Federal Tax Brackets For 2022 Canada Web 2022 Personal tax calculator EY Canada Calculate your combined federal and provincial tax bill in each province and territory The calculator reflects known rates as of December

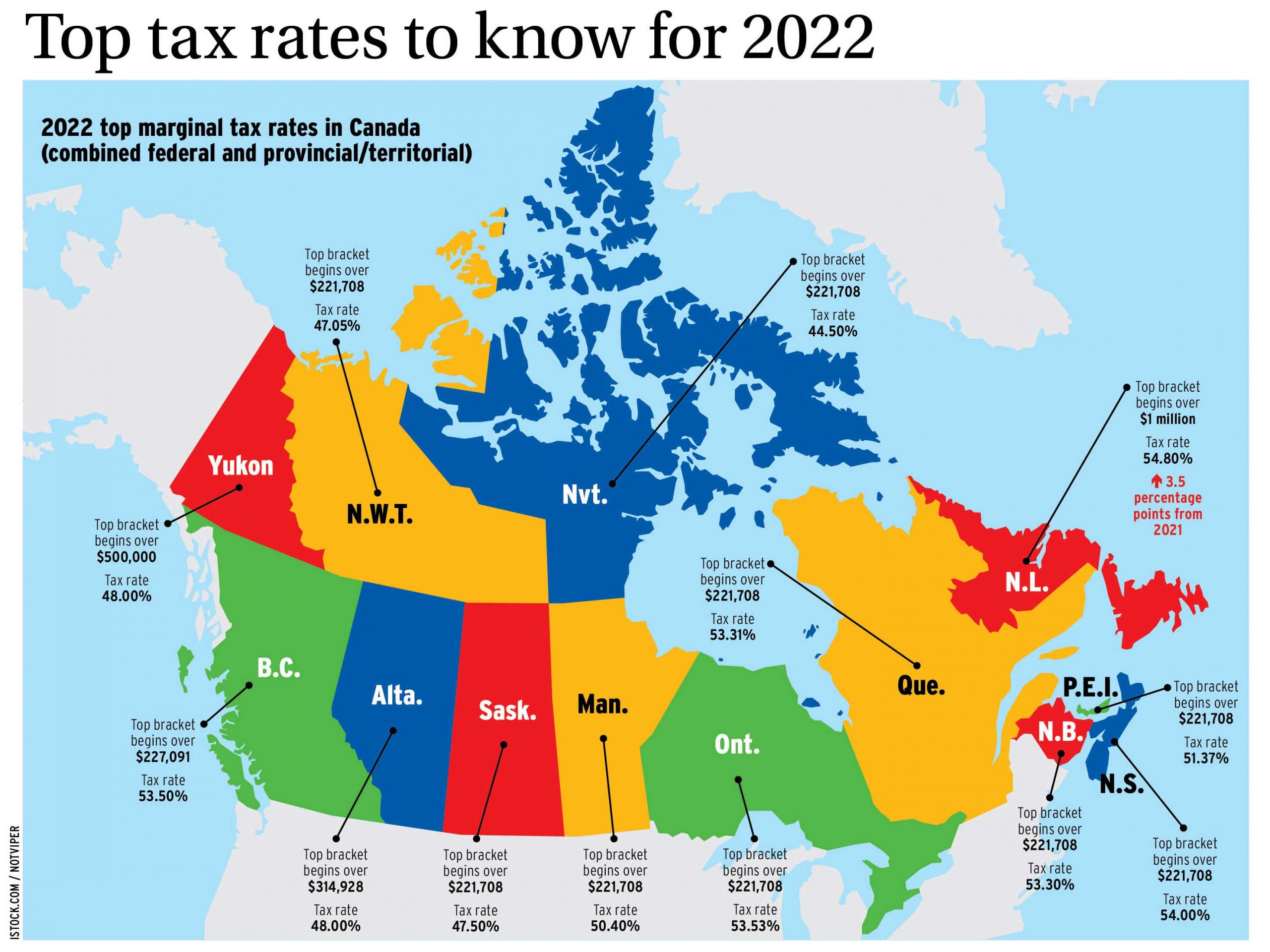

Web Federal and Provincial Territorial Income Tax Rates and Brackets for 20221 Quebec7 15 00 20 00 24 00 25 75 Refer to notes on the following pages 10 Up to 46 295 Web Nov 3 2023 nbsp 0183 32 Start filing Canada s federal income tax rates for the 2023 Tax Year Canadian income tax rates vary according to the total amount of income you earn and

