word PDF EForms

1099 Form Independent Contractor Free

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)

Form Fillable Se Printable Forms Free Online

Exploring The Differences Between An Employee And An Independent

https://www.irs.gov › businesses › small-businesses...

May 15 2025 nbsp 0183 32 Workers who believe they have been improperly classified as independent contractors by an employer can use Form 8919 Uncollected Social Security and Medicare Tax

https://www.stayexempt.irs.gov › se › files › downloads

Independent contractors complete Form W 9 while employees complete Form W 4 Independent contractors may be issued Form 1099 MISC while employees receive a W 2 No withholding is

https://www.stephanoslack.com › employee...

Jan 13 2025 nbsp 0183 32 Correctly classifying workers as employees or independent contractors is essential for business owners to meet tax obligations and avoid costly penalties The IRS provides clear guidelines including a 20 factor test

https://kkca.io › taxation

Mar 30 2025 nbsp 0183 32 The IRS requires employers to issue Form W 2 to employees and Form 1099 NEC to independent contractors The distinction between the two classifications matters significantly

https://www.irs.gov › newsroom

Aug 2 2022 nbsp 0183 32 Workers who believe they have been improperly classified as independent contractors generally must receive a determination of worker status from the IRS Then they

Jun 18 2021 nbsp 0183 32 Download IRS Form 1096 here The written contract While not a form per se all business owners should prepare a written contract before working with an independent Jan 29 2025 nbsp 0183 32 Firms and workers file Form SS 8 with the IRS to request an IRS determination of the status of a worker for purposes of federal employment taxes and income tax withholding

Mar 4 2025 nbsp 0183 32 Generally if you re an independent contractor you re considered self employed and should report your income nonemployee compensation on Schedule C Form 1040 Profit or