Income Tax Rates 2023 To 2024 Web Nov 10 2023 nbsp 0183 32 The standard deduction for couples filing jointly is 29 200 in 2024 up from 27 700 in the 2023 tax yea r The standard deduction is the fixed amount the IRS allows you to deduct from your annual income even if you don t itemize your tax return The lower your taxable income is the lower your tax bill There s even more good news

Web Oct 18 2022 nbsp 0183 32 Marginal Rates For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578 125 693 750 for married couples filing jointly The other rates are 35 for incomes over 231 250 462 500 for married couples filing jointly Web 2024 Federal Tax Brackets By Kelley R Taylor last updated December 13 2023 It s essential to know which federal tax bracket you are in as your tax bracket determines your federal income tax

Income Tax Rates 2023 To 2024

Income Tax Rates 2023 To 2024

Income Tax Rates 2023 To 2024

https://californiapolicycenter.org/wp-content/uploads/2017/05/Top_State_Marginal_Tax_Rates.jpg

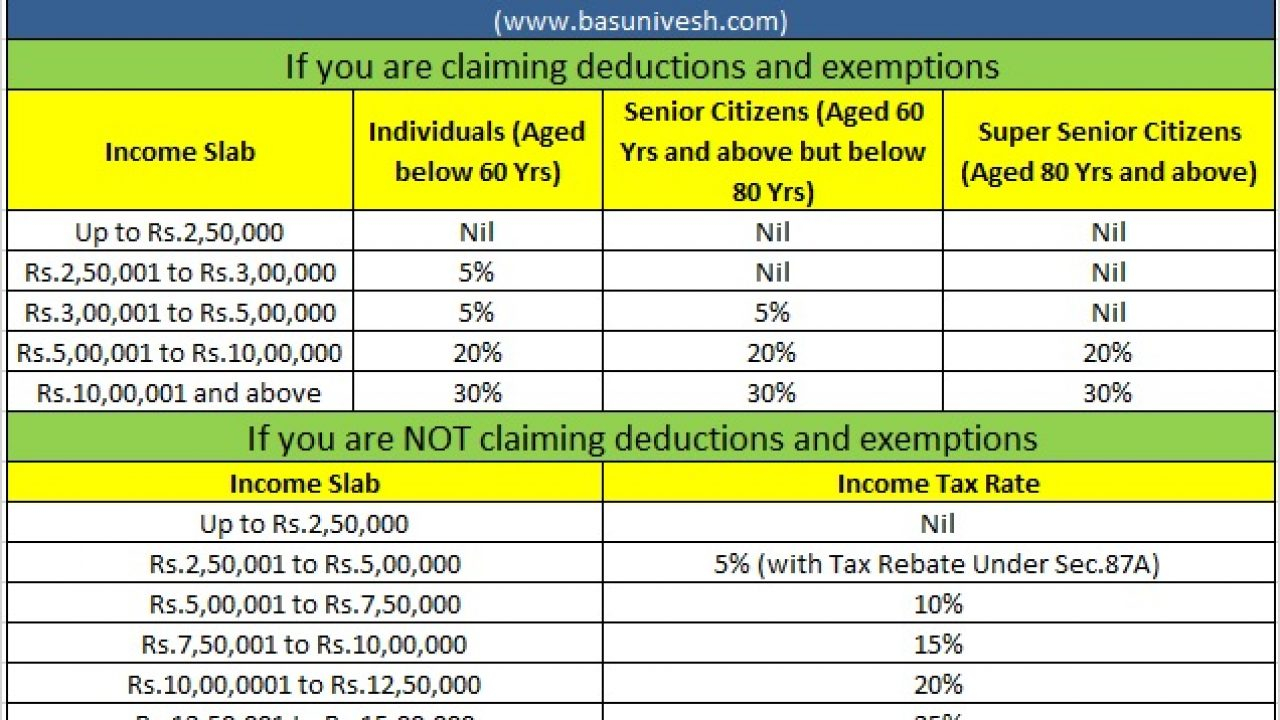

Web Feb 1 2024 nbsp 0183 32 No changes in the income tax slabs for the upcoming financial year 2024 25 April 1 2024 March 31 2025 have been made in the interim budget 2024 by the finance minister Nirmala Sitharaman This would mean that individuals will calculate the income tax payable on their incomes same as they are doing it for current financial year 2023 24

Templates are pre-designed files or files that can be used for numerous purposes. They can save effort and time by providing a ready-made format and layout for developing various sort of material. Templates can be utilized for individual or professional jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Income Tax Rates 2023 To 2024

Tax Rates 2023 24 Fortus

Income Tax Rates 2023 In Pakistan

State Of California Tax Calculator TaxProAdvice

Income Tax 2023 24 FY 2024 25 AY New IT Slab Rates Online Income Tax

Personal Income Tax Brackets Ontario 2019 MD Tax Physician

State And Local Sales Tax Rates 2019 State Sales Tax 2019 Sales Tax

https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

Web Jan 29 2024 nbsp 0183 32 There are seven federal income tax rates and brackets in 2023 and 2024 10 12 22 24 32 35 and 37 Your taxable income and filing status determine which federal tax rates

https://www.forbes.com/advisor/taxes/taxes-federal

Web Jan 9 2024 nbsp 0183 32 2023 2024 Tax Brackets amp Federal Income Tax Rates Forbes Advisor advisor Taxes Advertiser Disclosure 2023 2024 Tax Brackets And Federal Income Tax Rates Kemberley

https://taxfoundation.org/data/all/federal/2023-tax-brackets

Web Oct 18 2022 nbsp 0183 32 2023 Tax Brackets and Rates The income limits for all 2023 tax brackets and all filers will be adjusted for inflation and will be as follows Table 1 There are seven federal income tax rates in 2023 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent

https://www.irs.gov/newsroom/irs-provides-tax...

Web Marginal rates For tax year 2024 the top tax rate remains 37 for individual single taxpayers with incomes greater than 609 350 731 200 for married couples filing jointly The other rates are 35 for incomes over 243 725

https://www.msn.com/en-us/money/personalfinance/...

Web WealthUp Tax Brackets for 2023 vs 2024 How Do They Compare Story by Rocky Mengle 5d More for You It s an unusual time of year for people who pay attention to their taxes On the one

Web Income Slabs Income Tax Rates FY 2023 24 AY 2024 25 Up to Rs 3 00 000 Nil Rs 3 00 000 to Rs 6 00 000 5 on income which exceeds Rs 3 00 000 Rs 6 00 000 to Rs 900 000 Rs 15 000 10 on income more than Rs 6 00 000 Rs 9 00 000 to Rs 12 00 000 Rs 45 000 15 on income more than Rs 9 00 000 Rs 12 00 000 to Rs Web Nov 23 2023 nbsp 0183 32 Beginning with the 2018 tax year the federal income tax rates are 10 12 22 24 32 35 and 37 These are the rates in effect for both the 2023 and 2024 tax years However these lower

Web Feb 27 2023 nbsp 0183 32 Starter tax rate 19 Up to 163 2 162 Basic tax rate 20 From 163 2 163 to 163 13 118 Intermediate tax rate 21 From 163 13 119 to 163 31 092 Higher tax rate 42 From 163 31 093 to