Federal Tax Brackets For 2022 Canada

Federal Tax Brackets For 2022 Canada

Federal Tax Brackets For 2022 Canada

https://filingtaxes.ca/wp-content/uploads/2021/12/Screenshot_2.png

Web Canada s income tax brackets for 2023 plus the maximum tax you ll pay based on income Quickly find your federal and provincial tax brackets to help you prep for your 2023

Templates are pre-designed documents or files that can be used for numerous functions. They can conserve time and effort by offering a ready-made format and design for producing various kinds of material. Templates can be used for personal or expert jobs, such as resumes, invitations, leaflets, newsletters, reports, discussions, and more.

Federal Tax Brackets For 2022 Canada

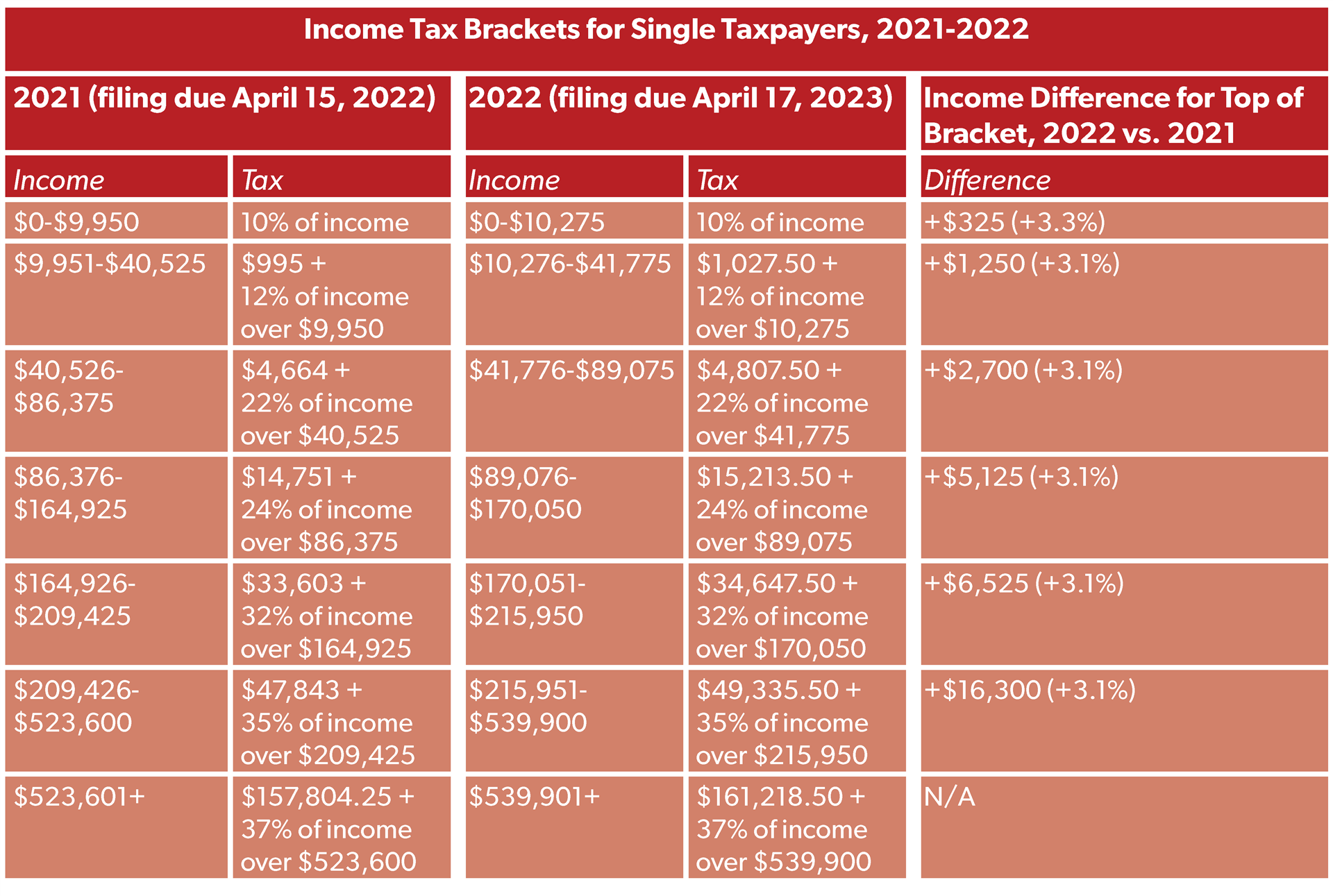

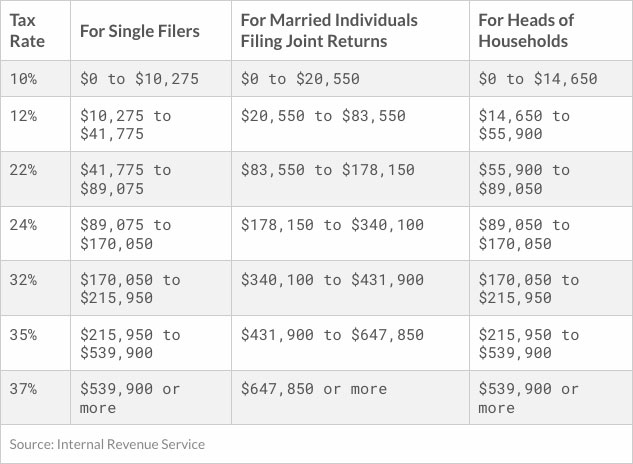

What Are The Tax Brackets For 2022 Married Filing Jointly Printable

2022 Tax Tables Married Filing Jointly Printable Form Templates And

2022 Tax Brackets Canada Ontario

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth

Married Tax Brackets 2021 Westassets

2022 Tax Brackets AnnmarieEira

https://www.moneysense.ca/save/taxes/2022-tax-brackets-in-canada

Web Dec 6 2022 nbsp 0183 32 Canadian federal tax brackets Alberta tax brackets British Columbia tax brackets Manitoba tax brackets New Brunswick tax brackets Newfoundland tax

https://www.wealthsimple.com/en-ca/learn/tax-brackets-canada

