Federal Tax Rates For 2022 Canada Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Tax Rates Tax Brackets Surtax Rates Surtax Thresholds Federal1 15 00 20 50 26 00 29 00 33 00 Up to 50 197 50 198 100 392 100 393 155 625 155 626 221 708 221 709 and over British Columbia2 5 06 7 70 10 50 12 29 14 70 16 80 20 50 Up to 43 070 43 071 86 141

Web The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to Canada Revenue Agency CRA information See Indexation adjustment for personal income tax and benefit amounts on the CRA website Web Tax calculator 2022 The tax calculator is better viewed on a desktop If using a mobile it is best viewed in landscape mode Follow PwC Canada Calculate your tax bill and marginal tax rates for 2022

Federal Tax Rates For 2022 Canada

Federal Tax Rates For 2022 Canada

Federal Tax Rates For 2022 Canada

https://www.ntu.org/Library/imglib/2021/11/2021-22-single-tax-brackets-2-.png

Web Nov 3 2023 nbsp 0183 32 Need some clarity On Canada s Federal Tax Brackets for 2023 We help you with the best tax

Pre-crafted templates offer a time-saving solution for producing a varied series of files and files. These pre-designed formats and layouts can be used for various personal and expert projects, including resumes, invites, flyers, newsletters, reports, discussions, and more, enhancing the content development process.

Federal Tax Rates For 2022 Canada

Your First Look At 2021 Tax Rates Projected Brackets Standard

TaxTips ca Business 2022 Corporate Income Tax Rates

What Are Your 2021 Federal Tax Rates For Your Business Revenued

2022 Tax Brackets Canada Ontario

2022 Tax Brackets DhugalKillen

2021 IRS Income Tax Brackets Vs 2020 Tax Brackets Tax Brackets

https://www.wealthsimple.com/en-ca/learn/tax-brackets-canada

Web Nov 25 2023 nbsp 0183 32 The following are the provincial territorial tax rates for 2023 in addition to federal tax according to the CRA Province Territory Tax Rate British Columbia 5 06 on the first 45 654 of taxable income 7 7 on taxable income over 45 654 up to 91 310 10 5 on taxable income over 91 310 up to 104 835

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Here s how this gets calculated The lowest federal tax bracket for 2022 is 0 up to 50 197 If you earned say 40 000 from all sources of taxable income that includes paid work bank

https://www.canada.ca/.../5000-g/income-tax-benefit-guide.html

Web Step 1 Identification and other information Step 2 Total income Step 3 Net income Step 4 Taxable income Step 5 Federal tax Part A Federal tax on taxable income Part B Federal non refundable tax credits Part C Net federal tax Step 6 Refund or balance owing Supporting documents After you file your return

https://www.manulifeim.com/.../tax-planning/2022-tax-rate-card-for-canada

Web Tax planning for 2022 Combined federal and provincial marginal tax rates and tax brackets by taxable income source plus some of the most common non refundable tax credits EI and CPP contribution amounts and OAS and CPP benefit amounts are all

https://www.canada.ca/en/revenue-agency/programs/about-canada-reven…

Web The 2022 edition of Individual Tax Statistics by Tax Bracket presents basic counts and amounts of individual tax filer information by tax bracket These statistics are based on the 2020 tax year initial assessment data up to January 28 2022 Table of Contents Explanatory notes Confidentiality procedures Data source Classification variables Age

