Income Tax Slab Rates For Ay 2022 23 Pdf WEB Surcharge Surcharge is levied on the amount of income tax at following rates if total income of an assessee exceeds specified limits Rate of Surcharge Assessment Year 2023 24 Assessment Year 2022 23 Range of Income Range of Income Rs 50 Lakhs to Crores Rs 1 Crore Rs 1 Crore toRs 2 Crores Rs 2 crore to Rs 5 Crores Rs 5 crore s

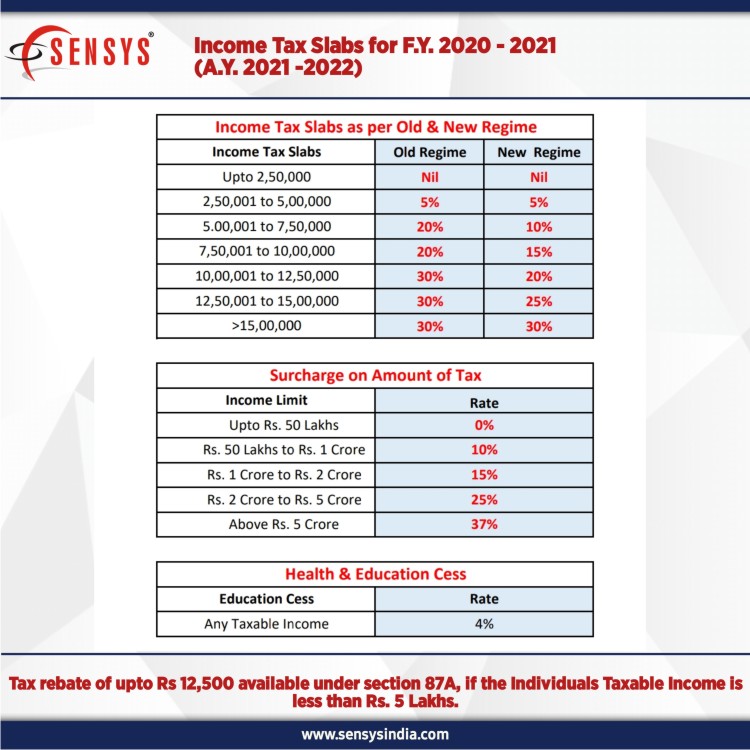

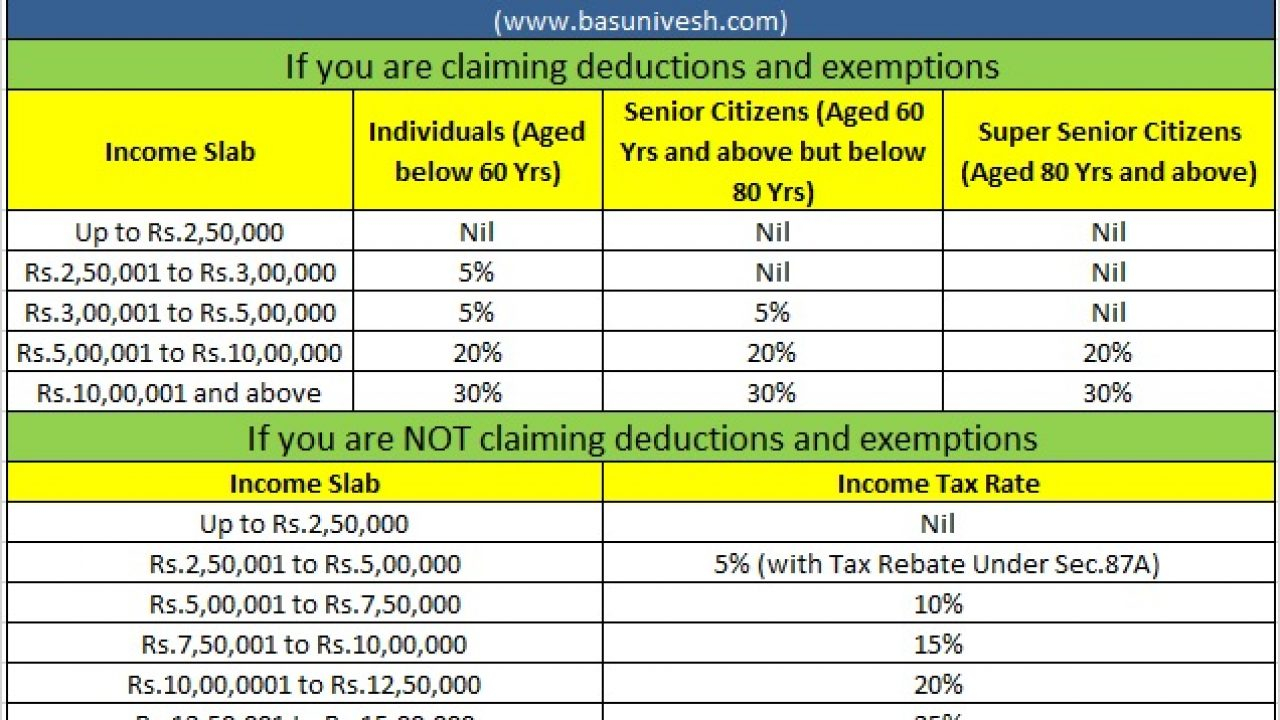

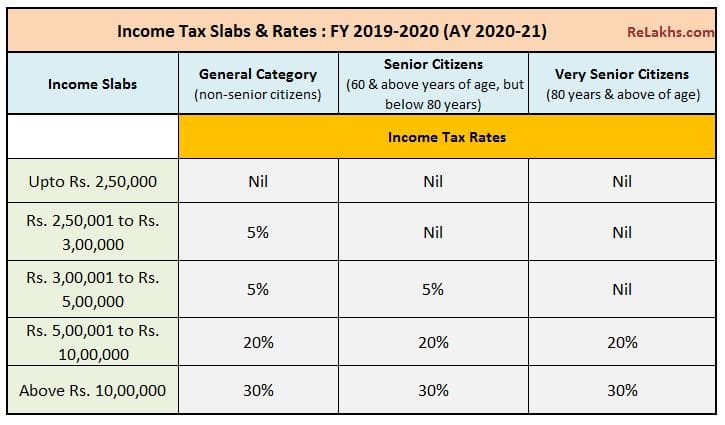

WEB 4 days ago nbsp 0183 32 Income Tax Slab Rs Old Tax Regime FY 2022 23 AY 2023 24 and FY 2023 24 AY 2024 25 New tax Regime Before budget 2023 New Tax Regime Applicable for FY 2023 24 AY 2024 25 0 2 50 000 2 50 001 3 00 000 5 5 3 00 001 5 00 000 5 5 5 5 00 001 6 00 000 20 10 5 6 00 001 7 50 000 20 WEB Jan 16 2024 nbsp 0183 32 Income Tax Slab Rates 2022 23 Updated New Income Tax Regime Section 115BAC Updated on 16 Jan 2024 05 49 PM New Tax Regime Slabs Rates Exemptions amp Deductions Availability analysis New income tax regime for Individuals and HUF has been proposed under Section 115BAC in the budget 2020

Income Tax Slab Rates For Ay 2022 23 Pdf

Income Tax Slab Rates For Ay 2022 23 Pdf

Income Tax Slab Rates For Ay 2022 23 Pdf

http://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210.jpg

WEB Feb 7 2023 nbsp 0183 32 Income tax slab rate FY 2021 22 AY 2022 23 Applicable for New Tax regime Income Tax Slab New Regime Income Tax Slab Rates FY 2021 22 Applicable for All Individuals amp HUF Rs 0 0 Rs 2 5 lakh NIL Rs 2 5 lakh Rs 3 00 lakh 5 tax rebate u s 87A is available Rs 3 00 lakh Rs 5 00 lakh

Pre-crafted templates provide a time-saving service for producing a diverse series of documents and files. These pre-designed formats and layouts can be used for numerous individual and professional jobs, consisting of resumes, invites, leaflets, newsletters, reports, discussions, and more, streamlining the content production process.