Web 61 rows nbsp 0183 32 Nov 25 2023 nbsp 0183 32 The following are the provincial territorial tax rates for 2023 in

https://www.taxtips.ca/priortaxrates/tax …

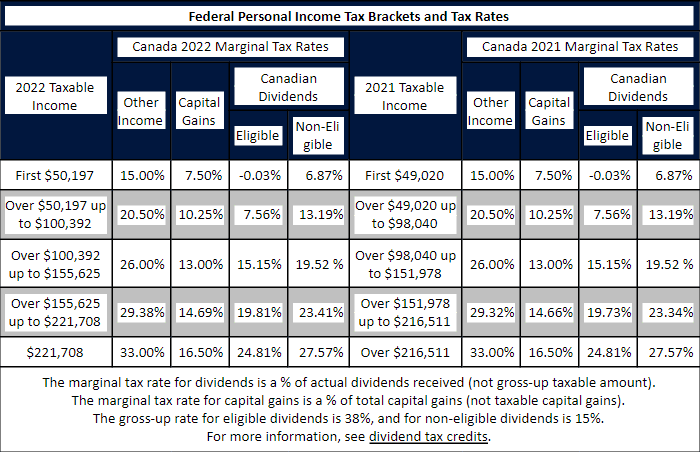

Web The Federal tax brackets and personal tax credit amounts are increased for 2022 by an indexation factor of 1 024 a 2 4 increase The federal indexation factors tax brackets and tax rates have been confirmed to

https://ca.icalculator.com/income-tax-rates/2022.html

Web GST Rates Alternate Tax Years Canada Personal Income Tax Tables in 2022 The Income tax rates and personal allowances in Canada are updated annually with new tax tables

https://www.taxtips.ca/taxrates/canada.htm

Web 14 rows nbsp 0183 32 The Federal tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1 047 a 4 7 increase See Indexation of the Personal Income

Web Canadians pay tax to the federal government as well as the province or territory where they live which is why you ll see tax rates for both To help you figure out how much you can Web Oct 15 2020 nbsp 0183 32 The federal income tax rates and brackets for 2023 and 2024 are Provincial Tax Brackets and Rates for 2023 and 2024 The different provinces and territories in

Web Individuals earning more than 214 368 will pay a federal tax rate of 33 in 2022 up from 29 in 2021 This change is intended to address the COVID 19 pandemic and is set to