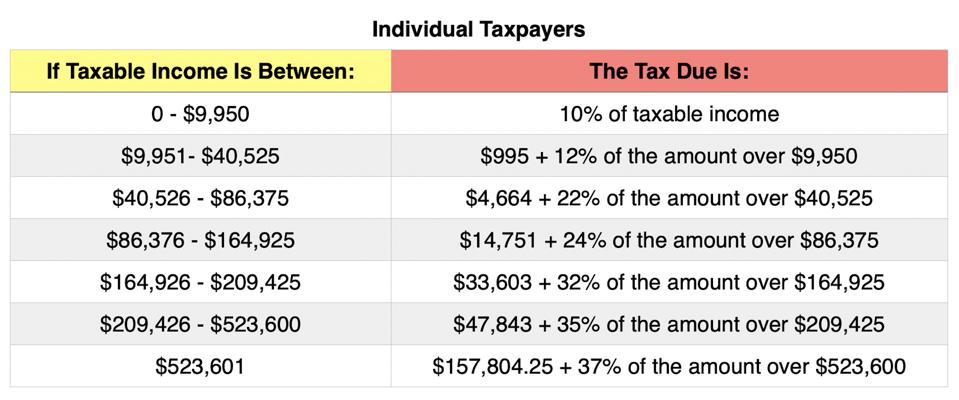

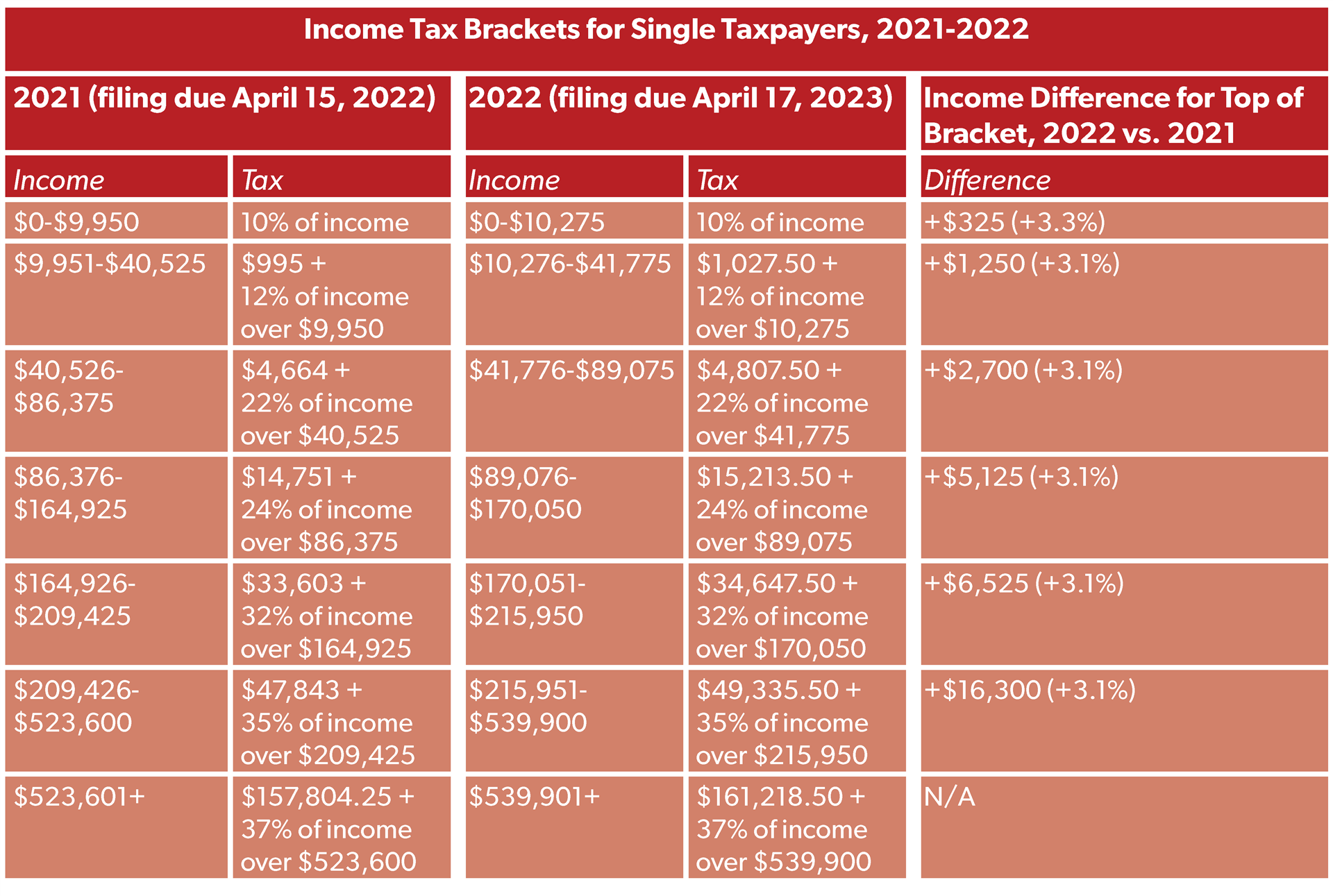

Web Canada Residents Federal Income Tax Tables in 2022 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 15 Income from 0 000 00 to 55 867 00 20 5 Income from 55 867 01 to 111 733 00 26 Income from 111 733 01 to 173 205 00 29 32 Income from 173 205 01 to 246 752 00 33 Web Nov 7 2022 nbsp 0183 32 Once you know your taxable income you ll be able to calculate your federal and provincial tax brackets 2022 Federal Tax Brackets Here are the federal tax brackets for 2022 according to the Government of Canada 15 on the first 50 197 of taxable income plus 1 20 5 on the next 50 195 of taxable income on the portion of taxable

Web 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December 1 2022 Taxable Income Calculate These calculations do not include non refundable tax credits other than the basic personal tax credit