Income Tax Slab Rates For Ay 2022 23 Pdf

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

Income Tax Rates Slab For Fy 2022 23 Or Ay 2023 24 Ebizfiling Otosection

New Income Tax Slab Rate For AY 2021 22 FY 2020 21 IDeal ConsulTax

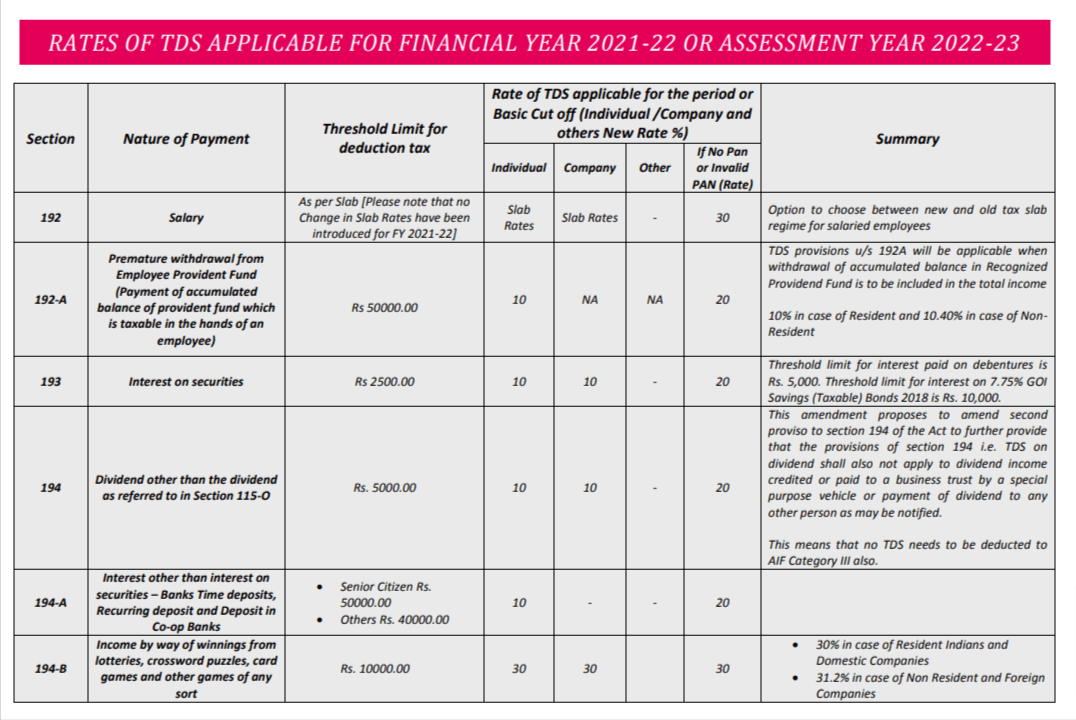

Latest TDS Rates Chart For FY 2022 23 PDF

Tax Calculator 2022 23 Bed Frames Ideas

Income Tax Slab Rate 2022 23 Slab Rate For Ay 2023 24 Fy 2022 23 Which

https://www.incometax.gov.in/iec/foportal/help/...

WEB New Tax Regime u s 115BAC Income Tax Slab Income Tax Rate Income Tax Slab Income Tax Rate Up to 5 00 000 Nil Up to 2 50 000 Nil 5 00 001 10 00 000 20 above 5 00 000 2 50 001 5 00 000 5 above 2 50 000 Above 10 00 000 1 00 000 30 above 10 00 000 5 00 001 7 50 000

https://taxguru.in/income-tax/income-tax-rates...

WEB Jun 13 2022 nbsp 0183 32 Net Income Range Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 5 00 000 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Hindu Undivided Family Including AOP BOI and Artificial Juridical Person Net Income Range Rate of Income tax Assessment Year

https://incometaxindia.gov.in/Tutorials/2 Tax Rates.pdf

WEB Checking your browser before accessing incometaxindia gov in This process is automatic Your browser will redirect to requested content shortly

https://taxguru.in/income-tax/income-tax-rates...

WEB Sep 9 2023 nbsp 0183 32 Partnership Firm For the Assessment Years 2023 24 amp 2024 25 a partnership firm including LLP is taxable at 30 Add a Surcharge The amount of income tax shall be increased by a surcharge at the rate of 12 of such tax where total income exceeds one crore rupees

https://taxguru.in/income-tax/income-tax-rates-fy...

WEB Feb 4 2022 nbsp 0183 32 Since there is no change in Tax Rates in the Finance Bill Budget 2022 hence Tax Rates applicable to both the assessment year are same except few changes proposed in Budget 2022 mentioned separately in article Following amendments related to tax rates have been proposed in Budget 2022 a To reduce surcharge on long term capital gains

WEB The New Tax Slabs are made common for taxpayers of all age groups with reduced income tax rates allowed in income brackets up to INR 15 00 000 But it disallows 70 tax exemptions and deductions that are available as reliefs with Old Regime Tax Rates There is following Income Tax Rate under the New Tax Regime and Old tax Regime WEB Mar 30 2021 nbsp 0183 32 Income tax rates applicable to Individuals and HUF under new optional tax regime Section 115BAC A new tax regime for Individual and HUF under the Income Tax Act to tax the income of such assessees at lower tax rates if they agree to forego prescribed deductions and exemptions under the Act

WEB A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between the new or old tax regime and pay applicable income tax as per slabs and rates for FY 2021 22 AY 2022 23